Staked ETH Nears 14 Million As Ethereum Readies For Breakout

September 26 2022 - 1:00PM

NEWSBTC

Since the completion of the Ethereum Merge, sentiment among the

community has remained positive. There had been no withdrawal

mechanisms coded into the hard fork, which meant that the feared

dump of millions of ETH into the market did not happen. What had

happened is that the amount of ETH that was being staked on the

network had continued to grow, now getting close to another

important milestone for the network. Staked ETH Almost At 14

Million By the time the Merge was to be implemented, there had been

more than 13 million ETH already staked on the network. This

represented more than 11% of the total circulating ETH supply being

taken out of circulation temporarily. Related Reading:

Cardano (ADA) Price Reacts Poorly To Vasil Hard Fork Now, less than

two weeks after the Merge was completed, the staked volume on the

network is already ramping up. Since September 15th, there have

been more than 200,000 ETH staked on the network. This has brought

the total staked ETH to 13.979 million, leaving less than 27 ETH

left for the network to reach the 14 million mark. This means that

the addition of one more validator will push the staked amount

above 14 million, meaning more than 11.5% of the total supply of

ETH is now staked. The accelerated rate of staking speaks volumes

about the support that Ethereum is getting. Even though there are

those who have lamented the network’s move to proof of stake, the

improved capabilities of the network point to this being the right

direction for it. Ethereum Wants Another Breakout The crypto market

has been reeling from the crash, but it has seen some meaningful

recovery in this time. One of the cryptocurrencies that continues

to show great promise even through this bear run has been Ethereum,

and this has everything to do with ETH staking. Related Reading:

Number Of Bitcoin Addresses Sending BTC To Exchanges Continues To

Drop Since more ETH is being staked on the network and there is no

withdrawal mechanism in place, these ETH are being taken out of

circulation and essentially reducing the supply. The ETH issuance

since the Merge is also down 98%, meaning that the supply of ETH is

declining by the day. All of these point towards an incoming supply

squeeze. When taking into account the fact that ETH continues to

show accumulation trends and the support forming at $1,300, a

breakout towards $1,500 is more likely at this point, as more

investors move their coins out of centralized exchanges, as was

seen in the last 7 days, the supply will get tighter, causing the

value of the cryptocurrency to balloon. Featured image from

Business 2 Community, charts from TradingView.com Follow Best Owie

on Twitter for market insights, updates, and the occasional funny

tweet…

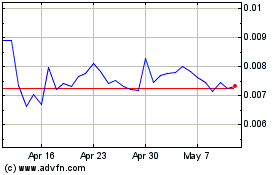

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles