3M Cuts More Jobs as U.S. Demand Falls -- 4th Update

January 28 2020 - 5:26PM

Dow Jones News

By Austen Hufford

3M Co. posted lower revenue in significant U.S. markets and set

plans for fresh layoffs, the latest manufacturer to exhibit signs

of strain at a time of weakness for the industrial economy.

3M sells its diverse array of products in a wide swath of the

economy, including to consumers, offices, manufacturers and

hospitals.

While the U.S. economy remains strong overall, the manufacturing

sector has contracted for five consecutive months through

December.3M's results on Tuesday showed this divergence. Units that

largely serve the industrial economy posted revenue declines, while

sales in units serving consumers and the health-care industry were

flat.

"The industrial-production-related businesses are a little lower

growth, " 3M Chief Executive Mike Roman said in an interview.

Shares in 3M fell 5.7% to $165.58.

Slow rates of domestic car production, lower shale-drilling

activity and slack demand from China have all weighed on U.S.

manufacturers. Boeing Co.'s decision to first slow and then suspend

production of its 737 MAX jetliner has also been working its way

through the company's supply chain. New orders for capital goods, a

proxy for business investment, declined in December from the

previous month, the Commerce Department said Tuesday.

The maker of products as diverse as Post-it Notes and industrial

sandpaper reported a fourth-quarter revenue decline of 2.6% when

excluding currency movements and acquisitions, including a 2.9%

drop in the U.S. 3M said it was eliminating 1,500 jobs as part of a

continuing restructuring to streamline its global operations. The

company, based in St. Paul, Minn., employs 96,000 people and said

last April that it was cutting 2,000 jobs in underperforming

business lines, such as energy and electronics.

The cuts will save the company as much as $120 million a year,

3M said. It booked a $134 million restructuring charge in the

fourth quarter related to the cuts.

3M also said Tuesday that it received a grand-jury subpoena in

late December related to chemical discharges from a facility in

Decatur, Ala. 3M said chemicals might have been released from that

plant into the Tennessee River, and that it was cooperating with

the investigation by the U.S. attorney's office for the northern

district of Alabama.

The U.S. attorney's office said it doesn't confirm or deny

potential investigations.

3M said sales in mainland China and Hong Kong rose 0.8% for the

latest quarter, even as the economy slows there. As one of the

largest makers of medical face masks, the company has increased

production to meet a surge in demand because of the global outbreak

of a coronavirus in China.

"We are ramping up production in all of our facilities around

the world, including in China, to full capacity. Twenty-four-seven

production to meet the demand," Mr. Roman said.

At the same time, 3M said extended shutdowns at factories and

other businesses in China could weigh on demand for other 3M

products. The outbreak gained momentum this month, so the impact to

the company's fourth quarter, which ended in December, was

limited.

Sales in 3M's safety and industrial business fell 2.8% to $2.8

billion for the quarter, and sales in its transportation and

electronics business fell 5.9% -- excluding currencies and

acquisitions. Revenue also declined in 3M's aerospace unit, which

makes industrial glues and other products for plane makers. Revenue

in the company's health-care business declined 0.2%, and increased

0.2% in its consumer unit.

The company said sales in the latest quarter rose to $8.11

billion overall from $7.95 billion a year earlier, in part because

of 3M's October completion of its $4.3 billion acquisition of

wound-care company Acelity Inc.

Analysts had expected revenue of $8.11 billion in the quarter,

according to FactSet. 3M reported a profit of $969 million,

compared with $1.35 billion a year earlier. Adjusted earnings were

$1.95 a share. Analysts polled by FactSet were expecting adjusted

earnings of $2.11 a share.

For 2020, the company said it expects earnings between $9.30 and

$9.75 a share. Analysts were expecting the company to earn $9.59 a

share in 2020.

Amber Burton contributed to this article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

January 28, 2020 17:11 ET (22:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

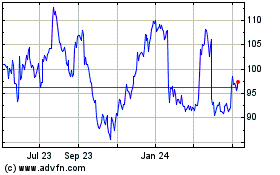

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

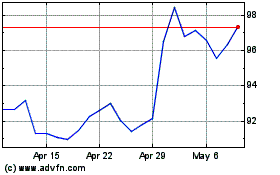

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024