Current Report Filing (8-k)

April 07 2021 - 8:26AM

Edgar (US Regulatory)

false 0001406587 0001406587 2021-04-07 2021-04-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 7, 2021

Forestar Group Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33662

|

|

26-1336998

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

2221 E. Lamar Blvd., Suite 790, Arlington, Texas 76006

|

|

(Address of principal executive offices)

|

(817) 769-1860

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol

|

|

Name of Each Exchange

on Which Registered

|

|

Common Stock, par value $1.00 per share

|

|

FOR

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

In connection with a proposed private offering of $400 million aggregate principal amount of senior notes (the “Offering”), Forestar Group Inc. (“we,” or the “Company”) is disclosing the following preliminary financial results:

Recent Financial Results

We have not yet completed preparation of financial statements for the fiscal quarter ended March 31, 2021, but based on preliminary data available to us, we expect to report:

|

|

•

|

|

3,588 total lots sold for such period, including 3,358 lots sold to D.R. Horton, Inc. (“D.R. Horton”) compared to 1,951 total lots sold including 1,906 lots sold to D.R. Horton for the fiscal quarter ended March 31, 2020;

|

|

|

•

|

|

Total revenues of $287.1 million for such period compared to $159.1 million of total revenues for the fiscal quarter ended March 31, 2020;

|

|

|

•

|

|

Total cash and cash equivalents of $167.2 million as of March 31, 2021;

|

|

|

•

|

|

Total debt, net of discount and fees, of $654.6 million, with no outstanding borrowings under our unsecured revolving credit facility, as of March 31, 2021; and

|

|

|

•

|

|

1,018,503 shares issued under the at-the-market equity offering program during such period for proceeds of $23.3 million, net of commissions and other issuance costs.

|

The preliminary results presented above are based upon currently available information, and are subject to revision as a result of, among other things, the completion of our financial closing procedures, the completion of our financial statements for such period and the completion of other operational procedures (all of which have not yet been completed). Additional items that may require adjustments to the preliminary results may be identified. Our actual results may be materially different from our preliminary results, which should not be regarded as a representation by us, our management or the initial purchasers as to our actual results for the fiscal quarter ended March 31, 2021. You should not place undue reliance on this preliminary information. In addition, the preliminary data is not necessarily indicative of our results for any future period. We do not intend to update or otherwise revise these preliminary results to reflect future events. These preliminary results have been prepared by and are the responsibility of our management. Ernst & Young LLP, our independent registered public accounting firm, has not audited, reviewed, compiled or performed any procedures with respect to this preliminary data, and accordingly, Ernst & Young LLP does not express an opinion or any other form of assurance with respect thereto. The assumptions underlying the preliminary financial data are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties, including those described under “Special Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our annual report on Form 10-K for the fiscal year ended September 30, 2020 and our quarterly report on Form 10-Q for the three months ended December 31, 2020.

Item 7.01. Regulation FD Disclosure.

On April 7, 2021, the Company commenced the Offering, subject to market and other conditions. In connection with the Offering, on April 7, 2021, the Company distributed a confidential preliminary offering memorandum containing the preliminary financial results set forth above in Item 2.02, which are incorporated herein by reference. The Company intends to use the net proceeds from the Offering to fund the redemption of its $350 million 8.000% Senior Notes due 2024 (the “2024 Notes”). This Form 8-K does not constitute a notice of redemption for the 2024 Notes, which, if given, will be made in accordance with the indenture governing the 2024 Notes. Any excess net proceeds will be used for general corporate purposes, including to fund land acquisition and development activities.

The information furnished under Items 2.02 and 7.01 herein is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

This communication does not constitute an offer to sell, or a solicitation of an offer to buy, securities in any jurisdiction. The Offering has not been and will not be registered under the Securities Act of 1933, as amended, and will be made pursuant to applicable exemptions from the registration requirements thereof.

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of federal securities laws. These forward-looking statements are identified by their use of terms and phrases such as “believe,” “anticipate,” “could,” “estimate,” “likely,” “intend,” “may,” “plan,” “expect,” and similar expressions, including references to assumptions. These statements reflect the Company’s current views with respect to future events and are subject to risks and uncertainties. The Company notes that a variety of factors and uncertainties could cause its actual results to differ significantly from the results discussed in the forward-looking statements. Factors and uncertainties that might cause such differences include, but are not limited to: the effect of D.R. Horton’s controlling level of ownership on the Company and the holders of the Company’s securities; the Company’s ability to realize the potential benefits of the strategic relationship with D.R. Horton; the effect of the Company’s strategic relationship with D.R. Horton on its ability to maintain relationships with its customers; the impact of the COVID-19 pandemic on the economy and the Company’s business; the cyclical nature of the homebuilding and lot development industries and changes in economic, real estate and other conditions; competitive conditions in the Company’s industry; changes in the Company’s business strategy and the Company’s ability to achieve its strategic initiatives; continuing liabilities related to assets that have been sold; the impact of governmental policies, laws or regulations and actions or restrictions of regulatory agencies; the cost and availability of property suitable for residential lot development; general economic, market or business conditions where the Company’s real estate activities are concentrated; the Company’s dependence on relationships with national, regional and local homebuilders; the Company’s ability to obtain or the availability of surety bonds to secure its performance related to construction and development activities and the pricing of bonds; obtaining reimbursements and other payments from governmental districts and other agencies and timing of such payments; the Company’s ability to succeed in new markets; the conditions of the capital markets and the Company’s ability to raise capital to fund expected growth; the Company’s ability to manage and service its debt and comply with its debt covenants, restrictions and limitations; the volatility of the market price and trading volume of the Company’s common stock; the Company’s ability to hire and retain key personnel; and the strength of the Company’s information technology systems and the risk of cybersecurity breaches and its ability to satisfy privacy and data protection laws and regulations. Additional information about issues that could lead to material changes in performance and risk factors that have the potential to affect the Company is contained in its annual report on Form 10-K and its most recent quarterly report on Form 10-Q, both of which are filed with the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Forestar Group Inc.

|

|

|

|

|

|

|

Date: April 7, 2021

|

|

|

|

By:

|

|

/s/ JAMES D. ALLEN

|

|

|

|

|

|

|

|

James D. Allen

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

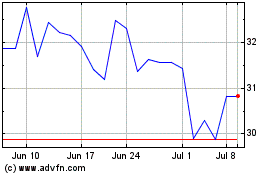

Forestar (NYSE:FOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

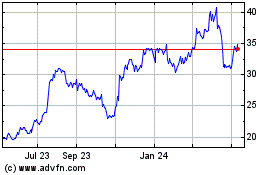

Forestar (NYSE:FOR)

Historical Stock Chart

From Apr 2023 to Apr 2024