Statement of Changes in Beneficial Ownership (4)

January 05 2021 - 6:46PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Fiedelman Cindy |

2. Issuer Name and Ticker or Trading Symbol

DIGITAL REALTY TRUST, INC.

[

DLR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

CHIEF HUMAN RESOURCES OFFICER |

|

(Last)

(First)

(Middle)

FOUR EMBARCADERO CENTER, SUITE 3200 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/1/2021 |

|

(Street)

SAN FRANCISCO, CA 94111

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Long-Term Incentive Units (1) | (1) | 1/1/2021 | | A | | 2365 (2) | | (2) | (2) | Common Stock | 2365 | $0 | 21193 | D |

|

| Long-Term Incentive Units (1) | (1) | 1/3/2021 | | A | | 9597 (3) | | (3) | (3) | Common Stock | 9597 | $0 | 30790 | D |

|

| Long-Term Incentive Units (1) | (1) | 1/3/2021 | | A | | 1339 (4) | | (4) | (4) | Common Stock | 1339 | $0 | 32129 | D |

|

| Explanation of Responses: |

| (1) | Long-Term Incentive Units are profits interest units in Digital Realty Trust, L.P. ("Operating Partnership"), of which the Issuer is the general partner. Profits interest units may initially not have full parity with common limited partnership units of Operating Partnership ("Common Units") with respect to liquidating distributions; however upon the occurrence of specified events, profits interest units may achieve full parity with Common Units for all purposes. Vested profits interest units that have achieved full parity with Common Units may be converted into an equal number of Common Units on a 1-for-1 basis at any time. Common Units are redeemable for cash based on the FMV of an equivalent number of shares of common stock of the Issuer, or, at the election of the Issuer, for an equal number of shares of the Issuer's common stock, subject to adjustment in the event of stock splits, stock dividends, issuance of stock rights, specified extraordinary distributions or similar events. |

| (2) | The units will vest in four equal annual installments beginning on February 27, 2022. The vested profits interest units have no expiration date. |

| (3) | Reflects an award initially granted on January 1, 2018 that was subject to a performance-based vesting condition which was determined to be satisfied on January 3, 2021. The number of units reported herein includes 835 distribution equivalent units, which vested effective as of December 31, 2020. The remaining 8762 units are subject to an additional time-based vesting condition, pursuant to which 50% of the units will vest annually over two years, beginning on February 27, 2021. The vested profits interest units have no expiration date. |

| (4) | Reflects an award initially granted on March 9, 2018 that was subject to a performance-based vesting condition which was determined to be satisfied on January 3, 2021. The number of units reported herein includes 117 distribution equivalent units, which vested effective as of December 31, 2020. The remaining 1222 units are subject to an additional time-based vesting condition, pursuant to which 50% of the units will vest annually over two years, beginning on February 27, 2021. The vested profits interest units have no expiration date. |

Remarks:

This statement of changes in beneficial ownership of securities ("Form 4") of the Issuer is being filed to report transactions that are being reported concurrently on a Form 4 for the Operating Partnership. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Fiedelman Cindy

FOUR EMBARCADERO CENTER, SUITE 3200

SAN FRANCISCO, CA 94111 |

|

| CHIEF HUMAN RESOURCES OFFICER |

|

Signatures

|

| /s/ Salini Nandipati, Attorney-in-Fact | | 1/5/2020 |

| **Signature of Reporting Person | Date |

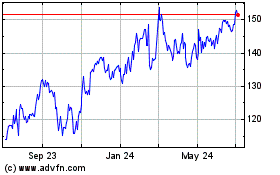

Digital Realty (NYSE:DLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

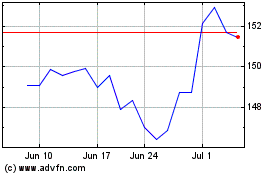

Digital Realty (NYSE:DLR)

Historical Stock Chart

From Apr 2023 to Apr 2024