Current Report Filing (8-k)

November 02 2020 - 4:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 29, 2020

Battalion

Oil Corporation

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-35467

|

|

20-0700684

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1000 Louisiana St., Suite 6600

Houston, Texas

|

|

77002

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (832) 538-0300

|

|

(Former name or former address, if changed since last report)

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001

|

|

BATL

|

|

NYSE American

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.¨

|

|

Item 1.01

|

Entry Into Material Definitive Agreement.

|

On October 29, 2020,

Battalion Oil Corporation, a Delaware corporation (the “Company”), and the subsidiary guarantors party

thereto (collectively, the “Loan Parties”) entered into a Third Amendment to the Senior Secured Revolving

Credit Agreement & Limited Waiver (the “Amendment”) with Bank of Montreal, as administrative agent

(the “Administrative Agent”) and the lenders party thereto (the “Lenders”).

The Amendment amends that certain Senior Secured Revolving Credit Agreement, dated as of October 8, 2019 (as may be amended, restated,

supplemented or otherwise modified from time to time, the “Credit Agreement”) among the Loan Parties,

the Administrative Agent, the Lenders, and certain other financial institutions party thereto from time to time. Capitalized terms

used but not defined herein shall have the meaning ascribed to such terms in the Credit Agreement.

The Amendment, among

other things, sets the borrowing base to $190 million as of November 1, 2020. The Amendment also suspends testing of the Current Ratio financial covenant

until the fiscal quarter ending December 31, 2021 and amends certain other covenants including, but not limited to, covenants

relating to increasing the minimum mortgaged total value of proved Borrowing Base Properties from 85% to 90%. Additionally, the

Amendment provides for new covenants that, among other things, require the Company to enter into Required Swap Agreements representing

not less than 65% of the Company’s reasonably anticipated projected production from the Proved Reserves classified as Developed

Producing Reserves for a period from the Third Amendment Effective Date through at least December 31, 2022 and prohibit no more

than $3 million of the Company’s uncontested accounts payable or accrued expenses, liabilities or other obligations

from remaining outstanding for longer than 90 days.

Furthermore, pursuant

to the Amendment, the Administrative Agent and the Lenders consented to a waiver of the Current Ratio covenant in Section 9.01(b)

of the Credit Agreement for the fiscal quarter ended September 30, 2020.

The foregoing description

of the Amendment does not purport to be complete and is qualified in its entirety by the terms and conditions of the Amendment.

A copy of the Amendment is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following is a list of exhibits that are furnished herewith:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Battalion Oil Corporation

|

|

|

|

|

|

November 2, 2020

|

By:

|

/s/ R. Kevin Andrews

|

|

|

Name:

|

R. Kevin Andrews

|

|

|

Title:

|

Executive Vice President,

Chief Financial Officer and Treasurer

|

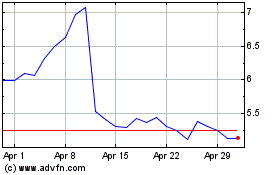

Battalion Oil (AMEX:BATL)

Historical Stock Chart

From Apr 2024 to May 2024

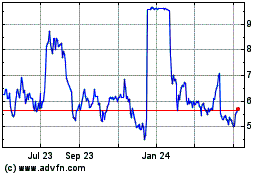

Battalion Oil (AMEX:BATL)

Historical Stock Chart

From May 2023 to May 2024