TIDMWAFR

RNS Number : 9758K

Walls & Futures REIT PLC

08 January 2021

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR")

8 January 2021

WALLS & FUTURES REIT PLC

("Walls & Futures" or the "Company")

Half Year Results for the period to 30 September 2020 &

Southfields disposal

Walls & Futures REIT plc ("WAFR") the Ethical Housing

Investor and developer, is pleased to announce its interim results

for the six months to 30 September 2020.

We are also happy to announce the sale of its leasehold property

in Southfields for GBP660,000 before costs which reflects a 5.7 per

cent discount to its valuation dated as 31 March 2020.

Joe McTaggart, CEO of Walls & Futures REIT plc said:

"We are pleased to have completed the transaction despite the

ongoing economic uncertainty.

We will seek to dispose of our last residential property asset

in London in the coming months and recycle the capital to make

further investments and develop Specialist Supported Housing, where

we have successfully delivered raised the bar and delivered

innovative housing.

This development strategy has enabled us to increase our Net

Asset Value (during the previous 6 months) and revenues in a sector

which, unlike commercial property, has largely been unaffected by

the economic fallout of Covid-19."

Consolidated Income Statement

For the Six-Month Period to 30 September 2020

6 Months to 6 Months to

30 September 30 September

2020 2019

GBP GBP

Rent received 79,023 67,650

Cost of sales (31,409) -

Increase in property values - -

Other Income 27,617 -

Gross Profit 75,231 67,650

Administrative Expenses (121,630) (151,526)

Depreciation (316) -

____________ ____________

OPERATING PROFIT/(LOSS) (46,715) (83,876)

Interest receivable and similar

income - 218

Interest payable (5,578) (8,542)

____________ ____________

PROFIT/(LOSS) BEFORE TAXATION (52,293) (92,200)

Taxation - -

Loss on disposal of fixed assets (19,000) -

& depreciation

____________ ____________

PROFIT/(LOSS) FOR THE FINANCIAL

PERIOD (71,293) (92,200)

Other comprehensive income 176,118 -

TOTAL COMPREHENSIVE INCOME FOR

THE PERIOD 104,825 (92,200)

Consolidated Balance Sheet

30 September 2019

30 September 2020 30 September 2019

GBP GBP GBP GBP

FIXED ASSETS

Investment Property 3,950,316 3,730,010

CURRENT ASSETS

Cash at Bank 40,313 169,036

Debtors and Prepayments 6,934 6,645

------- --------

47,247 175,681

CREDITORS

Amounts falling due within

one year (5,189) (6,176)

------- --------

NET CURRENT ASSETS 42,058 169,505

--------------- -------------------

TOTAL ASSETS LESS CURRENT

LIABILITIES 3,992,404 3,899,515

Provision for Liabilities - -

Amounts falling due over

one year (30,000) (600,000)

--------------- -------------------

NET ASSETS 3,962,374 3,299,515

CAPITAL AND RESERVES

Called up share capital 187,754 187,754

Share Premium 3,505,154 3,505,154

Fair Value Reserve 934,900 297,150

Retained Earnings (665,434) (690,543)

3,962,374 3,299,515

The above figures have not been reviewed by the Company's

auditors.

The Directors of the issuer accept responsibility for the

contents of this announcement.

For further information, contact:

Walls & Futures REIT PLC 0333 700 7171

Joe McTaggart, Chief Executive

Website www.wallsandfutures.com

Allenby Capital Limited (Corporate Adviser)

Nick Harriss/James Reeve 020 3328 5656

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXSSIFIWEFSESF

(END) Dow Jones Newswires

January 08, 2021 02:00 ET (07:00 GMT)

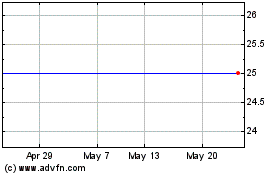

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From May 2024 to Jun 2024

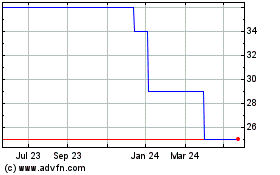

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Jun 2023 to Jun 2024