Free Writing Prospectus

VanEck Merk Gold ETF

2024-09-10-merk-insight

0001546652

Pursuant to 433/164

333-274643

The VanEck Merk Gold ETF Delivers. Literally. Axel Merk, Merk Investments While other exchange traded gold products had outflows for several months, OUNZ - we refer to the VanEck Merk Gold ETF by its ticker symbol - bucked the trend, gathering more gold. I created OUNZ in 2014 in response to criticism in the blogosphere about the large exchange traded gold products then in the market. Recently, the gold held by OUNZ exceeded US$1 billion - I couldn't be prouder of my team and our relationship with VanEck. Let me explain why OUNZ is different and, in my humble, admittedly biased opinion, a better way to hold gold. Ultimately, the beauty of physical gold is that it doesn't have counter - party risk; except, you introduce risk the moment you touch it. Even when you buy a gold coin, you introduce counter - party risk, namely yourself as you could lose it. And once you own the physical coin, you may worry about theft. For smaller gold holdings, a coin under the pillow might do, but what about if you want to hold larger amounts? I created OUNZ to provide a vehicle to allow investors to hold gold cost effectively while allowing the flexibility to request delivery at any time. I always eat my own cooking when it comes to investment products and personally own several thousand ounces of gold through OUNZ. But I get ahead of myself. Below is the growth in shares outstanding of U.S. exchange traded gold products over $500 million over the past year. OUNZ, in blue, is on top: [ 1] https://legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight 1 /8 9/ 1 1/24, 6:21 AM legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight

Noteworthy during this period is that physical gold buying has been in the news - even Costco got involved - while exchange - traded products only had a lukewarm reception, with several experiencing outflows. Which gets me to what may be the most important differentiator between OUNZ and the rest of the pack: investors in OUNZ have the option to request delivery of the gold they own. This positions OUNZ in the realm of physical gold in the minds of many investors. While most investors elect not to take delivery of the physical gold, they appreciate the optionality. It has the side effect that, in our experience, OUNZ tends to attract the more long - term oriented investor with an appreciation for physical gold rather than the speculator looking for an instrument to bet on the price of gold short - term. A few tidbits you may not be aware of: OUNZ's delivery feature is not merely theoretical, OUNZ literally delivers. Year - to - date, OUNZ has delivered 383 ounces of gold. Retail investors generally do not have an interest in taking delivery of the so - called London bars OUNZ holds. Those are the large "James Bond" looking bars held by institutions. As a result, we built a unique, patented interface, to allow for the exchange of the London bars held by OUNZ into other coins and bars. https://legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight 2 /8 9/ 1 1/24, 6:21 AM legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight

9/11/24, 6:21 AM legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight Taking delivery of gold is not a taxable event because you merely take delivery of what you own through OUNZ. [ 2] We applied for and were granted a patent because we devised a process that's scalable. Our process allows us to efficiently process applications should there be a surge for deliveries. When you request delivery, you pay the premium of the coin over the spot price of gold. W e o f fer deliverability as a service, not a separate profit cente r . As such, those who have done the math (see merkgold.com/fees) may notice that is often less expensive to get gold through us than a coin dealer if it's more than just a few ounces. While investors may always request London Bars, other coins and bars are available based on inventory at our dealer. During the pandemic, when inventory for coins was tight, some investors purchased OUNZ to lock in the price of gold, wait, and then request delivery when premiums were more in line with historic levels. Another reason why OUNZ has been popular with some investors of late may be that, a year ago, we eliminated a historic quirk in the industry: whereas our competitors value their gold based on the price of gold in London in the afternoon (and then only when the https://legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight 3 /8

9/11/24, 6:21 AM legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight UK is not on holiday), we price OUNZ's gold based on the closing price of gold at the New York Stock Exchange. To facilitate this, we work with index provider, Solactive, which created the Solactive Gold Spot Index. As a result, the Net Asset Value premium or discount over the past 12 months, on a closing basis, is near zero for OUNZ (source: Bloomberg). At Merk, for what it's worth, we think in terms of ounces more so than dollars. Did I mention that at OUNZ, our management fee is paid in shares of OUNZ? As such, we get paid in gold and no gold needs to be sold to pay Merk. Merk, in turn, pays OUNZ's ordinary expenses which, again, means OUNZ does not need to sell any gold. Which reminds me to clarify another misconception: what happens if demand for OUNZ is high and there's no gold available at the vault to issue new shares? One of the p rinciples of OUNZ is that shares must not be issued unless the custodian confirms that gold has been delivered and allocated. That's right, we never buy gold; in the unlikely scenario that there would be no gold available, but there would be demand for OUNZ, we would not issue any shares. In this context, if you look closely, you may have noticed that, unlike our competitors, it's only OUNZ's secondary objective to track the price of gold. The "primary objective is to provide investors with an opportunity to invest in gold through the Shares and be able to take delivery of physical gold bullion (physical gold) in exchange for their Shares." There's more to OUNZ, including that 100% of the bars held are res p onsibly sourced . Please visit merk g old.com for further details on this and other features. For now, a billion thanks to our investors for making OUNZ a billion - dollar product. To stay informed, subscribe to our newsletter at merkinvestments.com/newsletter and to follow me at twitter.com/AxelMerk . Please reach out with any questions you have. Axel Merk President and CIO, Merk Investments Important Disclosure: All exchange - traded products mentioned herein are grantor trusts regulated under the Securities Act of 1933. They all offer investors exposure to gold. The respective objectives are similar. The exchange - traded products' objectives, risks, tax features and fluctuation of principal or returns are all similar. As discussed above, key material differences lie in their expense ratio, pricing source, liquidity, premiums and discounts, and delivery feature (or lack thereof). Below are average annual returns of the Net Asset Value (NAV) of the profiled exchange traded gold products. https://legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight 4 /8

9/ 1 1/24, 6:21 AM https://legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight 5 /8 legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight

9/11/24, 6:21 AM legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight This material must be preceded or accompanied by a p rospectus . Before investing, you should carefully consider the Trust's investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by visiting www.merk g old.com/prospectus or calling 855 - MRK OUNZ. Please read the prospectus carefully before you invest. Investing involves significant risk, including possible loss of principal. The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity pool for the purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds. Because shares of the Trust are intended to reflect the price of the gold held in the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value ("NAV"). Brokerage commissions will reduce returns. The request for redemption of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take a considerable amount of time depending on your location. Commodities and commodity - index linked securities may be affected by changes in overall market movements and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities. Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. The Trust does not generate any income, and as the Trust regularly issues shares to pay for the Sponsor's ongoing expenses, the amount of gold represented by each Share will decline over time. Investing involves risk, and you could lose money on an investment in the Trust . For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus . The sponsor of the Trust is Merk Investments LLC (the "Sponsor"). VanEck provides marketing services to the Trust. https://legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight 6 /8

9/11/24, 6:21 AM legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight This report was prepared by Merk Investments LLC ("Merk Investments"),and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments makes no representation regarding the advisability of investing in the products herein. The information contained herein reflects Merk Investments' current views and opinions with respect to, among other things, future events and financial performance. Charts, graphs, and tables are provided for illustrative purposes only. Any forward - looking statements contained herein are based on current estimates and expectations. Opinions and forward - looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. Some believe predicting recessions is either impossible or very difficult. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. Past performance is no guarantee of future results. Solactive AG ("Solactive") is the licensor of the Solactive Gold Spot Index (the "Index"). The financial instruments that are based on the Index are not sponsored, endorsed, promoted or sold by Solactive in any way and Solactive makes no express or implied representation, guarantee or assurance with regard to: (a) the advisability in investing in the financial instruments; (b) the quality, accuracy and/or completeness of the Index; and/or (c) the results obtained or to be obtained by any person or entity from the use of the Index. Solactive reserves the right to change the methods of calculation or publication with respect to the Index. Solactive shall not be liable for any damages suffered or incurred as a result of the use (or inability to use) of the Index. Data in tables as of September 9, 2024, unless otherwise specified. 1 The chart shows "normalized" growth, meaning the shares outstanding for each product are indexed to 100 at the beginning of the chart. The list chosen are physical gold exchange traded products over $500million based on VettaFi. Source for the chart: Bloomberg. Rather than listing the other exchange traded gold products by name, they are referred to as Gold ETP A, Gold ETP B, etc. 2 A subsequent sale of the gold is taxable. See Taxation of the Trust in the p rospectus . Merk Investments LLC does not provide tax advice. https://legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight 7 /8 Merk Investments LLC, 1150 Chestnut St, Menlo Park, CA 94025

9/ 1 1/24, 6:21 AM https://legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight 8 /8 legacy.merkinvestments.com/staging/2024 - 09 - 10 - merk - insight

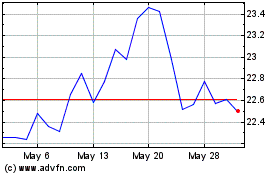

VanEck Merk Gold ETF (AMEX:OUNZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

VanEck Merk Gold ETF (AMEX:OUNZ)

Historical Stock Chart

From Nov 2023 to Nov 2024