Let’s Go Electric..!

September 26 2022 - 1:23PM

NEWSBTC

EasyFi’s On-chain Permissionless Margin Trading Protocol aims to

bring scale to the burgeoning DEX based trades The permissionless

and composability ethos of the DeFi space has allowed the creation,

listing and trading of the almost 20000 tokens and coins with

varying degrees of liquidity, volumes and growth. Leveraged

trading, however, has had its share of centralization with over

$200 billion worth of margin trades happening on a daily basis on

the many centralized exchanges. On DEXs – not so much!

Permissionless markets for leveraged trading have been few and far

between and that too with minimal market penetration and depth.

What the DeFi market truly needs is enough scale to meet the

decentralized margin trade demand that it displays. Introducing

Electric Building on the #DoMoreWithDeFi vision at EasyFi, we bring

you Electric – a decentralized, permissionless, scalable, secure,

leverage trading platform, that enables traders to take out

short-term loans to trade margin positions from publicly sourced

liquidity on from different AMMs / decentralized exchanges. This

will happen on the EasyFi App where users can conduct margin trades

on designated trading pairs in an efficient and secure manner.

Leverage hundreds of tokens on EasyFi’s multichain margin trading

product and execute leveraged trades with integrated liquidity from

top DEXs like Uniswap, Sushiswap, PancakeSwap, QuickSwap and more

on multiple blockchain networks. Key Features

– Trades with

Liquidity on DEXs – Will connect traders to trade with the most

liquid decentralized markets / AMMs. We are exploring a

collaboration with every AMM of repute.

– Risk-reward –

Separate pools of different asset pairs will be created. This will

allow lenders to invest understanding different risk and interest

parameters. Lenders can invest based on the calculated risk-reward

ratio – Real-time

AMM Price – Collateral ratio with real-time AMM price for any pair

available from a DEX.

– On-Demand Oracle

– Electric uses price feed oracles from Chainlink integrated into

the lending protocol and the ones provided by the DEX to detect the

market price and any manipulation whatsoever. This detection forces

a price update that makes it trading and liquidation valid.

– UI/UX – EasyFi

has been a pioneer in building simple, intuitive and user-friendly

products. The interface and experience for Electric has been

planned in a similar manner. Product Vision Trading Pairs – The

trading pairs on Electric will be based on the isolated and

independent lending pools that are available on Electric. We will

start with a small set of tokens for the margin markets which will

include both volatile and stable assets. Lending Pools – As of now,

EasyFi will create all lending pools for Electric. We expect these

decisions to be taken over by the community when we launch the

EasyFi DAO. Margin Markets – The margin markets to begin will start

with a few pairs as mentioned above. Users who wish to trade on the

margin trading markets will essentially have to first deposit a

collateral directly on the Electric module. Margin Interest –

Margin interest incurred by leveraged traders is paid out to

lenders. Lenders can earn higher yields by depositing assets into

the lending pools, earning interest from borrowed assets and also

receive other rewards, via some exclusive programs. DEX Chains – We

will essentially be connecting to top AMM / DEXs on Polygon,

Ethereum & BNB Chain to begin with and slowly expand to others

Community involvement – The community will eventually own the

decision-making process on proposals sent to Electric when the

governance process on EasyFi DAO kicks-in. Decisions on lending

collaterals, margin trading pairs, default interest rates, risk

parameters, will eventually be the community’s prerogative in the

long term. Testnet Launch – The Testnet has been launched – it will

enable the users to try and test the module to the hilt and so we

can iron out any issues. In the Testnet version, we are opening

testing of leveraged trading on MATIC, USDT, DAI & USDC – we

will keep adding new trading pairs in due course for testing as

well. Coming up Next The Electric contracts have been deployed to

the Polygon Mumbai Testnet with a connection to QuickSwap Testnet

as a DEX integration Ample time for the community to try and test

this protocol before mainnet launch Partnering with DEXs to

integrate with the Electric Protocol About EasyFi EasyFi Network is

a universal layer-2 multi-chain money market protocol for digital

assets with focus on liquidity sourcing & capital efficiency

for structured lending in a non-custodial manner. The Protocol is

currently live on Polygon, Binance Smart Chain and Ethereum.

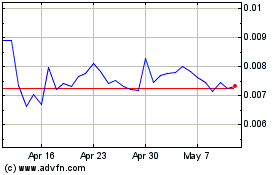

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles