Current Report Filing (8-k)

November 09 2020 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 6, 2020

Sanchez Midstream Partners LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

001-33147

|

11-3742489

|

|

(State or other jurisdiction of

|

(Commission

|

(IRS Employer

|

|

incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

|

1360 Post Oak Blvd, Suite 2400

|

|

|

Houston, TX

|

77056

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

Registrant’s telephone number, including area code: (713) 783-8000

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

◻ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

◻ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

◻ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

◻ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units representing limited partner

|

SNMP

|

NYSE American

|

|

interests

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company◻

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01Entry into a Material Definitive Agreement.

On November 6, 2020, Sanchez Midstream Partners LP (the “Partnership”), as borrower, entered into that certain Tenth Amendment to Third Amended and Restated Credit Agreement with the guarantors party thereto, Royal Bank of Canada, as administrative agent and collateral agent (the “Agent”) and the lenders party thereto (each a “Lender”) (the “Credit Agreement Amendment” and the Third Amended and Restated Credit Agreement, as amended by the Tenth Amendment, the “Amended Credit Agreement”). Pursuant to the Credit Agreement Amendment, the parties agreed to, among other things: (a) amend the initial aggregate commitment amount under the first lien revolving credit facility to reduce such amount to $17.5 million, including a further limitation on such amount to $15.0 million through May 14, 2021 (the “Maximum Revolving Credit Amount”); (b) amend the conditions precedent to the obligations of any Lender to make a Loan (as defined in the Amended Credit Agreement) to provide that through May 14, 2021, a Borrowing Base Deficiency (as defined in the Amended Credit Agreement) may exist; (c) amend the annual financial statements and annual budget affirmative covenant to provide that the Partnership’s audited annual financial statements as reported on by the Partnership’s independent public accountants may be delivered with a “going concern” or like qualification or exception, if such qualification or exception results from (i) any actual or prospective breach of the financial covenants set forth in Section 9.01 of the Amended Credit Agreement or (ii) the fact that the final maturity date of any Debt (as defined in the Amended Credit Agreement) is less than one year after the date of such report, and does not otherwise include any qualification or exception as to the scope of such audit; and (d) include a new post-closing covenant requiring the Partnership to either engage an Advisory Firm (as defined in the Credit Agreement Amendment) or certify that the Partnership has taken material steps in either case, to implement a strategic transaction generating net cash proceeds reasonably expected to be greater than an amount that will allow the Partnership to repay in full all outstanding obligations under the Loan Documents (as defined in the Amended Credit Agreement) that is anticipated to close by August 31, 2021.

The Partnership also agreed to pay fees and expenses of the Agent in connection with the Credit Agreement Amendment (including the reasonable fees, disbursements and other charges of counsel to the Agent). The foregoing description of the Credit Agreement Amendment does not purport to be complete and is qualified in its entirety by reference to such document, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 2.03Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

A description of the Credit Agreement is included in Item 1.01 above and incorporated herein by reference.

Item 9.01Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

Exhibit No.

|

Exhibit

|

|

10.1

|

Tenth Amendment to Third Amended and Restated Credit Agreement dated as of November 6, 2020, between Sanchez Midstream Partners LP, the guarantors party thereto, the lenders party thereto and Royal Bank of Canada, as Administrative Agent and as Collateral Agent.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SANCHEZ MIDSTREAM PARTNERS LP

|

|

|

|

|

|

|

|

|

By: Sanchez Midstream Partners GP LLC,

its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: November 9, 2020

|

|

|

|

By:

|

/s/ Charles C. Ward

|

|

|

|

|

|

|

|

|

|

Charles C. Ward

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer, Secretary and Treasurer

|

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From May 2024 to Jun 2024

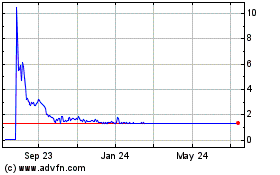

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jun 2023 to Jun 2024