UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2019

Commission File Number: 001-35936

B2Gold

Corp.

(Translation of registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 3100, Three Bentall

Centre

595 Burrard Street

Vancouver, British Columbia V7X 1J1

Canada

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

DOCUMENTS INCLUDED AS PART

OF THIS FORM 6-K

See the Exhibit Index hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

B2Gold Corp. |

|

| |

|

|

|

| |

|

|

|

| Date: December 9,

2019 |

By: |

/s/ Roger Richer |

|

| |

Name: |

Roger Richer |

|

| |

Title: |

Executive Vice President, General Counsel & Secretary |

|

EXHIBIT INDEX

Exhibit

99.1

News Release

B2Gold Announces Positive Year-End Exploration

Drill Results

for the Fekola Property and Anaconda Area in Mali

Vancouver, Canada, December 9, 2019

- B2Gold Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or the “Company”) announces positive

year-end exploration drill results for the Fekola property and Anaconda area.

Highlights

| • | Positive infill drilling of the Fekola Inferred Mineral Resource |

| • | Fekola remains open to the north with new good-grade drill results |

| • | Anaconda area exploration results: |

| o | New drill results extend the Mamba and Adder saprolite zones (located 20 kilometres

north of Fekola) |

| o | Additional high-grade drill intercepts expand the Mamba sulphide (bedrock) discovery below the saprolite |

| • | Initial positive drilling results from the Cardinal and FMZ zones indicate potential for additional gold deposits near the

Fekola open-pit mine |

Recent Exploration

As part of B2Gold’s continuing exploration

of the Fekola and Anaconda regional projects in 2019, the Company completed approximately 114,000 metres of combined reverse circulation,

diamond, aircore and auger drilling. Drilling has resulted in the discovery of significant new bedrock-hosted mineralization in

the Mamba structure at Anaconda. At Fekola, the infill drilling results have continued to support the conversion of Inferred Mineral

Resources to Indicated Mineral Resources within the resource pit boundary and drilling north of the resource pit continues to extend

good-grade mineralization, remaining open to the north.

Fekola Resource Infill Drill Program and North Extension Drilling

By November 2019, B2Gold completed more

than 25,000 metres of drilling in the area, with the majority of the area having been sufficiently drilled to upgrade the 1.37

million ounces of Inferred Mineral Resource to Indicated Mineral Resource status (see news release dated October 25, 2018).

An updated resource model is expected to be completed by the end of 2019.

As reported in September 2019, excellent

infill drill results were obtained from the deepest portions of the 2018 $1,400/ounce resource pit shell. Drill holes FKD_409 (4.03

grams per tonne (“g/t”) gold over 30.50 metres from 437.5 metres), FKD_413 (10.44 g/t gold over 19.8 metres from 495.2

metres) and FKD_415 (3.3 g/t gold over 38.2 metres from 467.5 metres) provide added confirmation that significant intervals of

high-grade gold mineralization occur beyond the limits of the 2019 preliminary economic assessment pit shell (see news release

dated May 13, 2019). More recently, FKD_432 (1.50 g/t gold over 23.20 metres from 525.80 metres, including 2.44 g/t gold over

11.50 metres from 525.80 metres) shows that mineralization related to the Fekola shear zone extends beyond the limits of the current

pit shells to the north. The Company plans on extensively testing the potential for additional mineral resources at Fekola as part

of the proposed 2020 drill program.

Recent highlights from the Fekola North

Extension drilling include:

| Target |

Hole ID |

From |

To |

Metres |

Au_g/t |

Domain |

| Fekola North |

FKD_432 |

525.80 |

549.00 |

23.20 |

1.50 |

Sulphide |

| Fekola North |

Incl |

528.40 |

539.90 |

11.50 |

2.44 |

Sulphide |

| Fekola North |

FKD_443 |

411.25 |

431.85 |

20.60 |

1.39 |

Sulphide |

| Fekola North |

Incl |

411.25 |

429.00 |

17.75 |

1.50 |

Sulphide |

| Fekola North |

FKD_445 |

328.00 |

360.00 |

32.00 |

1.72 |

Sulphide |

| Fekola North |

Incl |

334.00 |

360.00 |

26.00 |

1.94 |

Sulphide |

Composites are reported above a 0.6

g/t gold cutoff.

Included high-grade intervals are reported

above a 1.0 g/t gold cutoff.

Fig. 1 - Fekola schematic long section:

Anaconda Area Exploration

In addition to the Fekola drill program,

in 2019, B2Gold completed over 45,000 metres of combined aircore, diamond and reverse circulation drilling in the Anaconda region

where the Company previously announced an initial Inferred Mineral Resource estimate of 767,000 ounces of gold at 1.1 g/t in near-surface

mineralization over 4.5 kilometres and up to 500 metres wide.

In 2019, drilling focused on increasing

the known saprolite resources at the Adder and Mamba zones and further testing the underlying sulphide mineralization in the Mamba

zone. At Adder, drilling has extended the strike extent of mineralization up to 1 kilometre north of the known resource area. At

Mamba, recent drilling has extended the high-grade mineralized saprolite zone by approximately 600 metres, resulting in more than

1 kilometre of known strike length, and has led to the discovery of a continuous bedrock sulphide zone down plunge of the Mamba

zone’s saprolite mineralization. Good grade and width combinations, including intersections in MSD_177 (2.64 g/t gold over

35.60 metres, including 4.71 g/t gold over 11.00 metres from 267.00 metres) and MSD_179 (4.94 g/t gold over 31.20 metres, including

10.02 g/t gold over 13.80 metres from 133.80 metres), provide early indications that the Mamba zone discovery has the potential

to become a significant new gold deposit for B2Gold near the Fekola Mine. This Fekola-style, south-plunging body of sulphide mineralization

remains open down plunge and will be the subject of extensive drilling in 2020.

Recent highlights from the Anaconda area

exploration include:

| Target |

Hole ID |

From |

To |

Metres |

Au_g/t |

Domain |

| Adder |

BNR_026 |

0.00 |

37.00 |

37.00 |

1.34 |

Saprolite |

| Adder |

BNR_035 |

47.00 |

63.00 |

16.00 |

1.38 |

Saprolite |

| Adder |

BNR_036 |

71.00 |

91.00 |

20.00 |

2.99 |

Saprolite |

| Adder |

BNR_037 |

112.00 |

127.00 |

15.00 |

1.73 |

Saprolite |

| Adder |

BNR_033 |

4.00 |

19.00 |

15.00 |

1.21 |

Saprolite |

| Adder |

BNR_061 |

17.00 |

67.00 |

50.00 |

1.09 |

Saprolite |

| Mamba |

BND_003 |

127.60 |

146.70 |

19.10 |

3.16 |

Sulphide |

| Mamba |

Incl |

127.60 |

141.90 |

14.30 |

3.70 |

Sulphide |

| Mamba |

BND_003 |

151.90 |

169.00 |

17.10 |

1.56 |

Saprolite |

| Mamba |

MSD_175 |

124.30 |

134.00 |

9.70 |

4.23 |

Sulphide |

| Mamba |

Incl |

125.50 |

134.00 |

8.50 |

4.70 |

Sulphide |

| Mamba |

MSD_177 |

267.00 |

302.60 |

35.60 |

2.64 |

Sulphide |

| Mamba |

Incl |

267.00 |

278.00 |

11.00 |

4.71 |

Sulphide |

| Mamba |

MSD_178 |

180.50 |

194.20 |

13.70 |

2.09 |

Sulphide |

| Mamba |

MSD_178 |

251.60 |

286.50 |

34.90 |

1.03 |

Sulphide |

| Mamba |

Incl |

259.60 |

280.00 |

20.40 |

1.10 |

Sulphide |

| Mamba |

MSD_179 |

123.20 |

154.40 |

31.20 |

4.94 |

Sulphide |

| Mamba |

Incl |

133.80 |

147.60 |

13.80 |

10.02 |

Sulphide |

Sulphide composites are reported above

a 0.6 g/t gold cutoff.

Saprolite composites are reported above

a 0.2 g/t gold cutoff.

Included high-grade intervals are reported

above a 1.0 g/t gold cutoff.

Fig. 2 - Anaconda regional plan map:

Fig. 3 - Mamba schematic long section:

Fekola Regional Exploration

Near Fekola, over 7,500 metres of initial

drilling was completed on the Cardinal and FMZ structures which have demonstrated the potential to host near-surface mineralization

within 3 kilometres of the Fekola mill. Additional drilling is required and is scheduled for completion in 2020.

Recent highlights from the Cardinal and

FMZ exploration programs include:

| Target |

Hole ID |

From |

To |

Metres |

Au_g/t |

Domain |

| Cardinal |

FER_067 |

87.00 |

111.00 |

24.00 |

1.80 |

Sulphide |

| Cardinal |

Incl |

104.00 |

110.00 |

6.00 |

5.46 |

Sulphide |

| Cardinal |

FER_068 |

66.00 |

72.00 |

6.00 |

3.52 |

Sulphide |

| Cardinal |

FER_069 |

20.00 |

40.00 |

20.00 |

3.46 |

Saprolite |

| Cardinal |

FER_070 |

57.00 |

73.00 |

16.00 |

1.58 |

Sulphide |

| Cardinal |

FER_073 |

57.00 |

64.00 |

7.00 |

3.34 |

Sulphide |

| Cardinal |

Incl |

58.00 |

64.00 |

6.00 |

3.75 |

Sulphide |

| Cardinal |

FER_077 |

80.00 |

118.00 |

38.00 |

1.15 |

Sulphide |

| Cardinal |

Incl |

94.00 |

106.00 |

12.00 |

1.80 |

Sulphide |

| Cardinal |

FER_080 |

57.00 |

64.00 |

7.00 |

14.54 |

Sulphide |

| Cardinal |

FER_085 |

19.00 |

30.00 |

11.00 |

2.35 |

Sulphide |

| Cardinal |

FKD_427 |

233.00 |

251.00 |

18.00 |

2.12 |

Sulphide |

| Cardinal |

Incl |

233.00 |

248.40 |

15.40 |

2.41 |

Sulphide |

| Cardinal |

FKD_438 |

74.75 |

81.00 |

6.25 |

7.08 |

Sulphide |

| Cardinal |

FKD_440 |

182.40 |

191.57 |

9.17 |

2.69 |

Sulphide |

| Cardinal |

Incl |

186.56 |

191.57 |

5.01 |

4.63 |

Sulphide |

| Cardinal |

FKD_448 |

129.80 |

138.40 |

8.60 |

2.53 |

Sulphide |

| FMZ |

FER_093 |

107.00 |

119.00 |

12.00 |

2.73 |

Sulphide |

Composites are reported above a 0.6

g/t gold cutoff.

Included high-grade intervals are reported

above a 1.0 g/t gold cutoff.

Ongoing Exploration

Drilling on the Fekola and Anaconda regional

projects will continue in 2020 with a proposed exploration budget in West Mali of approximately $18 million.

About B2Gold Corp.

Headquartered in Vancouver, Canada, B2Gold

is the world’s new senior gold producer. Founded in 2007, today, B2Gold has three operating gold mines and numerous exploration

and development projects in various countries including, Mali, the Philippines, Namibia and Colombia. In 2020, B2Gold forecasts

consolidated gold production of between 1,005,000 and 1,050,000 ounces.

QA/QC on Sample Collection and Assaying

The primary laboratories for Fekola are

SGS Laboratories in Bamako, Mali and Bureau Veritas Laboratories in Abidjan, Cote d’Ivoire. Periodically, exploration samples

will be analyzed at the Fekola mine lab. At each lab, samples are prepared and analyzed using 50 g fire assay with atomic absorption

finish and/or gravimetric finish. Umpire assays are used to monitor lab performance monthly.

Quality assurance and quality control

(“QA/QC”) procedures include the systematic insertion of blanks, standards and duplicates into the core, reverse circulation

and aircore drilling sample strings. The results of the control samples are evaluated on a regular basis with batches re-analyzed

and/or resubmitted as needed. All results stated in this news release have passed B2Gold’s QA/QC protocols.

Qualified Persons

Tom Garagan, Senior Vice President of

Exploration at B2Gold, a qualified person under NI 43-101, has approved the exploration information contained in this news release.

B2Gold Investor Day 2019: Webcast Details

B2Gold will be hosting an Investor Day

in Vancouver, British Columbia, Canada, on Monday, December 9, 2019, at 1:00 pm PST/4:00 pm EST.

The event will feature presentations from

B2Gold executives and senior managers from around the world and will be followed by Q&A sessions.

The Investor Day will be available to

view via live video webcast which you may access by clicking here: https://www.b2gold.com/investor-day-2019/. A playback

version of the webcast will be available for one year after the event.

On

Behalf of B2GOLD CORP.

“Clive T. Johnson”

President and Chief Executive Officer

For more information on B2Gold, please

visit the Company website at www.b2gold.com or contact:

| Ian MacLean |

Katie Bromley |

| Vice President, Investor Relations |

Manager, Investor Relations & Public Relations |

| +1 604-681-8371 |

+1 604-681-8371 |

| imaclean@b2gold.com |

kbromley@b2gold.com |

The Toronto Stock Exchange and the

NYSE American LLC neither approve nor disapprove the information contained in this news release.

This news release includes certain

“forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”)

within the meaning of applicable Canadian and United States securities legislation, including projections, estimates and other

statements regarding future financial and operational performance, events, production, costs, including projected cash operating

costs and all-in sustaining costs, capital expenditures, budgets and growth, production estimates and guidance, including the Company’s

projected gold production of between 1,005,000 and 1,050,000 ounces in 2020, and statements regarding anticipated exploration,

development, construction, production, permitting and other activities and achievements of the Company, including but not limited

to: mineralization in the upper portion of the Fekola North Extension zone being one continuous mineralized zone and the potential

to increase the extent of Fekola mineralization; the potential to extend good-grade mineralization much further north from the

Fekola resource pit boundary; results indicating the deeper portion of the Fekola Northern Extension zone extending closer to surface

and indicating continuity with mineralization from the deeper drilling results from the upper portion of the Fekola North Extension;

the potential for additional large Fekola style deposits; the potential for highly prospective structures beneath the Anaconda

and Mamba zones; the conversion of inferred mineral resources to indicated mineral resources; the projections included in existing

technical reports, economic assessments and feasibility studies; the results of anticipated or potential new technical reports

and studies, including the potential findings and conclusions thereof. Estimates of mineral resources and reserves are also forward-looking

statements because they constitute projections regarding the amount of minerals that may be encountered in the future and/or the

anticipated economics of production, should a production decision be made. All statements in this news release that address events

or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements

that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”,

“anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”,

“budget”, “estimate”, “intend” or “believe” and similar expressions or their negative

connotations, or that events or conditions “will”, “would”, “may”, “could”, “should”

or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the

date such statements are made. Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of

which are beyond B2Gold’s control, including risks and assumptions associated with the volatility of metal prices and our

common shares; risks and dangers inherent in exploration, development and mining activities; uncertainty of reserve and resource

estimates; risk of not achieving production, cost or other estimates; risk that actual production, development plans and costs

differ materially from the estimates in our feasibility studies; risks related to hedging activities and ore purchase commitments;

the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; risks related

to environmental regulations or hazards and compliance with complex regulations associated with mining activities; the ability

to replace mineral reserves and identify acquisition opportunities; unknown liabilities of companies acquired by B2Gold; ability

to successfully integrate new acquisitions; fluctuations in exchange rates; availability of financing; risks relating to financing

and debt; risks related to operations in foreign and developing countries and compliance with foreign laws; risks related to remote

operations and the availability of adequate infrastructure, fluctuations in price and availability of energy and other inputs necessary

for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country

risks; risks related to reliance upon contractors, third parties and joint venture partners; challenges to title or surface rights;

dependence on key personnel and ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss;

adverse climate and weather conditions; litigation risk; competition with other mining companies; changes in tax laws; community

support for our operations including risks related to strikes and the halting of such operations from time to time; risks related

to failures of information systems or information security threats; ability to maintain adequate internal control over financial

reporting as required by law; risks relating to compliance with anti-corruption laws; as well as other factors identified and as

described in more detail under the heading “Risk Factors” in B2Gold’s most recent Annual Information Form and

B2Gold’s other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission (the “SEC”),

which may be viewed at www.sedar.com and www.sec.gov, respectively (the “Websites”). The list is not exhaustive of

the factors that may affect the Company’s forward-looking statements. There can be no assurance that such statements will

prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied

by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. The Company’s

forward-looking statements reflect current expectations regarding future events and operating performance and speak only as of

the date hereof and the Company does not assume any obligation to update forward-looking statements if circumstances or management's

beliefs, expectations or opinions should change other than as required by applicable law. The Company’s forward-looking statements

are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information

available to management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related

to the Company's ability to carry on current and future operations, including development and exploration activities; the timing,

extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or

achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including

gold; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to

obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions and

other assumptions and factors generally associated with the mining industry. For the reasons set forth above, undue reliance should

not be placed on forward-looking statements.

Cautionary Note to United States

Investors

The Company has prepared its public

disclosures in accordance with Canadian securities laws, which differ in certain respects from U.S. securities laws. In particular,

this news release may refer to “mineral resources”, “measured mineral resources”, “indicated mineral

resources” or “inferred mineral resources”. While these categories of mineralization are recognized and required

by Canadian securities laws, they are not recognized by the SEC and are not normally permitted to be disclosed in SEC filings by

U.S. companies. U.S. investors are cautioned not to assume that any part of a “mineral resource”, “measured mineral

resource”, “indicated mineral resource” or “inferred mineral resource” will ever be converted into

a “reserve.” In addition, “reserves” reported by the Company under Canadian standards may not qualify as

reserves under SEC standards. Under SEC standards, mineralization may not be classified as a “reserve” unless the mineralization

can be economically and legally extracted or produced at the time the “reserve” determination is made. Accordingly,

information contained or referenced in this news release containing descriptions of the Company’s mineral deposits may not

be compatible to similar information made public by U.S. companies subject to the reporting and disclosure requirements of U.S.

federal securities laws, rules and regulations. “Inferred mineral resources” have a great amount of uncertainty as

to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part

of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented

herein are not guarantees or expectations of future performance.

8

This regulatory filing also includes additional resources:

ex991.pdf

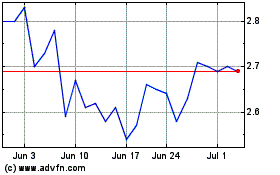

B2Gold (AMEX:BTG)

Historical Stock Chart

From Aug 2024 to Sep 2024

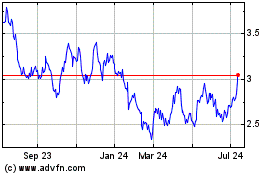

B2Gold (AMEX:BTG)

Historical Stock Chart

From Sep 2023 to Sep 2024