Solid Quarter as Diversification Continues at inTEST - Analyst Blog

March 08 2012 - 5:26AM

Zacks

Solid Quarter as Diversification Continues at

inTEST

Ken Nagy, CFA

On March 7, 2012, inTest Corporation

(INTT), an independent designer,

manufacturer and marketer of semiconductor automatic test equipment

interface solutions and temperature management products, reported

financial results for its fiscal 2011 fourth quarter and full year,

ended December 31, 2011.

Company revenues during the fourth quarter remained steady at

$10.081 million compared to revenues of $10.110 million for the

three months ended December 31, 2010.

However, inTest reported that fourth quarter bookings were $8.1

million, down from its third quarter 2011 bookings of $10.5 million

and year over year fourth quarter 2010 bookings of $11.7

million.

Still, while bookings during the quarter were down, first quarter

2012 quarter-to-date bookings currently reflect an increase of $1.4

million or 18% over the Company’s fourth quarter 2011 bookings.

Furthermore, the Company continues to leverage its thermal division

and sigma systems acquisition, making significant progress in

diversifying its end market penetration with non-semi related

bookings jumping from 19 percent of consolidated bookings in 2010

to 29 percent in fiscal 2011 and 38 percent in the fourth quarter,

ended December 31, 2011.

Although the fourth quarter net income of $769,000 marked inTest’s

ninth consecutive quarter of profitability, net income plunged year

over year by $525,000 from $1.294 million for the three months

ended December 31, 2010.

The drop in year over year net income was primarily due to an

increase in general and administrative expenses offset by improved

gross margin.

General and administrative expenses increased $274,000 year over

year to $1.619 million during the fourth quarter fiscal 2011.

Still, gross margin increased by 90 basis points year over year

from 47.4 percent to 48.3 percent for the three months ended

December 31, 2011.

Sequentially, gross margin fell from 53 percent during the third

quarter as a result of a less favorable product mix in the

mechanical product segment and electrical products segment.

Based on a weighted average number of diluted shares outstanding of

10.281 million, diluted net income per share resulted in $0.08 per

share for the quarter. This compared to diluted net income

per share of $0.13 on a weighted average number of diluted shares

of 10.184 million during the three months, ended December 31,

2010.

For the full year ended December 31, 2011, year over year revenues

improved by 2.3 percent or $1.062 million to $47.266 million from

$46.204 million for fiscal 2010.

It should be noted that revenues have steadily improved each year

since 2007 and are now approaching pre-recession levels.

Net income for the year improved by $2.611 million or 36 percent

year over year to $9.863 million for the fiscal year ended December

31, 2011. This compares to $7.252 million for fiscal 2010.

The increase in net income was primarily due to improved gross

margin as well as the effect of a reversal of valuation allowance

against deferred tax assets.

During the twelve months, gross margin improved by 50 basis points

year over year to 48.4 percent, its highest level since 2006. This

compares to gross margin of 47.9 percent for the year ended

December 31, 2010.

Similarly, 2011 net earnings reflect the effect of a reversal of

$3.1 million of valuation allowance against deferred tax assets

which resulted in an increase to diluted earnings per share of

$0.30 for the year.

Based on a weighted average number of diluted shares outstanding of

10.286 million, diluted net income per share resulted in $0.96 per

share for the year. This compared to diluted net income per

share of $0.72 on a weighted average number of diluted shares of

10.142 million during the full year, ended December 31, 2010.

inTest’s balance sheet continued to improve with cash and

equivalents increasing sequentially by $1.893 million to $13.597

million and working capital improving sequentially by $1.141

million to $19.759 million for the period ended December 31,

2011.

The increase in cash was due to strong cash collections during the

fourth quarter. However, management predicts that cash and

equivalents will decrease in the first quarter of fiscal 2012 due

to the recent acquisition of Thermonics, Inc., but will then begin

increasing sequentially starting in the second quarter of fiscal

2012.

Still, total stockholder’s equity improved sequentially by nearly 3

percent or $758,000 to $26.199 million.

It should be noted that the Company remains focused on growth

through acquisitions as well as increasing its footprint in the

non-semi space.

Over the past few years inTest has been attempting to transform

itself through the strategic diversification of its Thermal

Products segment, which remains the Company’s strongest segment,

driven by mobility and opportunities in the telecom market.

In January 2012, Temptronic Corporation, a member of inTEST

Corporation's Thermal Solutions Group, closed on the acquisition of

Thermonics, Inc.

With a purchase price for the assets of approximately $3.8 million

in cash (which included net working capital of approximately $1.1

million) , Thermonics is expected to further enhance inTEST's

presence in the ATE industry as well as provide additional leverage

into growth industries outside of the semiconductor industry.

The integration of the acquisition is on track and management

expects it to be accretive to operations beginning in the second

quarter of 2012. Furthermore, management anticipates a 30 percent

net contribution margin on incremental revenues which are expected

to improve sequentially throughout 2012 eventually reaching as much

as 35 to 36 percent over time.

Along the same lines, it should be noted that moving forward; the

Company expects non-semiconductor related products to play an even

greater role in the Company's growth strategy and success.

Additionally, management reported that it anticipates net revenue

for its first quarter ended March 31, 2012 will be in the range of

$9.5 million to $10.5 million and that net loss will be in the

range of $(0.03) to $(0.07) per diluted share.

Guidance for the first quarter reflects the weak semiconductor

market as well as costs related with the closing of the Thermonics

acquisition.

Still, management believes that the recent softness from

semiconductor customers has improved substantially over the past

few weeks and that this trend will continue.

Furthermore, inTest’s management is confident in its long

term growth prospects as a result of the improving semiconductor

dealings as well as its continued expansion of non-semiconductor

businesses.

Likewise, the Company further believes that the diversification of

its served markets via its thermal group, improved efficiency and

reduced operating costs attributable to its relocation of

facilities are all strengths it can leverage moving forward.

To view a free copy of our most recent research report on INTT

or subscribe to our daily morning email alert, visit Ken Nagy's

coverage page at http://scr.zacks.com/.

INTEST CORP (INTT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

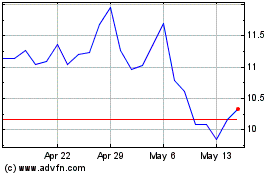

inTest (AMEX:INTT)

Historical Stock Chart

From May 2024 to Jun 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Jun 2023 to Jun 2024