Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 20 2021 - 8:40AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date of Report: May 2021

Commission File Number: 001-39368

MAXEON SOLAR TECHNOLOGIES, LTD.

(Exact Name of registrant as specified in its charter)

8 Marina Boulevard #05-02

Marina Bay Financial Centre

018981, Singapore

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On May 20, 2021, Maxeon Solar Technologies, Ltd. (“Maxeon”) issued a press release announcing that Maxeon will supply high-efficiency bifacial solar panels for Primergy’s GW-scale Gemini solar plus storage power plant project. A copy of the press release is filed as Exhibit 99.1.

On May 18, 2021, Maxeon Americas, Inc., a subsidiary of Maxeon Solar Technologies (“Maxeon”) and Solar Partners XI, LLC, a project company owned by Primergy Solar, LLC (“Primergy”), entered into a Solar Module Supply Agreement (the “Supply Agreement”) whereby Maxeon has agreed to sell approximately 1GW dc of its Performance 5 Series solar panels for Primergy’s Gemini solar project. Deliveries are scheduled to begin in April, 2022, with the final solar panel deliveries scheduled for March, 2023. Under the Supply Agreement, Primergy is required to issue to Maxeon a “Notice to Proceed” by no later than June 30, 2021. In the absence of such notice, the parties may terminate the Supply Agreement, subject to Primergy’s payment of a termination fee. The Supply Agreement also contains a termination for convenience provision whereby Primergy may terminate the Supply Agreement early, subject to a 90-day advance notice requirement and the payment of damages.

Upon the issuance of the Notice to Proceed, Primergy has agreed to make a down payment and Maxeon has agreed to provide a letter of credit reflective of customary market terms within the solar industry.

The Supply Agreement also contains technical terms and conditions, such as setting out detailed quality, testing, and performance specifications. In the event Maxeon is unable to deliver conforming solar panels pursuant to the required delivery schedule, Maxeon is required to pay damages for such delivery delays subject to an agreed upon cap. In the event that delay damage liability reaches the cap, Primergy may terminate the Supply Agreement for cause. Primergy may also terminate the Supply Agreement for cause if 12% or more of the solar panels are at least 30 days late. All solar panels will be covered by a 12-year product warranty, a 30-year power warranty, and are subject to a 3-year serial defects coverage period.

The Supply Agreement also contains limitation of liability, termination for cause, tariff-sharing, and credit support requirements, customary within the solar industry.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAXEON SOLAR TECHNOLOGIES, LTD.

(Registrant)

|

|

|

|

|

|

|

May 20, 2021

|

|

|

|

By:

|

|

/s/ Kai Strohbecke

|

|

|

|

|

|

|

|

Kai Strohbecke

|

|

|

|

|

|

|

|

Chief Financial Officer

|

EXHIBITS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Title

|

|

|

|

|

|

|

Press release dated May 20, 2021

|

|

|

|

|

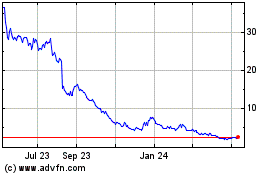

Maxeon Solar Technologies (NASDAQ:MAXN)

Historical Stock Chart

From Mar 2024 to Apr 2024

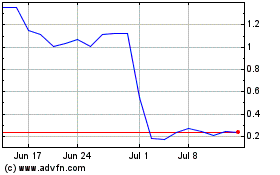

Maxeon Solar Technologies (NASDAQ:MAXN)

Historical Stock Chart

From Apr 2023 to Apr 2024