false000084271700008427172023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 31, 2023 |

BLUE RIDGE BANKSHARES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

001-39165 |

54-1838100 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1807 Seminole Trail |

|

Charlottesville, Virginia |

|

22901 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (540) 743-6521 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, no par value |

|

BRBS |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 31, 2023 Blue Ridge Bankshares, Inc. issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this report and is incorporated by reference into this Item 2.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is being furnished pursuant to Item 2.02 above.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

BLUE RIDGE BANKSHARES, INC. |

|

|

|

|

Date: |

October 31, 2023 |

By: |

/s/ Judy C. Gavant |

|

|

|

Judy C. Gavant

Executive Vice President and

Chief Financial Officer |

Exhibit 99.1

Blue Ridge Bankshares, Inc. Announces Third Quarter 2023 Results

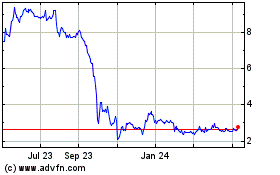

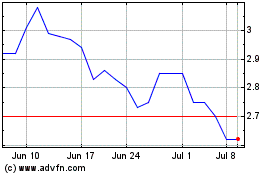

Third quarter 2023 net loss from continuing operations reflects a $26.8 million non-cash, after-tax charge for goodwill impairment related to company stock performance

Review of specialty finance loan portfolio results in prior period earnings restatements, with a positive impact to 2023 earnings

Company achieves additional milestones in regulatory remediation efforts

Blue Ridge Bank remains well-capitalized

CHARLOTTESVILLE, VA, October 31, 2023 /PRNewswire/ -- Blue Ridge Bankshares, Inc. (the “Company”) (NYSE American: BRBS), the holding company of Blue Ridge Bank, National Association (“Blue Ridge Bank” or the “Bank”) and BRB Financial Group, Inc. (“BRB Financial Group”), today announced financial results for the quarter ended September 30, 2023.

On October 31, 2023, the Company filed a Form 8-K with the U.S. Securities and Exchange Commission (“SEC”) reporting that it would be restating financial statements included in its annual report on Form 10-K for the year ended December 31, 2022, and quarterly reports on Form 10-Q for the periods ended March 31, 2023 and June 30, 2023. Financial information included herein for the periods subject to restatement reflect the Company’s current expectations of the restated amounts as of and for such periods. The restated financial statements will be reflected in amendments to the aforementioned reports to be filed with the SEC in the next several weeks.

For the third quarter of 2023, the Company reported a net loss from continuing operations of $41.4 million, or $2.18 per diluted common share, compared to a net loss from continuing operations of $8.6 million, or $0.45 per diluted common share, for the second quarter of 2023, and net income from continuing operations of $2.7 million, or $0.15 per diluted common share, for the third quarter of 2022. The net loss from continuing operations for the third quarter of 2023 included a non-cash, after-tax goodwill impairment charge of $26.8 million, which was the entirety of the goodwill balance, and a $6.0 million settlement reserve for the previously disclosed Employee Stock Ownership Plan (“ESOP”) litigation assumed in the 2019 acquisition of Virginia Community Bankshares, Inc. (“VCB”), as further discussed below. Excluding the impact of the goodwill impairment charge, the ESOP settlement reserve, and regulatory remediation costs, third quarter 2023 net loss from continuing operations was slightly improved from the second quarter of 2023. The goodwill impairment charge does not impact the Bank’s regulatory capital position.

A Message From Blue Ridge Bankshares, Inc. President and CEO, G. William “Billy” Beale:

“My focus since coming on board at Blue Ridge has been to ensure we are driving enhanced oversight, rigor, and portfolio refinement into our operations so we can take better advantage of our inherent strengths and the opportunities before us. Specifically, these focus areas involve our ongoing regulatory remediation efforts related to our Fintech operations, as well as further advancing our team’s review of and controls over our loan portfolio and its risk profile.

“During the quarter, we made meaningful progress on these and other fronts.

“Regarding our OCC remediation efforts, we:

•Completed the Bank Secrecy Act look-back requirement;

•Significantly narrowed our base of Banking as a Service ("BaaS") customer accounts by closing accounts that were inactive or lacked proper documentation; and

•Developed a strategic road map for refining and rationalizing our Fintech/BaaS line of business.

“Fintech remains an important focus for Blue Ridge and I'm confident that our ongoing work with our primary regulator will enhance our position in how we serve this market.

“Regarding our specialty finance loan portfolio review, we:

•Completed two external loan reviews which revealed no additional problematic loans;

•In consultation with our independent public accounting firm and our primary bank regulator, moved to restate financial statements for certain prior periods to more accurately reflect the nonaccrual nature of certain, previously disclosed components of our loan portfolio and its impact;

•Established a credit policy and risk committee charged with drafting a new credit policy; and

•Began institutionalizing a new philosophy around loan portfolio management.

“Importantly, we believe these restatements do not significantly impact our present financial condition, nor do they indicate any trends in our current or prospective business.

“Our performance during the quarter reflects the near-term impacts of these initiatives as well as two non-recurring, non-operational items:

•The impact of a non-cash goodwill impairment charge driven by the pressure on our stock price, and

•A reserve established for the proposed settlement of previously disclosed ESOP litigation that we assumed in a prior acquisition. We are hopeful that our efforts toward settlement will help eliminate the uncertainty related to this litigation and curtail the additional costs of pursuing a trial.

“With our specialty finance loan portfolio review largely behind us, additional progress in our Fintech remediation efforts and portfolio rationalization, and improved rigor in the business, I am confident we are building a stronger platform for growth and shareholder value.”

Q3 2023 Highlights

(Comparisons for Third Quarter 2023 are relative to Second Quarter 2023 unless otherwise noted.)

Formal Written Agreement:

•As previously disclosed, Blue Ridge Bank entered into a formal written agreement (the “Agreement”) with the Office of the Comptroller of the Currency (“OCC”) on August 29, 2022. The Agreement principally concerns the Bank’s Fintech line of business and requires the Bank to continue enhancing its controls for assessing and managing the third-party, BSA/AML, and IT risks stemming from its Fintech partnerships. The Company continues to actively work to bring the Bank’s Fintech policies, procedures, and operations into conformity with OCC directives. The Company reports that, although work is progressing, many aspects of the Agreement require considerable time for completion, implementation, validation, and sustainability. Remediation costs related to regulatory matters were $3.8 million, compared to $2.4 million in the prior quarter.

ESOP Litigation:

•As a result of its acquisition of VCB in 2019, the Company assumed liability in connection with a class action complaint filed by a former VCB employee against VCB relating to its ESOP. The Company and the Bank have entered into a settlement term sheet with the plaintiff to resolve the litigation (the “Term Sheet”). Under the Term Sheet, the parties have agreed to negotiate towards entering into a formal settlement agreement (the “Settlement Agreement”) that would be contingent upon approval by the court hearing the case. As provided in the Term Sheet, the plaintiff has agreed to release the Company, the Bank, and related parties from all claims related to acts or omissions associated with the VCB ESOP, once the Settlement Agreement is entered into and approved by the court. The Company has agreed to make a settlement payment of $6.0 million to a fund for the benefit of VCB ESOP participants, with $5.95 million due after final approval of the settlement by the court, which is expected to occur late in the first quarter or early in the second quarter of 2024. If the court approves the Settlement Agreement, the ongoing lawsuit will be dismissed with prejudice, and all similar claims that were or could have been brought relating to the VCB ESOP will be released and barred. The Company entered into the Term Sheet to eliminate the burden and expense of further litigation and to resolve the claims that were or could have been asserted related to the VCB ESOP.

Asset Quality:

•Nonperforming loans totaled $81.8 million, or 2.51% of total assets, compared to $81.6 million, or 2.54% of total assets, at the prior quarter-end. Elevated nonperforming loans reflect, as previously disclosed, a group of specialty finance loans on nonaccrual status. These specific loans have carrying values totaling $48.2 million, for which the Company holds reserves of $21.8 million as of September 30, 2023. Of the $53.6 million of these loans reported as of June 30, 2023, one loan in the amount of $2.4 million paid off in full and another loan was reduced by $2.5 million in the third quarter.

•The provision for credit losses was $11.1 million, compared to $10.0 million last quarter. Net loan charge-offs were $0.5 million in the quarter, representing an annualized net charge-off

rate of 0.09% of average loans, compared to $8.0 million, representing an annualized net charge-off rate of 1.29% of average loans, for the prior quarter.

•The allowance for credit losses (“ACL”) as a percentage of total loans held for investment was 2.03% at quarter-end, compared to 1.58% at the prior quarter-end. Specific reserves associated with the aforementioned specialty finance loans totaled $21.8 million and $9.6 million at September 30, 2023 and June 30, 2023, respectively.

Capital:

•On October 30, 2023, the Board of Directors determined to suspend the payment of future quarterly dividend payments until further notice. The decision was based on the desire to preserve capital.

•The ratio of tangible stockholders’ equity to tangible total assets was 5.5%1, compared to 6.3%1 at the prior quarter-end. Tangible book value per common share was $9.301, compared to $10.551 at the prior quarter-end.

•For the quarter ended September 30, 2023, the Bank’s tier 1 leverage ratio, tier 1 risk-based capital ratio, common equity tier 1 capital ratio, and total risk-based capital ratio were 7.63%, 9.18%, 9.18%, and 10.44%, respectively, compared to 7.92%, 9.35%, 9.35%, and 10.60%, respectively, at the prior quarter-end. Capital ratios at quarter-end were within regulatory guidelines to categorize the Bank as well capitalized.

Net Interest Income / Net Interest Margin:

•Net interest income was $22.2 million, a decline of $1.7 million from the prior quarter. Increasing loan yields in the quarter, which increased 9 basis points, were offset by higher funding costs, which increased by 24 basis points, primarily due to higher rates paid on deposits, including wholesale deposits acquired in the quarter. Net interest margin was 2.92% compared to 3.12% for the prior quarter, with the decline primarily attributable to higher funding costs.

•Cost of deposits and total cost of funds were 2.46% and 2.73%, respectively, compared to 2.21% and 2.49%, respectively, for the prior quarter. Federal Home Loan Bank of Atlanta (“FHLB”) and Federal Reserve Bank of Richmond (“FRB”) advances were $215.0 million at September 30, 2023, compared to $284.1 million at the prior quarter-end. Deposit costs and overall funding costs increased during the third quarter of 2023 due primarily to the impact of higher average balances of and rates paid on wholesale funding, as well as interest rates on certain deposits that adjust with changes in federal funds rates.

Balance Sheet:

•Total deposit balances increased $163.1 million from the prior quarter-end, due primarily to an increase of $147.7 million in wholesale funding, principally time deposits and interest-bearing demand balances. Excluding wholesale funding, total deposits during the third quarter of 2023 increased by 0.6% from the prior quarter-end.

•Deposits related to Fintech relationships were $720.8 million at September 30, 2023, compared to $707.6 million at the prior quarter-end. These deposits represented 26.0% of total deposits at September 30, 2023, compared to 27.1% of total deposits at the prior quarter-end. Excluding wholesale funding, deposits related to Fintech relationships represented 30.5% and 30.1% of total deposits at September 30, 2023 and June 30, 2023, respectively.

•Loans held for investment were $2.45 billion, essentially level with the prior quarter-end. The held for investment loan to deposit ratio measured 88.1% at quarter-end, compared to 93.9% at the prior quarter-end.

Noninterest Income / Noninterest Expense:

•Noninterest income was $7.4 million, compared to $9.7 million for the prior quarter, a decline of $2.3 million. Noninterest income was lower due primarily to a lower gain on sale of government guaranteed loans.

•Noninterest expense was $64.6 million, compared to $34.1 million for the prior quarter, an increase of $30.5 million. Excluding the previously noted $26.8 million goodwill impairment charge and the $6.0 million reserve for the proposed settlement of the ESOP litigation, noninterest expense declined $2.3 million from the prior quarter, which was primarily attributable to declines in other contractual services and legal expenses, partially offset by higher regulatory remediation expenses.

Income Statement:

Net Interest Income

Net interest income was $22.2 million for the third quarter of 2023, compared to $23.9 million for the second quarter of 2023, and $28.7 million for the third quarter of 2022. Relative to both the prior quarter and year-ago periods, net interest income declined due to the impact of higher interest rates on deposits and overall funding costs, and actions taken to add balance sheet liquidity following the market events that began in March 2023. Relative to the year-ago period, these developments were partially offset by an increase in average interest-earning asset balances at higher loan yields.

Total interest income was $42.5 million for both the second and third quarters of 2023, and $33.1 million for the third quarter of 2022. The increase relative to the prior year reflects higher average balances of and yields on interest-earning asset balances, partially offset by lower income from purchase accounting adjustments. The yield on average loans held for investment, excluding Paycheck Protection

Program (“PPP”) loans, was 6.19% for the third quarter of 2023, compared to 6.10% for the second quarter of 2023, and 5.67% for the third quarter of 2022.

Total interest expense was $20.3 million for the third quarter of 2023, compared to $18.6 million for the second quarter of 2023, and $4.5 million for the third quarter of 2022. The increase relative to the prior quarter and the year-ago period reflects higher deposit costs and overall funding costs due to higher market interest rates and a shift in the mix of average interest-bearing liabilities, primarily to higher cost wholesale funding sources.

Average balances of interest-earning assets decreased $25.3 million to $3.04 billion in the third quarter of 2023, relative to the prior quarter, and increased $352.4 million from the year-ago period. Relative to the prior quarter, the decrease reflected a slight decline in average total securities and loans held for investment balances, partially offset by higher average balances of loans held for sale and interest-earning deposits in other banks. Relative to the year-ago period, the increase in average interest-earning asset balances was due primarily to higher balances of loans held for investment and interest-earning deposits at other banks.

Average balances of interest-bearing liabilities increased $7.6 million to $2.35 billion in the third quarter of 2023, relative to the prior quarter, and increased $583.1 million from the year-ago period. Relative to the prior quarter, the increase reflected higher average FRB borrowings, which encompass advances under the Bank Term Funding Program, partially offset by lower average balances of time deposits and FHLB borrowings. Relative to the prior year, the increase reflected higher average balances of interest-bearing deposits and FHLB borrowings.

Cost of funds was 2.73% for the third quarter of 2023, compared to 2.49% for the second quarter of 2023, and 0.69% for the third quarter of 2022, while cost of deposits was 2.46%, 2.21%, and 0.50%, for the same respective periods. Higher deposit costs and overall funding costs reflect the impact of higher market interest rates and a shift in the mix of funding.

Net interest margin was 2.92% for the third quarter of 2023, compared to 3.12% for the second quarter of 2023, and 4.27% for the third quarter of 2022. The decline in net interest margin relative to both prior periods primarily reflects the impact of higher interest rates on funding costs and less benefit from purchase accounting adjustments. These declines were partially offset by higher yields on loans.

Provision for Credit Losses

The Company recorded a provision for credit losses of $11.1 million for the third quarter of 2023, compared to $10.0 million for the second quarter of 2023, and $3.9 million for the third quarter of 2022. Relative to both prior periods, the increase in provision is primarily attributable to specific reserves on the aforementioned group of specialty finance loans.

Noninterest Income

Noninterest income was $7.4 million for the third quarter of 2023, compared to $9.7 million for the second quarter of 2023, and $8.0 million for the third quarter of 2022. Relative to the prior quarter, the decline primarily reflected a lower gain on sale of government guaranteed loans, residential mortgage banking income, and a loss on the sale of securities. Relative to the year-ago period, the decline

primarily reflected a lower gain on sale of government guaranteed loans and a loss on the sale of securities, partially offset by higher residential mortgage banking income.

Noninterest Expense

Noninterest expense was $64.6 million for the third quarter of 2023, compared to $34.1 million for the second quarter of 2023, and $29.2 million for the third quarter of 2022. Excluding the $26.8 million goodwill impairment charge, the $6.0 million reserve for proposed settlement of the ESOP litigation, and regulatory remediation costs, noninterest expense declined $3.7 million from the prior quarter and increased $2.8 million from the year-ago period, on a relative basis.

Balance Sheet:

Loans

Loans held for investment, excluding PPP loans, were $2.44 billion at September 30, 2023, compared to $2.45 billion at June 30, 2023, and $2.16 billion at September 30, 2022. While loan balances were flat with the prior quarter level, the Company selectively replaced the amortization of balances with higher yielding loans. The increase in loan balances relative to the year ago period reflected the high level of growth, particularly in the fourth quarter of 2022.

Deposits

Total deposits were $2.78 billion at September 30, 2023, an increase of $163.1 million, from the prior quarter-end, and an increase of $366.7 million, from the year-ago period. Relative to the prior quarter, the increase reflected an increase in wholesale funding, primarily time deposits, and, to a lesser extent, increases in interest-bearing demand and money market deposits. Relative to the year-ago period, the increase reflected higher wholesale funding balances, interest-bearing demand and money market deposits, partially offset by lower noninterest-bearing demand deposits and savings deposits. Noninterest-bearing deposits declined 0.5% and 27.2% relative to the prior quarter and year-ago periods, respectively, and represented 20.6%, 22.0%, and 32.7% of total deposits at September 30, 2023, June 30, 2023, and September 30, 2022, respectively. The change from the year-ago period was primarily due to certain Fintech-related balances shifting to interest-bearing accounts.

The held for investment loan to deposit ratio was 88.1% at September 30, 2023, compared to 93.9% at the prior quarter-end, and 90.1% at the year-ago period-end. The decrease on a comparative basis was due primarily to higher wholesale funding.

Fintech Business:

Interest and fee income related to Fintech partnerships represented approximately $3.6 million, $3.4 million, and $2.9 million of total revenue for the Company for the third quarter of 2023, the second quarter of 2023, and the third quarter of 2022, respectively.

Deposits related to Fintech relationships were $721 million at September 30, 2023, compared to $708 million at the prior quarter-end. These deposits represented 28.8% of total deposits at September 30, 2023, compared to 27.1% of total deposits at the prior quarter-end. Included in deposits related to

Fintech relationships were assets managed by BRB Financial Group’s trust division of $24.6 million as of September 30, 2023.

Other Matters:

On May 15, 2023, the Company sold its wholesale mortgage business operating as LenderSelect Mortgage Group (“LSMG”) to a third-party for $250 thousand in cash. The Company recorded a loss on the sale of LSMG of $553 thousand, which is reported in other noninterest income in the consolidated statements of operations for the nine months ended September 30, 2023.

In the first quarter of 2022, the Company sold its majority interest in MoneyWise Payroll Solutions, Inc. (“MoneyWise”) to the holder of the minority interest in MoneyWise. Income statement amounts related to MoneyWise are reported as discontinued operations for all periods presented.

Non-GAAP Financial Measures:

The accounting and reporting policies of the Company conform to U.S. generally accepted accounting principles (“GAAP”) and prevailing practices in the banking industry. However, management uses certain non-GAAP measures, including tangible assets, tangible common equity, and tangible book value per share, to supplement the evaluation of the Company’s financial condition and performance. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of GAAP to non-GAAP measures are included at the end of this release.

Forward-Looking Statements:

This release of the Company contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements.

The following factors, among others, could cause the Company’s financial performance to differ materially from that expressed in such forward-looking statements: (i) the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; (ii) geopolitical conditions, including acts or threats of terrorism and/or military conflicts, or actions

taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the United States and abroad; (iii) the residual effects of the COVID-19 pandemic, including the adverse impact on the Company’s business and operations and on the Company’s customers which may result, among other things, in increased delinquencies, defaults, foreclosures and losses on loans; (iv) the occurrence of significant natural disasters, including severe weather conditions, floods, health related issues, and other catastrophic events; (v) the Company’s management of risks inherent in its loan portfolio, the credit quality of its borrowers, and the risk of a prolonged downturn in the real estate market, which could impair the value of the Company’s collateral and its ability to sell collateral upon any foreclosure; (vi) changes in consumer spending and savings habits; (vii) deposit outflows; (viii) technological and social media changes; (ix) the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rate, market and monetary fluctuations; (x) changing bank regulatory conditions, policies or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or the Company’s subsidiary bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, regulation or prohibition of certain income producing activities or changes in the secondary market for loans and other products; (xi) the impact of changes in financial services policies, laws, and regulations, including laws, regulations and policies concerning taxes, banking, securities and insurance, and the application thereof by regulatory bodies; (xii) the impact of, and the ability to comply with, the terms of the formal written agreement between the Bank and the OCC; (xiii) the impact of changes in laws, regulations, and policies affecting the real estate industry; (xiv) the effect of changes in accounting policies and practices, as may be adopted from time to time by bank regulatory agencies, the SEC, the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setting bodies; (xv) the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; (xvi) the willingness of users to substitute competitors’ products and services for the Company’s products and services; (xvii) the outcome of any legal proceedings that may be instituted against the Company; (xviii) reputational risk and potential adverse reactions of the Company’s customers, suppliers, employees, or other business partners; (xix) the ability to maintain adequate liquidity by retaining deposits customers and secondary funding sources, especially if the Company's or industry's reputation become damaged; (xx) maintaining capital levels adequate to support the Company's growth and to adhere to regulatory capital standards; (xxi) the effects of acquisitions the Company had to make and may make, including, without limitation, the failure to achieve the expected revenue growth and/or expense savings from such transactions; (xxii) changes in the level of the Company’s nonperforming assets and charge-offs; (xxiii) the Company’s involvement, from time to time, in legal proceedings and examination and remedial actions by regulators; (xxiv) adverse developments in the financial industry generally, such as recent bank failures, responsive measures to mitigate and manage such developments, related supervisory and regulatory actions and costs, and related impacts on customer and client behavior; (xxv) potential exposure to fraud, negligence, computer theft, and cyber-crime; (xxvi) the Company’s ability to pay dividends; (xxvii) the ability to manage the Company's Fintech relationships, including implementing enhanced controls and maintaining deposit levels and the quality of loans associated with these relationships; (xxviii) the Company’s involvement as a participating lender in the PPP as administered through the U.S. Small Business Administration; and (xxix) other risks and factors identified in the “Risk Factors” sections and elsewhere in documents the Company files from time to time with the SEC.

1 Non-GAAP financial measure. Further information can be found at the end of this press release.

|

|

|

|

|

|

|

|

|

Blue Ridge Bankshares, Inc. |

|

|

|

|

|

|

Consolidated Balance Sheets |

|

|

|

|

|

|

(Dollars in thousands, except share data) |

|

(unaudited)

September 30, 2023 |

|

|

(As restated, unaudited) December 31, 2022 (1) |

|

Assets |

|

|

|

|

|

|

Cash and due from banks |

|

$ |

238,573 |

|

|

$ |

77,274 |

|

Federal funds sold |

|

|

2,584 |

|

|

|

1,426 |

|

Securities available for sale, at fair value |

|

|

313,930 |

|

|

|

354,341 |

|

Restricted equity investments |

|

|

16,006 |

|

|

|

21,257 |

|

Other equity investments |

|

|

22,061 |

|

|

|

23,776 |

|

Other investments |

|

|

28,453 |

|

|

|

24,672 |

|

Loans held for sale |

|

|

69,640 |

|

|

|

69,534 |

|

Paycheck Protection Program loans, net of deferred fees and costs |

|

|

6,414 |

|

|

|

11,967 |

|

Loans held for investment, net of deferred fees and costs |

|

|

2,439,956 |

|

|

|

2,399,092 |

|

Less: allowance for credit losses |

|

|

(49,631 |

) |

|

|

(30,740 |

) |

Loans held for investment, net |

|

|

2,390,325 |

|

|

|

2,368,352 |

|

Accrued interest receivable |

|

|

16,387 |

|

|

|

11,569 |

|

Other real estate owned |

|

|

— |

|

|

|

195 |

|

Premises and equipment, net |

|

|

22,506 |

|

|

|

23,152 |

|

Right-of-use asset |

|

|

9,100 |

|

|

|

6,903 |

|

Bank owned life insurance |

|

|

48,136 |

|

|

|

47,245 |

|

Goodwill |

|

|

— |

|

|

|

26,826 |

|

Other intangible assets |

|

|

5,520 |

|

|

|

6,583 |

|

Mortgage servicing rights, net |

|

|

29,139 |

|

|

|

28,991 |

|

Deferred tax asset, net |

|

|

13,237 |

|

|

|

12,227 |

|

Other assets |

|

|

30,702 |

|

|

|

14,175 |

|

Total assets |

|

$ |

3,262,713 |

|

|

$ |

3,130,465 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Noninterest-bearing demand |

|

$ |

572,969 |

|

|

$ |

640,101 |

|

Interest-bearing demand and money market deposits |

|

|

1,350,602 |

|

|

|

1,318,799 |

|

Savings |

|

|

124,321 |

|

|

|

151,646 |

|

Time deposits |

|

|

728,260 |

|

|

|

391,961 |

|

Total deposits |

|

|

2,776,152 |

|

|

|

2,502,507 |

|

FHLB borrowings |

|

|

150,000 |

|

|

|

311,700 |

|

FRB borrowings |

|

|

65,000 |

|

|

|

51 |

|

Subordinated notes, net |

|

|

39,871 |

|

|

|

39,920 |

|

Lease liability |

|

|

10,015 |

|

|

|

7,860 |

|

Other liabilities |

|

|

38,838 |

|

|

|

19,634 |

|

Total liabilities |

|

|

3,079,876 |

|

|

|

2,881,672 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

Common stock, no par value; 50,000,000 shares authorized at September 30, 2023 and December 31, 2022; 19,192,471 and 18,950,329 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively |

|

|

197,445 |

|

|

|

195,960 |

|

Additional paid-in capital |

|

|

252 |

|

|

|

252 |

|

Retained earnings |

|

|

38,916 |

|

|

|

97,682 |

|

Accumulated other comprehensive loss, net of tax |

|

|

(53,776 |

) |

|

|

(45,101 |

) |

Total stockholders’ equity |

|

|

182,837 |

|

|

|

248,793 |

|

Total liabilities and stockholders’ equity |

|

$ |

3,262,713 |

|

|

$ |

3,130,465 |

|

|

|

|

|

|

|

|

(1) Reflects the Company’s current expectations of amounts, as restated, as of December 31, 2022. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blue Ridge Bankshares, Inc. |

|

|

|

|

|

|

|

Consolidated Statements of Income (unaudited) |

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

(Dollars in thousands, except per common share data) |

|

September 30, 2023 |

|

|

As restated (1)

June 30, 2023 |

|

|

September 30, 2022 |

|

Interest income: |

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

38,551 |

|

|

$ |

38,326 |

|

|

$ |

30,206 |

|

Interest on taxable securities |

|

|

2,492 |

|

|

|

2,543 |

|

|

|

2,337 |

|

Interest on nontaxable securities |

|

|

72 |

|

|

|

94 |

|

|

|

81 |

|

Interest on deposit accounts and federal funds sold |

|

|

1,370 |

|

|

|

1,497 |

|

|

|

522 |

|

Total interest income |

|

|

42,485 |

|

|

|

42,460 |

|

|

|

33,146 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

|

16,115 |

|

|

|

14,624 |

|

|

|

3,032 |

|

Interest on subordinated notes |

|

|

566 |

|

|

|

547 |

|

|

|

570 |

|

Interest on FHLB and FRB borrowings |

|

|

3,612 |

|

|

|

3,399 |

|

|

|

867 |

|

Total interest expense |

|

|

20,293 |

|

|

|

18,570 |

|

|

|

4,469 |

|

Net interest income |

|

|

22,192 |

|

|

|

23,890 |

|

|

|

28,677 |

|

Provision for credit losses - loans |

|

|

11,600 |

|

|

|

10,613 |

|

|

|

3,900 |

|

Provision for (recovery of) credit losses - unfunded commitments |

|

|

(550 |

) |

|

|

(600 |

) |

|

|

— |

|

Total provision for credit losses |

|

|

11,050 |

|

|

|

10,013 |

|

|

|

3,900 |

|

Net interest income after provision for credit losses |

|

|

11,142 |

|

|

|

13,877 |

|

|

|

24,777 |

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

Fair value adjustments of other equity investments |

|

|

55 |

|

|

|

(281 |

) |

|

|

(50 |

) |

Residential mortgage banking income, including MSRs |

|

|

3,811 |

|

|

|

4,295 |

|

|

|

3,167 |

|

Gain on sale of government guaranteed loans |

|

|

6 |

|

|

|

2,384 |

|

|

|

1,565 |

|

Wealth and trust management |

|

|

462 |

|

|

|

462 |

|

|

|

513 |

|

Service charges on deposit accounts |

|

|

365 |

|

|

|

349 |

|

|

|

354 |

|

Increase in cash surrender value of BOLI |

|

|

311 |

|

|

|

292 |

|

|

|

398 |

|

Bank and purchase card, net |

|

|

357 |

|

|

|

560 |

|

|

|

353 |

|

Loss on sale of securities available for sale |

|

|

(442 |

) |

|

|

— |

|

|

|

— |

|

Other |

|

|

2,490 |

|

|

|

1,675 |

|

|

|

1,668 |

|

Total noninterest income |

|

|

7,415 |

|

|

|

9,736 |

|

|

|

7,968 |

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

14,640 |

|

|

|

14,518 |

|

|

|

14,174 |

|

Occupancy and equipment |

|

|

1,475 |

|

|

|

1,913 |

|

|

|

1,422 |

|

Data processing |

|

|

1,710 |

|

|

|

1,131 |

|

|

|

1,332 |

|

Legal |

|

|

912 |

|

|

|

2,753 |

|

|

|

804 |

|

Advertising and marketing |

|

|

350 |

|

|

|

337 |

|

|

|

302 |

|

Communications |

|

|

1,181 |

|

|

|

1,171 |

|

|

|

932 |

|

Audit and accounting fees |

|

|

791 |

|

|

|

503 |

|

|

|

308 |

|

FDIC insurance |

|

|

1,322 |

|

|

|

1,246 |

|

|

|

460 |

|

Intangible amortization |

|

|

308 |

|

|

|

335 |

|

|

|

377 |

|

Other contractual services |

|

|

1,492 |

|

|

|

3,218 |

|

|

|

703 |

|

Other taxes and assessments |

|

|

802 |

|

|

|

803 |

|

|

|

711 |

|

Regulatory remediation |

|

|

3,782 |

|

|

|

2,388 |

|

|

|

4,025 |

|

Goodwill impairment |

|

|

26,826 |

|

|

|

— |

|

|

|

— |

|

Other |

|

|

9,030 |

|

|

|

3,736 |

|

|

|

3,658 |

|

Total noninterest expense |

|

|

64,621 |

|

|

|

34,052 |

|

|

|

29,208 |

|

(Loss) income before income tax |

|

|

(46,064 |

) |

|

|

(10,439 |

) |

|

|

3,537 |

|

Income tax (benefit) expense |

|

|

(4,693 |

) |

|

|

(1,826 |

) |

|

|

801 |

|

Net (loss) income |

|

|

(41,371 |

) |

|

|

(8,613 |

) |

|

|

2,736 |

|

Basic and diluted (loss) earnings per common share |

|

$ |

(2.18 |

) |

|

$ |

(0.45 |

) |

|

$ |

0.15 |

|

(1) Reflects the Company’s current expectations of amounts, as restated, for the period stated. |

|

|

|

|

|

|

|

|

|

|

Blue Ridge Bankshares, Inc. |

|

|

|

|

|

|

Consolidated Statements of Income (unaudited) |

|

|

|

|

|

|

|

|

For the Nine Months Ended |

|

(Dollars in thousands except per share data) |

|

As restated (1) September 30, 2023 |

|

|

September 30, 2022 |

|

Interest income: |

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

114,009 |

|

|

$ |

77,892 |

|

Interest on taxable securities |

|

|

7,663 |

|

|

|

6,236 |

|

Interest on nontaxable securities |

|

|

257 |

|

|

|

245 |

|

Interest on deposit accounts and federal funds sold |

|

|

3,906 |

|

|

|

818 |

|

Total interest income |

|

|

125,835 |

|

|

|

85,191 |

|

Interest expense: |

|

|

|

|

|

|

Interest on deposits |

|

|

42,070 |

|

|

|

6,129 |

|

Interest on subordinated notes |

|

|

1,666 |

|

|

|

1,668 |

|

Interest on FHLB and FRB borrowings |

|

|

10,821 |

|

|

|

959 |

|

Total interest expense |

|

|

54,557 |

|

|

|

8,756 |

|

Net interest income |

|

|

71,278 |

|

|

|

76,435 |

|

Provision for credit losses - loans |

|

|

21,103 |

|

|

|

13,894 |

|

Provision for (recovery of) credit losses - unfunded commitments |

|

|

(1,550 |

) |

|

|

— |

|

Total provision for credit losses |

|

|

19,553 |

|

|

|

13,894 |

|

Net interest income after provision for credit losses |

|

|

51,725 |

|

|

|

62,541 |

|

Noninterest income: |

|

|

|

|

|

|

Fair value adjustments of other equity investments |

|

|

(277 |

) |

|

|

9,228 |

|

Residential mortgage banking income, including MSRs |

|

|

9,409 |

|

|

|

18,686 |

|

Gain on sale of government guaranteed loans |

|

|

4,799 |

|

|

|

4,530 |

|

Wealth and trust management |

|

|

1,356 |

|

|

|

1,318 |

|

Service charges on deposit accounts |

|

|

1,057 |

|

|

|

996 |

|

Increase in cash surrender value of BOLI |

|

|

885 |

|

|

|

946 |

|

Bank and purchase card, net |

|

|

1,257 |

|

|

|

1,374 |

|

Loss on sale of securities available for sale |

|

|

(442 |

) |

|

|

— |

|

Other |

|

|

6,390 |

|

|

|

5,174 |

|

Total noninterest income |

|

|

24,434 |

|

|

|

42,252 |

|

Noninterest expense: |

|

|

|

|

|

|

Salaries and employee benefits |

|

|

44,447 |

|

|

|

44,143 |

|

Occupancy and equipment |

|

|

4,957 |

|

|

|

4,407 |

|

Data processing |

|

|

4,187 |

|

|

|

3,152 |

|

Legal |

|

|

4,899 |

|

|

|

1,704 |

|

Advertising and marketing |

|

|

973 |

|

|

|

1,142 |

|

Communications |

|

|

3,483 |

|

|

|

2,761 |

|

Audit and accounting fees |

|

|

1,440 |

|

|

|

828 |

|

FDIC insurance |

|

|

3,297 |

|

|

|

797 |

|

Intangible amortization |

|

|

998 |

|

|

|

1,160 |

|

Other contractual services |

|

|

5,649 |

|

|

|

1,803 |

|

Other taxes and assessments |

|

|

2,407 |

|

|

|

1,952 |

|

Regulatory remediation |

|

|

7,304 |

|

|

|

4,558 |

|

Merger-related |

|

|

— |

|

|

|

50 |

|

Goodwill impairment |

|

|

26,826 |

|

|

|

— |

|

Other |

|

|

16,653 |

|

|

|

8,767 |

|

Total noninterest expense |

|

|

127,520 |

|

|

|

77,224 |

|

(Loss) income from continuing operations before income tax |

|

|

(51,361 |

) |

|

|

27,569 |

|

Income tax (benefit) expense |

|

|

(5,347 |

) |

|

|

6,296 |

|

Net (loss) income from continuing operations |

|

$ |

(46,014 |

) |

|

$ |

21,273 |

|

Discontinued operations: |

|

|

|

|

|

|

Income from discontinued operations before income taxes (including gain on disposal of $471 thousand for the nine months ended September 30, 2022) |

|

|

— |

|

|

|

426 |

|

Income tax expense |

|

|

— |

|

|

|

89 |

|

Net income from discontinued operations |

|

$ |

— |

|

|

$ |

337 |

|

Net (loss) income |

|

$ |

(46,014 |

) |

|

$ |

21,610 |

|

|

|

|

|

|

|

|

|

|

Net income from discontinued operations attributable to noncontrolling interest |

|

|

— |

|

|

|

(1 |

) |

Net (loss) income attributable to Blue Ridge Bankshares, Inc. |

|

$ |

(46,014 |

) |

|

$ |

21,609 |

|

Net (loss) income available to common stockholders |

|

$ |

(46,014 |

) |

|

$ |

21,609 |

|

Basic and diluted (loss) earnings per common share from continuing operations |

|

$ |

(2.42 |

) |

|

$ |

1.13 |

|

Basic and diluted (loss) earnings per common share from discontinued operations |

|

$ |

— |

|

|

$ |

0.02 |

|

Basic and diluted (loss) earnings per common share attributable to Blue Ridge Bankshares, Inc. |

|

$ |

(2.42 |

) |

|

$ |

1.15 |

|

(1) Reflects the Company’s current expectations of amounts, as restated, for the period stated. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blue Ridge Bankshares, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Summary of Selected Financial Data (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Three Months Ended |

|

|

|

|

|

|

As restated (3) |

|

|

As restated (3) |

|

|

As restated (3) |

|

|

|

|

(Dollars and shares in thousands, except per common share data) |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

Income Statement Data: |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

Interest income |

|

$ |

42,485 |

|

|

$ |

42,460 |

|

|

$ |

40,890 |

|

|

$ |

36,461 |

|

|

$ |

33,146 |

|

Interest expense |

|

|

20,293 |

|

|

|

18,570 |

|

|

|

15,694 |

|

|

|

8,329 |

|

|

|

4,469 |

|

Net interest income |

|

|

22,192 |

|

|

|

23,890 |

|

|

|

25,196 |

|

|

|

28,132 |

|

|

|

28,677 |

|

Provision for (recovery of) credit losses |

|

|

11,050 |

|

|

|

10,013 |

|

|

|

(1,510 |

) |

|

|

11,793 |

|

|

|

3,900 |

|

Net interest income after provision for credit losses |

|

|

11,142 |

|

|

|

13,877 |

|

|

|

26,706 |

|

|

|

16,339 |

|

|

|

24,777 |

|

Noninterest income |

|

|

7,415 |

|

|

|

9,736 |

|

|

|

7,283 |

|

|

|

5,840 |

|

|

|

7,968 |

|

Noninterest expense, excluding goodwill impairment |

|

|

37,795 |

|

|

|

34,052 |

|

|

|

28,847 |

|

|

|

27,552 |

|

|

|

29,208 |

|

Goodwill impairment |

|

|

26,826 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

(Loss) income before income taxes |

|

|

(46,064 |

) |

|

|

(10,439 |

) |

|

|

5,142 |

|

|

|

(5,373 |

) |

|

|

3,537 |

|

Income tax (benefit) expense |

|

|

(4,693 |

) |

|

|

(1,826 |

) |

|

|

1,172 |

|

|

|

(1,097 |

) |

|

|

801 |

|

Net (loss) income |

|

$ |

(41,371 |

) |

|

$ |

(8,613 |

) |

|

$ |

3,970 |

|

|

$ |

(4,276 |

) |

|

$ |

2,736 |

|

Per Common Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) earnings per common share - basic and diluted |

|

$ |

(2.18 |

) |

|

$ |

(0.45 |

) |

|

$ |

0.22 |

|

|

$ |

(0.23 |

) |

|

$ |

0.15 |

|

Dividends declared per common share |

|

|

— |

|

|

|

— |

|

|

|

0.1225 |

|

|

|

0.1225 |

|

|

|

0.1225 |

|

Book value per common share |

|

|

9.53 |

|

|

|

12.21 |

|

|

|

13.03 |

|

|

|

13.13 |

|

|

|

13.22 |

|

Tangible book value per common share - Non-GAAP |

|

|

9.30 |

|

|

|

10.55 |

|

|

|

11.36 |

|

|

|

11.44 |

|

|

|

11.51 |

|

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

3,262,713 |

|

|

$ |

3,214,424 |

|

|

$ |

3,324,060 |

|

|

$ |

3,130,465 |

|

|

$ |

2,881,451 |

|

Average assets |

|

|

3,249,112 |

|

|

|

3,277,282 |

|

|

|

3,270,110 |

|

|

|

3,020,371 |

|

|

|

2,903,447 |

|

Average interest-earning assets |

|

|

3,038,795 |

|

|

|

3,064,103 |

|

|

|

3,060,534 |

|

|

|

2,812,898 |

|

|

|

2,686,376 |

|

Loans held for investment (including PPP loans) |

|

|

2,446,370 |

|

|

|

2,454,431 |

|

|

|

2,452,783 |

|

|

|

2,411,059 |

|

|

|

2,171,490 |

|

Loans held for investment (excluding PPP loans) |

|

|

2,439,956 |

|

|

|

2,447,197 |

|

|

|

2,444,795 |

|

|

|

2,399,092 |

|

|

|

2,158,342 |

|

Allowance for credit losses |

|

|

49,631 |

|

|

|

38,567 |

|

|

|

35,961 |

|

|

|

30,740 |

|

|

|

20,534 |

|

Purchase accounting adjustments (discounts) on acquired loans |

|

|

5,831 |

|

|

|

6,381 |

|

|

|

6,724 |

|

|

|

7,872 |

|

|

|

10,373 |

|

Loans held for sale |

|

|

69,640 |

|

|

|

64,102 |

|

|

|

76,528 |

|

|

|

69,534 |

|

|

|

25,800 |

|

Securities available for sale, at fair value |

|

|

313,930 |

|

|

|

340,617 |

|

|

|

351,990 |

|

|

|

354,341 |

|

|

|

359,516 |

|

Noninterest-bearing demand deposits |

|

|

572,969 |

|

|

|

575,989 |

|

|

|

594,518 |

|

|

|

640,101 |

|

|

|

787,514 |

|

Total deposits |

|

|

2,776,152 |

|

|

|

2,613,094 |

|

|

|

2,761,047 |

|

|

|

2,502,507 |

|

|

|

2,409,486 |

|

Subordinated notes, net |

|

|

39,871 |

|

|

|

39,888 |

|

|

|

39,904 |

|

|

|

39,920 |

|

|

|

39,937 |

|

FHLB and FRB advances |

|

|

215,000 |

|

|

|

284,100 |

|

|

|

239,100 |

|

|

|

311,751 |

|

|

|

150,155 |

|

Average interest-bearing liabilities |

|

|

2,354,360 |

|

|

|

2,346,722 |

|

|

|

2,169,643 |

|

|

|

1,777,391 |

|

|

|

1,771,246 |

|

Total stockholders' equity |

|

|

182,837 |

|

|

|

231,271 |

|

|

|

246,735 |

|

|

|

248,793 |

|

|

|

250,502 |

|

Average stockholders' equity |

|

|

238,530 |

|

|

|

257,117 |

|

|

|

259,911 |

|

|

|

263,826 |

|

|

|

267,057 |

|

Weighted average common shares outstanding - basic |

|

|

19,015 |

|

|

|

18,851 |

|

|

|

18,856 |

|

|

|

18,857 |

|

|

|

18,849 |

|

Weighted average common shares outstanding - diluted |

|

|

19,015 |

|

|

|

18,851 |

|

|

|

18,860 |

|

|

|

18,857 |

|

|

|

18,860 |

|

Financial Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (1) |

|

|

-5.09 |

% |

|

|

-1.05 |

% |

|

|

0.49 |

% |

|

|

-0.57 |

% |

|

|

0.38 |

% |

Return on average equity (1) |

|

|

-69.38 |

% |

|

|

-13.40 |

% |

|

|

6.11 |

% |

|

|

-6.48 |

% |

|

|

4.10 |

% |

Total loan to deposit ratio |

|

|

90.6 |

% |

|

|

96.4 |

% |

|

|

91.6 |

% |

|

|

99.1 |

% |

|

|

91.2 |

% |

Held for investment loan to deposit ratio |

|

|

88.1 |

% |

|

|

93.9 |

% |

|

|

88.8 |

% |

|

|

96.3 |

% |

|

|

90.1 |

% |

Net interest margin (1) |

|

|

2.92 |

% |

|

|

3.12 |

% |

|

|

3.30 |

% |

|

|

4.00 |

% |

|

|

4.27 |

% |

Cost of deposits (1) |

|

|

2.46 |

% |

|

|

2.21 |

% |

|

|

1.74 |

% |

|

|

0.85 |

% |

|

|

0.50 |

% |

Cost of funds (1) |

|

|

2.73 |

% |

|

|

2.49 |

% |

|

|

2.11 |

% |

|

|

1.22 |

% |

|

|

0.69 |

% |

Efficiency ratio |

|

|

127.7 |

% |

|

|

101.3 |

% |

|

|

88.8 |

% |

|

|

81.1 |

% |

|

|

79.7 |

% |

Regulatory remediation expenses |

|

|

3,782 |

|

|

|

2,388 |

|

|

|

1,134 |

|

|

|

2,884 |

|

|

|

4,025 |

|

Capital and Asset Quality Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average stockholders' equity to average assets |

|

|

7.3 |

% |

|

|

7.8 |

% |

|

|

7.9 |

% |

|

|

8.7 |

% |

|

|

9.2 |

% |

Allowance for credit losses to loans held for investment, excluding PPP loans |

|

|

2.03 |

% |

|

|

1.58 |

% |

|

|

1.47 |

% |

|

|

1.28 |

% |

|

|

0.95 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming loans to total assets |

|

|

2.51 |

% |

|

|

2.54 |

% |

|

|

2.63 |

% |

|

|

2.69 |

% |

|

|

0.35 |

% |

Nonperforming assets to total assets |

|

|

2.51 |

% |

|

|

2.54 |

% |

|

|

2.63 |

% |

|

|

2.70 |

% |

|

|

0.36 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measures (unaudited): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible Common Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders' equity |

|

$ |

182,837 |

|

|

$ |

231,271 |

|

|

$ |

246,735 |

|

|

$ |

248,793 |

|

|

$ |

250,502 |

|

Less: Goodwill and other intangibles, net of deferred tax liability (2) |

|

|

(4,286 |

) |

|

|

(31,427 |

) |

|

|

(31,637 |

) |

|

|

(32,027 |

) |

|

|

(32,369 |

) |

Tangible common equity (Non-GAAP) |

|

$ |

178,551 |

|

|

$ |

199,844 |

|

|

$ |

215,098 |

|

|

$ |

216,766 |

|

|

$ |

218,133 |

|

Total shares outstanding |

|

|

19,192 |

|

|

|

18,934 |

|

|

|

18,942 |

|

|

|

18,950 |

|

|

|

18,946 |

|

Book value per common share |

|

$ |

9.53 |

|

|

$ |

12.21 |

|

|

$ |

13.03 |

|

|

$ |

13.13 |

|

|

$ |

13.22 |

|

Tangible book value per common share (Non-GAAP) |

|

|

9.30 |

|

|

|

10.55 |

|

|

|

11.36 |

|

|

|

11.44 |

|

|

|

11.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible stockholders' equity to tangible total assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

3,262,713 |

|

|

$ |

3,214,424 |

|

|

$ |

3,324,060 |

|

|

$ |

3,130,465 |

|

|

$ |

2,881,451 |

|

Less: Goodwill and other intangibles, net of deferred tax liability (2) |

|

|

(4,286 |

) |

|

|

(31,427 |

) |

|

|

(31,637 |

) |

|

|

(32,027 |

) |

|

|

(32,369 |

) |

Tangible total assets (Non-GAAP) |

|

$ |

3,258,427 |

|

|

$ |

3,182,997 |

|

|

$ |

3,292,423 |

|

|

$ |

3,098,438 |

|

|

$ |

2,849,082 |

|

Tangible common equity (Non-GAAP) |

|

$ |

178,551 |

|

|

$ |

199,844 |

|

|

$ |

215,098 |

|

|

$ |

216,766 |

|

|

$ |

218,133 |

|

Tangible stockholders' equity to tangible total assets (Non-GAAP) |

|

|

5.5 |

% |

|

|

6.3 |

% |

|

|

6.5 |

% |

|

|

7.0 |

% |

|

|

7.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Annualized. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Excludes mortgage servicing rights. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Reflects the Company’s current expectations of amounts, as restated, as of and for the periods stated. |

|

v3.23.3

Document And Entity Information

|

Oct. 31, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 31, 2023

|

| Entity Registrant Name |

BLUE RIDGE BANKSHARES, INC.

|

| Entity Central Index Key |

0000842717

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39165

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Tax Identification Number |

54-1838100

|

| Entity Address, Address Line One |

1807 Seminole Trail

|

| Entity Address, City or Town |

Charlottesville

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22901

|

| City Area Code |

(540)

|

| Local Phone Number |

743-6521

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

BRBS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |