Current Report Filing (8-k)

April 06 2021 - 4:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 31, 2021

IIOT-OXYS, Inc.

(Exact name of registrant as specified in

its charter)

|

Nevada

|

|

000-50773

|

|

56-2415252

|

|

(State or Other Jurisdiction

|

|

(Commission File

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

Number)

|

|

Identification Number)

|

|

705 Cambridge Street

Cambridge, MA 02141

|

|

(Address of principal executive offices, including zip code)

|

|

(401) 307-3092

|

|

(Registrant’s telephone number,

including area code)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ . Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ . Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ . Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ . Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

N/A

|

N/A

|

N/A

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On April 1, 2021, IIOT-OXYS, Inc., a Nevada

corporation (the “Company”), entered into an Employment Contract (the “Employment Contract”)

with Chandran Seshagiri, pursuant to which Mr. Seshagiri was appointed as the Company’s Interim Chief Technology Officer

to replace the departing Antony Coufal. The term of the Employment Contract is from April 1, 2021 to June 30, 2021 and Mr. Seshagiri

will be providing services on a part-time basis. Pursuant to the Employment Contract, the Company will award to Mr. Seshagiri 200,000

shares of the Company’s Common Stock, which will vest as follows: 50,000 shares upon the date of the Employment Contract,

100,000 shares three-months from the date of the Employment Contract, and 50,000 shares upon the completion of the Employment Contract

(the “Seshagiri Shares”). The Employment Contract is terminable by the Company for cause or upon more than two

weeks’ notice by either Mr. Seshagiri or the Company, subject to the terms of the Employment Contract.

|

|

Item 1.02

|

Termination of a Material Definitive Agreement.

|

The disclosure contained in Item 5.02 herein

is incorporated into this Item 1.02 by reference.

|

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The disclosure contained in Items 1.01

and 5.02 herein are incorporated into this Item 3.02.

Messrs. Coufal and Seshagiri each delivered

appropriate investment representations with respect to the Coufal Shares and the Seshagiri Shares, respectively, and consented

to the imposition of restrictive legends upon the stock certificates representing the Coufal Shares and the Seshagiri Shares, respectively.

Messrs Coufal and Seshagiri did not enter into their respective transactions with the Company as a result of or subsequent to any

advertisement, article, notice, or other communication published in any newspaper, magazine, or similar media or broadcast on television

or radio, or presented at any seminar or meeting. Each of Messrs. Coufal and Seshagiri was also afforded the opportunity to ask

questions of management and to receive answers concerning the terms and conditions of the transaction. The Coufal Shares and the

Seshagiri Shares, respectively, were issued without registration under the Securities Act of 1933, as amended, by reason of the

exemption from registration afforded by the provisions of Section 4(a)(2) thereof, and Rule 506(b) promulgated thereunder, as a

transaction by an issuer not involving any public offering. No selling commissions were paid in connection with the issuance of

the Coufal Shares and the Seshagiri Shares, respectively.

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

Resignation of Chief Technology Officer

and Termination Agreement

Effective March 31, 2021 (the “Effective

Date”), the Company entered into a Termination Agreement (the “Termination Agreement”) with Antony

Coufal, the Company’s Chief Technology Officer (the “CTO”) pursuant to which Mr. Coufal resigned as CTO

and from all positions within the Company and any of its subsidiaries. In addition, the Termination Agreement provides for the

payment of $11,144.42 in reimbursable expenses and $130,451 in accrued and unpaid consulting fees to Mr. Coufal within five business

days of the Effective Date. The Termination Agreement also provides for the issuance to Mr. Coufal 843,288 shares of the Company’s

Common Stock (the “Coufal Shares”) within five business days of the Effective Date. Due to the fact that both

the unpaid reimbursable expenses and the accrued and unpaid consulting fees were convertible into shares of the Company’s Common

Stock at a discount, the cash payment to Mr. Coufal eliminates a potential dilutive event to shareholders.

Chief Operating Officer Appointment

The disclosure contained in Item 1.01 herein

is incorporated into this Item 5.02 by reference.

On April 6, 2021, the Company issued a

press release announcing the appointment of Chandran Seshagiri as the Company’s Interim

CTO and the departure of Mr. Coufal.

The Press Release, furnished as Exhibit

99.1 to this Form 8-K, may contain forward-looking statements. Such forward-looking statements are based on information presently

available to the Company’s management and are current only as of the date made. Actual results could also differ materially

from those anticipated as a result of a number of factors, including, but not limited to, those discussed in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2020, and subsequent reports filed by the Company with the Securities

and Exchange Commission (the “Commission”). For those reasons, undue reliance should not be placed on any forward-looking

statement. The Company assumes no duty or obligation to update or revise any forward-looking statement, although it may do so from

time to time as management believes is warranted or as may be required by applicable securities law. Any such updates or revisions

may be made by the registrant by filing reports with the Commission, through the issuance of press releases or by other methods

of public disclosure.

|

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

IIOT-OXYS, Inc.

|

|

|

|

|

Date: April 6, 2021

|

By:

|

/s/ Clifford L. Emmons

|

|

|

|

Clifford L. Emmons, Chief Executive Officer

|

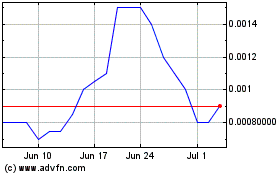

IIOT OXYS (PK) (USOTC:ITOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

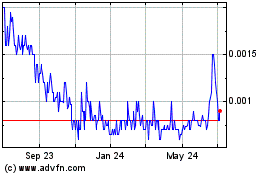

IIOT OXYS (PK) (USOTC:ITOX)

Historical Stock Chart

From Apr 2023 to Apr 2024