UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed

by the Registrant x |

| |

| Filed

by a Party other than the Registrant ¨ |

| |

| Check

the appropriate box: |

| ¨ |

Preliminary

Proxy Statement |

| ¨ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive

Proxy Statement |

| x |

Definitive

Additional Materials |

| ¨ |

Soliciting

Material under §240.14a-12 |

| |

CREDIT SUISSE COMMODITY STRATEGY FUNDS

CREDIT SUISSE OPPORTUNITY FUNDS

CREDIT SUISSE TRUST

CREDIT SUISSE ASSET MANAGEMENT INCOME FUND, INC.

CREDIT SUISSE HIGH YIELD BOND FUND |

| (Name

of Registrant as Specified In Its Charter) |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment

of Filing Fee (Check the appropriate box): |

| x |

No

fee required. |

| ¨ |

Fee

paid previously with preliminary materials. |

| ¨ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

ADVISOR

NOTIFICATION

CREDIT SUISSE

–UBS MERGER UPDATE & PROXY INSIGHTS

On June 12,

2023, Credit Suisse Group AG (“CS Group”) merged with and into UBS Group AG, a multinational investment bank and financial

services company (“UBS Group”), with UBS Group remaining as the surviving company (the “Merger”). The closing

of the Merger was deemed to result in an assignment, thereby causing the Credit Suisse Funds’ investment advisory agreements with

Credit Suisse Asset Management, LLC (“Credit Suisse”), as well as the sub-advisory agreement between Credit Suisse and Credit

Suisse Asset Management Limited (“Credit Suisse UK”) with respect to Credit Suisse Strategic Income Fund, to automatically

terminate in accordance with applicable law.

In order for Credit

Suisse and Credit Suisse UK to continue to manage the Funds, shareholders of each Fund must approve a new investment advisory agreement

with Credit Suisse. In addition, the Credit Suisse Strategic Income Fund will also require shareholder approval of a new sub-advisory

agreement between Credit Suisse and Credit Suisse UK. It is important to note that each Fund’s advisory fee rate under its new

agreement will remain the same, and no changes to the investment objective(s), principal investment strategies and policies, principal

risks, fundamental and non-fundamental investment policies, or portfolio managers (other than potential personnel changes outside of

Credit Suisse’s control) of the Funds are currently contemplated as a result of the Merger.

PROPOSAL HIGHLIGHTS:

The proposed advisory/sub-advisory agreements

are identical to the previous agreements in place prior to their termination due to the change of ownership, except for the dates of

execution, effectiveness and termination and certain non-material changes.

| ü | Same

Portfolio Managers |

| ü | Same

investment objectives and strategies |

| ü | Same

advisory fees and expenses |

IMPORTANT MILESTONES:

| Record

Date: |

Friday,

June 23, 2023 |

| Anticipated

Mail Date: |

Wednesday,

July 19, 2023 |

| Meeting

Date: |

Thursday,

August 24, 2023 |

| Communications

Campaign: |

Monday,

July 24, 2023 |

PROXY

MATERIAL WILL CONSIST OF A PROXY STATEMENT, PROXY CARD AND BUSINESS RETURN ENVELOPE. SHAREHOLDERS WILL BE GIVEN THE OPTION TO VOTE ONLINE,

TELEPHONICALLY OR BY MAIL. ALL VOTING INSTRUCTIONS ARE FOUND ON THE PROXY CARD PROVIDED IN THE PACKAGE.

WE

NEED YOUR HELP IN COMMUNICATING WITH YOUR CLIENTS REGARDING THE IMPORTANCE OF VOTING IN HOPES TO SECURE THE VOTE BY THE MEETING DATE.

Shareholders should have received their proxy information the week of July 24th and it is extremely important that

all holders vote, no matter the amount of shares they own, as there are tens of thousands of shareholders across all the Funds making

every vote critical. Compounding that issue, approval of each new agreement will require the vote of (i) 67% of shares present at

the meeting, if more than 50% of outstanding shares voting are present, or (ii) 50% of outstanding shares, whichever is less.

PROXY

SOLICITATION CAMPAIGN - Will my clients get contacted? Since the approval of each Fund’s advisory agreement is extremely critical

to the ongoing management of the Funds, we anticipate the need to reach out to certain holders who have not voted in hopes to record

their vote. We are working with our solicitor to identify those holders; however, an outbound communications campaign is highly probable,

which will include follow-up proxy material and potentially phone calls. Therefore, your clients could receive a courtesy call from AST

Fund Solutions, LLC our proxy solicitor, reminding shareholders about the importance of voting and providing an option to vote at the

time of the call.

For questions

about this proxy, insight into what the shareholders will receive, and the voting process, please contact AST Fund Solutions, LLC at

877-674-6273 from Monday to Friday 9:00am to 10:00 pm eastern time.

Questions

and Answers

| Q. | What

funds are included in the proxy statement? |

| A. | A joint special meeting of the funds listed

below (each, a “Fund” and collectively, the “Funds”) will be held

on Thursday, August 24, 2023 at 4 p.m., Eastern Time. You have received this letter

because you were a shareholder of record of one of the Funds: |

Credit Suisse Commodity Return Strategy

Fund, a series of Credit Suisse Commodity Strategy Funds

Credit Suisse Floating Rate High Income

Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Strategic Income Fund,

a series of Credit Suisse Opportunity Funds

Credit Suisse Managed Futures Strategy

Fund, a series of Credit Suisse Opportunity Funds

Credit Suisse Multialternative Strategy

Fund, a series of Credit Suisse Opportunity Funds

Commodity Return Strategy Portfolio,

a series of Credit Suisse Trust

Credit Suisse Asset Management Income

Fund, Inc.

Credit Suisse High Yield Bond Fund

The enclosed joint proxy statement

describes a proposal to approve a new investment advisory agreement between your Fund and Credit Suisse Asset Management, LLC (“Credit

Suisse”) and, solely with respect Credit Suisse Strategic Income Fund (the “Strategic Income Fund”), a proposal to

approve a new sub-advisory agreement between Credit Suisse and Credit Suisse Asset Management Limited (“Credit Suisse UK”)

with respect to such Fund.

| Q. | Who

is asking for shareholders to vote? |

| A. | The Board of Directors or Board of Trustees

(each, a “Board”), as applicable, of each Fund is asking shareholders to vote

at the meeting on the proposal(s) applicable to each Fund. Each Fund’s Board approved

the Fund’s new investment advisory agreement (“New Investment Advisory Agreement(s)”

and, in the case of the Strategic Income Fund, the new sub-advisory agreement (“New

Sub-Advisory Agreement”) with respect to such Fund. Each Fund’s Board also voted

to submit each new agreement to be voted upon by shareholders of the applicable Fund. |

| Q. | Why

should shareholders vote “FOR” in this proxy? |

| A. | Shareholders are being asked to vote in favor

of a proposal to approve the New Investment Advisory Agreement for each Fund. In addition,

if you are a shareholder of the Strategic Income Fund, you are being asked to approve a New

Sub-Advisory Agreement between Credit Suisse and Credit Suisse UK. |

| Q. | Why are shareholders being asked to vote on the New Investment

Advisory and New Sub-Advisory Agreements? |

| A. | Shareholders are being asked to approve a New

Investment Advisory Agreement(s) for their respective Fund(s) as a result of recent

events involving CS Group and UBS Group. On June 12, 2023 (the “Closing Date”),

CS Group merged with and into UBS Group, with UBS Group remaining as the surviving company,

pursuant to a definitive merger agreement signed on March 19, 2023. Immediately prior

to the Closing Date, CS Group was the ultimate parent company of the Credit Suisse Investment

Advisers. |

Each Fund was party to an investment

advisory agreement with Credit Suisse and Credit Suisse was party to a sub-advisory agreement with Credit Suisse UK with respect to the

Strategic Income Fund prior to the Closing Date (collectively, the “Prior Advisory Agreements”). As required by the 1940

Act, each Prior Advisory Agreement provided that the agreement would automatically terminate upon its assignment. The closing of the

Merger was deemed to result in an assignment of each Prior Advisory Agreement, resulting in its automatic termination as of the Closing

Date. Your Fund requires shareholder approval of its New Investment Advisory Agreement and the Strategic Income Fund requires shareholder

approval of the New Sub-Advisory Agreement for the Funds to continue to receive investment advisory services from Credit Suisse and,

in the case of the Strategic Income Fund, Credit Suisse UK.

| Q. | If the Prior Advisory Agreements terminated on the Closing Date,

are there any investment advisory agreements in place for the Funds? |

| A. | Yes. Prior to the Closing Date, the Board of

each Fund approved an interim investment advisory agreement with Credit Suisse and, in the

case of the Strategic Income Fund, an interim sub-advisory agreement between Credit Suisse

and Credit Suisse UK (“Interim Advisory Agreements”). The Interim Advisory Agreements

did not require shareholder approval and took effect on the Closing Date when the Prior Advisory

Agreements were deemed to have terminated so that Credit Suisse and Credit Suisse UK could

continue to manage the Funds following the Closing Date. Each Interim Advisory Agreement

will terminate upon the earlier of shareholder approval of the corresponding New Investment

Advisory Agreement or 150 days following the Closing Date which is November 9, 2023.

Each Interim Advisory Agreement contains the same terms and conditions as the corresponding

Prior Advisory Agreement except for the effective and termination dates, escrow provisions

and certain non-material changes. |

| Q. | What else is happening with

Credit Suisse and the Funds? |

| A. | On June 7, 2023, the Credit Suisse Investment

Advisers and certain of their affiliates filed an application with the Securities and Exchange

Commission (the “Commission”) for temporary and permanent orders granting an

exemption to the Credit Suisse Investment Advisers and their affiliates, as well as to UBS

Group and its affiliates (collectively, “UBS”), as further described below, from

the prohibitions under Section 9(a) of the 1940 Act, in connection with a consent

order and final judgment (“Consent Judgment”) filed in New Jersey Superior Court

on October 24, 2022, which was entered against certain of Credit Suisse’s affiliates.

Section 9(a) of the 1940 Act automatically prohibits entities that are, or whose

affiliates are, subject to, among other things, certain court ordered “injunctions,”

from serving or acting as investment adviser of any investment company registered under the

1940 Act or a principal underwriter for any registered open-end investment company under

the 1940 Act, or, serving in various other capacities in respect of registered investment

companies. The Consent Judgment did not involve any of the Funds or the services that the

Credit Suisse Investment Advisers and their affiliates provided to the Funds. As further

described in the Joint Proxy Statement sent to shareholders, as a result of the Consent Judgment,

the Credit Suisse Investment Advisers could be disqualified from providing investment advisory

services to the Funds without such an exemption, even though they did not engage in the conduct

underlying the Consent Judgment, due to the broad scope of Section 9(a) of the

1940 Act. Upon learning of the terms of the Consent Judgment and the potential consequences

thereof under Section 9(a), Credit Suisse promptly contacted the Boards and the Staff

of the Commission. |

The Commission granted a temporary

exemption from Section 9(a) on June 7, 2023 to the Credit Suisse Investment Advisers and their affiliates, as well as

to UBS, effective upon the Closing Date. The Credit Suisse Investment Advisers and certain of their affiliates also applied for a permanent

order, which the Commission granted on July 5, 2023. The permanent order grants: (i) a time-limited exemption from Section 9(a) to

the Credit Suisse Investment Advisers and certain of their affiliates (the “Time-Limited Exemption”), which enables the Credit

Suisse Investment Advisers to provide investment advisory services to the Funds until June 12, 2024 (by which point such services

are anticipated to be transitioned to one or more UBS Investment Advisers in the UBS Transition), and (ii) a permanent exemption

from Section 9(a) to UBS (together with the Time-Limited Exemption, the “Permanent Order”).

Following the expiration of the Time-Limited

Exemption, Credit Suisse and Credit Suisse UK will be disqualified from providing investment advisory services to the Funds. Accordingly,

it is anticipated that the investment advisory services that the Credit Suisse Investment Advisers currently provide to the Funds will

be transitioned to one or UBS Investment Advisers within one year of the Closing Date (i.e., on or prior to June 12, 2024) as part

of the UBS Transition described above; however, the exact structure and timing of the UBS Transition have not yet been finalized.

| Q. | How do the New Investment Advisory Agreements and New Sub-Advisory

Agreement, as applicable, differ from my Fund’s current agreement(s)? |

| A. | Each New Investment Advisory Agreement and

the New Sub-Advisory Agreement will be identical to the corresponding Prior Advisory Agreement,

except for the dates of execution, effectiveness and termination and certain non-material

changes. |

| Q. | Will the Fund’s contractual

advisory fee rates go up? |

| A. | No. Each Fund’s contractual advisory

fee rates will not change as a result of the New Investment Advisory Agreement(s). |

| Q. | Will the New Investment Advisory Agreements and New Sub-Advisory

Agreement result in any changes in the portfolio management, investment objective or investment

strategy of my Fund? |

| A. | No changes to the investment objective(s),

principal investment strategies and policies, principal risks, fundamental and non-fundamental

investment policies, or portfolio managers (other than potential personnel changes outside

of Credit Suisse’s control) of your Fund are currently contemplated as a result of

the Merger. |

Subject to shareholder approval of

the New Investment Advisory Agreements and New Sub-Advisory Agreement, Credit Suisse and, in the case of the Strategic Income Fund, Credit

Suisse UK, will manage the Funds until the UBS Transition is completed (i.e., on or prior to June 12, 2024). However, in connection

with, or following the completion of, the UBS Transition, it is possible that there could be Fund-specific changes. The exact structure

and timing of the UBS Transition and Fund-specific changes (if any) related to the UBS Transition have not yet been finalized. Any Fund-specific

changes would be implemented without shareholder approval to the extent permitted under the federal securities laws (except for any changes

to a Fund’s fundamental investment policies, which would require shareholder approval). Shareholders of a Fund will be promptly

notified of any material Fund-specific changes.

| Q. | What happens if New Investment Advisory Agreement and New Sub-advisory

Agreement are not approved for my Fund? |

| A. | If shareholders do not approve the New Investment

Advisory Agreement(s) and/or a New Sub-Advisory Agreement, as applicable, Credit Suisse

and Credit Suisse UK, as applicable, will not be able to provide investment advisory services

for any applicable Fund following the expiration of the 150-day period following the closing

of the Merger, which will occur on November 9, 2023 and that Fund may be forced to liquidate. |

Shareholder vote to approve the New Investment Advisory

Agreement(s) is necessary to ensure that Credit Suisse and, in the case of the Strategic Income Fund, Credit Suisse UK, can continue

to manage the Funds until the UBS Transition is completed within one year of the Closing Date (i.e., June 12, 2024).

| Q. | Will there be any changes to each Fund’s custodian or other

service providers as a result of the Merger? |

| A. | No changes are being proposed to each Fund’s

custodian, administrator, distributor and transfer agent, as applicable, or the fees currently

charged to the Funds by such service providers at this time. However, it is expected that,

subject to Board approval, one or more service providers will change prior to the 12-month

anniversary of the Closing Date of the Merger in connection with the UBS Transition. |

| Q. | Who

is paying for this proxy statement? |

| A. | All

costs of the proxy and the shareholder meetings, including proxy solicitation costs, legal

fees and the costs of printing and mailing the proxy statement, will be borne by Credit Suisse. |

| Q. | How

do shareholders vote? |

| A. | · |

By

telephone: Call the toll-free number printed on the enclosed proxy card(s) and follow

the directions. |

| · | By

Internet: Access the website address printed on the enclosed proxy card(s) and follow

the directions on the website. |

| · | By

mail: Complete, sign and date the proxy card(s) you received and return in the self-addressed,

postage-paid envelope. |

| · | At

the meeting: Vote your shares at the meeting scheduled to be held on Thursday, August 24,

2023 at 4 p.m., Eastern Time. Please see the Question and Answer below regarding the location

of the meeting. |

| Q. | When

and where is the meeting scheduled to be held? |

| A. | The

meeting will be held at the offices of the Funds, Eleven Madison Avenue, Floor 2B, New York,

New York 10010, on Thursday, August 24, 2023 at 4 p.m., Eastern Time |

| Q. | What

if my client owns more than one investment? |

| A. | If

a shareholder owns more than one Fund on the Record Date, they will receive more than one

proxy card. Please have your client sign, date and return EACH proxy card they receive, or

vote on the proposal with respect to EACH Fund they own using any of the other convenient

options such as by telephone or Internet set forth on their proxy card. |

| Q. | Whom

do I call if I have question about voting this proxy? |

| A. | If you need more information, or have any questions

about voting, please call the Funds’ proxy solicitor, AST Fund Solutions, LLC

at 877-674-6273. |

| Q. | Will anyone contact my clients? |

| A. | Shareholders

may receive a call to verify that they received the proxy materials, or to answer any questions

about the proposals and to encourage participation by voting. |

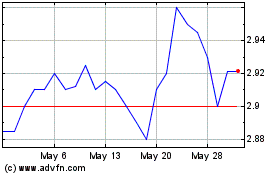

Credit Suisse Asset Mana... (AMEX:CIK)

Historical Stock Chart

From Apr 2024 to May 2024

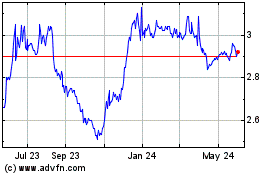

Credit Suisse Asset Mana... (AMEX:CIK)

Historical Stock Chart

From May 2023 to May 2024