Bitcoin & The Global Currency Meltdown | BTCUSD September 28, 2022

September 28 2022 - 2:29PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis videos, we

examine how Bitcoin is trading against other currency pairs and not

USD. We also look at BTC against WTI Crude Oil and the S&P 500.

Take a look at the video below: VIDEO: Bitcoin Price Analysis

(BTCUSD): September 28, 2022 The market continues to be shaken

up by the strength of the dollar. Following yesterday’s rally in

BTC that was immediately wiped out, traders are even more hesitant

to pull the trigger with the top cryptocurrency rising again.

Related Reading: Bitcoin & The Hunt For A Green October |

BTCUSD September 27, 2022 Bitcoin Daily Momentum Change Causes

Chain Reaction Bitcoin daily has flipped bullish on the LMACD,

setting off a chain reaction across a variety of

timeframes. In terms of this chain reaction, we have a bullish

crossover on the 3-day and the weekly timeframe. Both, especially

the weekly, have been like bait, snapping back at bulls each time

they attempt to turn the tides of momentum. Momentum causes

a bullish chain reaction of crossovers | Source: BTCUSD on

TradingView.com How BTC Fares Against Other World Currencies The

DXY Dollar Currency Index is the dollar trading against a weighted

basket of top national currencies. These currencies include the

British pound sterling, the euro, the Canadian dollar, Japanese

yen, Swedish krona, and Swiss franc. Due to the enormous shakeup

and volatility in global currency markets, we put Bitcoin up

against other currencies and not the standard USD pair. As you can

see, the pound, euro, canadian dollar, and Japanese yen all crossed

bullish weeks prior, while the USD pair struggles to do so. Other

strong national currencies like the Swedish krona and Swiss franc

have yet to cross over much like the dollar. Bitcoin could be

bottoming against several top currencies | Source: BTCUSD on

TradingView.com Related Reading: Bitcoin Shows Resilience In

Dollar-Driven Bloodbath | BTCUSD September 26, 2022 Comparing The

Top Crypto To The S&P 500 And WTI Crude Oil Continuing the deep

dive into unorthodox Bitcoin charts, we’ve combined the charts of

BTCUSD and the SPX. This unique chart shows that Bitcoin never made

a higher high in late 2021, and the downtrend began with the April

peak. This chart also is flipping bullish and has a weekly close

confirming the crossover. Bullish momentum will need to grow

to sustain a rally. Next, we’ve compared Bitcoin to what could be

the most important macro asset globally: oil. In this comparison,

much like the SPX example, we put BTCUSD up against WTI Crude Oil.

WTI Crude oil is American produced oil from West Texas

Intermediate. In this oddball trading pair, Bitcoin also had

a lower high and a much steeper downtrend. However, Bitcoin flipped

bullish against oil several weeks ago, but has yet to produce a

meaningful upside move. Is such a move coming soon enough? Bitcoin

has crossed bullish against the SPX and WTI Crude Oil | Source:

BTCUSD on TradingView.com Learn crypto technical analysis yourself

with the NewsBTC Trading Course. Click here to access the free

educational program. Follow @TonySpilotroBTC on Twitter or

join the TonyTradesBTC Telegram for exclusive daily market

insights and technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from

TradingView.com

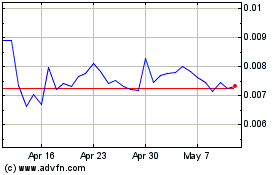

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles