TIDMWAFR

RNS Number : 8856Z

Walls & Futures REIT PLC

23 September 2020

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

23 September 2020

WALLS & FUTURES REIT PLC

("Wall & Futures" or the "Company")

Final Results for the year to 31 March 2020

Walls & Futures REIT plc ("WAFR") the Ethical Housing

Investor and Developer, is pleased to announce its final results

and the publication of its audited annual report and accounts for

the year to 31 March 2020. A copy of the annual report and accounts

has been posted on the Company's website, www.wallsandfutures.com,

and can also be viewed here:

http://www.rns-pdf.londonstockexchange.com/rns/8856Z_1-2020-9-23.pdf

Walls & Futures is an ethical housing investor and developer

on a mission to address the unfulfilled demand for specialist

social housing in the UK.

We design, fund and develop specialist social housing which is

let on Full Repairing and Insuring (FRI), inflation linked leases

to our partners and customers who include local authorities,

registered providers and charities. Their tenants are often

individuals with learning & physical disabilities, autism,

dementia, mental health and life changing injuries.

Walls & Futures REIT plc does not have any involvement with

the care delivered within the properties, this is managed by care

providers approved by local authorities.

Highlights Include:

-- Profit GBP625,835 (2018: Loss of GBP18,408)

-- Revenue up 1.5% to GBP138,036 (2019: GBP135,878)

-- Investment property value increased by 21.9%

-- Earnings per share 16.93p (2019: -0.51p)

-- Outperformed MSCI UK residential benchmark by 423% for year ending 2019

Key elements of the final results can be viewed below.

Joe McTaggart, CEO of Walls & Futures REIT plc said:

"We're delighted investments in Specialist supported housing

have created fantastic new homes for residents and much needed

high-quality and flexible capacity to the sector.

Additionally, by our strategy of deal origination and real

estate development has enabled us to create significant value

growth, increasing our property portfolio 21.9%.

We will be seeking to dispose of our remaining London

residential assets and recycle the capital to make further, more

profitable Specialist supported housing investments, translating

our benchmark beating performance into a maiden and regular

dividend."

For further information, contact:

Walls & Futures REIT PLC 0333 700 7171

Joe McTaggart, Chief Executive

Website www.wallsandfutures.com

Allenby Capital Limited (Corporate Adviser)

Nick Harriss/James Reeve 020 3328 5656

Overview

For the calendar year 2019, our portfolio delivered a total

return of 23% against the MSCI UK Residential index, which returned

4.4%. This is the third consecutive year that we have outperformed

our benchmark. We believe our ongoing success is due to our

strategy of proprietary deal origination and real estate

development which creates value growth and contributes towards

building a resilient income stream.

On 3 June 2019, we announced that we had secured a GBP600,000

Revolving Credit Facility from a private lender, Monastery Hire and

Sales Limited. Set to run for an initial 5-year term, at an

interest margin of 3.5% over LIBOR. A fee of 0.1% per annum is

payable on any undrawn balances. It will be used to provide

flexibility to finance the acquisition and refurbishment of

specialist supported housing.

On 4 June 2019, we announced the completion of the acquisition

of a freehold detached bungalow in Didcot, Oxfordshire for

GBP465,000. The property was redeveloped and adapted to provide a

high-quality home with specialist support, for four adults with

physical & learning disabilities. It was successfully handed

over in December 2020 let on a 25-year full repairing and insuring

lease linked to inflation (CPI) to one of the UK's largest and

longest-established providers currently supporting more than 2,500

adults nationwide.

The value growth created is evidenced in this year's results and

the full benefit of the income will be reflected in our 2020-21

results.

We were once again nominated for the "Impact Company" and "NEX

Exchange Company" of the year at the Small Cap 2019 awards. The

annual event shines a light on the best companies and participants

in the small and micro-cap community (sub-GBP100m market

capitalisation).

On 28 August 2019, we announced that we had received a

subscription 142,857 ordinary shares of 5 pence each at a price of

70 pence per share for a total of GBP100,000 from a new

investor.

Post balance sheet event

On 12 June 2020, we announced the disposal of our freehold

property in Wimbledon Park for GBP656,000. Despite the challenges

posed by Covid-19 and the economic backdrop the price achieved

reflected just a 2.9% discount on its valuation and highlights the

underlying strength of our London residential portfolio.

We will continue to review our assets in the Private Rental

Sector with a view of recycling the capital to make further

investments in Specialist Supported Housing.

Outlook for the future

To date our investments in Specialist Supported Housing have

created a total return that has enabled us to outperform the MSCI

UK residential index for three consecutive years.

To translate this performance into a maiden and regular dividend

we intend to dispose of our remaining London residential assets and

to recycle the capital making further and more profitable

investments in Specialist Supported Housing.

We note with disappointment that the share price has been lower

than our net asset value of 107p per share. We believe this is due

to an overhang of shares being held by the market maker. We are

working to increase awareness of Walls & Futures REIT plc and

our investment aims to a wider range of retail and institutional

investors.

We continue to develop relationships with key stakeholders and

customers and are always reviewing new investments which will be

announced as they are finalised.

The directors will continue the same investment policies which

have been successful since joining the AQUIS Stock Exchange.

Finally, we would like to thank all our shareholders for their

support.

Consolidated Income Statement for the year ended 31 March

2020

2020 2019

Notes GBP GBP

TURNOVER 4

138,036 135,878

Cost of sales 13,286 13,607

----------- ----------

GROSS PROFIT 124,750 122,271

Administrative expenses 275,725 286,093

----------

(150,975) (163,822)

Gain/loss on revaluation of tangible assets 797,686 145,000

----------

OPERATING PROFIT/(LOSS) 6 646,711 (18,822)

Interest receivable and similar income 350 522

----------

647,061 (18,300)

Interest payable and similar expenses 7 21,226 -

----------

PROFIT/(LOSS) BEFORE TAXATION 625,835 (18,300)

Tax on profit/(loss) 8 67 108

----------

PROFIT/(LOSS) FOR THE FINANCIAL YEAR 625,768 (18,408)

-----------

Profit/(loss) attributable to: Owners of

the parent 625,768 (18,408)

-----------

Earnings per share expressed

in pence per share: 10

Basic 16.93 -0.51

Diluted 16.93 -0.51

Consolidated Statement of Financial Position as at 31 March

2020

2020 2019

Notes GBP GBP GBP GBP

FIXED ASSETS

Tangible assets 11 631 1,263

Investments 12 - -

Investment property 13 4,625,000 3,170,000

---------------------------------------- -----------

4,625,631 3,171,263

CURRENT ASSETS

Debtors 14 4,489 4,363

Cash at bank 22,306 148,955

---------------------------------------- --------------------

CREDITORS 26,795 153,318

Amounts falling due within

one year 15 18,760 16,683

---------------------------------------- --------------------

NET CURRENT ASSETS 8,035 136,635

---------------------------------------- -----------

TOTAL ASSETS LESS CURRENT LIABILITIES 4,633,666 3,307,898

CREDITORS

Amounts falling due after more

than one

year 16 600,000 -

---------------------------------------- -----------

NET ASSETS 4,033,666 3,307,898

----------------------------------------

CAPITAL AND RESERVES

Called up share capital 21 187,754 180,611

Share premium 22 3,505,154 3,412,297

Fair value reserve 22 1,111,019 313,333

Retained earnings 22 (770,261) (598,343)

---------------------------------------- -----------

SHAREHOLDERS' FUNDS 25 4,033,666 3,307,898

---------------------------------------- -----------

Consolidated Statement of Cash Flows for the year ended 31 March

2020

2020 2019

Notes GBP GBP

Cash flows from operating

activities

Cash generated from operations 1 (148,459) (165,603)

Interest paid (21,226) -

Tax paid - (9)

-------------

Net cash from operating

activities (169,685) (165,612)

Cash flows from investing

activities

Purchase of tangible fixed

assets - (1,894)

Purchase of investment

property (657,314) -

Interest received 350 522

Net cash from investing

activities (656,964) (1,372)

Cash flows from financing

activities

New loans in year 600,000 -

Share issue 7,143 4,259

Share premium paid 92,857 267,494

Net cash from financing

activities 700,000 271,753

-------------

(Decrease)/increase in cash and cash equivalents

Cash and cash equivalents at beginning (126,649) 104,769

of year 2 148,955 44,186

------------- ------------

Cash and cash equivalents at end of year

2 22,306 148,955

-------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXSEMFSDESSESU

(END) Dow Jones Newswires

September 23, 2020 07:00 ET (11:00 GMT)

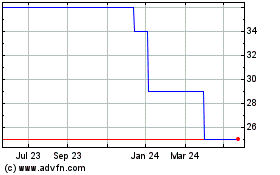

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From May 2024 to Jun 2024

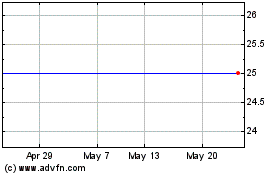

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Jun 2023 to Jun 2024