Diversified Income Plus Fund

Schedule of Investments as of September 28, 2012

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Common Stock (36.9%)

|

|

Value

|

|

|

|

Health Care (3.4%) - continued

|

|

|

|

|

|

|

26,900

|

|

|

Eli Lilly and Company

|

|

|

$1,275,329

|

|

|

|

22,100

|

|

|

Forest Laboratories, Inc.

h

|

|

|

786,981

|

|

|

|

29,000

|

|

|

Medtronic, Inc.

|

|

|

1,250,480

|

|

|

|

6,300

|

|

|

Novo Nordisk A/S ADR

|

|

|

994,203

|

|

|

|

104,300

|

|

|

PDL BioPharma, Inc.

g

|

|

|

802,067

|

|

|

|

39,328

|

|

|

Pfizer, Inc.

|

|

|

977,301

|

|

|

|

24,900

|

|

|

UnitedHealth Group, Inc.

|

|

|

1,379,709

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

10,312,982

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrials (3.3%)

|

|

|

|

|

|

|

13,100

|

|

|

3M Company

|

|

|

1,210,702

|

|

|

|

140,500

|

|

|

Alerian MLP ETF

|

|

|

2,328,085

|

|

|

|

24,300

|

|

|

C.H. Robinson Worldwide, Inc.

|

|

|

1,422,765

|

|

|

|

10,000

|

|

|

Emerson Electric Company

|

|

|

482,700

|

|

|

|

12,200

|

|

|

Lockheed Martin Corporation

|

|

|

1,139,236

|

|

|

|

16,200

|

|

|

Northrop Grumman Corporation

|

|

|

1,076,166

|

|

|

|

101,100

|

|

|

Pitney Bowes, Inc.

g

|

|

|

1,397,202

|

|

|

|

12,800

|

|

|

United Parcel Service, Inc.

|

|

|

916,096

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

9,972,952

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information Technology (3.4%)

|

|

|

|

|

|

|

9,100

|

|

|

Accenture plc

|

|

|

637,273

|

|

|

|

900

|

|

|

Apple, Inc.

|

|

|

600,534

|

|

|

|

20,500

|

|

|

GameStop Corporation

g

|

|

|

430,500

|

|

|

|

77,500

|

|

|

Intel Corporation

|

|

|

1,757,700

|

|

|

|

7,900

|

|

|

International Business Machines Corporation

|

|

|

1,638,855

|

|

|

|

98,100

|

|

|

Marvell Technology Group, Ltd.

|

|

|

897,615

|

|

|

|

2,200

|

|

|

MasterCard, Inc.

|

|

|

993,256

|

|

|

|

79,200

|

|

|

Microsoft Corporation

|

|

|

2,358,576

|

|

|

|

37,200

|

|

|

Seagate Technology plc

|

|

|

1,153,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

10,467,509

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Materials (2.3%)

|

|

|

|

|

|

|

2,400

|

|

|

CF Industries Holdings, Inc.

|

|

|

533,376

|

|

|

|

28,600

|

|

|

Gold Resource Corporation

g

|

|

|

613,470

|

|

|

|

5,100

|

|

|

Monsanto Company

|

|

|

464,202

|

|

|

|

47,500

|

|

|

Newmont Mining Corporation

|

|

|

2,660,475

|

|

|

|

9,600

|

|

|

PPG Industries, Inc.

|

|

|

1,102,464

|

|

|

|

42,800

|

|

|

Southern Copper Corporation

|

|

|

1,470,608

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

6,844,595

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telecommunications Services (1.6%)

|

|

|

|

|

|

|

43,500

|

|

|

AT&T, Inc.

|

|

|

1,639,950

|

|

|

|

7,500

|

|

|

Philippine Long Distance Telephone Company ADR

|

|

|

495,075

|

|

|

|

11,200

|

|

|

Telekomunikasi Indonesia Tbk PT ADR

|

|

|

436,016

|

|

|

|

25,400

|

|

|

Verizon Communications, Inc.

|

|

|

1,157,478

|

|

|

|

41,800

|

|

|

Vodafone Group plc ADR

|

|

|

1,191,091

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

4,919,610

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utilities (1.5%)

|

|

|

|

|

|

|

33,700

|

|

|

American Electric Power Company, Inc.

|

|

|

1,480,778

|

|

|

|

13,700

|

|

|

Consolidated Edison, Inc.

|

|

|

820,493

|

|

|

|

29,300

|

|

|

Public Service Enterprise Group, Inc.

|

|

|

942,874

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Common Stock (36.9%)

|

|

Value

|

|

|

|

Utilities (1.5%) - continued

|

|

|

|

|

|

|

31,500

|

|

|

Southern Company

|

|

|

$1,451,835

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

4,695,980

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stock (cost $107,002,838)

|

|

|

112,787,461

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Preferred Stock (1.3%)

|

|

|

Value

|

|

|

|

|

|

|

Financials (1.3%)

|

|

|

|

|

|

|

34,000

|

|

|

Annaly Capital Management, Inc.,

7.500%

f,h

|

|

|

857,820

|

|

|

|

10,000

|

|

|

ING Groep NV, 8.500%

f

|

|

|

262,000

|

|

|

|

19,500

|

|

|

PNC Financial Services Group, Inc.,

6.125%

f

|

|

|

535,665

|

|

|

|

15,000

|

|

|

Royal Bank of Scotland Group plc,

7.250%

f

|

|

|

340,350

|

|

|

|

15,000

|

|

|

State Street Corporation, 5.250%

f,h

|

|

|

378,750

|

|

|

|

52,000

|

|

|

U.S. Bancorp, 6.500%

f

|

|

|

1,513,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

3,887,785

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Preferred Stock (cost $3,550,390)

|

|

|

3,887,785

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Collateral Held for Securities Loaned (3.3%)

|

|

Value

|

|

|

|

10,093,400

|

|

|

Thrivent Financial Securities Lending Trust

|

|

|

10,093,400

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Collateral Held for Securities Loaned

(cost $10,093,400)

|

|

|

10,093,400

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares or

Principal

Amount

|

|

|

Short-Term Investments (8.6%)

|

|

|

Value

|

|

|

|

|

|

|

Federal Home Loan Bank

Discount Notes

|

|

|

|

|

|

|

9,000,000

|

|

|

0.088%,

10/17/2012

i

|

|

|

8,999,602

|

|

|

|

5,000,000

|

|

|

0.125%,

12/21/2012

i

|

|

|

4,998,559

|

|

|

|

|

|

|

Federal Home Loan Mortgage

Corporation Discount Notes

|

|

|

|

|

|

|

1,100,000

|

|

|

0.160%,

12/17/2012

i,j

|

|

|

1,099,614

|

|

|

|

|

|

|

Federal National Mortgage

Association Discount Notes

|

|

|

|

|

|

|

5,000,000

|

|

|

0.070%,

10/3/2012

i

|

|

|

4,999,961

|

|

|

|

6,000,000

|

|

|

0.100%,

10/16/2012

i

|

|

|

5,999,717

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Short-Term Investments (at amortized cost)

|

|

|

26,097,453

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments (cost $293,287,493) 100.7%

|

|

|

$307,385,724

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets and Liabilities, Net (0.7%)

|

|

|

(2,077,024)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Net Assets 100.0%

|

|

|

$305,308,700

|

|

|

|

|

|

|

|

|

|

a

|

The stated interest rate represents the weighted average of all contracts within the bank loan facility.

|

|

b

|

All or a portion of the loan is unfunded.

|

|

c

|

Denotes investments purchased on a when-issued or delayed delivery basis.

|

|

d

|

Denotes variable rate securities. Variable rate securities are securities whose yields vary with a designated market index or market rate. The rate shown is as of

September 28, 2012.

|

|

|

|

The accompanying Notes to Schedule of Investments are an integral part of this schedule.

|

|

12

|

Diversified Income Plus Fund

Schedule of Investments as of September 28, 2012

(unaudited)

|

e

|

Denotes securities sold under Rule 144A of the Securities Act of 1933, which exempts them from registration. These securities have been deemed liquid and may be resold

to other dealers in the program or to other qualified institutional buyers. As of September 28, 2012, the value of these investments was $24,979,013 or 8.2% of total net assets.

|

|

f

|

Denotes perpetual securities. Perpetual securities pay an indefinite stream of interest, but may be called by the issuer at an earlier date.

|

|

g

|

All or a portion of the security is on loan.

|

|

h

|

Non-income producing security.

|

|

i

|

The interest rate shown reflects the yield, coupon rate or the discount rate at the date of purchase.

|

|

j

|

At September 28, 2012, $1,099,614 of investments were held on deposit with the counterparty and pledged as the initial margin deposit for open futures contracts.

|

Definitions:

|

|

|

|

|

|

|

ADR

|

|

-

|

|

American Depositary Receipt, which are certificates for an underlying foreign security’s shares held by an issuing U.S. depository bank.

|

|

ETF

|

|

-

|

|

Exchange Traded Fund.

|

|

ETN

|

|

-

|

|

Exchange Traded Note.

|

Unrealized Appreciation (Depreciation)

Gross unrealized appreciation and depreciation of investments, based on cost for federal income tax purposes, were as follows:

|

|

|

|

|

|

|

Gross unrealized appreciation

|

|

|

$19,474,981

|

|

|

Gross unrealized depreciation

|

|

|

(5,376,750)

|

|

|

|

|

|

|

|

|

Net unrealized appreciation (depreciation)

|

|

|

$14,098,231

|

|

|

|

|

|

Cost for federal income tax purposes

|

|

|

$293,287,493

|

|

|

|

|

The accompanying Notes to Schedule of Investments are an integral part of this schedule.

|

|

13

|

Diversified Income Plus Fund

Schedule of Investments as of September 28, 2012

(unaudited)

Fair Valuation Measurements

The following table is a summary of the inputs used, as of September 28, 2012, in valuing Diversified Income Plus Fund’s assets carried at fair value.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in Securities

|

|

Total

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Bank Loans

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Materials

|

|

|

1,757,619

|

|

|

|

–

|

|

|

|

1,757,619

|

|

|

|

–

|

|

|

Communications Services

|

|

|

8,160,918

|

|

|

|

–

|

|

|

|

7,360,918

|

|

|

|

800,000

|

|

|

Consumer Cyclical

|

|

|

1,606,364

|

|

|

|

–

|

|

|

|

1,606,364

|

|

|

|

–

|

|

|

Consumer Non-Cyclical

|

|

|

3,890,081

|

|

|

|

–

|

|

|

|

3,890,081

|

|

|

|

–

|

|

|

Energy

|

|

|

802,040

|

|

|

|

–

|

|

|

|

802,040

|

|

|

|

–

|

|

|

Financials

|

|

|

793,504

|

|

|

|

–

|

|

|

|

793,504

|

|

|

|

–

|

|

|

Technology

|

|

|

2,354,481

|

|

|

|

–

|

|

|

|

2,354,481

|

|

|

|

–

|

|

|

Transportation

|

|

|

799,201

|

|

|

|

–

|

|

|

|

799,201

|

|

|

|

–

|

|

|

Utilities

|

|

|

814,336

|

|

|

|

–

|

|

|

|

814,336

|

|

|

|

–

|

|

|

Long-Term Fixed Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset-Backed Securities

|

|

|

3,594,122

|

|

|

|

–

|

|

|

|

3,594,122

|

|

|

|

–

|

|

|

Basic Materials

|

|

|

1,498,489

|

|

|

|

–

|

|

|

|

1,498,489

|

|

|

|

–

|

|

|

Capital Goods

|

|

|

4,091,063

|

|

|

|

–

|

|

|

|

4,091,063

|

|

|

|

–

|

|

|

Collateralized Mortgage Obligations

|

|

|

35,546,019

|

|

|

|

–

|

|

|

|

35,546,019

|

|

|

|

–

|

|

|

Commercial Mortgage-Backed Securities

|

|

|

3,289,188

|

|

|

|

–

|

|

|

|

3,289,188

|

|

|

|

–

|

|

|

Communications Services

|

|

|

11,126,026

|

|

|

|

–

|

|

|

|

10,826,575

|

|

|

|

299,451

|

|

|

Consumer Cyclical

|

|

|

7,028,616

|

|

|

|

–

|

|

|

|

7,028,616

|

|

|

|

–

|

|

|

Consumer Non-Cyclical

|

|

|

8,284,668

|

|

|

|

–

|

|

|

|

8,284,668

|

|

|

|

–

|

|

|

Energy

|

|

|

7,396,554

|

|

|

|

–

|

|

|

|

7,396,554

|

|

|

|

–

|

|

|

Financials

|

|

|

31,394,952

|

|

|

|

–

|

|

|

|

31,394,952

|

|

|

|

–

|

|

|

Mortgage-Backed Securities

|

|

|

9,858,000

|

|

|

|

–

|

|

|

|

9,858,000

|

|

|

|

–

|

|

|

Technology

|

|

|

997,044

|

|

|

|

–

|

|

|

|

997,044

|

|

|

|

–

|

|

|

Transportation

|

|

|

1,252,548

|

|

|

|

–

|

|

|

|

1,252,548

|

|

|

|

–

|

|

|

U.S. Government and Agencies

|

|

|

350,354

|

|

|

|

–

|

|

|

|

350,354

|

|

|

|

–

|

|

|

Utilities

|

|

|

7,833,438

|

|

|

|

–

|

|

|

|

7,833,438

|

|

|

|

–

|

|

|

Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Discretionary

|

|

|

8,979,151

|

|

|

|

8,979,151

|

|

|

|

–

|

|

|

|

–

|

|

|

Consumer Staples

|

|

|

10,734,897

|

|

|

|

10,734,897

|

|

|

|

–

|

|

|

|

–

|

|

|

Energy

|

|

|

13,097,180

|

|

|

|

13,097,180

|

|

|

|

–

|

|

|

|

–

|

|

|

Financials

|

|

|

32,762,605

|

|

|

|

32,762,605

|

|

|

|

–

|

|

|

|

–

|

|

|

Health Care

|

|

|

10,312,982

|

|

|

|

10,312,982

|

|

|

|

–

|

|

|

|

–

|

|

|

Industrials

|

|

|

9,972,952

|

|

|

|

9,972,952

|

|

|

|

–

|

|

|

|

–

|

|

|

Information Technology

|

|

|

10,467,509

|

|

|

|

10,467,509

|

|

|

|

–

|

|

|

|

–

|

|

|

Materials

|

|

|

6,844,595

|

|

|

|

6,844,595

|

|

|

|

–

|

|

|

|

–

|

|

|

Telecommunications Services

|

|

|

4,919,610

|

|

|

|

4,919,610

|

|

|

|

–

|

|

|

|

–

|

|

|

Utilities

|

|

|

4,695,980

|

|

|

|

4,695,980

|

|

|

|

–

|

|

|

|

–

|

|

|

Preferred Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financials

|

|

|

3,887,785

|

|

|

|

3,887,785

|

|

|

|

–

|

|

|

|

–

|

|

|

Collateral Held for Securities Loaned

|

|

|

10,093,400

|

|

|

|

10,093,400

|

|

|

|

–

|

|

|

|

–

|

|

|

Short-Term Investments

|

|

|

26,097,453

|

|

|

|

–

|

|

|

|

26,097,453

|

|

|

|

–

|

|

|

Total

|

|

|

$307,385,724

|

|

|

|

$126,768,646

|

|

|

|

$179,517,627

|

|

|

|

$1,099,451

|

|

|

|

|

There were no significant transfers between the Levels during the period ended September 28, 2012. Transfers between

the Levels are identified as of the end of the period.

The significant unobservable input used in the fair value measurement of the reporting

entity’s Bank Loans Communications Services Level 3 security is the lack of marketability. A significant increase or decrease in the inputs in isolation would result in a significantly lower or higher fair value measurement.

The significant unobservable input used in the fair value measurement of the reporting entity’s Long-Term Fixed Income Communications Services Level

3 security is the lack of marketability. A significant increase or decrease in the inputs in isolation would result in a significantly lower or higher fair value measurement.

|

|

|

The accompanying Notes to Schedule of Investments are an integral part of this schedule.

|

|

14

|

Diversified Income Plus Fund

Schedule of Investments as of September 28, 2012

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Futures Contracts

|

|

Number of

Contracts

Long/(Short)

|

|

Expiration

Date

|

|

|

Notional

Principal

Amount

|

|

|

Value

|

|

|

Unrealized

Gain/(Loss)

|

|

|

5-Yr. U.S. Treasury Bond Futures

|

|

39

|

|

|

December 2012

|

|

|

|

$4,838,556

|

|

|

|

$4,860,679

|

|

|

|

$22,123

|

|

|

10-Yr. U.S. Treasury Bond Futures

|

|

(10)

|

|

|

December 2012

|

|

|

|

(1,330,751)

|

|

|

|

(1,334,844)

|

|

|

|

(4,093)

|

|

|

S&P 500 Index Futures

|

|

(19)

|

|

|

December 2012

|

|

|

|

(6,804,536)

|

|

|

|

(6,812,450)

|

|

|

|

(7,914)

|

|

|

S&P 500 Index Mini-Futures

|

|

72

|

|

|

December 2012

|

|

|

|

5,244,630

|

|

|

|

5,163,120

|

|

|

|

(81,510)

|

|

|

Total Futures Contracts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($71,394)

|

|

Investment in Affiliates

Affiliated issuers, as defined under the Investment Company Act of 1940, include those in which the Fund’s holdings of an issuer represent 5% or more of the outstanding voting securities of an

issuer, or any affiliated mutual fund.

A summary of transactions for the fiscal year to date, in Diversified Income Plus Fund, is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund

|

|

Value

December 31,

2011

|

|

|

Gross

Purchases

|

|

|

Gross

Sales

|

|

|

Shares Held at

September 28,

2012

|

|

|

Value

September 28,

2012

|

|

|

Income Earned

January 1, 2012 -

September 28, 2012

|

|

|

Securities Lending Trust-Collateral Investment

|

|

|

$7,698,775

|

|

|

|

$68,914,864

|

|

|

|

$66,520,239

|

|

|

|

10,093,400

|

|

|

|

$10,093,400

|

|

|

|

$111,997

|

|

|

Total Value and Income Earned

|

|

|

7,698,775

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,093,400

|

|

|

|

111,997

|

|

|

|

|

The accompanying Notes to Schedule of Investments are an integral part of this schedule.

|

|

15

|

Notes to Schedule of Investments

As of September 28, 2012

(unaudited)

SIGNIFICANT ACCOUNTING POLICIES

Valuation of Investments –

Securities traded on U.S. or foreign securities exchanges or included in a national market system are valued at the official closing price at the close of each

business day unless otherwise stated below. Over-the-counter securities and listed securities for which no price is readily available are valued at the current bid price considered best to represent the value at that time. Security prices are based

on quotes that are obtained from an independent pricing service approved by the Board of Trustees (the “Board”). The pricing service, in determining values of fixed-income securities, takes into consideration such factors as current

quotations by broker/dealers, coupon, maturity, quality, type of issue, trading characteristics, and other yield and risk factors it deems relevant in determining valuations. Securities which cannot be valued by the approved pricing service are

valued using valuations obtained from dealers that make markets in the securities. Exchange listed options and futures contracts are valued at the last quoted sales price. Swaps are valued using pricing sources approved by the Board and the change

in value, if any, is recorded as unrealized gains or losses. Mutual funds are valued at the net asset value at the close of each business day.

For all Funds, other than Money Market Fund, short-term securities with maturities of 60 days or less are valued at amortized cost. Securities held by

Money Market Fund are valued on the basis of amortized cost (which approximates market value), whereby a fund security is valued at its cost initially and thereafter valued to reflect a constant amortization to maturity of any discount or premium.

The market values of the securities held in Money Market Fund are determined once per week using prices supplied by the Funds’ independent pricing service. Money Market Fund and the Funds’ investment adviser follow procedures designed to

help maintain a constant net asset value of $1.00 per share.

The Board has delegated responsibility for daily valuation to each Fund’s

Adviser. The Fund Advisers have formed a Portfolio Compliance and Valuation Committee (“Committee”) that is responsible for overseeing the Fund’s valuation policies in accordance with Policies and Procedures. The Committee meets on a

monthly and on an as needed basis to review price challenges, price overrides, stale prices, shadow prices, manual prices, money market pricing, international fair valuation, and other securities requiring fair valuation.

The Funds monitor for significant events occurring prior to the close of trading on the New York Stock Exchange that could have a material impact on the

value of any securities that are held by the Funds. Examples of such events include trading halts, national news/events, and issuer-specific developments. If the Committee decides that such events warrant using fair value estimates, a Quorum of the

Committee will take such events into consideration in determining the fair value of such securities. If market quotations or prices are not readily available or determined to be unreliable, the securities will be valued at fair value as determined

in good faith pursuant to procedures adopted by the Board.

Generally Accepted Accounting Principles defines fair value, establishes a framework for measuring fair

value and expands disclosures about fair value requirements, which improve the consistency and comparability of fair value measurements used in financial reporting. Various inputs are summarized in three broad levels: Level 1 includes quoted prices

in active markets for identical securities; Level 2 includes other significant observable inputs such as quoted prices for similar securities, interest rates, prepayment speeds and credit risk; and Level 3 includes significant unobservable inputs

such as the Fund’s own assumptions and broker evaluations in determining the fair value of investments.

Fair Valuation of

International Securities

– Because many foreign markets close before the U.S. markets, events may occur between the close of the foreign market and the close of the U.S. markets that could have a material impact on the valuation of foreign

securities. The Funds, under the supervision of the Board, evaluates the impacts of these events and may adjust the valuation of foreign securities to reflect the fair value as of the close of the U.S. markets. The Board has authorized the

investment adviser to make fair valuation determinations pursuant to policies approved by the Board.

Foreign Currency Forward

Contracts

– In connection with purchases and sales of securities denominated in foreign currencies, all Funds, except Money Market Fund, may enter into foreign currency forward contracts. Additionally, these Funds may enter into such

contracts to hedge certain other foreign currency denominated investments. These contracts are recorded at value and the related realized and unrealized foreign exchange gains and losses are recorded. In the event that counterparties fail to settle

these forward contracts, the Funds could be exposed to foreign currency fluctuations. Foreign currency contracts are valued daily and unrealized appreciation or depreciation is recorded daily as the difference between the contract exchange rate and

the closing forward rate applied to the face amount of the contract. A realized gain or loss is recorded at the time a forward contract is closed. These contracts are over-the-counter and the Fund is exposed to counterparty risk equal to the

discounted net amount of payments to the Fund. This risk is partially mitigated by the Fund’s collateral posting requirements. As the foreign currency contract increases in value to the Fund, the Fund receives additional collateral from the

counterparty.

Options

– All Funds, with the exception of Money Market Fund, may buy put and call options and write put and

covered call options. The Funds intend to use such derivative instruments as hedges to facilitate buying or selling securities or to provide protection against adverse movements in security prices or interest rates. The Funds may also enter into

options contracts to protect against adverse foreign exchange rate fluctuations. Option contracts are valued daily and unrealized appreciation or depreciation is recorded. A Fund will realize a gain or loss upon expiration or closing of the option

transaction. When an option is exercised, the proceeds upon sale for a written call option or the cost of a security for purchased put and call options is adjusted by the amount of premium received or paid.

Notes to Schedule of Investments

As of September 28, 2012

(unaudited)

Buying put options tends to decrease a Fund’s exposure to the underlying security while buying call

options tends to increase a Fund’s exposure to the underlying security. The risk associated with purchasing put and call options is limited to the premium paid and has no significant counterparty risk as the exchange guarantees the contract

against default. Writing put options tends to increase a Fund’s exposure to the underlying security while writing call options tends to decrease a Fund’s exposure to the underlying security. The writer of an option has no control over

whether the underlying security may be bought or sold, and therefore bears the market risk of an unfavorable change in the price of the underlying security. The counterparty risk for written options arises when the Fund has purchased an option,

exercised that option, and the counterparty does not buy or sell the Fund’s underlying asset as required. In the case where the Fund has sold an option, the Fund does not have counterparty risk. Counterparty risk on written options is partially

mitigated by the Fund’s collateral posting requirements. As the written option increases in value to the Fund, the Fund receives additional collateral from the counterparty.

Futures Contracts

– Certain Funds may use futures contracts to manage the exposure to interest rate, market and currency fluctuations. Gains or losses on futures contracts can offset changes

in the yield of securities. When a futures contract is opened, cash or other investments equal to the required “initial margin deposit” are held on deposit with and pledged to the broker. Additional securities held by the Funds may be

earmarked to cover open futures contracts. The futures contract’s daily change in value (“variation margin”) is either paid to or received from the broker, and is recorded as an unrealized gain or loss. When the contract is closed,

the realized gain or loss is recorded equal to the difference between the value of the contract when opened and the value of the contract when closed. Futures contracts involve, to varying degrees, risk of loss in excess of the variation margin.

Exchange-traded futures have no significant counterparty risk as the exchange guarantees the contracts against default.

Swap

Agreements

– Certain Funds may enter into swap transactions, which involve swapping one or more investment characteristics of a security, or a basket of securities, with another party. Such transactions include market risk, risk of default

by the other party to the transaction, risk of imperfect correlation and manager risk and may involve commissions or other costs. Swap transactions generally do not involve delivery of securities, other underlying assets or principal. Accordingly,

the risk of loss with respect to swap transactions is generally limited to the net amount of payments that the Fund is contractually obligated to make, or in the case of the counterparty defaulting, the net amount of payments that the Fund is

contractually entitled to receive. If there is a default by the counterparty, the Fund may have contractual remedies pursuant to the agreements related to the transaction. The contracts are valued daily and unrealized appreciation or depreciation is

recorded. Swap agreements are valued at fair value of the contract as provided by an independent pricing service. The pricing service takes into account such factors as swap curves, default probabilities, recent trades, recovery rates and other

factors it deems relevant in determining valuations.

Periodic payments and receipts and payments received or made as a result of a credit event or termination

of the contract are recognized as realized gains or losses. Collateral, in the form of cash or securities, may be required to be held with the Fund’s custodian, or third party, in connection with these agreements. These swap agreements are

over-the-counter and the Fund is exposed to counterparty risk, which is the discounted net amount of payments owed to the Fund. This risk is partially mitigated by the Fund’s collateral posting requirements. As the swap increases in value to

the Fund, the Fund receives additional collateral from the counterparty.

Credit Default Swaps

– A credit default swap is a swap

agreement between two parties to exchange the credit risk of a particular issuer, basket of securities or reference entity. In a credit default swap transaction, a buyer pays periodic fees in return for payment by the seller which is contingent upon

an adverse credit event occurring in the underlying issuer or reference entity. The seller collects periodic fees from the buyer and profits if the credit of the underlying issuer or reference entity remains stable or improves while the swap is

outstanding, but the seller in a credit default swap contract would be required to pay the amount of credit loss, determined as specified in the agreement, to the buyer in the event of an adverse credit event in the reference entity. A buyer of a

credit default swap is said to buy protection whereas a seller of a credit default swap is said to sell protection. The Funds may be either the protection seller or the protection buyer.

Certain Funds may enter into credit default derivative contracts directly through credit default swaps (CDS) or through credit default swap indices (CDX Indices). CDX Indices are static funds of equally

weighted credit default swaps referencing corporate bonds and/or loans designed to provide diversified credit exposure to these asset classes. Funds sell default protection and assume long-risk positions in individual credits or the indices. Index

positions are entered into to gain exposure to the corporate bond and/or loan markets in a cost efficient and diversified structure. In the event that a position would default, by going into bankruptcy and failing to pay interest or principal on

borrowed money, within any given CDX Index held, the maximum potential amount of future payments required would be equal to the pro-rata share of that position within the index based on the notional amount of the index. In the event of a default

under a CDS contract, the maximum potential amount of future payments would be the notional amount. For CDS contracts, the default events could be bankruptcy and failing to pay interest or principal on borrowed money or a restructuring. A

restructuring is a change in the underlying obligations which would include reduction in interest or principal, maturity extension and subordination to other obligations. Refer to the credit default swap tables located within the Fund’s

Schedule of Investments for additional information.

Additional information for the Funds’ policy regarding valuation of investments and

other significant accounting policies can be obtained by referring to the Funds’ most recent annual or semiannual shareholder report.

Item 2.

Controls and Procedures

(a) Registrant’s President and Treasurer have concluded that registrant’s disclosure controls and procedures

(as defined in Rule 30a-3(c) under the Investment Company Act of 1940) are effective, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(b) Registrant’s President and Treasurer are aware of no change in registrant’s internal control over financial

reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, registrant’s internal

control over financial reporting.

Item 3.

Exhibits

Separate certifications pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Date: December 27, 2012

|

|

|

|

THRIVENT MUTUAL FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

/s/ Russell W. Swansen

|

|

|

|

|

|

|

|

|

|

Russell W. Swansen

|

|

|

|

|

|

|

|

|

|

President

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of

1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

Date: December 27, 2012

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Russell W. Swansen

|

|

|

|

|

|

|

|

|

|

Russell W. Swansen

|

|

|

|

|

|

|

|

|

|

President

|

|

|

|

|

|

|

|

|

|

Date: December 27, 2012

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Gerard V. Vaillancourt

|

|

|

|

|

|

|

|

|

|

Gerard V. Vaillancourt

|

|

|

|

|

|

|

|

|

|

Treasurer

|

|

|

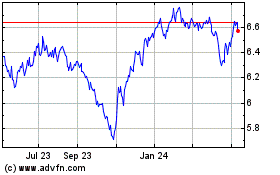

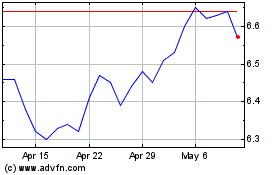

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From May 2024 to Jun 2024

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Jun 2023 to Jun 2024