Definitive Materials Filed by Investment Companies. (497)

June 06 2013 - 3:40PM

Edgar (US Regulatory)

OPPENHEIMER SHORT DURATION FUND

Supplement dated June 6, 2013 to the

Prospectus and Statement of Additional

Information dated November 28, 2012

This supplement amends the Prospectus and Statement of Additional

Information (“SAI”) of the above referenced fund and is in addition to any other supplement(s).

Effective July 22, 2013, the Prospectus is revised

as follows:

|

|

1.

|

The section titled “Portfolio Managers” on page 4 is deleted in its entirety and

is replaced with the following:

|

Portfolio Managers.

Christopher Proctor,

CFA, has been a portfolio manager and Vice President of the Fund since its inception, and Adam Wilde has been a portfolio manager

of the Fund since July 2013.

|

|

2.

|

The section titled “Portfolio Managers” on page 10 is deleted in its entirety and

is replaced with the following:

|

Portfolio Managers.

The Fund’s portfolio

is managed by Christopher Proctor, CFA, and Adam Wilde who are primarily responsible for the day-to-day management of the Fund’s

investments. Mr. Proctor has been a portfolio manager and Vice President of the Fund since its inception. Mr. Wilde has been a

portfolio manager of the Fund since July 2013.

Mr. Proctor has been a Vice President of the Sub-Adviser

since August 2008 and Senior Portfolio Manager of the Sub-Adviser since January 2010. Prior to joining the Sub-Adviser, he was

Vice President at Calamos Asset Management January 2007 – March 2008 and Scudder-Kemper Investments from 1999 to 2002. He

was Managing Director and Co-Founder of Elmhurst Capital Management from 2004 to 2007 and Senior Manager of Research for Etrade

Global Asset Management from 2002 to 2004.

Mr. Wilde has been a Vice President of the Sub-Adviser

since May 2011 and a Portfolio Manager of the Sub-Adviser since July 2013. He served as the head of credit research for the

cash strategies team of the Sub-Adviser from 2011 to 2013, and as an Assistant Vice President and senior research analyst of the

Sub-Adviser from 2008 to 2011. Mr. Wilde served as an intermediate research analyst of the Sub-Adviser from 2007 to

2008 and served in other analyst roles of the Sub-Adviser since 2002. Mr. Wilde joined the Sub-Adviser in 2001.

The Statement of Additional Information provides

additional information about portfolio manager compensation, other accounts managed and ownership of Fund shares.

Effective July 22, 2013, the SAI is revised as follows:

|

|

1.

|

Carol Wolf is no longer Vice President and Portfolio Manager of the Fund. All references to Ms.

Wolf are hereby removed.

|

|

|

2.

|

The section titled “Portfolio Managers” on page 33 is deleted in its entirety and

replaced with the following:

|

Portfolio Managers.

The Fund is managed

by Christopher Proctor and Adam Wilde (referred to as the “Portfolio Managers”), who are responsible for the day-to-day

management of the Fund’s investments.

Other Accounts Managed.

As of May 30, 2013,

Mr. Wilde did not manage other investment portfolios and accounts on behalf of the Sub-Adviser or its affiliates. In addition to

managing the Fund’s investment portfolio, Mr. Proctor also manages other investment portfolios and accounts on behalf of

the Sub-Adviser or its affiliates. The following table provides information regarding those other portfolios and accounts as of

May 30, 2013. For each category, the number of accounts and total assets in accounts with fees based on performance is indicated

by footnote:

|

Portfolio Manager

|

Registered Investment Companies Managed

|

Total Assets in Registered Investment Companies Managed

1

|

Other Pooled Investment Vehicles Managed

|

Total Assets in Other Pooled Investment Vehicles Managed

|

Other Accounts Managed

|

Total Assets in Other Accounts Managed

2,3

|

|

Christopher Proctor

|

4

|

$9.97

|

0

|

$0

|

1

|

$277.44

|

|

Adam Wilde

4

|

0

|

$0

|

0

|

$0

|

0

|

$0

|

1. In billions.

2. In millions.

3. Does not include personal accounts of the portfolio

managers and their families, which are subject to the Code of Ethics.

4. As of May 30, 2013, Mr. Wilde did not manage

any Funds for the Sub-Adviser.

|

|

3.

|

The section titled “Ownership of Fund Shares” on page 34 is deleted in its entirety

and replaced with the following:

|

Ownership of Fund Shares.

As of May 30,

2013, the Portfolio Manager(s) beneficially owned shares of the Fund as follows:

|

Portfolio Manager

|

Range of Shares Beneficially Owned in the Fund

|

|

Christopher Proctor

|

$10,001-$50,000

|

|

Adam Wilde

|

None

|

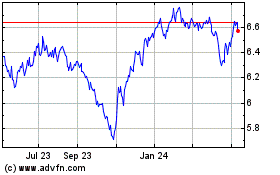

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From May 2024 to Jun 2024

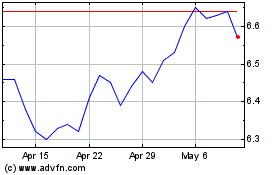

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Jun 2023 to Jun 2024