Are Bitcoin Bulls Ready To Stampede? | BTCUSD Analysis October 25, 2022

October 25 2022 - 1:24PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis videos, we

take a look at the Bitcoin price rally to see if it can turn

into something much bigger. Are bulls ready to stampede all over

bears? Take a look at the video below: VIDEO: Bitcoin Price

(BTCUSD): October 25, 2022 Crypto Winter Finally, some action in

Bitcoin, and so far it is to the upside. Bitcoin price is testing

just below $20,000 currently. Related Reading: Can Bitcoin Bring An

End To Crypto Winter? | BTCUSD Analysis October 24, 2022 BTCUSD

Daily Begins Potential Bollinger Band Squeeze This is particularly

important for a variety of reasons, first and foremost being the

daily Bollinger Bands. The tool is at the tightest levels since

prior to the October 2020 bull impulse. Bitcoin price must

close above the upper Bollinger Band on high enough volume to spark

a sustainable trend. This is called riding the bands and volume

should be roughly two thirds what it has been during the recent

sideways phase. Just above the upper Bollinger Band, is the

Ichimoku cloud. The last time Bitcoin daily price action touched

the cloud, it was rejected, but this time could be different.

BTCUSD is also above the Tenkan-sen and Kijun-sen which are crossed

bullish at the moment. At almost exactly the same levels, is

the daily Parabolic SAR. The tool is used to set trailing stop

losses, so a short squeeze could begin after pushing through there.

Dynamic indicator resistance is piled up | Source: BTCUSD on

TradingView.com Related Reading: Bitcoin Dominance To Regain

Control Over Crypto? | BTC.D Analysis October 20, 2022 Bitcoin

Price Targets $21K And $25K Next Bitcoin price action has also made

it through the 50-day moving average, making the 100-day and

200-day moving averages the next logical price targets. These

targets are located at roughly $21,000 and $25,000 give or take a

couple hundred dollars. All of the bullish signals are occurring

just as momentum begins to approach the zero line on the LMACD.

Passing through it could confirm a change in the trend in the short

term. The medium term trend could also be about to chance,

according to the same tool on the weekly timeframe. Momentum is

beginning to turn upward and strengthen after reaching levels from

the last bear market bottom. The 100-day and 200-day moving

averages could be next targets | Source: BTCUSD on TradingView.com

Related Reading: Is The Final Wave In Ethereum Up Next? | ETHUSD

Analysis October 19, 2022 The Pixel Perfect Line For Crypto To

Cross At the moment, Bitcoin price on the daily timeframe is still

struggling with an important resistance level –– perhaps one of the

most important levels it has ever faced as resistance: Former

all-time high resistance set nearly five years earlier. In

combination with all of the dynamic indicator resistance above,

price action is taking a pause to struggle with this exact level,

down to a one-pixel line of resistance. Update: Bitcoin price has

broke above this level and is now trading above $20,000. Bitcoin

price is stuck at former ATH resistance | Source: BTCUSD on

TradingView.com Learn crypto technical analysis yourself with the

NewsBTC Trading Course. Click here to access the free educational

program. Follow @TonySpilotroBTC on Twitter or join the

TonyTradesBTC Telegram for exclusive daily market insights and

technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from

TradingView.com

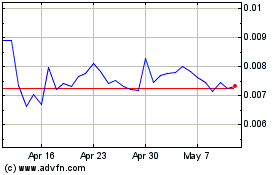

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles