JP Morgan To Render Crypto Services Despite The Bear Run

September 21 2022 - 11:38PM

NEWSBTC

JPMorgan & Co. is one of the leading financial services

institutions globally, including crypto. Its assets and worldwide

operations are worth over $2.6 trillion. The company’s rich history

has been on for more than 200 years. JP Morgan is committed to

providing commercial banking, financial services for small

businesses and customers, investment banking, etc. It also provides

asset management and financial transaction processing. Related

Reading: Post-Merge Profit-Taking Cuts 13% Off Ethereum Ratio

Against BTC The company shared some recent happenings among its

clients. It revealed that many are withdrawing from using digital

currencies as payment means. According to the company, this new

action from its clients has been on for the last few months. The

primary reason for the drop in interest is the current bear market

in the digital currency industry. Crypto Market And Effect On

JPMorgan Several adverse events are the main reasons for the

current bearish market. Some of these are the U.S. 40-year record

inflation rate, the Ukraine conflict, the European Union energy

crisis, etc. This bearish crypto market negatively affects

investors and traders in several crypto financial firms. An example

of these companies is JPMorgan Chase. Takis Georgakopoulos cited

that the company’s clients were eager to use cryptocurrencies as a

means of payment six months before now. Georgakopoulos is the

Global Head of Payments at JPMorgan Chase & Co. In a recent

interview with Bloomberg, he stated that customers’ loss of

interest was observed in the heat of the bear market. At the time,

BTC was trading at about $40K. Other digital currencies, including

Ether, were also doing well compared to the present look of the

market. The crypto winter started in the middle of 2022,

significantly changing the global macroeconomic environment. This

became the major cause of the decline in the cryptocurrency

interest of the company’s clients. Georgakopoulos encouraged other

clients stating that the company would continue its crypto services

regardless of the current market situation. Other companies like

Wall Street still believe that digital tokens are still the future

of the world’s financial system. Moreover, these tokens are already

gaining popularity in the Metaverse and gaming sectors. Metaverse

And JPMorgan Chase Participants in the Metaverse 3D virtual reality

space can communicate with themselves using digital objects. This

space seems to be a good spot for JPMorgan to expand its financial

services. Related Reading: XRP Braces For Turbulence Amid Looming

Fed Hike, Ongoing Ripple-SEC Court War The company is already

making plans to achieve these objectives. It wants to hire a leader

to identify and gain more payment opportunities in the Metaverse,

Crypto, and Web 3 sub-vertical. The bank also needs tech-savvy

individuals and financial specialists to carry out the potential

tasks to achieve its goal. Featured image from Pixabay, Chart:

TradingView.com

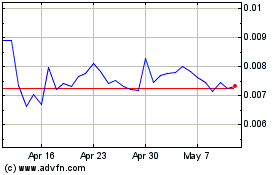

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles