UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

RADIANT LOGISTICS, INC.

(Name of Issuer)

Common Stock, $0.001 par value per share

(Title of Class of Securities)

75025X100

(CUSIP Number)

Bohn H. Crain

405 114th Avenue, S.E., Third Floor

Bellevue, WA 98004

(425) 943-4599

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

July 21, 2015

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

NOTE: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d- 7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

(1) |

Names of reporting persons

Bohn H. Crain |

|

(2) |

Check the appropriate box if a member of a group (see instructions)

(a) ☐ (b) ☐ |

|

(3) |

SEC use only

|

|

(4) |

Source of funds (see instructions)

PF |

|

(5) |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

|

|

(6) |

Citizenship or place of organization

United States of America |

|

Number of |

(7) |

Sole voting power

9,945,152 |

|

shares

beneficially

owned by |

(8) |

Shared voting power

0 |

|

each

reporting

person |

(9) |

Sole dispositive power

9,945,152 |

|

with: |

(10) |

Shared dispositive power

0 |

|

(11) |

Aggregate amount beneficially owned by each reporting person

9,945,152 |

|

(12) |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions)

☐ |

|

(13) |

Percent of class represented by amount in Row (11)

20.4% (1) |

|

(14) |

Type of reporting person (see instructions)

IN |

|

(1) |

Based on 48,696,558 shares of Common Stock (as defined below) stated to be outstanding as of July 21, 2015, after taking into account the completion of the Issuer’s most recent public offering of its Common Stock, as set forth in the final prospectus supplement filed with the Securities and Exchange Commission on July 17, 2015. |

2

|

(1) |

Names of reporting persons

Radiant Capital Partners, LLC |

|

(2) |

Check the appropriate box if a member of a group (see instructions)

(a) ☐ (b) ☐ |

|

(3) |

SEC use only

|

|

(4) |

Source of funds (see instructions)

PF |

|

(5) |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

|

|

(6) |

Citizenship or place of organization

United States of America |

|

Number of |

(7) |

Sole voting power

8,856,959 |

|

shares

beneficially

owned by |

(8) |

Shared voting power

0 |

|

each

reporting

person |

(9) |

Sole dispositive power

8,856,959 |

|

with: |

(10) |

Shared dispositive power

0 |

|

(11) |

Aggregate amount beneficially owned by each reporting person

8,856,959 |

|

(12) |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions)

☐ |

|

(13) |

Percent of class represented by amount in Row (11)

18.2% |

|

(14) |

Type of reporting person (see instructions)

CO |

3

This Amendment No. 4 to Schedule 13D (“Amendment No. 3”) amends and supplements the prior statement on Schedule 13D, as amended (the “Statement”) as filed by Bohn H. Crain related to the common stock, $.001 par value per share (the “Common Stock”), of Radiant Logistics, Inc., a Delaware corporation (the “Issuer”). All capitalized terms contained herein that are not defined shall have the meanings ascribed to such terms in the Statement. In the event that any disclosure contained in this Amendment No. 4 is inconsistent with the disclosures contained in the Statement, the disclosures contained herein shall supersede such inconsistent disclosures from the date of this Amendment No. 4.

ITEM 1. SECURITY AND ISSUER

There are no amendments to Item 1 of the Statement pursuant to this Amendment No. 4.

ITEM 2. IDENTITY AND BACKGROUND

There are no amendments to Item 2 of the Statement pursuant to this Amendment No. 4.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

There are no amendments to Item 3 of the Statement pursuant to this Amendment No. 4.

ITEM 4. PURPOSE OF TRANSACTION

Item 4 is hereby amended by deleting the last two paragraphs of the prior disclosure and adding the following:

On July 21, 2015, Bohn H. Crain and Radiant Capital Partners, LLC, sold an aggregate of 935,333 shares (the “Shares”) of Common Stock in an underwritten public offering (the “July 2015 Offering”) as contemplated by an Underwriting Agreement, dated July 16, 2015, by and among Radiant Logistics, Inc., certain of its stockholders, and the several underwriters named therein for whom Cowen and Company, LLC and BB&T Capital Markets, a division of BB&T Securities, LLC are acting as representatives (the “Underwriting Agreement”) and set forth in a final prospectus supplement dated July 17, 2015, as filed by the Issuer with the SEC, which supplements the prospectus, dated May 28, 2015, contained in the registration statement on Form S-3 (File No. 333-203821). After deducting underwriting discounts, Bohn H. Crain and Radiant Capital Partners, LLC received aggregate net proceeds (before expenses) of approximately $5.84 million (or $6.345 per share) from the sale of the Shares.

Except as set forth herein, Mr. Crain and RCP have no present plan or proposal that would relate to or result in any of the matters set forth in subparagraphs (a)-(j) of Item 4 of Schedule 13D. Depending on various factors including, without limitation, the Issuer's financial position and strategic direction, actions taken by the board of directors, price levels of the Common Stock, other investment opportunities available to Mr. Crain and RCP, conditions in the securities market and general economic and industry conditions, Mr. Crain and RCP may in the future take such actions with respect to their investment in the Issuer as they deem appropriate including, without limitation: (i) continuing to hold the Common Stock for investment; (ii) acquiring additional shares of Common Stock in the open market, upon exercise of options or in privately negotiated transactions; or (iii) selling some or all of their shares of Common Stock in the open market or in privately negotiated transactions. In addition, Mr. Crain has been listed as a selling stockholder in the Issuer’s Registration Statement on Form S-3 for up to 1,500,000 shares, of which 564,667 shares remain after the recent sale described above. Mr. Crain may, at any time, sell all or any portion of such remaining shares pursuant to a prospectus (and any prospectus supplement thereto) under such Registration Statement.

Notwithstanding the above, Mr. Crain may, in his capacity as an executive officer and/or director of the Issuer, have plans or proposals relating to items (a) through (j) of Item 4 of Schedule 13D and to such extent, Mr. Crain declines to indicate such plans or proposals, and disclaims any obligation to update such disclosure, except to the extent they derive solely from his status as a stockholder instead of an executive officer and/or director.

4

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

Item 5 of the Statement is hereby amended by deleting the paragraphs (a), (b) and (c) thereof and inserting the following:

(a) Mr. Crain beneficially owns all of the 9,945,152 shares of Common Stock reported on this Statement, which shares represent approximately 20.4% of the outstanding shares of the Common Stock. This amount includes 31,619 shares issuable upon exercise of options within 60 days of the date of this report. Mr. Crain beneficially owns 1,088,193 shares of the Common Stock directly, of which 2,329 are subject to forfeiture due to vesting requirements, and 8,856,959 of such shares indirectly through RCP. The foregoing does not include 56,595 shares of Common Stock issuable to Mr. Crain upon exercise of options issued to Mr. Crain that are subject to vesting.

(b) Mr. Crain has sole voting and sole dispositive power as to the following: the 1,056,574 outstanding shares of the Common Stock that he owns directly; and the 8,856,959 shares of the Common Stock owned indirectly through RCP, as reported on this Statement.

(c) On July 21, 2015, Bohn H. Crain and Radiant Capital Partners, LLC, sold the Shares in the July 2015 Offering, as contemplated by the Underwriting Agreement and set forth in a final prospectus supplement dated July 17, 2015, as filed by the Issuer with the SEC, which supplements the prospectus, dated May 28, 2015, contained in the registration statement on Form S-3 (File No. 333-203821). After deducting underwriting discounts, Bohn H. Crain and Radiant Capital Partners, LLC received aggregate net proceeds (before expenses) of approximately $5.84 million (or $6.345 per share) from the sale of the Shares.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

In the July 2015 Offering, Mr. Crain and RCP to the underwriters pursuant to the Underwriting Agreement the Shares at a purchase price of $6.345 per share. In addition, in connection with the July 2015 Offering, Mr. Crain entered into a Lock-Up Agreement, which restricts him from selling shares of Common Stock (or securities convertible into or exercisable or exchangeable for shares of Common Stock) for a period of ninety days, subject to certain exceptions. The form of Lock-Up Agreement is attached as Exhibit I to the Underwriting Agreement.

The description of the Underwriting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of such document, which is included as Exhibit 99.4 to this Schedule 13D and is incorporated herein by reference.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

|

99.4 |

Underwriting Agreement, dated July 16, 2015, by and among Radiant Logistics, Inc., certain of its stockholders, and the several underwriters named therein for whom Cowen and Company, LLC and BB&T Capital Markets, a division of BB&T Securities, LLC are acting as representatives (incorporated by reference to Exhibit 1.1 to the Current Report of Radiant Logistics, Inc. on Form 8-K, filed with the SEC on July 17, 2015) |

5

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

Dated: September 9, 2015

|

|

|

|

|

/s/ Bohn H. Crain |

|

Bohn H. Crain |

|

|

|

RADIANT CAPITAL PARTNERS, LLC |

|

|

|

|

By: |

|

/s/ Bohn H. Crain |

|

|

|

Bohn H. Crain |

|

|

|

Chief Executive Officer |

6

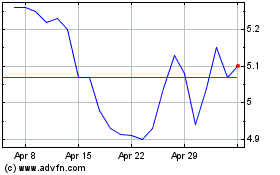

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Oct 2024 to Nov 2024

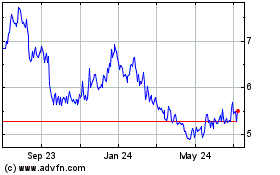

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Nov 2023 to Nov 2024