UPDATE:BlueScope Steel 1st Half Loss Deepens As Materials Costs Rise

February 20 2011 - 8:03PM

Dow Jones News

Net losses for Australia's largest steelmaker by revenue,

BlueScope Steel Ltd. (BSL.AU), deepened over its fiscal first half

to Dec. 31 as the price of key raw materials boomed in an

oversupplied global steel market.

Net losses in the half nearly doubled to A$55 million, from A$28

million the previous year, the company said, although revenues rose

13% to A$4.62 billion from A$4.11 billion.

The outcome illustrates the stark divide between miners and

producers in the steel industry, as materials costs rise against a

more restrained backdrop for steel prices. Steel is a crucial

commodity for the world's manufacturing and construction sectors

and a vital indicator of global economic health.

Diversified miners including BHP Billiton Ltd. (BHP), Rio Tinto

Ltd. (RIO), Anglo American PLC (AAL.LN), Xstrata PLC (XTA.LN), and

Fortescue Metals Group Ltd. (FMG.AU) have announced surging profits

over the past two weeks on the back of record prices for

steelmaking materials, particularly iron ore and coking coal. Each

ton of steel requires around 1.5 tons of iron ore and 0.6 ton of

coking coal.

East Asian hot-rolled coil, a benchmark sheet metal product, has

risen 18% to US$730 a metric ton from US$620 since the new year

amid rising expectations of global growth, according to

Commonwealth Bank of Australia. But record wet weather in mining

regions of Australia has driven up prices of iron ore and coking

coal still further.

Based on price data from CBA and data service CoalPortal, that

has pushed raw materials costs up to US$488/ton from US$387/ton

over the same period, a rise to 67% from 62% in key input costs as

a percentage of sale prices.

BlueScope Chief Executive Officer Paul O'Malley said the

still-fragile global economy is keeping supply ahead of demand in

an oversupplied world steelmaking sector.

"We need to see gross domestic product in the developed world

improve, and drive increased steel demand, to narrow the

supply/demand gap. Steel margins continue to be impacted by the

high cost of raw materials," he said.

The company said the A$285 million deterioration in its

underlying earnings from the second half of the 2010 financial year

was largely caused by a A$356 million increase in materials costs,

which was offset by only a A$106 million improvement in steel sale

prices.

But BlueScope's results were also hit by a stronger Australian

dollar cutting into export margins and offshore profits, by lower

steel demand in Australia, and A$16 million of negative accounting

and tax changes, the company said.

Australia's construction and manufacturing sectors have been hit

hard by a stronger currency and rising interest rates caused by the

resurgent mining sector, with the sectors suffering contractions

since August and May, respectively, according to the Australian

Industry Group, a trade body.

BlueScope's largest division in Australia particularly

underperformed, accounting for A$35 million of the A$41 million

on-year decline in first-half underlying earnings before interest

and tax.

However, on an underlying basis excluding one-off items, the

company's net loss narrowed 11% to A$47 million from A$53 million,

and management proposed an interim dividend of 2 cents per share,

including franking tax credits, compared to a halted payout the

year before.

BlueScope, a former division of BHP Billiton that traditionally

uses product from BHP's mines in Australia's iron-rich Pilbara

region, has taken to buying Fortescue's cheaper iron ore over the

past six months as prices for the material have risen.

O'Malley said it would be hard to forecast performance in the

second half of the financial year due to the difficulty in

estimating the spread between costs of the key raw materials of

iron ore, scrap and coking coal, and steel prices.

"This spread is difficult to forecast. At the moment we expect

to deliver a break-even net profit after tax" in the second half,

he said.

The company also said it had agreed a A$1.35 billion loan from a

syndicate of 13 banks to replace a A$1.28 billion facility due to

expire in July.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

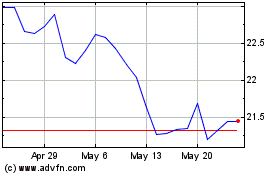

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From May 2024 to Jun 2024

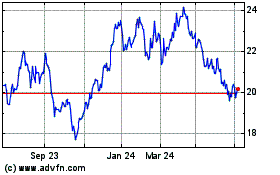

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Jun 2023 to Jun 2024