Current Report Filing (8-k)

August 10 2020 - 7:31AM

Edgar (US Regulatory)

0001396033

false

0001396033

2020-08-06

2020-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 6, 2020

Lumber Liquidators Holdings, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-33767

|

|

27-1310817

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

4901 Bakers Mill Lane, Richmond, Virginia

|

|

23230

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (804) 463-2000

Not Applicable

(Former name or former address, if changed

since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol:

|

|

Name of exchange on which registered:

|

|

Common Stock, par value $0.001 per share

|

|

LL

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Beginning

in September 2018, goods coming from China were subject to a 10% tariff under Section 301, which was increased to 25% in June 2019.

On November 7, 2019, the United States Trade Representative (“USTR”) ruled on a request made by certain interested

parties, including Lumber Liquidators Holdings, Inc. (the “Company”), and retroactively excluded certain flooring products

imported from China from these Section 301 tariffs. The granted exclusion applied retroactively from the date the tariffs were

originally implemented on September 24, 2018 through August 7, 2020.

On August

6, 2020, the USTR announced its intention not to extend the exclusion pertaining to those certain flooring products imported from

China, and the exclusion expired as of August 7, 2020. Consequently those certain flooring products imported from China are again

subject to the Section 301 tariffs. Currently, approximately 43% of the Company’s merchandise receipts originate from China.

Approximately 10% of the Company’s merchandise receipts already are subject to the Section 301 tariffs; the remaining 33%

will again be subject to the Section 301 tariffs.

Changes in

costs from vendors or due to tariffs do not have an immediate impact to the Company’s statement of operations. There is an

impact to cash flow related to future product purchases, but a delayed impact to gross margin based primarily on the flow of inventory.

The Company

has several approaches to address the impact of the tariffs, including partnering with current vendors to lower costs, altering

its supply chain to source the same or similar products from other countries at lower costs, and adjusting its pricing. The Company

continues to monitor market pricing and promotional strategies to inform and guide its decisions. As the Company examines each

product, it may employ one or more of the above approaches in an effort to mitigate the impacts of these tariffs.

Cautionary Note Regarding

Forward-Looking Statements

This report

includes statements of the Company’s expectations, intentions, plans and beliefs that constitute “forward-looking statements”

within the meanings of the Private Securities Litigation Reform Act of 1995. These statements, which may be identified by words

such as “may,” “will,” “should,” “expects,” “intends,” “plans,”

“anticipates,” “believes,” “thinks,” “estimates,” “seeks,” “predicts,”

“could,” “projects,” “potential” and other similar terms and phrases, are based on the beliefs

of the Company’s management, as well as assumptions made by, and information currently available to, the Company’s

management as of the date of such statements. These statements are subject to risks and uncertainties, all of which are difficult

to predict and many of which are beyond the Company’s control. These risks include, without limitation, the impact on us

of any of the following:

|

|

·

|

an overall decline in the health of the economy, the hard-surface flooring

industry, the housing market and overall consumer spending, including the effects of the COVID-19 pandemic;

|

|

|

·

|

impact on sales, ability to obtain and distribute products, and employee safety

and retention, including the effects of the COVID-19 pandemic;

|

|

|

·

|

obligations related to and impacts of new laws and regulations, including

pertaining to tariffs and exemptions;

|

|

|

·

|

the outcomes of legal proceedings, and the related impact on liquidity;

|

|

|

·

|

obtaining products from abroad, including the effects of COVID-19 and tariffs,

as well as the effects of antidumping and countervailing duties;

|

|

|

·

|

obligations under various settlement agreements and other compliance matters;

|

|

|

·

|

disruption due to cybersecurity threats, including any impacts from a network

security incident;

|

|

|

·

|

inability to open new stores, find suitable locations, and fund other capital

expenditures;

|

|

|

·

|

inability to execute on our key initiatives or such key initiatives do not

yield desired results;

|

|

|

·

|

disruption in our ability to distribute our products, including due to disruptions

from the impacts of severe weather;

|

|

|

·

|

operating stores in Canada and an office in China;

|

|

|

·

|

managing third-party installers and product delivery companies;

|

|

|

·

|

renewing store, warehouse, or other corporate leases;

|

|

|

·

|

having sufficient suppliers;

|

|

|

·

|

our, and our suppliers’, compliance with complex and evolving rules,

regulations, and laws at the federal, state, and local level;

|

|

|

·

|

disruption in our ability to obtain products from our suppliers;

|

|

|

·

|

product liability claims;

|

|

|

·

|

availability of suitable hardwood, including due to disruptions from the impacts

of severe weather;

|

|

|

·

|

sufficient insurance coverage, including cybersecurity insurance;

|

|

|

·

|

access to and costs of capital;

|

|

|

·

|

the handling of confidential customer information, including the impacts from

the California Consumer Privacy Act;

|

|

|

·

|

management information systems disruptions;

|

|

|

·

|

alternative e-commerce offerings;

|

|

|

·

|

our advertising and overall marketing strategy;

|

|

|

·

|

anticipating consumer trends;

|

|

|

·

|

impact of changes in accounting guidance, including the implementation guidelines

and interpretations;

|

|

|

·

|

maintenance of valuation allowances on deferred tax assets and the impacts

thereof;

|

|

|

·

|

stock price volatility; and

|

|

|

·

|

anti-takeover provisions

|

Information

regarding risks and uncertainties is contained in the Company’s reports filed with the SEC, including the Item 1A, “Risk

Factors,” section of the Form 10-Q for the period ended June 30, 2020, and the Form 10-K for the year ended December 31,

2019.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

LUMBER LIQUIDATORS HOLDINGS, INC.

|

|

|

|

|

|

Date: August 10, 2020

|

By:

|

/s/ Nancy A. Walsh

|

|

|

|

Nancy A. Walsh

Chief Financial Officer

(Principal Financial Officer)

|

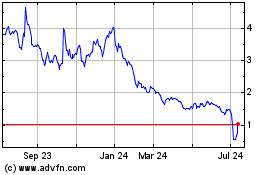

LL Flooring (NYSE:LL)

Historical Stock Chart

From Mar 2024 to Apr 2024

LL Flooring (NYSE:LL)

Historical Stock Chart

From Apr 2023 to Apr 2024