Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-225049

Prospectus Supplement

(to Prospectus dated

July 23, 2018)

Jones

Soda Co.

Up

to 11,315,000 Shares of Common Stock

This

prospectus supplement supplements the prospectus, dated July 23, 2018 (the “Prospectus”), which forms a part of our

Amendment No. 1 to our Registration Statement on Form S-3 on Form S-1 (Registration No. 333-225049). This prospectus supplement

is being filed to update, amend and supplement the information included or incorporated by reference in the Prospectus with the

information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”)

on May 7, 2020 (the “Current Report”). Accordingly, we have attached the Current Report (including exhibits) to this

prospectus supplement.

The

Prospectus and this prospectus supplement relates to the sale of up to 11,315,000 shares of our common stock which may be resold

from time to time by the selling shareholders identified in the Prospectus. The shares of common stock covered by the Prospectus

and this prospectus supplement are issuable upon the conversion of a portion or all

of the convertible subordinated promissory notes (the “Convertible Notes”) issued pursuant to that certain Note Purchase

Agreement dated as of March 23, 2018 among the Company and the purchasers of the Convertible Notes.

We are not selling any common stock under the Prospectus and this prospectus supplement and will not receive any of the proceeds

from the sale or other disposition of shares by the selling shareholders.

This

prospectus supplement should be read in conjunction with the Prospectus. This prospectus supplement updates, amends and supplements

the information included or incorporated by reference in the Prospectus. If there is any inconsistency between the information

in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our

common stock is listed for quotation on the OTCQB quotation system under the symbol “JSDA.” The last bid price of our

common stock on May 6, 2020 was $0.20 per share.

Investing

in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” of the Prospectus, and under similar headings in any amendment or

supplements to the Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal

offense.

The

date of this prospectus supplement is May 7, 2020.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): May 7, 2020

Jones Soda Co.

(Exact Name of Registrant as Specified in Charter)

|

Washington

|

0-28820

|

52-2336602

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

66 South Hanford Street, Suite 150, Seattle, Washington 98134

|

|

(Address of Principal Executive Offices) (Zip Code)

|

(206) 624-3357

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

Item 2.02. Results of Operations and Financial Condition.

On May 7, 2020, Jones Soda Co. (the “Company”) issued a press release announcing its financial results for the first quarter ended March 31, 2020. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The Company will discuss its results for the first quarter ended March 31, 2020 on its scheduled conference call today, May 7, 2020, at 4:30 p.m. Eastern time (1:30 p.m. Pacific time). This call will be webcast and can be accessed by visiting http://public.viavid.com/player/index.php?id=139235 or our website at www.jonessoda.com. Investors may also listen to the call via telephone by dialing (888) 254-3590 (confirmation code: 6655263). In addition, a telephone replay will be available by dialing (844) 512-2921 (confirmation code: 6655263) through May 14, 2020, at 7:30 p.m. Eastern Time.

The information in this Current Report in Item 2.02 and Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Jones Soda Co.

|

|

|

|

|

|

|

|

|

|

Date: May 7, 2020

|

By:

|

/s/ JAMIE COLBOURNE

|

|

|

|

Jamie Colbourne

|

|

|

|

Interim Chief Executive Officer and Acting Principal Financial Officer

|

|

|

|

|

EXHIBIT 99.1

Jones Soda Reports First Quarter 2020 Results

SEATTLE, May 07, 2020 (GLOBE NEWSWIRE) -- Jones Soda Co. (the

“Company”) (OTCQB: JSDA), a leader in the craft soda industry known for its unique branding and authentic connection

to its consumers, announced results for the first quarter ended March 31, 2020.

First Quarter 2020 Financial Summary vs. Year-Ago Quarter

-

Revenue remained flat at $2.8 million.

-

Gross profit as a percentage of sales increased 70 basis points to 20.8% compared

to 20.1%.

-

Net loss was $891,000, or $(0.01) per share, compared to a net loss of $796,000,

or $(0.02) per share.

-

Adjusted EBITDA1 was $(815,000) compared to $(635,000).

Management Commentary

“The team made solid progress during the quarter expanding our brand’s

presence and driving growth across key business segments,” said Interim CEO Jamie Colbourne. “The first quarter reflected

steady demand for our core bottled soda sales, a significant improvement in our fountain business and progress returning Lemoncocco

to growth, despite the expected decline in 7-Select revenue. However, the COVID-19 global pandemic has certainly changed our operating

environment and we are currently pivoting various sales and marketing strategies to adapt to the evolving market. In addition,

we are working to optimize our cost structure and reduce operating expenses where possible.

“Although the long-term effects of COVID-19 are still unknown, we believe

we are taking the necessary steps to help ensure our organization remains operational and equipped to meet the ever-changing needs

of our customers. In fact, despite the pandemic, our business in the grocery channel remains stable. Conversely, our partners in

the food service channel have been hit hard and several conversations with potential customers have been put on hold for the time

being. This channel is a minimal percentage of our overall revenue, but we will remain in active discussions with all current and

potential partners to ensure we are best positioned to meet their needs when restaurant dining returns.

“Given the cancellation of large events throughout North America, including

the Vans Park Series, our marketing team is evaluating and implementing new strategies to continue expanding our presence with

consumers, particularly through significantly increased social media activity. As we move forward, we believe in Jones’ value

proposition as a craft soda that resonates with consumers through unique branding and a better taste, and we anticipate this increased

activity will bolster brand awareness. Although there remains a lot of uncertainty with the COVID-19 pandemic, we are still committed

to returning Jones to profitable growth and believe we are well-positioned to remain a valuable partner to all of our customers

during these challenging times.”

First Quarter 2020 Financial Results

Revenue in the first quarter of 2020 remained flat at $2.8 million compared to the

year-ago quarter. This was primarily the result of a decrease of $206,000, or 66%, in 7-Select revenue due to declining 7-Eleven

store counts, offset by a 3% increase in revenues from Jones’ core bottled soda products and a 51% increase in fountain soda

revenue. Excluding the 7-Select segment, total revenue for the first quarter of 2020 increased from $2.5 million to $2.7 million,

or 7%, as compared to the prior year period, reflecting positive momentum across the Company’s other product lines.

Gross profit as a percentage of sales increased 70 basis points to 20.8% for the

first quarter of 2020 compared to 20.1% in the same year-ago quarter. The improvement was primarily driven by retail price increases

implemented in 2019 for our bottled soda products.

Net loss for the first quarter of 2020 was $891,000, or $(0.01) per share, compared

to a net loss of $796,000, or $(0.02) per share, in the same quarter a year ago.

Adjusted EBITDA1 in the first quarter of 2020 was $(815,000) compared

to $(635,000) in the same quarter a year ago.

At March 31, 2020, cash and cash equivalents totaled $4.9 million compared to $6.0

million at December 31, 2019. Apart from an outstanding convertible debt instrument, the Company did not have any substantial debt

and is actively evaluating a new line of credit.

__________________________________________________________________________________________________________________________________

1Adjusted EBITDA is defined as net loss from operations before interest expense, interest income, taxes, depreciation,

amortization and stock-based compensation and is a non-GAAP measure (reconciliation provided below).

Conference Call

Jones Soda will hold a conference call today at 4:30 p.m. Eastern time to discuss

its results for the first quarter ended March 31, 2020.

Date: Thursday, May 7, 2020

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

Toll-free dial-in number: 1-888-254-3590

International dial-in number: 1-323-994-2082

Conference ID: 6655263

Please call the conference telephone number 5-10 minutes prior to the start time.

An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact

Gateway Investor Relations at 1-949-574-3860.

The conference call will be broadcast live and available for replay here

and via the investor relations section of the Company’s website at www.jonessoda.com.

A replay of the conference call will be available after 7:30 p.m. Eastern time on

the same day through May 14, 2020.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 6655263

Presentation of Non-GAAP Information

This press release contains disclosure of the Company's Adjusted

EBITDA, which is a not a United States Generally Accepted Accounting Principle (“GAAP”) financial measure. The difference

between Adjusted EBITDA (a non-GAAP measure) and Net Loss (the most comparable GAAP financial measure) is the exclusion of interest

expense, income tax expense, depreciation and amortization expense and stock-based compensation. We have included a reconciliation

of Adjusted EBITDA to Net Loss in our Non-GAAP Reconciliation in this press release. This non-GAAP measure should be considered

in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP. Adjusted

EBITDA has certain limitations in that it does not take into account the impact of certain expenses to our consolidated statements

of operations. In addition, because Adjusted EBITDA may not be calculated identically by all companies, the presentation here may

not be comparable to other similarly titled measures of other companies. We believe that Adjusted EBITDA provides useful information

to investors about the Company's results attributable to operations, in particular by eliminating the impact of non-cash charges

related to stock-based compensation, amortization and depreciation that is consistent with the manner in which we evaluate the

Company's performance. These adjustments to the Company's GAAP results are made with the intent of providing a more complete understanding

of the Company's underlying operational results and provide supplemental information regarding our current ability to generate

cash flow. This non-GAAP financial measure is not intended to be considered in isolation or as a replacement for, or superior to

net loss as an indicator of the Company's operating performance, or cash flow, as a measure of its liquidity. Adjusted EBITDA should

be reviewed in conjunction with Net Loss as calculated in accordance with GAAP.

About Jones Soda Co.

Headquartered in Seattle, Washington, Jones Soda Co.® (OTCQB: JSDA)

markets and distributes premium beverages under the Jones® Soda and Lemoncocco® brands. A leader

in the premium soda category, Jones Soda is made with pure cane sugar and other high-quality ingredients, and is known for packaging

that incorporates ever-changing photos sent in from its consumers. Jones’ diverse product line offers something for everyone

– pure cane sugar soda, zero-calorie soda and Lemoncocco non-carbonated premium refreshment. Jones is sold across North America

in glass bottles, cans and on fountain through traditional beverage outlets, restaurants and alternative accounts. For more information,

visit www.jonessoda.com or www.myjones.com or www.drinklemoncocco.com.

Forward-Looking Statements Disclosure

Certain statements in this press release are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all passages containing

words such as “will,” “aims,” “anticipates,” “becoming,” “believes,”

“continue,” “estimates,” “expects,” “future,” “intends,” “plans,”

“predicts,” “projects,” “targets,” or “upcoming.” Forward-looking statements also

include any other passages that are primarily relevant to expected future events or that can only be evaluated by events that will

occur in the future. Forward-looking statements are based on the opinions and estimates of management at the time the statements

are made and are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated

or implied in the forward-looking statements. Factors that could affect the Company's actual results, including its financial condition

and results of operations and its ability to continue as a going concern, include, among others: its ability to successfully execute

on its growth strategies and operating plans for the future; the ongoing negative impact that the novel coronavirus (COVID-19)

pandemic has had and will likely continue to have on the Company’s business operations and sales; the Company’s ability

to effectively utilize the proceeds from its 2019 strategic financing from HeavenlyRx; the Company’s ability to manage operating

expenses and generate sufficient cash flow from operations; the Company’s ability to create and maintain brand name recognition

and acceptance of its products; the Company’s ability to execute its marketing strategies, especially in light of the closures

and delays caused by the COVID-19 pandemic; the Company’s ability to compete successfully against much larger, well-funded,

established companies currently operating in the beverage industry generally and in the craft beverage segment specifically; the

Company’s ability to respond to changes in the consumer beverage marketplace, including potential reduced consumer demand

due to health concerns (including obesity) and legislative initiatives against sweetened beverages (including the imposition of

taxes); its ability to develop and launch new products and to maintain brand image and product quality; the Company’s ability

to maintain and expand distribution arrangements with distributors, independent accounts, retailers or national retail accounts;

the Company’s ability to maintain its relationship with 7-Eleven; its ability to manage inventory levels and maintain relationships

with manufacturers of its products; its ability to maintain a consistent and cost-effective supply of raw materials and flavors

and manage the impact of the COVID-19 pandemic on its supply chain; the Company’s ability to develop CBD-infused beverages;

its ability to attract, retain and motivate key personnel; its ability to protect its intellectual property; the impact of future

litigation and the Company’s ability to comply with applicable regulations; fluctuations in freight and fuel costs; the impact

of currency rate fluctuations; its ability to access the capital markets for any future equity financing and to manage the impact

that the COVID-19 pandemic may have on the Company’s ability to access capital; the Company’s ability to maintain disclosure

controls and procedures and internal control over financial reporting; dilutive and other adverse effects from future potential

securities issuances; and any actual or perceived limitations by being traded on the OTCQB Marketplace. More information about

factors that potentially could affect the Company’s operations or financial results is included in its most recent annual

report on Form 10-K for the year ended December 31, 2019 filed with the Securities and Exchange Commission (“SEC”)

on March 30, 2020 and in the other reports filed with the SEC since that that date. Readers are cautioned not to place undue reliance

upon these forward-looking statements that speak only as to the date of this release. Except as required by law, the Company undertakes

no obligation to update any forward-looking or other statements in this press release, whether as a result of new information,

future events or otherwise.

Investor Relations Contact

Cody Slach

Gateway Investor Relations

1-949-574-3860

JSDA@gatewayir.com

finance@jonessoda.com

JONES SODA CO.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share data)

|

|

|

|

|

|

|

|

|

|

Three months ended March 31,

|

|

|

|

2020

|

|

|

2019

|

|

|

|

|

(In thousands, except share data)

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

Revenue

|

$

|

2,792

|

|

|

$

|

2,824

|

|

|

|

Cost of goods sold

|

|

2,210

|

|

|

|

2,257

|

|

|

|

Gross profit

|

|

582

|

|

|

|

567

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

Selling and marketing

|

|

753

|

|

|

|

615

|

|

|

|

General and administrative

|

|

708

|

|

|

|

658

|

|

|

|

Total operating expenses

|

|

1,461

|

|

|

|

1,273

|

|

|

|

Loss from operations

|

|

(879

|

)

|

|

|

(706

|

)

|

|

|

Interest income

|

|

17

|

|

|

|

-

|

|

|

|

Interest expense

|

|

(38

|

)

|

|

|

(89

|

)

|

|

|

Other income, net

|

|

13

|

|

|

|

2

|

|

|

|

Loss before income taxes

|

|

(887

|

)

|

|

|

(793

|

)

|

|

|

Income tax expense, net

|

|

(4

|

)

|

|

|

(3

|

)

|

|

|

Net loss

|

$

|

(891

|

)

|

|

$

|

(796

|

)

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted

|

$

|

(0.01

|

)

|

|

$

|

(0.02

|

)

|

|

|

Weighted average basic and diluted common shares outstanding

|

|

61,665,435

|

|

|

|

41,592,851

|

|

|

|

|

|

|

|

|

|

|

JONES SODA CO.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

|

|

|

|

|

|

|

|

|

|

March 31, 2020

|

|

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

ASSETS

|

|

|

(In thousands, except share data)

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

4,904

|

|

|

$

|

5,969

|

|

|

|

Accounts receivable, net of allowance of $99 and $44

|

|

|

2,024

|

|

|

|

1,573

|

|

|

|

Inventory

|

|

|

2,293

|

|

|

|

1,788

|

|

|

|

Prepaid expenses and other current assets

|

|

|

169

|

|

|

|

310

|

|

|

|

Total current assets

|

|

|

9,390

|

|

|

|

9,640

|

|

|

|

Fixed assets, net of accumulated depreciation of $493 and $484

|

|

|

153

|

|

|

|

162

|

|

|

|

Other assets

|

|

|

33

|

|

|

|

33

|

|

|

|

Right of use lease asset

|

|

|

547

|

|

|

|

17

|

|

|

|

Total assets

|

|

$

|

10,123

|

|

|

$

|

9,852

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

1,234

|

|

|

$

|

554

|

|

|

|

Lease liability, current portion

|

|

|

96

|

|

|

|

18

|

|

|

|

Accrued expenses

|

|

|

639

|

|

|

|

663

|

|

|

|

Taxes payable

|

|

|

1

|

|

|

|

10

|

|

|

|

Total current liabilities

|

|

|

1,970

|

|

|

|

1,245

|

|

|

|

Convertible subordinated notes payable, net

|

|

|

1,346

|

|

|

|

1,333

|

|

|

|

Accrued interest expense

|

|

|

169

|

|

|

|

147

|

|

|

|

Lease liability, net of current portion

|

|

|

451

|

|

|

|

-

|

|

|

|

Total liabilities

|

|

|

3,936

|

|

|

|

2,725

|

|

|

|

Shareholders’ equity (deficit):

|

|

|

|

|

|

|

|

|

Common stock, no par value:

|

|

|

|

|

|

|

|

Authorized — 100,000,000; issued and outstanding shares — 61,667,668

shares and 61,566,076 shares, respectively

|

|

|

73,811

|

|

|

|

73,773

|

|

|

|

Accumulated other comprehensive income

|

|

|

255

|

|

|

|

342

|

|

|

|

Accumulated deficit

|

|

|

(67,879

|

)

|

|

|

(66,988

|

)

|

|

|

Total shareholders’ equity

|

|

|

6,187

|

|

|

|

7,127

|

|

|

|

Total liabilities and shareholders’ equity

|

|

$

|

10,123

|

|

|

$

|

9,852

|

|

|

|

|

|

|

|

|

|

|

|

JONES SODA CO.

NON-GAAP RECONCILIATION

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

Three months ended March 31,

|

|

|

|

|

2020

|

|

|

|

2019

|

|

|

|

GAAP net loss

|

$

|

(891

|

)

|

|

$

|

(796

|

)

|

|

|

Stock based compensation

|

|

41

|

|

|

|

61

|

|

|

|

Interest income

|

|

(17

|

)

|

|

|

-

|

|

|

|

Interest expense

|

|

38

|

|

|

|

89

|

|

|

|

Income tax expense, net

|

|

4

|

|

|

|

3

|

|

|

|

Depreciation and Amortization

|

|

10

|

|

|

|

8

|

|

|

|

Non-GAAP Adjusted EBITDA

|

$

|

(815

|

)

|

|

$

|

(635

|

)

|

|

|

|

|

|

|

|

|

|

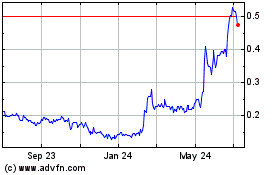

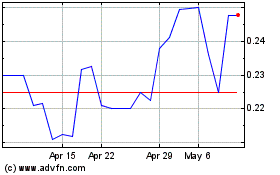

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2023 to Apr 2024