UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Sec. 240.14a-12

ROYALE ENERGY, INC.

(Name of Registrant as Specified in its Charter)

Filed on Behalf of the Board of Directors

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Royale Energy, Inc.

|

TIME:

|

9:00 a.m. Pacific Daylight Time

|

|

PLACE:

|

Royale Energy Inc.

104 W. Anapamu Street

Suite C

Santa Barbara, CA 93101

|

Matters to be Voted on:

|

1.

|

Elect directors to serve for the ensuing year;

|

|

2.

|

Approve Moss Adams LLP as independent auditor;

|

|

3.

|

To approve, in a nonbinding advisory vote, the compensation of the Company’s named executive officers;

|

|

4.

|

To determine, in a nonbinding advisory vote, the frequency of the nonbinding resolution to approve the compensation of our named executive officers every year, every two years or every three years;

|

|

5.

|

Transact such other business as may properly come before the meeting and any adjournment thereof.

|

Who May Attend and Vote at the Meeting

Shareholders of record at the close of business on August 14, 2020, and valid proxy holders may attend and vote at the meeting. If your shares are registered in the name of a brokerage firm or trustee and you plan to attend the meeting, please obtain from the firm or trustee a letter or other evidence of your beneficial ownership of those shares to facilitate your admittance to the meeting.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

|

Mel Riggs

|

|

|

Chairman of the Board of Directors

|

|

|

|

|

|

Date: August 7, 2020

|

PROXY STATEMENT

Royale Energy’s board of directors solicits your proxy, using the enclosed proxy card, for use at the annual meeting of shareholders to be held September 14, 2020, and at any adjournment thereof. This proxy statement has information about the annual meeting and was prepared by Royale Energy’s management for the board of directors. Your vote at the annual meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed envelope.

GENERAL INFORMATION

The only items of business which management intends to present at the meeting are listed in the preceding Notice of Annual Meeting of Shareholders and are explained in more detail on the following pages. By returning your signed proxy, you authorize management to vote your shares as you indicate on these items of business and to vote your shares in accordance with management’s best judgment in response to proposals initiated by others at the meeting.

1) Changing or Revoking Your Proxy Vote

You may revoke your signed proxy at any time before it is exercised at the annual meeting. You may do this by advising Royale Energy’s secretary in writing of your desire to revoke your proxy, or by submitting a duly executed proxy bearing a later date. We will honor the proxy card with the latest date. You may also revoke your proxy by attending the annual meeting and indicating that you wish to vote in person.

2) Who may Vote

Each shareholder of record at the close of business on August 14, 2020, is entitled, for each share then held, to one vote on each proposal or item that comes before the annual meeting, except that under certain circumstances shareholders may be entitled to cumulate their votes in voting for directors. (See Proposal 1: Election of Directors.) On June 23, 2020, Royale Energy had outstanding 50,742,248 shares of common stock entitled to vote at the meeting, and 2,089,407 shares of Series B preferred, convertible to 20,089,407 shares of common, entitled to vote at the meeting.

3) Voting in Person

Although we encourage you to complete and return your proxy to ensure that your vote is counted, you can attend the annual meeting and vote your shares in person.

4) How Your Votes are Counted

We will hold the annual meeting on September 14, 2020, if holders of a majority of the shares of common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the matters listed on the proxy card.

The shares represented by the proxies solicited by the board of directors of the Company will be voted in accordance with your directions as marked on your proxy ballot, but if you give no directions, such shares will be voted (i) FOR the election as directors of the nominees of the board of directors named below; (ii) in the discretion of Mel Riggs and Stephen M. Hosmer (the proxies named on the proxy ballot) on any other proposals to properly come before the annual meeting or any adjournment(s) thereof.

5) Broker Votes

If, like most shareholders, your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee (the “record holder”) along with a voting instruction card. As the beneficial owner, you have the right to direct your record holder how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions. Your broker is allowed to vote your shares only on certain “routine” proposals or if you provide your broker with instructions on how to vote. Brokers are prohibited from voting uninstructed shares on “non-routine” proposals, including proposals for elections of directors and on executive compensation related matters. If you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be considered as present and entitled to vote with respect to those matters. It is, therefore, important that you send in your proxy with instructions on how to vote your shares (or that you attend the meeting in person), to make sure that we have a quorum present and voting at the shareholders’ meeting.

As the beneficial owner of shares, you are invited to attend the Annual Meeting. Please note, however, that if you are a beneficial owner whose shares are held in street name, you may not vote your shares in person at the meeting unless you obtain a “legal proxy” from the record holder that holds your shares. To vote shares held in street name in person at the annual meeting, you should contact your broker before the annual meeting to obtain a proxy form in your name.

ABSTAINING IS THE SAME AS VOTING “NO”

If you mark “Abstain” with respect to any proposal on your proxy ballot, your shares will be counted in the number of votes cast. However, a vote to “Abstain” has the same effect as voting “No.” Management requests that you vote either “For” or “Against” on each proposal to come before the meeting.

This proxy statement and the accompanying proxy form will be first distributed on or about August 17, 2020, to shareholders entitled to vote at the meeting.

ITEMS OF BUSINESS

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

Six directors will be elected to serve on our board of directors until the next annual meeting of shareholders or until their successors are elected and qualified.

a) The Director Nomination Process

All of the nominees for our board of directors were approved unanimously by the three independent directors who serve on the nominations committee and unanimously by the full board of directors.

Six nominees for re-election to the board, Mel Riggs, Robert Vogel, Thomas Gladney, Jonathan Gregory, Karen Kerns, and Johnny Jordan, have served on our board. One nominee, Jonathan Gregory (our former Chief Executive Officer) was elected to the board in 2014. One nominee, Johnny Jordan (our current Chief Executive Officer) was appointed to the board in January 2018 in anticipation of the merger between Royale and Matrix Oil Management Corporation which closed in March 2018. Three nominees, Robert Vogel, Mel G. Riggs, and Thomas Gladney, were elected to the board in July 2018. The remaining nominee, Karen Kerns was elected to the board September 2019. All nominees are nominated for election for full one year terms.

b) Voting

The six nominees receiving the highest number of votes will be elected. Signed proxies received will be voted for the election of the nominees listed in this proxy statement, all of whom have agreed to serve if elected. Should any of the nominees become unavailable at the time of the meeting to accept nomination or election as a director, the proxy holders named in the enclosed proxy will vote for substitute nominees at their discretion. Votes withheld for a nominee will not be counted. Pursuant to the Company’s Bylaw 3.2, cumulative voting for directors is not permitted.

c) Qualifications of Directors

Royale Energy has not established specific, minimum qualifications for recommended nominees or specific qualities or skills for our directors to possess. We have used a subjective process for identifying nominees for director based on the judgment of our board of our current needs. The nomination committee has received suggested candidates from unaffiliated parties, however, we have never received any officially designated nominations from unaffiliated shareholders for new members of the board of directors. The board has and will consider outside nominations received in the future.

In selecting the 2020 nominees for director, the nominations committee sought candidates who possess the highest personal and professional ethics, integrity and values, and are committed to representing the long-term interests of our stockholders. In addition to reviewing a candidate’s background and accomplishments, the committee reviewed candidates for director in the context of the current composition of the board and the evolving needs of our businesses. A majority of our nominees for election as directors meet the standards of independence promulgated by the NASDAQ Stock Market and the SEC. As required by the nominations committee charter, the committee selects individuals as nominees for their character, judgment, ethics, integrity, business experience, and acumen, and the committee also seeks to ensure that the board reflects a range of talents, ages, skills, diversity, and expertise, particularly in the areas of accounting and finance sufficient to provide sound and prudent guidance with respect to the Company’s operations and interests. The board seeks to maintain a diverse membership, but it does not have a separate policy on diversity. The board also requires that its members be able to dedicate the time and resources necessary to ensure the diligent performance of their duties on the Company’s behalf, including attending board and applicable committee meetings.

The following are some of the key qualifications and skills the committee considered in evaluating the director nominees. The individual biographies beginning on page 4 provide additional information about each nominee’s specific experiences, qualifications and skills.

Significant management experience. We believe that directors with experience in management, including management of private, public, or non-profit corporations provide the Company with valuable insights. These individuals have a demonstrated record of leadership qualities and a practical understanding of organizations, processes, strategy, risk management, and the methods to drive change and growth. Through their service as top leaders at other organizations, they also have access to important sources of market intelligence, analysis, and relationships that benefit the Company.

Financial reporting experience. We believe that an understanding of finance and financial reporting processes is important for our directors. The Company measures its operating and strategic performance by reference to financial targets. In addition, accurate financial reporting and robust auditing are critical to the Company’s success. Our nominees include a director who qualifies as an audit committee financial expert, and we expect all of our directors to be financially knowledgeable.

Industry experience. We seek to have directors with experience as executives, directors, or other leadership positions in the energy industry. These directors have valuable perspective on energy industry business cycles and other issues specific to the Company’s business.

Government experience. We seek directors with governmental experience because the energy industry is heavily regulated and is directly affected by actions and decisions of federal, state, local, and other governmental agencies. The Company recognizes the importance of working constructively with governments, and directors with government experience offer valuable insight in this regard.

d) Board Leadership and Risk Oversight

We have separated the functions of chairman of the board (Mel Riggs) and chief executive officer (Johnny Jordan).

The board of directors is responsible for oversight of our risk management policies and procedures. We are exposed to a number of risks including financial risks, strategic and operational risks, and risks relating to regulatory and legal compliance. Our financial condition, results of operations, and capital resources are highly dependent upon the prevailing market prices of, and demand for, crude oil and natural gas, which are beyond our control. The board of directors reviews our business and financial plans, which includes evaluating the objectives of, and risks associated with, these plans. In addition, the audit committee reviews and discusses with management our major financial risks and the steps management has taken to monitor and control these risks, including our internal control over financial reporting. Our compensation committee strives to structure executive compensation to align the interests of our executive officers with the long-term interests of our shareholders and thus provides incentives to our executives to manage risks appropriately.

e) Nominees for the Board of Directors

Proxies solicited by the board of directors will be voted in favor of each nominee unless shareholders specify otherwise in their proxies. The following pages describe the nominees for director, including their principal occupations for the past five years, certain other directorships, age, and length of service as director of Royale Energy. Membership on board committees, attendance at board and committee meetings, and ownership of stock in Royale Energy are indicated in separate sections following the individual resumes of the nominees.

Each nominee has agreed to be named in this proxy statement and to serve as a director if elected. The ages listed are as of May 31, 2020.

Nominees for Director

|

Name

|

|

Age

|

|

First Became Director or Executive Officer

|

|

Position Held

|

|

Johnny Jordan

|

|

60

|

|

January 2018

|

|

Chief Executive Officer and Director

|

|

Mel Riggs

|

|

65

|

|

July 2018

|

|

Chairman of the Board of Directors

|

|

Robert Vogel (1)

|

|

60

|

|

July 2018

|

|

Director

|

|

Jonathan Gregory

|

|

56

|

|

March 2014

|

|

Director

|

|

Thomas Gladney (1)

|

|

67

|

|

July 2018

|

|

Director

|

|

Karen Kerns (1)

|

|

62

|

|

September 2019

|

|

Director

|

(1) Member of the compensation, nominations and audit committees.

The board has determined that nominees for director Thomas Gladney, Mel G. Riggs, Robert Vogel, and Karen Kerns qualify as independent directors under NASDAQ rules.

The following summarizes the business experience of each director and nominee for director.

Thomas Gladney – Director

Mr. Gladney became a director in July 2018. Since 2006 he has served as president of privately held Bodog Resources, LLC, a wholly owned private entity which invests in oil and gas and real estate. Mr. Gladney previously served as executive vice president of Plains Exploration and Production Company (PXP) where he helped increase proved reserves from 239 MMEB to more than 400 MMEB while directing various projects to include integration of the merger of two large public companies, work on development and exploration projects in the Gulf of Mexico and on several key engineering projects. Prior to that, Mr. Gladney served as senior vice president for PXP and Plains Resources, president of Arguello Inc. for Plains, project manager for Venoco and Torch, and Offshore Operations Manager and Gulf Coast Development Manager for Sun E&P/Oryx Energy. Mr. Gladney received a B.S. in Petroleum Engineering from Mississippi State University, in 1975. Mr. Gladney is experienced in operational management, has a broad knowledge of facilities and oil field management and is knowledgeable in mergers and acquisitions. The board has determined that Mr. Gladney will be an independent director.

Jonathan Gregory – Director

Mr. Gregory became a director of Royale in March 2014 and served as Royale’s chief executive officer from September 10, 2015, until June 1, 2018. Prior to becoming Royale’s CEO, Mr. Gregory, from March 2014 to July 2015, served as Chief Financial Officer and Chief Business Development Strategist for Americo Energy Resources, a private exploration and production company located in Houston, Texas. Prior to serving as CFO of Americo Energy, Mr. Gregory was CFO of J&S Oil & Gas, LLC, from April 2012 to February 2014. From December 2004 to April 2012, Mr. Gregory was head of the energy lending group in Houston, Texas for Texas Capital Bank, N.A. Mr. Gregory is presently CEO of RMX Resources, LLC (“RMX”), a private Texas based oil and gas company with oil and gas properties primarily located in California, in which, Royale holds an equity interest. Mr. Gregory is also a Credit Advisor to Anvil Capital Partners, a private debt capital provider to upstream energy companies and serves on the advisory board of the Center for Compassionate Leadership. Mr. Gregory graduated from Lamar University in 1986 with a Bachelor’s degree in Finance.

Johnny Jordan – Chief Executive Officer and Director

Mr. Jordan was appointed to the board in January 2018 and appointed Chief Executive Officer effective January 1, 2019. Mr. Jordan is a petroleum engineer with expertise in acquisitions, field economics and reserves analysis, bank negotiations, reservoir and field operations, and multi-team interaction. Mr. Jordan served on the Board of Directors of Matrix. Mr. Jordan has been active in the oil and gas industry since 1980 beginning as a floor hand on a well service rig. He has held various staff and supervisory positions for Exxon, Mack Energy, Enron Oil and Gas and Venoco Corporation. He was the team leader of a multi-discipline team from 1992 to 1996 that added 455 BCF and 79 MMCFD through acquisitions (71 BCF) and field development (365 wells) in the Val Verde Basin in West Texas. Mr. Jordan has managed acquisition evaluations in many of the oil and gas producing basins in the US. He has coordinated field development for various recovery mechanisms that include waterflood, tertiary flood, water drive oil and gas reservoirs, and pressure depletion fields with gas cap expansion or gravity drainage. Mr. Jordan received a B.S. in Chemical Engineering from the University of Oklahoma in 1983 and is currently a member of the Society of Petroleum Engineers and the American Petroleum Institute.

Mel G. Riggs – Nominee for Director

Mr. Riggs became a director in July 2018. Presently, he is affiliated with the Clayton Williams family office. Mr. Riggs previously served as President of Clayton Williams Energy, Inc. (NYSE: CWEI) from March, 2015 until April 2017 when CWEI was acquired for $2.7 billion by Noble Energy, Inc. (NYSE: NBL). In prior roles, Mr. Riggs served from March 1991 until December 2010 as the chief financial officer of CWEI and from 2010 to 2015 as the executive vice president and chief operating officer. Mr. Riggs also served as a director of CWEI from 1994 to 2017. Mr. Riggs currently serves on the board of directors of NexTier Oilfield Solutions, Inc. (NYSE:NEX) and Community National Bank of Midland, Texas and is a member of the audit committee for both companies. Mr. Riggs is a certified public accountant and received a BBA with a degree in accounting from Texas Tech University in 1977. The board has determined that Mr. Riggs will be an independent director.

Robert Vogel – Nominee for Director

Mr. Vogel became a director in July 2018. Presently, he is a Principal at Lucas Capital Management, a registered investment advisor providing a full suite of financial services to individuals and institutional clients. Mr. Vogel is a seasoned executive with an extensive background in the energy industry. He has served or worked as a principal, director, chief financial officer, trustee, vice president and treasurer, assistant treasurer, manager of corporate planning and control, manager inventory control and process engineer for organizations including Lucas Capital Management, Red Leaf Resources, GTL Energy, Blink Now Foundation, Community Foundation of New Jersey, Mt. Horeb United Methodist Church, Hess Corporation, Max Lotto, W.R. Grace and Co, and Chevron U.S.A. Inc. Mr. Vogel has a BS in chemical engineering and a MBA from NYU Stern School of Business. The board has determined that Mr. Vogel will be an independent director.

Karen Leik Kerns – Nominee for Director

Karen Leik Kerns became a director in September 2019. Ms. Kerns is an attorney with over 30 years of experience in business, contract and loan negotiation, and real estate law. Ms. Kerns previously served as General Counsel for a private real estate investment trust with over $400 million in limited partner investments throughout the United States. In her early legal career Ms. Kerns practiced business and insurance defense litigation. She holds a Juris Doctor from the University of Denver Sturm College of Law and a Bachelor’s degree from the University of Wyoming. The board has determined the Ms. Kerns will be an independent director.

Audit Committee

The board has appointed an audit committee to assist the board of directors in carrying out its responsibility as to the independence and competence of the Company’s independent public accountants. In accordance with the rules of NASDAQ for listed companies, all members of the audit committee are independent members of the board of directors. The audit committee operates pursuant to an audit committee charter which has been adopted by the board of directors to define the committee’s responsibilities. A copy of the audit committee charter is posted on our website, www.royl.com. From his election in 2018 and in 2019, the board determined Robert Vogel qualified as an “audit committee financial expert” as defined in Regulation S-K Item 407(d)(5) of the Securities and Exchange Commission.

In 2019, the members of the audit committee were Robert Vogel, Thomas Gladney and Karen Kerns.

Number of Meetings Held in 2019: 4

All nominated committee members attended all committee meetings in 2019.

Compensation Committee

Purpose: To review and make recommendations to the board of directors on setting the salaries of the company’s officers and the compensation to be paid to members of the board of directors who are not employees of the Company. The compensation committee operates pursuant to a committee charter adopted by the board of directors, a copy of which is posted on our website, www.royl.com.

In 2019, the members of the compensation committee were Karen Kerns, Robert Vogel and Thomas Gladney.

Number of Meetings Held in 2019: 0

No Compensation Committee Interlocks

No compensation committee interlocks as defined in SEC Regulation S-K, Item 407(e)(4) existed between committee members or executive officers of Royale and any other entity during 2019.

Nominations Committee

Purpose: To review and make recommendations to the board of directors concerning the nominees proposed for election of directors at the annual meeting of directors. The Nominations Committee operates pursuant to a committee charter which is posted on our website, www.royl.com.

For 2019, the members of the nominations committee were Thomas Gladney, Robert Vogel and Karen Kerns.

Number of Meetings Held in 2019: 2

f) Executive Compensation

As of December 31, 2018, the Board appointed Johnny Jordan, then current President and Chief Operating Officer, to serve as Chief Executive Officer of the Company. Mr. Jordan also remains as the President and Chief Operating Officer of the Company.

Mr. Jordan will continue to be compensated in accordance with his employment agreement with the Company dated October 10, 2018 and effective March 1, 2018, a copy of which was attached as Exhibit 10.2 to the Company’s Form S-8 filed October 29, 2018 (“Jordan Employment Agreement”). Pursuant to the terms of his employment agreement, Mr. Jordan’s base salary is $250,000 per year, subject to adjustment as set forth therein Mr. Jordan is also eligible for a discretionary annual bonus under the Company’s bonus plan, as determined in the sole and absolute discretion of the Compensation Committee. His employment terms included other standard employment, compensation and confidentiality provisions.

The Employment Agreements included severance provisions that apply upon certain terminations of employment. As a condition to the payment of any severance benefit described below, the Company may require the named executive officer to execute and not revoke a release of claims in favor of the Company. The Employment Agreements also contained certain restrictive covenants, including the obligation not to compete against the Company and a confidentiality requirement. In the event the named executive officer violates these restrictive covenants, the Company may cease paying all severance benefits to the named executive officer and may recover an amount equal to any severance benefits previously paid to the named executive officer under the Employment Agreement.

If the named executive officer’s employment was terminated by the Company other than for cause or termination by the named executive officer in the event of a change of control, the Employment Agreements provide that (1) (i) Mr. Jordan will receive payment in a lump sum of 18 months’ accrued base salary and (2) the Company will pay its portion of COBRA continuation coverage, as well as pay certain costs of continuing medical coverage for Mr. Jordan up to 2 years’, after the expiration of the maximum required period under COBRA; and (3) all granted but unvested awards under the Company’s Long Term Incentive Plan shall immediately vest and related restrictions shall be waived.

If a change of control had occurred and the named executive officer’s employment is terminated without cause, or by the named executive officer with good reason during the period beginning 12 months following the change of control (the “change of control period”), the named executive officers are entitled to the same severance benefits described above, except that the lump sum payment will be: (a) 2 years’ accrued salary and (b) target annual bonus.

The Employment Agreements provide that in the event of a termination of employment by the Company for cause or by the named executive officer without good reason, the named executive officer will be entitled to accrued but unpaid base salary and benefits through the date of termination but will forfeit any other compensation from the Company.

The Employment Agreements also contained customary confidentiality and non-solicitation provisions. The non-solicitation provisions of the Employment Agreements prohibit the named executive officers from soliciting for employment any employee of the Company or any person who was an employee of the Company. This prohibition applies during the named executive officer’s employment with the Company and for up to one year following the termination of his employment and extends to offers of employment for his own account or benefit or for the account or benefit of any other person, firm or entity, directly or indirectly.

Additionally, our equity award agreements under which we have granted restricted stock awards, stock appreciate rights awards and stock option awards contain provisions providing for accelerated vesting upon the death or disability of the named executive officer, upon termination of employment by the Company without cause or termination of employment by the named executive officer for “good reason” and upon a change in control of the Company.

The following table summarizes the compensation of the chief executive officer, chief financial officer and the one other most highly non-executive employees (the “named executives and employees”) of Royale and its subsidiaries during the past three years.

|

Year

|

|

Year

|

|

Salary (3)

|

|

|

Bonus

|

|

|

Option Awards

(1)

|

|

|

All Other

Compensation (2)

|

|

|

Total

|

|

|

Johnny Jordan (5)

|

|

2019

|

|

$

|

255,769

|

|

|

|

|

|

|

|

|

|

|

$

|

-

|

|

|

$

|

255,769

|

|

|

(CEO)

|

|

2018

|

|

$

|

213,141

|

|

|

|

|

|

|

|

|

|

|

$

|

-

|

|

|

$

|

213,141

|

|

|

|

|

2017

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jonathan Gregory (4)

|

|

2019

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

2018

|

|

$

|

72,909

|

|

|

|

|

|

|

|

|

|

|

$

|

9,583

|

|

|

$

|

82,492

|

|

|

|

|

2017

|

|

$

|

242,469

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

$

|

242,469

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Donald Hosmer

|

|

2019

|

|

$

|

189,344

|

|

|

$

|

95,193

|

|

|

|

|

|

|

$

|

18,930

|

|

|

$

|

303,467

|

|

|

(Business Development)

|

|

2018

|

|

$

|

236,331

|

|

|

|

|

|

|

|

|

|

|

$

|

18,930

|

|

|

$

|

255,261

|

|

|

|

|

2017

|

|

$

|

236,331

|

|

|

|

|

|

|

|

|

|

|

$

|

19,090

|

|

|

$

|

255,421

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen Hosmer

|

|

2019

|

|

$

|

230,192

|

|

|

|

|

|

|

|

|

|

|

$

|

18,906

|

|

|

$

|

249,098

|

|

|

(CFO)

|

|

2018

|

|

$

|

230,192

|

|

|

|

|

|

|

$

|

64,954

|

|

|

$

|

18,750

|

|

|

$

|

313,896

|

|

|

|

|

2017

|

|

$

|

230,192

|

|

|

|

|

|

|

|

|

|

|

$

|

18,906

|

|

|

$

|

249,098

|

|

(1) On October 10, 2018, the company entered into an agreement to issue Mr. Hosmer 250,000 options to purchase common stock previously approved by the Board of Directors with an exercise price of $0.31. These options were granted for a period of ten years with a maturity date of October 9, 2028.

(2) All other compensation consists of matching contributions to the Company’s simple IRA plan, except for Donald H. Hosmer and Stephen M. Hosmer, who also received a $12,000 car allowance. This category also includes Board fees for Mr. Gregory.

(3) Salary represents either direct payroll or common stock paid in lieu of taking a cash salary.

(4) Mr. Gregory served as CEO of the Company during 2016, 2017 and part of 2018. Mr. Gregory resigned from the CEO position with the execution of the RMX joint venture.

(5) Mr. Jordan became CEO of the Company in January 2019. Mr. Jordan joined the Company upon the merger with the Matrix entities on March 7, 2018.

Stock Options and Equity Compensation; Outstanding Equity Awards at Fiscal Year End

The following table presents the number of unexercised options at the 2019 year end for each named executive officer. No unvested stock awards were outstanding at the end of 2019.

|

Options

|

|

Name

|

|

Number of

securities underlying

unexercised options (1)

exercisable

|

|

|

|

|

Number of

securities underlying

unexercised options (1)

unexercisable

|

|

Option exercise price

($)

|

|

Option

expiration

date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen M. Hosmer

|

|

|

250,000

|

|

(1

|

)

|

|

|

|

$

|

0.31

|

|

10/09/2028

|

|

(1)

|

On October 10, 2018, the Board of Directors of Royale granted Mr. Stephen M. Hosmer 250,000 options to purchase common stock at an exercise price of $0.31 per share. These options expire on October 9, 2028.

|

Compensation Committee Report

Our executive compensation committee has reviewed and discussed the following Compensation Discussion and Analysis with management and, based on its discussion and review, has recommended that the Compensation Discussion and Analysis be included in this proxy statement.

Members of the Compensation Committee:

Thomas M. Gladney, Karen Kerns (Chair), and Robert Vogel

All members of the compensation committee are independent members of the Board of Directors.

Compensation Discussion and Analysis

Our executive compensation policy is designed to motivate, reward and retain the key executive talent necessary to achieve our business objectives and contribute to our long-term success. Our compensation policy for our executive officers focuses primarily on determining appropriate salary levels and performance-based cash bonuses.

The elements of executive compensation at Royale consist mainly of cash salary and, if appropriate, a cash bonus at year-end. The compensation committee makes recommendations to the board of directors annually on the compensation of the three top executives: Johnny Jordan, Chief Executive Officer, Donald H. Hosmer, Business Development and Stephen M. Hosmer, Chief Financial Officer.

Royale does not provide extensive personal benefits to its executives beyond those benefits, such as health insurance, that are provided to all employees. Donald Hosmer and Stephen Hosmer each receive an annual car allowance.

Policy

The compensation committee’s primary responsibility is making recommendations to the board of directors relating to compensation of our officers. The committee also makes recommendations to the board of directors regarding employee benefits, our defined benefit plans, defined contribution plans, and stock based plans.

Determination

To determine executive compensation, the committee, in December each year, meets with our officers to review our compensation programs, discuss the performance of the company, the duties and responsibilities of each of the officers pay levels and business results compared to others similarly situated within the industry. The committee then makes recommendations to the board of directors for any adjustment to the officers’ compensation levels. The committee does not employ compensation consultants to make recommendations on executive compensation.

Compensation Elements

Base. Base salaries for our executive officers are established based on the scope of their responsibilities, taking into account competitive market compensation paid by our peers. Base salaries are reviewed annually. The salaries we paid to our most highly paid executive officers for the last three years are set forth in the Summary Compensation Table included under Executive Compensation.

Bonus. The compensation committee meets annually to determine the quantity, if any, of the cash bonuses of executive officers. The amount granted is based, subjectively, upon the company’s stock price performance, earnings, revenue, reserves and production. The committee does not use quantifiable metrics for these criteria; but rather uses each in balance to assess the strength of the company’s performance. The committee believes that formulaic approaches to cash incentives can foster an unhealthy balance between short-term and long-term goals. No cash bonuses were paid to executive officers in 2018 or 2017.

Compensation of Directors

In 2018, board members or committee members accrued or received fees for attendance at board meetings or committee meetings during the year. In addition to cash payments, common stock was issued in lieu of compensation or reimbursements. Royale also reimbursed directors for the expenses incurred for their services.

The following table describes the compensation paid to our directors who are not also named executives for their services in 2019.

|

Name

|

|

Fees paid in Cash or Common Stock

|

|

|

Stock awards

|

|

|

Option awards

|

|

|

All Other Compensation

|

|

|

Total

|

|

|

Mel G. Riggs

|

|

$

|

44,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

44,000

|

|

|

Thomas M. Gladney

|

|

$

|

38,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

38,000

|

|

|

Karen Kerns

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Robert Vogel

|

|

$

|

47,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

47,000

|

|

|

Jonathan Gregory

|

|

$

|

33,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

33,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Board Members

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rod Eson (1)

|

|

$

|

25,500

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

25,500

|

|

|

Barry Lasker

|

|

$

|

35,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

35,000

|

|

|

Harry E. Hosmer

|

|

$

|

13,685

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

13,685

|

|

Preferred Stock

Royale has one class of Series B convertible preferred stock outstanding which, it became voting on March 1, 2020, and is immediately convertible to shares of common stock at the option of the shareholder. The number of shares of common stock issuable upon conversion of the preferred.

h) Certain Relationships and Related Transactions

Michael McCaskey and Jeffrey Kerns, each former directors of Royale, have consulting agreements to provide services as directed and at the discretion of the company.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics for our directors and executive officers. The code is posted on our website, www.royl.com.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE IN FAVOR OF ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR.

|

As required by the Sarbanes-Oxley Act of 2002, our Audit Committee is directly responsible for appointment, compensation, retention and oversight of the Company’s independent auditors. We are asking the shareholders to approve the Audit Committee’s recommendation Moss Adams LLP as independent auditors to audit the financial statements of the Company for the 2020 fiscal year. If the shareholders fail to ratify the appointment of the auditors, our Audit Committee will take that into consideration in determining whether to continue the auditing engagement.

Moss Adams LLP was engaged as independent auditors of the Company for the fiscal year ending December 31, 2019. The amounts paid to our independent auditors for the years 2019 and 2018 are provided below under Other Information – Independent Auditors – Auditors’ Fees.

No representatives of Moss Adams LLP are expected to be present at the annual meeting. Although the audit committee has the sole responsibility to appoint the auditors as required under the Securities Exchange Act of 1934, the audit committee welcomes the comments of shareholders and will reconsider the decision whether to appoint Moss Adams LLP as auditors if the shareholders fail to approve their appointment.

|

PROPOSAL 3: ADVISORY VOTE ON EXECUTIVE COMPENSATION

|

Pursuant to Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act”), the proxy rules of the SEC were amended to require that not less frequently than once every three years, a proxy statement for an annual meeting of stockholders for which the proxy solicitation rules of the SEC require compensation disclosure must also include a separate resolution subject to stockholder vote to approve the compensation of the company’s named executive officers disclosed in the proxy statement. The executive officers named in the summary compensation table and deemed to be “named executive officers” are Johnny Jordan and Stephen M. Hosmer. Reference is made to the summary compensation table and disclosures set forth under Executive Compensation in this proxy statement.

As described in this Proxy Statement, our compensation programs are designed to motivate, reward and retain the key executive talent necessary to achieve our business objective and contribute to our long-term success.

The 2019 compensation levels were set having regard to: (a) market rates for executives, (b) executives achieving efficient management of the business and controlling costs, to the extent possible, and (c) demonstrating integrated management teamwork, commitment and effectiveness in reaching the goals set by the board of directors.

The vote on this resolution is not intended to address any specific element of compensation; rather, the vote relates to the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the SEC’s compensation disclosure rules. The vote is advisory, which means that it is not binding on the Company or our board or the compensation committee of our board.

Accordingly, we ask our stockholders to vote on the following resolution at our annual meeting:

RESOLVED, that the stockholders approve the compensation of Royale Energy, Inc.'s named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which includes the Compensation Discussion and Analysis, the compensation tables and related narrative discussion).

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL OF THE COMPENSATION LEVEL OF THE COMPANY’S NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT.

|

|

PROPOSAL 4: ADVISORY VOTE ON FREQUENCY OF EXECUTIVE COMPENSATION VOTE

|

Section 951 of the Dodd-Frank Act also amended the proxy rules of the SEC to require that not less frequently than once every six years, a proxy statement for an annual meeting of stockholders for which the proxy solicitation rules of the SEC require compensation disclosure must also include a separate proposal subject to stockholder vote to determine whether the stockholder vote to approve the compensation of the named executive officers will occur every one, two or three years.

Accordingly, we are seeking a stockholder vote regarding whether the non-binding resolution to approve the compensation of our named executive officers should occur every three years, every two years or every year.

The board of directors asks that you support a frequency of every three years for future non-binding resolutions on compensation of our named executive officers. Stockholders should consider the value of having the opportunity every year to voice their opinion on the Company’s executive compensation through an advisory vote, weighing that against the additional burden and expense to the Company and stockholders of preparing and responding to proposals annually, as well as the other means available to stockholders to provide input on executive compensation.

The company believes that a vote on executive compensation that occurs every three years is the appropriate approach. The Company’s executive compensation program and policies are designed to balance current cash compensation with promoting long-term growth and performance of the Company. Changes in compensation structure, including those suggested by stockholders, would take time to implement, and evaluating the results of any such change would also take time and careful consideration. For these reasons, the board believes that evaluating these programs every three years as opposed to more frequently is more appropriate. The board also believes a three-year period will provide the Company with adequate time to engage stockholders and respond to “say-on-pay” vote results. Before you vote, we encourage you to consider the following:

● Our executive compensation program has consistently and effectively upheld our compensation philosophy by providing competitive pay for our named executive officers only when they have created or preserved shareholder value, creating a balanced focus for our executives on profitability and stability, and assuring that executives drive efficiencies by using capital judiciously.

● We have a consistent record of full and transparent disclosures regarding our compensation programs and the amounts paid to our executive officers.

The board is not bound by this non-binding advisory stockholder vote; however, it will give significant consideration to stockholder preferences on this matter.

The proposal is set forth in the following resolution:

RESOLVED, that a non-binding advisory vote of the stock holders of the Company to approve the compensation of the named executive officers shall be held (a) every year, (b) every two years, or (c) every three years.

The proxy ballot provides stockholders with the opportunity to choose among four options (holding the vote every one, two or three years, or abstaining) and, therefore, stockholders will not be voting to approve or disapprove the recommendation of our Board.

|

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE OPTION OF ONCE EVERY THREE YEARS AS THE PREFERRED FREQUENCY FOR THE ADVISORY VOTE ON EXECUTIVE COMPENSATION.

|

|

PROPOSAL 5: OTHER MATTERS

|

At the date of mailing of this proxy statement, we are not aware of any business to be presented at the annual meeting other than those items previously discussed. The proxy being solicited by the board of directors provides authority for the proxy holders, Stephen M. Hosmer, to use their discretion to vote on such other matters as may lawfully come before the meeting, including matters incidental to the conduct of the meeting, and any adjournment thereof.

OTHER INFORMATION

a) Independent Auditors – Auditors’ Fees

Moss Adams LLP served as the independent auditors to audit the Company’s financial statements for the fiscal year ended December 31, 2019. Previously, SingerLewak LLP served as the independent auditors for the years ended December 31, 2018 and 2017. This is the first annual audit performed by Moss Adams LLP. The aggregate fees billed for the years ended December 31, 2019 and 2018 are as follows, respectively:

|

|

|

2019

|

|

|

2018

|

|

|

|

|

Moss Adams LLP

|

|

|

SingerLewak LLP

|

|

|

Total

|

|

|

SingerLewak LLP

|

|

|

Audit fees (1)

|

|

|

226,000

|

|

|

|

27,650

|

|

|

|

253,650

|

|

|

|

265,062

|

|

|

Audit Related Fees

|

|

|

|

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

13,225

|

|

|

Tax fees (2)

|

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

All other fees (3)

|

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

Total

|

|

|

226,000

|

|

|

|

32,650

|

|

|

|

258,650

|

|

|

|

278,287

|

|

(1) Audit fees are fees for professional services rendered for the audit of Royale Energy’s annual financial statements, reviews of financial statements included in the company’s Forms 10-Q, and reviews of documents filed with the U.S. Securities and Exchange Commission.

(2) Tax fees consist of tax planning, consulting and tax return reviews.

(3) Other fees consist of work on registration statements under the Securities Act of 1933.

The audit committee of Royale Energy has adopted policies for the pre-approval of all audit and non-audit services provided by the company’s independent auditor. The policy requires pre-approval by the audit committee of specifically defined audit and non-audit services. Unless the specific service has been previously pre-approved with respect to that year, the audit committee must approve the permitted service before the independent auditor is engaged to perform it.

No representatives of Moss Adams LLP are expected to be present at the annual meeting. Although the audit committee has the sole responsibility to appoint the auditors as required under the Securities Exchange Act of 1934, the committee welcomes any comments from shareholders on auditor selection or performance. Comments may be sent to the audit committee chair, Robert Vogel, in care of Royale Energy’s executive office, 1870 Cordell Court, Suite 210, El Cajon, California 92020.

B Annual Report

An annual report to shareholders on Form 10-K for the year ended December 31, 2019, accompanies this proxy statement.

c) Method and Cost of Soliciting Proxies

The accompanying proxy is being solicited on behalf of the board of directors of Royale Energy. The expense of preparing, printing and mailing the form of proxy and the material used in the solicitation thereof will be borne by Royale Energy. Proxies may be solicited by officers, directors, and employees of Royale Energy in person, or by mail, courier, telephone or facsimile. In addition, Royale Energy has paid approximately $9,000 to Broadridge for mailing and proxy vote reporting services.

d) Section 16(a) Beneficial Ownership Reporting Requirement

Section 16(a) of the Securities Exchange Act of 1934 and Securities and Exchange Commission regulations require that Royale Energy’s directors, certain officers, and greater than 10 percent shareholders file reports of ownership and changes in ownership with the SEC and the NASD and furnish Royale Energy with copies of all such reports they file. Based solely upon a review of the copies of the forms furnished to Royale Energy, or representations from certain reporting persons that no reports were required, Royale Energy believes that no persons failed to file required reports on a timely basis for 2019.

e) Additional Information

Other reports that we file with the SEC may also be obtained from the SEC’s website, www.sec.gov.

f) Proposals by Shareholders – 2021

Any proposal by a shareholder to be submitted for inclusion in proxy soliciting material for the 2021 annual shareholders meeting must be received by the corporate secretary of Royale Energy no later than February 28, 2021.

g) Other Matters

No proposals have been received from shareholders for inclusion in the proxy statement or action at this annual meeting. Management does not know of any matter to be acted upon at the meeting other than the matters above described. However, if any other matter should properly come before the meeting, the proxy holders named in the enclosed proxy will vote the shares for which they hold proxies in their discretion. Your vote at the annual meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed envelope.

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

Date: August 7, 2020

|

|

Mel Riggs

|

|

|

|

Chairman of the Board

|

ANNUAL MEETING OF SHAREHOLDERS OF

ROYALE ENERGY, INC.

September 14, 2020

e-Consent makes it easy to go paperless. With e-Consent, you can quickly access your proxy material, statements and other eligible documents online, while reducing costs, clutter and paper waste. Enroll today via www.astfinancial.com to enjoy online access.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIAL:

The Notice of Meeting, proxy statement and proxy card

are available at www.sec.gov

Please sign, date and mail

your proxy card in the

envelope provided as soon

as possible.

Please detach along perforated line and mail in the envelope provided.

|

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE

|

X

|

|

1. To elect the nominees described in the proxy statement accompanying this notice as members of Royale’s board of directors, each for a term of one year, expiring at the later of the 2021 annual meeting of shareholders or upon a successor being elected and qualified.

|

|

|

|

☐ FOR ALL NOMINEES

☐ WITHHOLD AUTHORITY FOR ALL NOMINEES

☐ FOR ALL EXCEPT

(see instructions below)

|

NOMINEES

O Thomas Gladney

O Jonathan Gregory

O Johnny Jordan

O Karen Kerns

O Mel G. Riggs

O Robert Vogel

|

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting. This proxy when properly executed will be voted as directed herein by the undersigned shareholder. If no direction is made, this proxy will be voted FOR ALL NOMINEES in Proposal 1.

|

|

|

|

|

|

|

INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold. As shown here: ●

|

|

|

|

|

|

|

|

2. To ratify the selection of Moss Adams

|

|

|

☐ FOR

|

☐ AGAINST

|

☐ ABSTAIN

|

|

|

|

|

|

3. To approve, in a nonbinding advisory vote, the compensation of the Company’s named executive officers

|

|

☐ FOR

|

☐ AGAINST

|

☐ ABSTAIN

|

|

|

|

|

|

4. To determine, in a nonbinding advisory vote, the frequency of the nonbinding resolution to approve the compensation of our named executive officers every year, every two years or every three years

|

|

☐ 1 Year

|

☐ 2 Years

|

☐ 3 Years

|

☐ ABSTAIN

|

|

5. To transact such other business as may properly come before the Annual Meeting and any adjournments thereof.

|

|

☐ FOR

|

☐ AGAINST

|

☐ ABSTAIN

|

|

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. ☐

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Shareholder

|

Date

|

|

|

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

|

ROYALE ENERGY, INC.

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS September 14, 2020

PROXY SOLICITED BY THE BOARD OF DIRECTORS

The undersigned hereby appoints Mel Riggs and Stephen Hosmer as Proxies with the power to appoint their substitutes, and hereby authorizes them to represent and to vote, as designated below, all the shares of common stock of Royale Energy, Inc. held on record by the undersigned on August 14, 2020, at the Annual Meeting of Shareholders to be held at the office of the company, 104 W. Anapamu Street Suite C Santa Barbara, CA 93101 on September 14, 2020 at 9:00 a.m., Pacific Daylight Time.

(Continued and to be signed on the reverse side)

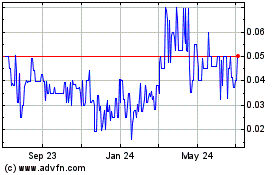

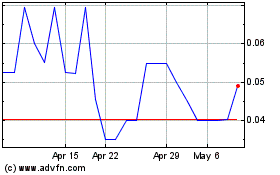

Royale Energy (QB) (USOTC:ROYL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royale Energy (QB) (USOTC:ROYL)

Historical Stock Chart

From Apr 2023 to Apr 2024