Lightning Speed: How To Take BTC From Reserve Asset To World Reserve Currency

August 09 2022 - 3:40AM

NEWSBTC

Is the Lightning Network bitcoin’s killer app? It might be, but it

still has a long road ahead. One of the stops on that road is the

possible inclusion of stablecoins. Does bitcoin need them? Aren’t

there inherent counterparty risks with those? The debate over those

questions rages on. And in their latest post, The Bitcoin Layer

makes the case for this development to be crucial in The Lightning

Networks trajectory. Related Reading: An Interview with Ben

Caselin on AAX- Lightning Network Integration and TARO Protocol

Implementation According to The Bitcoin Layer, “a global capital

market operating on top of bitcoin-denominated financial rails is

inching closer with each new onramp.” And the Taro protocol and all

of the assets it would bring to The Lightning Network is the mother

of all onramps. However, the risks it brings forth are as big as

the opportunities it presents. Let’s explore what The Bitcoin Layer

has to say before jumping to conclusions. They might surprise us.

Making Lightning Interoperable With Everything The first part of

the article is about Magma, “a Lightning liquidity marketplace that

allows nodes to buy and sell liquidity by leasing other network

participant’s channels for a minimum specified period of time.”

According to the article, Magma’s existence proves “a structural

demand for secondary markets of liquidity”. In those markets,

“participants can buy and sell collateral as needed—eventually

blossoming into a deep and liquid capital market.” Not only

that, The Bitcoin Layer also theorizes about: “Through time,

Lightning Banks will emerge. As market participants lack the

technical wherewithal to efficiently operate Lightning channels,

most Lightning Network channel management will be subsumed by these

entities who specialize in it.” And this is where the Taro protocol

comes in. When it was announced, our sister site Bitcoinist posed

the following questions: “So, the main idea is to create and

transact stablecoins over the Lightning Network, but the technology

allows users to create any asset including NFTs. And the bitcoin

network underpins the whole thing. However, is this a positive

development for bitcoin? How will this benefit the Lightning

Network? Does a hyperbitcoinized world require tokens?” And The

Bitcoin Layer provides convincing enough answers to those

questions. But first… “Taro makes bitcoin and Lightning

interoperable with everything. For the Lightning Network, this

means more network volume, more network liquidity, and more routing

fees for node operators, driving more innovation and capital into

the space. Any increase in demand for transactional capacity that

will come from these new assets (think stablecoins) will correspond

with increased liquidity on the bitcoin network to facilitate these

transactions.” BTC price chart for 08/09/2022 on Kraken |

Source: BTC/USD on TradingView.com A Bitcoin-Denominated Global

Capital Market “Using sats as the transmittal rails for

transactions across every currency opens the door for a

bitcoin-denominated global capital market”. No one would contest

that. Nor that “the Taro protocol opens the floodgates for this

traditional finance liquidity to be subsumed by a faster,

counterparty-free settlement network”. The network is

counterparty-free, but, what about the assets’ inherent

counterparty risk? Conceptual Future Bitcoin-Lightning Risk Curve |

Source: The Bitcoin Layer According to The Bitcoin Layer, it’s all

about risk and the barrier to entry: “Higher tiers on the risk

curve require less maintenance but incur more risk, whereas the

lower levels on the risk curve incur less risk but have a higher

barrier to entry for the average person who lacks the technical

wherewithal for maintenance and security best practices.” And

they make the case that the introduction of Taro is a crucial step

in the process of bitcoin fulfilling its destiny of becoming the

world reserve currency. “For bitcoin to become a world reserve

currency, a deeply liquid capital market is an intrinsic

requirement—and the Taro protocol is a promising step in making

that happen. While bitcoin and LN are trillions of dollars away

from becoming a legitimate alternative to other capital markets,

they arguably maintain the lowest collective risk profile of any

capital market in existence, as they are underwritten by an asset

that when custodied incurs zero counterparty risk.” Zero

counterparty risk. Does The Lightning Network Need Stablecoins,

Though? The answer to that question is still up in the air. The

Bitcoin Layer acknowledges the inherent counterparty risk those

present. It even puts them almost at the top of the risk curve.

However, they consider them crucial and even welcome every other

asset in the world to The Lightning Network. According to their

theory, that’s how “a bitcoin-denominated capital market” emerges.

Related Reading: Lightning Speed: Open-Source Bitcoin Banks’ Fee

Structures For Inbound Liquidity Of course, this is all

speculation. The Taro protocol has not been approved. Bitcoin’s

liquidity is far away from what it needs to be to become the global

reserve currency. And, even though stablecoins on The Lightning

Network might be closer than we think, the whole scenario takes

place in a distant future. Featured Image by WikimediaImages from

Pixabay | Charts by TradingView and The Bitcoin Layer

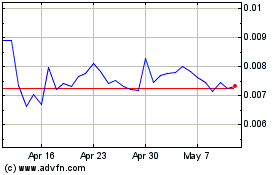

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles