As filed with the Securities and Exchange Commission on March 5, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Sanchez Production Partners LLC*

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1311 |

|

11-3742489 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

1000 Main Street, Suite 3000

Houston, Texas 77002

(713) 783-8000

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Stephen R.

Brunner

President, Chief Executive Officer and Chief Operating Officer

Sanchez Production Partners LLC

1000 Main Street, Suite 3000

Houston, Texas 77002

(713) 783-8000

(Name,

address, including zip code, and telephone number, including area code of agent for service)

Copies to:

G. Michael O’Leary

Scott L. Olson

Andrews

Kurth LLP

600 Travis, Suite 4200

Houston, Texas 77002

(713) 220-4200

Approximate date of commencement of proposed sale of the securities to the public: Not

applicable.

If the securities being registered on this form are being offered in connection with the

formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. x 333-198440

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

| Large accelerated filer ¨ |

|

|

|

Accelerated filer ¨ |

|

|

|

| Non-accelerated filer ¨ |

|

(Do not check if a smaller reporting company) |

|

Smaller reporting company x |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

Title of each class of

securities to be registered |

|

Amount to be

registered (1) |

|

Proposed maximum

offering price

per unit(2) (3) |

|

Proposed maximum

aggregate offering

price |

|

Amount of

registration fee |

| Common units representing limited partner interests |

|

58,042 |

|

$1.38 |

|

$80,098 |

|

$10 |

| |

| |

| (1) |

Represents, together with the 29,322,146 common units of Sanchez Production Partners LP, a Delaware limited partnership, previously registered under the Registration

Statement on Form S-4 filed on August 25, 2014 (Registration Number 333-198440), the maximum number of common units expected to be issued to the existing unitholders of Sanchez Production Partners LLC, a Delaware limited liability company, upon

completion of the conversion described in such Registration Statement. |

| (2) |

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933. |

| (3) |

Based on the average high and low trading price ($1.38) for the registrant’s common units on March 2, 2015. |

| * |

Immediately after the effective time of the Conversion described in the Registration Statement, the registrant will be Sanchez Production Partners LP. |

EXPLANATORY NOTE

This Registration Statement on Form S-4 is being filed pursuant to Rule 462(b) of the Securities Act of 1933, as amended (the “Securities

Act”), by Sanchez Production Partners LLC, a Delaware limited liability company (the “Company”) to register an additional 58,042 common units representing limited partner interests in Sanchez Production Partners LP, as the successor

issuer to the Company following the statutory conversion of the Company from a limited liability company to a limited partnership.

In

accordance with Rule 462(b), this registration statement incorporates by reference the contents of the Company’s currently effective Registration Statement on Form S-4 (File No. 333-198440), which was declared effective on January 30,

2015, including all amendments, supplements and exhibits thereto and all information incorporated by reference therein, other than the exhibits included herein. Additional opinions and consents required to be filed with this registration statement

are listed on the Index to Exhibits attached to and filed with this registration statement.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 20. |

Indemnification of Managers and Officers |

Under our operating agreement and subject to

specified limitations, we will indemnify to the fullest extent permitted by law from and against all losses, claims, damages or similar events any person who is or was our manager or officer, or while serving as our manager or officer, is or was

serving as a tax matters member or, at our request, as a manager, officer, tax matters member, employee, partner, fiduciary or trustee of us or any of our subsidiaries. In addition, we are required indemnify to the fullest extent permitted by law

and authorized by our board of managers, from and against all losses, claims, damages or similar events, any person who is or was an employee or agent (other than an officer) of our company.

Any indemnification under our operating agreement will only be out of our assets. We are authorized to purchase insurance against liabilities

asserted against and expenses incurred by persons for our activities, regardless of whether we would have the power to indemnify the person against liabilities under our operating agreement.

| Item 21. |

Exhibits and Financial Statement Schedules |

|

|

|

| 5.1* |

|

Opinion of Andrews Kurth LLP as to the legality of the securities |

|

|

| 8.1 |

|

Tax Opinion of Andrews Kurth LLP (incorporated by reference to Exhibit 8.1 to Sanchez Production Partners LLC’s Amendment No. 2 to Registration Statement on Form S-4 (File No. 333-198440) filed on September 26, 2014) |

|

|

| 23.1* |

|

Consent of KPMG LLP |

|

|

| 23.2* |

|

Consent of Andrews Kurth LLP (included in opinion filed as Exhibit 5.1) |

|

|

| 23.3* |

|

Consent of Netherland, Sewell & Associates, Inc. |

-2-

| (1) |

The undersigned Registrant hereby undertakes to file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: (i) to include any prospectus required by

Section 10(a)(3) of the Securities Act of 1933, as amended (the “Securities Act”); (ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement (notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the

Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective

registration statement); and (iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

|

| (2) |

The undersigned Registrant hereby undertakes that, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) |

The undersigned Registrant hereby undertakes to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

| (4) |

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or

Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference

in the registration statement will be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time will be deemed to be the initial bona fide offering thereof.

|

| (5) |

The undersigned Registrant hereby undertakes as follows: that prior to any public reoffering of the securities registered hereunder through use of a proxy statement/prospectus which is a part of this registration

statement, by any person or party who is deemed to be an underwriter within the meaning of Rule 145(c), the issuer undertakes that such reoffering proxy statement/prospectus will contain the information called for by the applicable registration form

with respect to reofferings by persons who may be deemed underwriters, in addition to the information called for by the other Items of the applicable form. |

| (6) |

The Registrant undertakes that every prospectus (1) that is filed pursuant to the immediately preceding paragraph, or (2) that purports to meet the requirements of Section 10(a)(3) of the Securities Act

and is used in connection with an offering of securities subject to Rule 415, will be filed as a part of an amendment to the registration statement and will not be used until such amendment is effective, and that, for purposes of determining any

liability under the Securities Act of 1933, each such post-effective amendment will be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time will be deemed to be the

initial bona fide offering thereof. |

| (7) |

The undersigned Registrant hereby undertakes to respond to requests for information that is incorporated by reference into the proxy statement/prospectus pursuant to Items 4, 10(b), 11 or 13 of this registration

statement on Form S-4, within one business day of receipt of such request, and to send the incorporated documents by first class mail or other equally prompt means. This includes information contained in documents filed subsequent to the effective

date of the registration statement through the date of responding to the request. |

| (8) |

The undersigned Registrant hereby undertakes to supply by means of a post-effective amendment all information concerning a transaction, and the company being acquired involved therein, that was not the subject of and

included in the registration statement when it became effective. |

-3-

| (9) |

The undersigned registrant hereby undertakes to deliver or cause to be delivered with the prospectus, to each person to whom the prospectus is sent or given, the latest annual report to security holders that is

incorporated by reference in the prospectus and furnished pursuant to and meeting the requirements of Rule 14a-3 or Rule 14c-3 under the Securities Exchange Act of 1934; and, where interim financial information required to be presented by Article 3

of Regulation S-X are not set forth in the prospectus, to deliver, or cause to be delivered to each person to whom the prospectus is sent or given, the latest quarterly report that is specifically incorporated by reference in the prospectus to

provide such interim financial information. |

| (10) |

The registrant undertakes to send to each limited partner at least on an annual basis a detailed statement of any transactions with the General Partner or its affiliates, and of fees, commissions, compensation and other

benefits paid, or accrued to the General Partner or its affiliates for the fiscal year completed, showing the amount paid or accrued to each recipient and the services performed. |

| (11) |

The registrant undertakes to provide to the limited partners the financial statements required by Form 10-K for the first full fiscal year of operations of the partnership. |

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the

Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of

any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

-4-

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant has duly caused this Registration Statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in Houston, Texas, on the 5th day of March, 2015.

|

|

|

| SANCHEZ PRODUCTION PARTNERS LLC |

|

|

| By: |

|

/s/ Stephen R. Brunner |

| Name: |

|

Stephen R. Brunner |

| Title: |

|

President, Chief Executive Officer and Chief Operating Officer |

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has

been signed by the following persons in the capacities and the dates indicated.

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Stephen R. Brunner

Stephen R. Brunner |

|

President, Chief Executive Officer and

Chief Operating Officer

(Principal Executive Officer) |

|

March 5, 2015 |

|

|

|

| /s/ Charles C. Ward

Charles C. Ward |

|

Chief Financial Officer, Treasurer and

Secretary (Principal Financial

Officer and Principal Accounting Officer) |

|

March 5, 2015 |

|

|

|

| /s/ Alan S. Bigman

Alan S. Bigman |

|

Manager |

|

March 5, 2015 |

|

|

|

| /s/ Richard S. Langdon

Richard S. Langdon |

|

Manager |

|

March 5, 2015 |

|

|

|

| /s/ G. M. Byrd Larberg

G. M. Byrd Larberg |

|

Manager |

|

March 5, 2015 |

|

|

|

| /s/ Antonio R. Sanchez, III

Antonio R. Sanchez, III |

|

Manager |

|

March 5, 2015 |

|

|

|

| /s/ Gerald P. Willinger

Gerald P. Willinger |

|

Manager |

|

March 5, 2015 |

-5-

EXHIBIT INDEX

|

|

|

| 5.1* |

|

Opinion of Andrews Kurth LLP as to the legality of the securities |

|

|

| 8.1 |

|

Tax Opinion of Andrews Kurth LLP (incorporated by reference to Exhibit 8.1 to Sanchez Production Partners LLC’s Amendment No. 2 to Registration Statement on Form S-4 (File No. 333-198440) filed on September 26, 2014) |

|

|

| 23.1* |

|

Consent of KPMG LLP |

|

|

| 23.2* |

|

Consent of Andrews Kurth LLP (included in opinion filed as Exhibit 5.1) |

|

|

| 23.3* |

|

Consent of Netherland, Sewell & Associates, Inc. |

-6-

Exhibit 5.1

|

|

|

|

|

|

|

|

|

|

|

|

|

600 Travis, Suite 4200

Houston, Texas 77002 713.220.4200 Phone

713.220.4285 Fax andrewskurth.com |

March 5, 2015

Sanchez Production Partners LLC

1000 Main Street, Suite 3000

Houston, Texas 77002

Ladies and Gentlemen:

We have acted as special counsel to Sanchez Production Partners LLC, a Delaware limited liability company (the “Company”), in

connection with the conversion of the Company to a Delaware limited partnership named Sanchez Production Partners LP (“Sanchez LP”) pursuant to a Plan of Conversion (the “Plan of Conversion”) adopted by the Board of

Managers of the Company on August 25, 2014 (the “Conversion”). Pursuant to the Plan of Conversion, at the effective time of the Conversion, the outstanding common units representing Class B limited liability company interests

in the Company and the outstanding Class A units representing Class A limited liability company interests in the Company will be converted into an aggregate 29,380,188 common units representing limited partner interests of Sanchez LP (the

“Common Units”) as described in the Company’s registration statement on Form S-4 (as amended, the “Initial Registration Statement”), filed with the Securities and Exchange Commission (the

“SEC”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), originally on August 28, 2014, SEC File No. 333-198440. We have also acted as special counsel to the Company in connection

with the registration of 58,042 Common Units (the “Additional Common Units”) pursuant to a registration statement on Form S-4 (the “Registration Statement”), filed with the SEC pursuant to the Securities Act on

March 5, 2015.

In arriving at the opinions expressed below, we have examined the following:

(i) a copy of the Certificate of Formation of the Company, as amended to date, certified by the Secretary of State of the State of Delaware as

in effect on March 4, 2015,

(ii) a copy of the Second Amended and Restated Operating Agreement of the Company, as amended to date, as

certified by the Secretary of the Company;

(iii) the form of Certificate of Limited Partnership of Sanchez LP, filed as an exhibit to the

Initial Registration Statement (the “Partnership Certificate”);

(iv) the form of Agreement of Limited Partnership of

Sanchez LP, filed as an exhibit to the Initial Registration Statement (the “Partnership Agreement”);

(v) the Initial

Registration Statement and the Registration Statement;

Sanchez Production Partners LLC

March 5, 2015

Page

2

(vi) the form of Certificate of Conversion of the Company, filed as an exhibit to the Initial

Registration Statement (the “Certificate of Conversion”);

(vii) a copy of the Plan of Conversion, including the

Conversion and Partnership Agreement contemplated thereby (collectively, the “Plan of Conversion”), dated as of August 25, 2014, as certified by the Secretary of the Company;

(viii) a copy of the resolutions of the Conflicts Committee of the Board of Managers of the Company, adopted on August 25, 2014, approving

the Plan of Conversion and the Partnership Agreement and recommending the Plan of Conversion for approval by the Board of Managers of the Company, as certified by the Secretary of the Company;

(ix) a copy of the resolutions of the Board of Managers of the Company, adopted on August 25, 2014, approving the Plan of Conversion,

including each of the transactions, agreements, instrument and documents contemplated thereby (including the Partnership Agreement), as certified by the Secretary of the Company; and

(x) the originals or copies certified or otherwise identified to our satisfaction of such other instruments and other certificates of public

officials, officers and representatives of the Company and such other persons, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinions expressed below.

In rendering the opinions expressed below, we have assumed and have not verified (i) the genuineness of the signatures on all documents

that we have examined, (ii) the legal capacity of all natural persons, (iii) the authenticity of all documents supplied to us as originals, and (iv) the conformity to the authentic originals of all documents supplied to us as

certified or photostatic or faxed copies. We have also assumed that (A) the Certificate of Conversion, the Partnership Certificate and the Partnership Agreement will be duly executed and will become effective prior to the issuance of the Common

Units by Sanchez LP and (B) all Common Units will be issued in the manner described in the Plan of Conversion, the Partnership Agreement and the Initial Registration Statement.

Based upon the foregoing and subject to the limitations, qualifications, exceptions and assumptions set forth herein, we are of the opinion

that:

1. The issuance of the Additional Common Units in accordance with the terms of the Plan of Conversion and the Partnership Agreement

has been duly authorized by the Company, subject to approval thereof by the Company’s unitholders as contemplated in the Plan of Conversion and the Initial Registration Statement.

2. When the Additional Common Units have been issued and delivered in accordance with the terms of the Plan of Conversion and the Partnership

Agreement and as described in the Initial Registration Statement, the Additional Common Units will be validly issued, fully paid (to the extent required under the Partnership Agreement) and non-assessable, except as such non-assessability may be

affected by the matters described below:

Sanchez Production Partners LLC

March 5, 2015

Page

3

| |

• |

|

If a court were to determine that the right or exercise of the right provided under the Partnership Agreement by the holders of Common Units (the “Limited Partners”) of Sanchez LP as a group (i) to

remove or replace the general partner of Sanchez LP (the “General Partner”), (ii) to approve certain amendments to the Partnership Agreement or (iii) to take certain other actions under the Partnership Agreement pursuant

to which a Limited Partner “participates in the control” of Sanchez LP’s business for purposes of Section 17-303 of the Delaware Revised Uniform Limited Partnership Act, as amended (the “Delaware Act”), then such

Limited Partner could be held personally liable for Sanchez LP’s obligations under the laws of Delaware, to the same extent as the General Partner with respect to persons who transact business with Sanchez LP and reasonably believe that such

Limited Partner is a general partner. |

| |

• |

|

Under Section 17-607 of the Delaware Act, a limited partnership may not make a distribution to a partner if, after the distribution, all liabilities of the limited partnership, other than liabilities to partners on

account of their partnership interests and liabilities for which the recourse of creditors is limited to specific property of the partnership, would exceed the fair value of the assets of the limited partnership. The Delaware Act provides that a

limited partner who receives a distribution and knew at the time of the distribution that the distribution was in violation of the Delaware Act shall be liable to the limited partnership for the amount of the distribution for three years.

|

We express no opinion other than as to the federal laws of the United States of America and the Delaware Act and the

Delaware Limited Liability Company Act (which are deemed to include the applicable provisions of the Delaware Constitution and reported judicial opinions interpreting those laws). We hereby consent to the filing of this opinion as an exhibit to the

Registration Statement. In giving this consent, we do not admit that we are “experts” under the Securities Act, or the rules and regulations of the SEC issued thereunder.

Very truly yours,

/s/ Andrews Kurth LLP

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Unitholders and Board of Managers of Sanchez Production Partners LLC:

We consent to the use of our report dated March 5, 2015, with respect to the consolidated balance sheet of Sanchez Production Partners LLC (formerly

Constellation Energy Partners LLC) as of December 31, 2014 and 2013, and the related consolidated statements of operations, changes in members’ equity, and cash flows for the years then ended, incorporated herein by reference and to the

reference to our firm under the heading “Experts” in the prospectus.

|

| /s/ KPMG LLP |

| Houston, Texas |

|

| March 5, 2015 |

Exhibit 23.3

CONSENT OF INDEPENDENT PETROLEUM ENGINEERS AND GEOLOGISTS

As independent petroleum engineers, we hereby consent to the incorporation by reference of our report dated February 3, 2015, included as part

of the consolidated financial statements of Sanchez Production Partners LLC as of December 31, 2014, which are incorporated by reference into the Registration Statement on Form S-4 of Sanchez Production Partners LLC.

|

|

|

| NETHERLAND, SEWELL & ASSOCIATES, INC. |

|

|

| By: |

|

/s/ Danny D. Simmons |

|

|

Danny D. Simmons |

|

|

President and Chief Operating Officer |

Houston, Texas

March 5, 2015

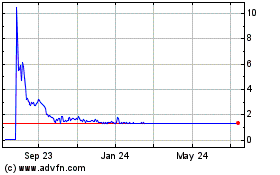

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jul 2023 to Jul 2024