Mutual Fund Summary Prospectus (497k)

December 28 2012 - 9:20AM

Edgar (US Regulatory)

|

|

|

Vanguard Admiral

™

Treasury Money Market Fund

|

|

|

|

Summary Prospectus

|

|

|

|

|

|

|

|

December 28, 2012

|

|

|

|

|

|

|

|

Investor Shares

|

|

|

|

Vanguard Admiral Treasury Money Market Fund Investor Shares (VUSXX)

|

|

|

|

|

|

|

|

|

|

The Fund’s statutory Prospectus and Statement of Additional Information dated

|

|

December 28, 2012, are incorporated into and made part of this Summary

|

|

Prospectus by reference.

|

|

Before you invest, you may want to review the Fund’s Prospectus, which

|

|

contains more information about the Fund and its risks. You can find

|

|

the Fund’s Prospectus and other information about the Fund online at

|

|

www.vanguard.com/prospectus

. You can also get this information at no

|

|

cost by calling 800-662-7447 or by sending an e-mail request to

|

|

online@vanguard.com.

|

|

|

|

|

|

|

|

|

|

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or

|

|

passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

Investment Objective

The Fund seeks to provide current income while maintaining liquidity and a stable share price of $1.

Fees and Expenses

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund.

|

|

|

|

Shareholder Fees

|

|

|

(Fees paid directly from your investment)

|

|

|

|

|

Sales Charge (Load) Imposed on Purchases

|

None

|

|

Purchase Fee

|

None

|

|

Sales Charge (Load) Imposed on Reinvested Dividends

|

None

|

|

Redemption Fee

|

None

|

|

Account Service Fee (for fund account balances below $10,000)

|

$20/year

|

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

Management Expenses

|

0.08%

|

|

12b-1 Distribution Fee

|

None

|

|

Other Expenses

|

0.02%

|

|

Total Annual Fund Operating Expenses

|

0.10%

1

|

1 Vanguard and the Fund's Board have voluntarily agreed to temporarily limit certain net operating expenses in excess of the Fund's daily yield so as to maintain a zero or positive yield for the Fund. Vanguard and the Fund's Board may terminate the temporary expense limitation at any time.

1

Example

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It illustrates the hypothetical expenses that you would incur over various periods if you invest $10,000 in the Fund’s shares. This example assumes that the Fund provides a return of 5% a year and that total annual fund operating expenses remain as stated in the preceding table. The results apply whether or not you redeem your investment at the end of the given period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$10

|

$32

|

$56

|

$128

|

Primary Investment Policies

The Fund invests solely in high-quality, short-term money market securities whose interest and principal payments are backed by the full faith and credit of the U.S. government. At least 80% of the Fund’s assets will be invested in U.S. Treasury securities; the remainder of the assets may be invested in securities issued by U.S. governmental agencies. The Fund maintains a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of 120 days or less.

Primary Risks

The Fund is designed for investors with a low tolerance for risk; however, the Fund is subject to the following risks, which could affect the Fund’s performance:

•

Income risk

, which is the chance that the Fund’s income will decline because of falling interest rates. Because the Fund’s income is based on short-term interest rates—which can fluctuate significantly over short periods—income risk is expected to be high.

•

Manager risk

, which is the chance that poor security selection will cause the Fund to underperform relevant benchmarks or other funds with a similar investment objective.

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Fund.

2

Annual Total Returns

The following bar chart and table are intended to help you understand the risks of investing in the Fund. The bar chart shows how the performance of the Fund has varied from one calendar year to another over the periods shown. The table shows how the average annual total returns compare with those of comparative benchmarks, which have investment characteristics similar to those of the Fund. Returns for the iMoneyNet Money Fund Report’s 100% Treasury Funds Average are derived from data provided by iMoneyNet, Inc.; returns for the U.S. Treasury Money Market Funds Average are derived from data provided by Lipper Inc. Keep in mind that the Fund’s past performance does not indicate how the Fund will perform in the future. Updated performance information is available online at

vanguard.com/performance

or by calling Vanguard toll-free at 800-662-7447.

Annual Total Returns — Vanguard Admiral Treasury Money Market Fund Investor Shares

1

1 The year-to-date return as of the most recent calendar quarter, which ended on September 30, 2012, was 0.01%.

During the periods shown in the bar chart, the highest return for a calendar quarter was 1.25% (quarter ended December 31, 2006), and the lowest return for a quarter was 0.00% (quarter ended March 31, 2010).

|

|

|

|

|

|

Average Annual Total Returns for Periods Ended December 31, 2011

|

|

|

|

|

1 Year

|

5 Years

|

10 Years

|

|

Vanguard Admiral Treasury Money Market Fund

|

|

|

|

|

Investor Shares

|

0.02%

|

1.41%

|

1.85%

|

|

Comparative Benchmarks

|

|

|

|

|

iMoneyNet Money Fund Report's 100% Treasury

|

|

|

|

|

Funds Average

|

0.00%

|

1.01%

|

1.35%

|

|

U.S. Treasury Money Market Funds Average

|

0.00

|

1.03

|

1.36

|

Investment Advisor

The Vanguard Group, Inc.

Portfolio Manager

David R. Glocke, Principal of Vanguard. He has managed the Fund since 1997.

Purchase and Sale of Fund Shares

You may purchase or redeem shares online through our website (

vanguard.com)

, by mail (The Vanguard Group, P.O. Box 1110, Valley Forge, PA 19482-1110), or by telephone (800-662-2739). The following table provides the Fund’s minimum initial and subsequent investment requirements.

|

|

|

|

Account Minimums

|

Investor Shares

|

|

To open and maintain an account

|

$50,000

|

|

To add to an existing account

|

Generally $100 (other than by Automatic Investment

|

|

|

Plan, which has no established minimum)

|

Tax Information

The Fund’s distributions may be taxable as ordinary income or capital gain.

Payments to Financial Intermediaries

The Fund and its investment advisor do not pay financial intermediaries for sales of Fund shares.

4

This page intentionally left blank.

This page intentionally left blank.

Vanguard Admiral Treasury Money Market Fund Investor Shares—Fund Number 11

© 2012 The Vanguard Group, Inc. All rights reserved.

Vanguard Marketing Corporation, Distributor.

SP 11 122012

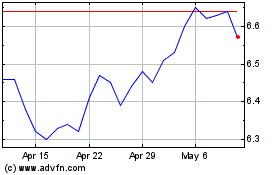

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From May 2024 to Jun 2024

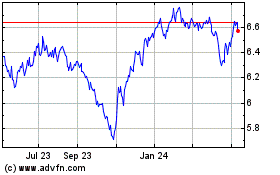

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Jun 2023 to Jun 2024