Mutual Fund Summary Prospectus (497k)

December 28 2012 - 11:59AM

Edgar (US Regulatory)

Small-MidCap Dividend Income Fund

|

|

Institutional

|

|

Ticker Symbol(s)

|

PMDIX

|

Principal Funds, Inc. Summary Prospectus December 28, 2012

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at www.principalfunds.com/prospectus. You can also get this information at no cost by calling 1-800-222-5852 or by sending an email to prospectus@principalfunds.com.

This Summary Prospectus incorporates by reference the Statutory Prospectus for classes Institutional, R-1, R-2, R-3, R-4, and R-5 shares dated December 28, 2012 and the Statement of Additional Information dated December 28, 2012 (which may be obtained in the same manner as the Prospectus).

Objective:

The Fund primarily seeks to provide a relatively high level of current income and long-term growth of income, and secondarily long-term growth of capital, while investing primarily in small- to mid-capitalization companies.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees (fees paid directly from your investment):

None

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

Institutional

Class

|

|

Management Fees

|

0.80%

|

|

Other Expenses

|

0.04

|

|

Acquired Fund Fees and Expenses

|

0.10

|

|

Total Annual Fund Operating Expenses

|

0.94%

|

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 year

|

3 years

|

5 years

|

10 years

|

|

Institutional Class

|

$96

|

$300

|

$520

|

$1,155

|

Page 1 of 4

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s annualized portfolio turnover rate was 19.1% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in dividend-paying equity securities of companies with small to medium market capitalizations (those with market capitalizations ranging from between $200 million and $7 billion) at the time of purchase. The Fund invests in value equity securities, an investment strategy that emphasizes buying equity securities that appear to be undervalued. The Fund invests in the securities of foreign issuers, real estate investment trusts, preferred securities, convertible securities, fixed-income securities, master limited partnerships, and royalty trusts.

Principal Risks

The Fund may be an appropriate investment for investors who seek dividends to generate income or to reinvest for growth and who can accept fluctuations in the value of investments and the risks of investing in equity securities, the securities of foreign issuers, real estate investment trusts, preferred securities, convertible securities, fixed-income securities, master limited partnerships, and royalty trusts.

The value of your investment in the Fund changes with the value of the Fund's investments. Many factors affect that value, and it is possible to lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The principal risks of investing in the Fund, in alphabetical order, are:

Convertible Securities Risk.

Convertible securities can be bonds, notes, debentures, preferred stock or other securities which are convertible into common stock. Convertible securities are subject to both the credit and interest rate risks associated with fixed income securities and to the stock market risk associated with equity securities.

Currency Risk.

Risks of investing in securities denominated in, or that trade in, foreign (non-U.S.) currencies include changes in foreign exchange rates and foreign exchange restrictions.

Equity Securities Risk.

The value of equity securities could decline if the issuer’s financial condition declines or in response to overall market and economic conditions. A fund's principal market segment(s), such as large cap, mid cap or small cap stocks, or growth or value stocks, may underperform other market segments or the equity markets as a whole. Investments in smaller companies and mid-size companies may involve greater risk and price volatility than investments in larger, more mature companies.

Fixed-Income Securities Risk.

Fixed-income securities are subject to interest rate risk and credit quality risk. The market value of fixed-income securities generally declines when interest rates rise, and an issuer of fixed-income securities could default on its payment obligations.

Foreign Securities Risk.

The risks of foreign securities include loss of value as a result of: political or economic instability; nationalization, expropriation or confiscatory taxation; settlement delays; and limited government regulation (including less stringent reporting, accounting, and disclosure standards than are required of U.S. companies).

Master Limited Partnership ("MLP") Risk.

MLPs are publicly-traded limited partnership interests or units. An MLP that invests in a particular industry (e.g., oil and gas) will be harmed by detrimental economic events within that industry. As partnerships, MLPs may be subject to less regulation (and less protection for investors) under state laws than corporations. In addition, MLPs may be subject to state taxation in certain jurisdictions, which may reduce the amount of income an MLP pays to its investors.

Page 2 of 4

Preferred Securities Risk.

Preferred securities are junior subordinated securities in a company’s capital structure and therefore can be subject to greater credit and liquidation risk. An issuer of preferred securities could redeem the security prior to the stated maturity date and reduce the return of the security.

Real Estate Investment Trusts (“REITs”) Risk.

A REIT could fail to qualify for tax-free pass-through of income under the Internal Revenue Code, and fund shareholders will indirectly bear their proportionate share of the expenses of REITs in which the fund invests.

Real Estate Securities Risk.

Real estate securities are subject to the risks associated with direct ownership of real estate, including declines in value, adverse economic conditions, increases in expenses, regulatory changes and environmental problems. Investing in securities of companies in the real estate industry, subjects a fund to the special risks associated with the real estate market including factors such as loss to casualty or condemnation, changes in real estate values, property taxes, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents, and the management skill and creditworthiness of the issuer.

Risk of Being an Underlying Fund.

A fund is subject to the risk of being an underlying fund to the extent that a fund of funds invests in the fund. An underlying fund of a fund of funds may experience relatively large redemptions or investments as the fund of funds periodically reallocates or rebalances its assets. These transactions may cause the underlying fund to sell portfolio securities to meet such redemptions, or to invest cash from such investments, at times it would not otherwise do so, and may as a result increase transaction costs and adversely affect underlying fund performance.

Royalty Trust Risk.

A royalty trust generally acquires an interest in natural resource or chemical companies and distributes the income it receives to its investors. A sustained decline in demand for natural resource and related products could adversely affect royalty trust revenues and cash flows. Such a decline could result from a recession or other adverse economic conditions, an increase in the market price of the underlying commodity, higher taxes or other regulatory actions that increase costs, or a shift in consumer demand. Rising interest rates could adversely affect the performance, and limit the capital appreciation, of royalty trusts because of the increased availability of alternative investments at more competitive yields. Fund shareholders will indirectly bear their proportionate share of the royalty trusts' expenses.

Value Stock Risk.

The market may not recognize the intrinsic value of value stocks for a long time, or they may be appropriately priced at the time of purchase.

Performance

No performance information is shown because the Fund has not yet had a calendar year of performance. The Fund’s performance will be benchmarked against the Russell 2500 Value Index.

Management

Investment Advisor:

Principal Management Corporation

Sub-Advisor(s) and Portfolio Manager(s):

Edge Asset Management, Inc.

·

Daniel R. Coleman (since 2011), Head of Equities, Portfolio Manager

·

David W. Simpson (since 2011), Portfolio Manager

Purchase and Sale of Fund Shares

There are no restrictions on amounts to be invested in shares of the Fund for an eligible purchaser. You may purchase or redeem shares on any business day (normally any day when the New York Stock Exchange is open for regular trading) through your plan or intermediary; by sending a written request to Principal Funds at P.O. Box 8024, Boston, MA 02266-8024 (regular mail) or 30 Dan Road, Canton, MA 02021-2809 (overnight mail); calling us at 1-800-222-5852; or accessing our website (

www.principalfunds.com

).

Page 3 of 4

Tax Information

The Fund’s distributions you receive are generally subject to federal income tax as ordinary income or capital gain and may also be subject to state and local taxes, unless you are tax-exempt or your account is tax-deferred in which case your distributions would be taxed when withdrawn from the tax-deferred account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank, insurance company, investment adviser, etc.), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment, or to recommend one share class of the Fund over another share class. Ask your salesperson or visit your financial intermediary's website for more information.

Page 4 of 4

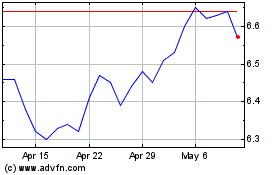

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From May 2024 to Jun 2024

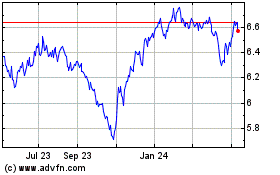

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Jun 2023 to Jun 2024