TIDMWAFR

RNS Number : 0884A

Virgata Services Ltd

27 May 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA OR

JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD BE

UNLAWFUL.

FOR IMMEDIATE RELEASE

27 May 2021

FIRM CASH OFFER

BY

VIRGATA SERVICES LIMITED

FOR

WALLS & FUTURES REIT PLC

FIRST CLOSING DATE & OFFER EXTED TO 10 JUNE 2021

On 8 April 2021 , Virgata Services Limited ("Virgata") announced

the terms of its firm cash offer ("Offer") to acquire the entire

issued and to be issued ordinary share capital of Walls &

Futures REIT plc ("Walls & Futures"). The full terms and

conditions of the Offer and the procedures for acceptance were set

out in the offer document ("Offer Document") and form of acceptance

("Form of Acceptance") published by Virgata on 6 May 2021.

Walls & Futures' Fundamental Challenge

On 20 May 2021, your Directors sent a circular to Walls &

Futures Shareholders (the "Response Circular"). A copy of the

Response Circular can be viewed on the Walls & Futures'

website, https://reit.wallsandfutures.com/unsolicited-offer .

The Response Circular is, in Virgata's view, an admission of

failure on the part of your Directors. The only alternative your

Directors have to offer to Virgata's cash offer is to throw in the

towel, a stated intention (but not promise) to liquidate the

company, and return to you any cash that is left over.

The Response Circular provides plenty of information to you as

Shareholders, but unfortunately, in Virgata's view, very little

that is relevant to your decision as to whether or not to accept

the Offer. It is more a distraction and an attempt to justify the

poor performance of the Directors, blaming external factors, other

shareholders and indeed the pressure on values in the commercial

real estate market (which should not be relevant given Walls &

Futures' focus on SSH developments).

Virgata has always been very transparent regarding the Offer.

The Offer is certain cash now and at a material premium to what a

Walls & Futures Shareholder would receive if selling their

Shares in the market. It is at a material discount to the reported

NAV.

Virgata believes that your Directors have spent 4.5 years being

paid substantial salaries (GBP486,000 in aggregate) and presided

over a 65% share price fall, paid no dividends and run a company

that lacks scale and the growth capital to address this and

therefore has no appeal to investors.

Fundamentally for the Walls & Futures share price to

increase, your Directors need to turn Walls & Futures into a

business that investors wish to invest in (i.e. buy shares in). To

achieve this, Virgata believes that your Directors need to address

fundamental and obvious issues that were not mentioned in the

Response Circular, namely:

× The sale value of your Shares in the market was 65 per cent.

less than the issue price when the Company IPO'd in 2016

o Investors do not wish to buy shares that will decrease in

value

× Your Directors run a company that each year spends more in

costs and expenses than it earns in property income

o Investors do not wish to see investable capital used on

Directors' salaries and other costs instead of being invested to

grow the business

× No dividends have been paid, despite your Directors' promise of a 3 - 4% dividend yield

o Investors holding shares in SIPPs or other pension funds

usually look for dividends to provide an income. Walls &

Futures shows no signs of being able to pay a dividend ahead of the

winding up vote

The result of this failed approach for you as Shareholders is

that selling your Shares, at your Directors' own admission, is very

hard to do and will negatively impact your share price.

The solution offered by your Directors is that if they continue

to fail to attract investors, they will propose to wind up the

Company and sell the property assets to whomever offers the best

price at the time. Virgata believes this solvent winding up will

result in a present value to Walls & Futures Shareholders of no

more than 55 to 60 pence, with no dividends to be paid between now

and the end of the liquidation. Not substantially higher than the

certain cash Virgata is offering today, with none of the risk and

without a 2.5 year wait!

It is also important that Shareholders be aware that there is no

binding commitment to offer a winding up vote. Your Directors can

simply change their minds and continue as before.

AS A RESULT, A CERTAIN CASH OFFER OF 50 PENCE IS THE BEST OPTION

FOR A WALLS & FUTURES SHAREHOLDER. VIRGATA URGES YOU TO ACCEPT

THE OFFER.

Virgata's views on the Response Circular

Virgata believes that there are a significant number of

statements in the Response Circular that are misleading and do not

present shareholders with a fair position upon which to make a

decision as to whether to accept the Offer or stick with the status

quo.

As previously stated, we believe this is a tactic to avoid the

Directors taking responsibility for the poor performance of the

Company under their management.

A few examples of these misleading statements, taken directly

from the Response Circular are provided below, alongside an

explanation from Virgata:

1. Your Directors said:

"...the Walls & Futures Directors therefore intend to

include a winding up resolution in the Company's 2022 notice of

annual general meeting, such meeting to take place before the end

of September 2022."

"No statement in this paragraph is a "post-offer undertaking"

for the purpose of Rule 19.5 of the Code."

Whilst providing lots of details as to the course of action your

Directors are intending to take, it should be made clear that

whilst this statement might appear to be a promise to offer

Shareholders such a vote, this statement is not a binding

commitment by your Directors and they can simply change their minds

and carry on with the current position.

Virgata believes it is important for Shareholders to understand

that if they reject the Offer, there is no certainty of such a

vote. Your Directors also failed to provide an indication of the

potential value that could be achieved through this process,

something Virgata has sought to do to help Shareholders decide the

best course of action to take.

2. Your Directors said:

" The Offer values our property assets at just GBP1.2

million..."

In making this statement your Directors are forgetting a number

of material items that significantly reduce the cash in the

business should the Offer complete, such as the cash payments to be

made to your Directors under their Management Incentive Plan, the

transaction costs that will be paid and that the Company spends

more each month than it receives in income.

These and other items aggregate to almost GBP400,000 which means

that Virgata is actually paying closer to GBP1.6 million (over 30

per cent. more than your Directors stated) and an equivalent price

to the original purchase cost of the properties of GBP1.64

million.

3. Your Directors said:

"The Offer would result in Virgata having control of your

company. Should it become the majority shareholder, it may be able

to use its voting power without restriction to significantly dilute

your shareholding."

What your Directors do not say is that whilst technically a 75

per cent. shareholder could pass such resolutions, the board of

directors would be in blatant breach of their fiduciary duties and

the other shareholders would have a straightforward claim for

unfair prejudice under section 994 of the Companies Act 2006. The

courts have very wide powers to make any order they deem

appropriate where there is such a claim and the English courts have

ruled that the improper purpose of diluting a minority

shareholder's shareholding is an obvious example of unfair

prejudice (see case law Re Coloursource Ltd (2004)).

As a result, any controlling shareholder seeking to take such

action would, in Virgata's opinion, face swift legal action which

would be supported by case law. Quite an important and relevant

piece of information when considering such an action.

4. Your Directors said:

"In the short term, our new investments will be made from our

cash deposits and from the capital released from the expected sale

of our final London property, although for so long as the Company

remains in an offer period any sale of the property would be

subject to shareholder approval at a general meeting, in accordance

with the requirements of Rule 21.1 of the Code."

As a Shareholder you may read this statement from your Directors

and believe that Virgata and the Offer is in some way preventing

your Directors from selling this property.

Your Directors have been trying (and have so far failed) to sell

this property since January 2021, well before the time of Virgata's

offer. In the opinion of Virgata, it is simply the case that your

Directors are unable to find a buyer that is willing to pay close

to the value your Directors attribute to this property. As

background, Virgata noted that the property that is being referred

to was advertised via Wigmore Jones Limited (a company whose two

directors, per Companies House, are Mr J McTaggart (your CEO) and

Mrs H McTaggart) on 25 January 2021 at GBP695,000 and on 3 March 21

the property was advertised as "sold, STC". More recently Virgata

notes that the sale has fallen through and the property now simply

remains advertised as "for sale" at the same price, albeit the

Response Circular provides a lower current market value of

GBP650,000.

For the avoidance of doubt, the Takeover Code is very clear that

there are numerous avenues to get through the requirements of Rule

21.1 so that this property could be sold if your Directors had an

appropriate buyer and wished to proceed. A straight-forward option

is to ask for offeror (being Virgata) consent. This consent has

never been sought from Virgata.

Key Reasons to Accept the Offer

Virgata considers the Response Circular as a feeble attempt by

the Walls & Futures Board to divert attention away from their

own failure.

ü VIRGATA'S OFFER REPRESENTS A DELIVERABLE AND CERTAIN EXIT AT

AN ATTRACTIVE VALUE OF 50 PENCE CASH PER WALLS & FUTURES

SHARE

× VIRGATA BELIEVES THAT THE WALLS & FUTURES BOARD'S PROPOSAL

DOES NOT PRESENT A CREDIBLE ALTERNATIVE BECAUSE:

-- it lacks any substance as to how the Directors will address

the poor share price performance and offers no certainty or binding

commitment as to the timing or value of a solvent winding up

-- in the period to the end of the solvent winding up, Virgata

estimates the Directors will be paid, in aggregate, a further

GBP270,000. As Walls & Futures is loss-making, this directly

erodes the NAV and reduces the cash reserves in the Company that

would be paid to you as Shareholders

-- the Directors have had 4.5 years and delivered: (i) a 65%

share price decline, (ii) no dividends, and (iii) for their

aggregate salaries of GBP486,000, have sold two properties at a

loss and bought two properties. What is suddenly going to

change?

-- the Directors' solution to continued poor performance: "keep

paying us and we will wind-up the Company and return what is left

after fees and expenses (and our salaries) to Walls & Futures

Shareholders"

-- Virgata believes that the present value a Walls & Futures

Shareholder would receive from a solvent winding up is no more than

55 to 60 pence, with no dividends to be paid out between now and

the end of the liquidation - some time in 2023

Level of acceptances from Walls & Futures Shareholders

As at 1.00 p.m. on 27 May 2021 (being the acceptance deadline

for the First Closing Date), valid acceptances had been received

from shareholders of Walls & Futures in respect of a total of

342,731 Walls & Futures Shares, representing approximately 9.13

per cent. of the issued share capital of Walls & Futures, which

Virgata may count towards the acceptance condition of the

Offer.

The percentages of Walls & Futures Shares referred to in

this announcement are based upon a figure of 3,755,086 Walls &

Futures Shares in issue at close of business on 26 May 2021.

Extension of Offer

The Offer has been extended to 1.00 p.m. (London Time) on 10

June 2021

Walls & Futures Shareholders who have not yet accepted the

Offer are urged to do so as soon as possible in accordance with the

following procedures:

-- acceptances of the Offer in respect of certificated Walls

& Futures Shares should be made by completing and returning the

Form of Acceptance as soon as possible; and

-- acceptances in respect of uncertificated Walls & Futures

Shares should be made electronically through CREST. If you are a

CREST sponsored member, you should refer to your CREST sponsor as

only your CREST sponsor will be able to send the necessary TTE

instruction to Euroclear.

Full instructions on how to accept the Offer are set out in the

Offer Document and (for holders of Walls & Futures Shares in

certificated format) the Form of Acceptance.

Copies of the Offer Document and the Form of Acceptance will be

available on Virgata's website at

https://www.virgatagroup.com/westminster and Walls & Futures'

website at https://reit.wallsandfutures.com/investors/ . Further

copies of the Offer Document and the Form of Acceptance may be

obtained (by Walls & Futures Shareholders) by contacting

Neville Registrars during business hours on +44 (0)121 585 1131 or

by submitting a request in writing to the Registrar at Neville

Registrars, Neville House, Steelpark Road, Halesowen, B62 8HD.

Commenting on the Response Circular and Offer, Jordi

Goetstouwers, Owner of Virgata, stated:

" I strongly urge the Walls & Futures Shareholders to

consider our Offer on its merits rather than listening to the weak

and misleading statements of a failed board that has for 4.5 years

failed to deliver the IPO strategy whilst taking substantial

salaries from a sub-scale, loss-making company.

"Virgata urges shareholders to accept the certainty of 50 pence

cash now, rather than hoping that after 4.5 years the Directors

will suddenly start to deliver, or, waiting for an uncertain but

potentially marginally higher amount from a solvent winding up in

2023."

WALLS & FUTURES SHAREHOLDERS ARE URGED TO ACCEPT VIRGATA'S

CASH OFFER AS SOON AS POSSIBLE. THE EXTED CLOSING DATE OF THE OFFER

IS 1.00 P.M. ON 10 JUNE 2021.

Words and expressions defined in the Offer Document shall,

unless the context provides otherwise, have the same meanings in

this announcement.

For further information, please contact:

Virgata Services Limited

Jordi Goetstouwers Tel: +44 (0) 208 123 9740

Andrew Hilbert Tel: +44 (0) 7748 638 542

Cairn Financial Advisers LLP (financial adviser to Virgata)

James Lewis / Sandy Jamieson Tel: +44 (0) 207 213 0880

Important notice related to financial adviser

Cairn Financial Advisers LLP, which is authorised and regulated

in the United Kingdom by the Financial Conduct Authority, is acting

exclusively for Virgata and for no one else in connection with the

Offer or any matters referred to in this announcement and will not

be responsible to anyone other than Virgata for providing the

protections afforded to its clients nor for providing advice in

relation to the Offer, the contents of this announcement or any

other matters referred to in this announcement.

Disclosure requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 p.m. (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 p.m. (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror, save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 p.m. (London time) on the

business day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on websites

A copy of this announcement and the display documents required

to be published pursuant to Rule 26.1 and 26.2 of the Code will be

made available, free of charge and subject to certain restrictions

relating to persons resident in Restricted Jurisdictions, on

Virgata's website at www.virgatagroup.com/westminster by no later

than 12.00 noon (London time) on the business day following the

release of this announcement.

A copy of this announcement is being sent in hard copy to Walls

& Futures Shareholders.

For the avoidance of doubt, neither the contents of such website

nor the content of any other website accessible from hyperlinks on

such websites is incorporated into, or forms part of, this

announcement.

In accordance with Rule 30.3 of the Code, a person so entitled

may request a hard copy of this announcement, free of charge, by

contacting Neville Registrars Limited on 0121 585 1131 (+44 (0) 121

585 1131). For persons who receive a copy of this announcement in

electronic form or via a website notification, a hard copy of this

announcement will not be sent unless so requested. In accordance

with Rule 30.3 of the Code, a person so entitled may also request

that all future documents, announcements and information to be sent

to them in relation to the Offer should be in hard copy form.

Overseas jurisdictions

The distribution of this announcement in jurisdictions other

than the United Kingdom and the ability of Walls & Futures'

Shareholders who are not resident in the United Kingdom to

participate in the Offer may be affected by the laws of relevant

jurisdictions. Therefore any persons who are subject to the laws of

any jurisdiction other than the United Kingdom or Walls &

Futures' Shareholders who are not resident in the United Kingdom

will need to inform themselves about, and observe, any applicable

legal or regulatory requirements. Any failure to comply with the

applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. Further details in

relation to overseas Walls & Futures' Shareholders will be

contained in the Offer Document.

The Offer is not being, and will not be, made available,

directly or indirectly, in or into or by the use of the mails of,

or by any other means or instrumentality of interstate or foreign

commerce of, or any facility of a national state or other

securities exchange of, any Restricted Jurisdiction unless

conducted pursuant to an exemption from the applicable securities

laws of such Restricted Jurisdiction.

Accordingly, copies of this announcement and all documents

relating to the Offer are not being, and must not be, directly or

indirectly, mailed, transmitted or otherwise forwarded, distributed

or sent in, into or from any Restricted Jurisdiction except

pursuant to an exemption from the applicable securities laws of

such Restricted Jurisdiction and persons receiving this

announcement (including, without limitation, agents, nominees,

custodians and trustees) must not distribute, send or mail it in,

into or from such jurisdiction. Any person (including, without

limitation, any agent, nominee, custodian or trustee) who has a

contractual or legal obligation, or may otherwise intend, to

forward this announcement and/or the Offer Document and/or any

other related document to a jurisdiction outside the United Kingdom

should inform themselves of, and observe, any applicable legal or

regulatory requirements of their jurisdiction.

Forward-looking statements

This announcement may contain certain "forward-looking

statements" with respect to Virgata Walls & Futures and/or the

Walls & Futures Group. These forward-looking statements can be

identified by the fact that they do not relate only to historical

or current facts. Forward-looking statements often use words such

as 'anticipate', 'target', 'expect', 'estimate', 'intend', 'plan',

'goal', 'believe', 'will', 'may', 'should', 'would', 'could' or

other words or terms of similar meaning or the negative thereof.

Forward-looking statements include statements relating to the

following: (i) future capital expenditures, expenses, revenues,

earnings, synergies, economic performance, indebtedness, financial

condition, dividend policy, losses and future prospects; (ii)

business and management strategies and the expansion and growth of

Virgata or the Walls & Futures Group and potential synergies

resulting from the Acquisition; and (iii) the expected timing and

scope of the Acquisition.

These forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause actual

results, performance or developments to differ materially from

those expressed in, or implied by, such forward-looking statements.

These forward-looking statements are based on numerous assumptions

regarding present and future strategies and environments. You are

cautioned not to place undue reliance on such forward-looking

statements, which speak only as of the date of this announcement.

All subsequent oral or written forward-looking statements

attributable to Virgata, Walls & Futures and/or the Walls &

Futures Group or any person acting on their behalf (respectively)

are expressly qualified in their entirety by the cautionary

statement above. Should one or more of these risks or uncertainties

materialise, or should underlying assumptions prove incorrect,

actual results may vary materially from those described in this

announcement. Virgata, Walls & Futures and/or the Walls &

Futures Group assume no obligation to update publicly or revise

forward-looking or other statements contained in this announcement,

whether as a result of new information, future events or otherwise,

except to the extent legally required.

Rounding

Certain figures included in this announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an

arithmetic aggregation of the figures that precede them.

No profit forecasts or estimates

No statement in this announcement is intended as a profit

forecast or estimate for any period and no statement in this

announcement should be interpreted to mean that earnings or

earnings per share for Virgata or Walls & Futures, as

appropriate, for the current or future financial years would

necessarily match or exceed the historical published earnings or

earnings per share for Virgata or Walls & Futures, as

appropriate.

Information relating to Walls & Futures' Shareholders

Walls & Futures' Shareholders should be aware that

addresses, electronic addresses and certain other information

provided by Walls & Futures' Shareholders and other relevant

persons for the receipt of communications from Walls & Futures

may be provided to Virgata during the Offer Period as required

under Section 4 of Appendix 4 to the Code.

Bases and sources of information

1. The aggregate salaries of GBP486,000 paid to the Directors of

the Company over a 4.5 year period is calculated from the annual

salaries for Mr J McTaggart, Mr D White and Mr P Wylie of

GBP50,000, GBP50,000 and GBP8,000 as disclosed in the Response

Circular.

2. The 65 per cent. share price decline is based on the IPO

price per Walls & Futures Share of 100p and the Closing Bid

Price of 35 pence per Walls & Futures Share on 7 April 2021,

being the last Business Day before the commencement of the Offer

Period.

3. The value of a Walls & Futures Share being worth 65 per

cent. less in the market than when the Company IPO'd in 2016 is

based on the IPO price per Walls & Futures Share of 100p and

the Closing Bid Price (being the price a shareholder could sell a

Walls & Futures Share at) of 35 pence per Walls & Futures

Share on 7 April 2021, being the last Business Day before the

commencement of the Offer Period.

4. The fact that Walls & Futures spends more in costs and

expenses than it earns in property income each year is extracted

from the annual report and accounts of the Company for the years

ended 31 March 2017, 31 March 2018, 31 March 2019 and 31 March

2020.

5. The following statement "Our target is to deliver a long-term

annual net return of 7 - 9% of which 3 - 4% will be paid in the

form of a dividend." was contained in "The Note to Editors"

statement in Walls & Futures Final Results for the period ended

31 March 2017 RNS announcements released on 29 August 2017 and

subsequent announcements. It was not contained in the Final Results

for the Year to 31 March 2019 RNS announcement released on 20

August 2019 or any announcement after that date.

6. The calculation of the return to a Walls & Futures

Shareholder of a present value of no more than 55 to 60 pence per

Walls & Futures Share is based on;

(i) the disposal of each of the SSH properties currently held by

Walls & Futures at a discount of 11.4% to the current market

value. The discount of 11.4% being the average discount achieved on

the disposal of each of the two properties sold by Walls &

Futures since the IPO in 2016;

(ii) the disposal of the 54 Elsenham Street (Ground Floor Flat)

property at an 11.4% discount to the market value of GBP695,000 at

IPO, not the materially lower current market value of GBP650,000

per the Response Circular;

(iii) 3% costs associated with the disposal of the properties;

(iv) A solvent winding up being approved by Walls & Futures

Shareholders in late 2022 and completed by September 2023 through

an orderly sale of the properties;

(v) The Company's cash balance of GBP658,468 per the Response

Circular being reduced by 2.5 years of operating cash outflows

(GBP424,445 based on the annual operating cash outflow for the year

to 31 March 2020), transaction costs as disclosed in the Response

Circular, cash payments to the Directors of GBP76,604 under the

Management Incentive Plan (being 2% of the 31 March 2021 NAV) and

assumed costs of the voluntary winding up process paid to external

advisers of GBP25,000;

(vi) The net liabilities of the Company at 31 March 2021 of

GBP43,280, based on a NAV of GBP3,830,188, the market value of

properties being GBP3,215,000 and cash of GBP658,468;

(vii) Given the valuation of the SSH properties was unchanged

from 31 March 2020 to 31 March 2021, no further increase in market

value has been assumed;

(viii) No reinvestment of any of the disposal proceeds or

current cash balance is carried out prior to the winding up vote in

Q3 2022. Given the Directors have acquired two properties in the

4.5 years since IPO, Virgata believes this to be a realistic

assumption, especially in the knowledge that a winding up vote

would be imminent if the Directors offer Walls & Futures

Shareholders that voting opportunity;

(ix) No tax is payable on the disposal of any of the properties; and

(x) The calculated cash returns to shareholders have then been

discounted back to 31 March 2021 using a weighted average cost of

capital of between 7.5% - 10.0%.

7. The GBP1.6 million valuation of the property assets of the

Company has been calculated by deducting the Company's cash

balances as at 31 March 2021 of GBP658,468 from the value of the

Offer for the entire issued share capital of the Company of

GBP1,877,543, and then also adjusting for known expenses of the

Company paid or payable on completion of the Offer. These expenses

include:

-- Ongoing cash burn of the Company. Expenses exceeded income

(operating cash flows) for the year to 31 March 2020 by GBP169,685.

If we assume that the Offer completes on Day 60 (5 July 2021) then

an estimated cash burn for the period from 31 March 2021 to 5 July

2021 by the Company would be c.GBP45,000;

-- Adviser fees relating to the Offer for the Company were

disclosed in your Directors' Response Circular as a high of

GBP210,000;

-- Cash payments to be made to your Directors under the

Management Incentive Plan are set out in the Response Circular to

be 2% of NAV, if the NAV is under GBP50m. As the disclosed NAV at

31 March 2021 is c.GBP3.83m, this would result in a cash payment to

your Directors of almost GBP80,000; and

-- If the NAV of the business is c.GBP3.83m at 31 March 2021 and

there is c.GBP0.66m of cash on the balance sheet and GBP3.15m of

properties, then the balancing net liabilities of the company total

c.GBP43,000.

8. Aggregate Director salaries paid in the period to the end of

the solvent winding up have been calculated by looking at the

aggregate reduction in cash in the Company as a result of Directors

salaries from the last disclosed date (31 March 2021) to the

assumed end of the winding up period (being 30 September 2023).

9. The original purchase cost of the properties of GBP1.64

million is calculated by aggregating the market value of 54

Elsenham Street from the Admission Document at IPO (GBP695,000) and

the purchase prices of the Stroud (GBP475,000) and Didcot

(GBP465,000) properties, as disclosed in the RNS announcements of 8

May 2017 and 4 June 2019 respectively.

10. The Company's cash balance of GBP658,468 has been extracted

from the Walls & Futures RNS announcement dated 27 April

2021.

11. Total dividends paid of GBP0 has been calculated by

aggregating the total dividends declared figures from the annual

report and accounts of Walls & Futures for the Review

Period.

12. Financial information relating to Walls & Futures has

been extracted from the audited financial statements of Walls &

Futures for the financial years ended 31 March 2017, 31 March 2018,

31 March 2019 and 31 March 2020.

13. References to the value of the Offer for the whole of the

issued ordinary share capital of Walls & Futures are based on

the 3,755,086 Walls & Futures Shares in issue at close of

business on 26 May 2021 and the Offer Price of 50 pence per Walls

& Futures Share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OUPBSGDUDDDDGBR

(END) Dow Jones Newswires

May 27, 2021 10:35 ET (14:35 GMT)

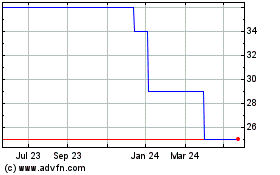

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From May 2024 to Jun 2024

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Jun 2023 to Jun 2024