Biogen, Reversing Itself, to Seek FDA OK for Alzheimer's Drug -- Update

October 22 2019 - 8:47AM

Dow Jones News

By Colin Kellaher

Biogen Inc. said it plans to pursue regulatory approval for

aducanumab, an investigational treatment for early Alzheimer's

disease, after pulling the plug on phase 3 studies of the drug

earlier this year.

Shares of Biogen surged 40% in premarket trading, putting the

company on track to add more than $16 billion in market value. When

the company and partner Eisai & Co. in March said they would

terminate the late-stage studies, Biogen lost about $18 billion in

market value.

The Cambridge, Mass., biopharmaceutical company said Tuesday

that the reversal follows an analysis of a larger dataset from the

studies that showed aducanumab reduced clinical decline in patients

with early Alzheimer's disease as measured by the prespecified

primary and secondary endpoints.

Biogen said it conducted the new analysis in consultation with

the U.S. Food and Drug Administration, and it included data that

became available after the prespecified futility analysis. In

March, the company and Eisai determined the drug would likely fail

to help patients.

The company said that based on discussions with the FDA, it

plans to file a biologics license application for aducanumab in

early 2020 and said it would continue talks with regulatory

authorities in international markets, including Europe and

Japan.

The reversal brings renewed hope to the hypothesis that has

informed much of the recent research and investment into potential

Alzheimer's drugs: that the buildup in the brain of a sticky

substance called Beta amyloid plays a pivotal role in the

disease.

Drugs like aducanumab have targeted the sticky tangles with the

goal of slowing or halting the progression of the disorder. But a

number of drugs developed with the idea in mind have failed.

Aducanumab was an important bet for Biogen because the biotech

company has been looking to Alzheimer's disease treatment to fuel

future revenue growth, especially as competition eats into sales of

its core franchise of drugs treating multiple sclerosis.

Many investors were also taken by the company's wager on

Alzheimer's. The massive market opportunity treating the

memory-robbing disease -- potentially worth billions of dollars a

year in sales -- as well as some promising data from early-stage

studies attracted new investors to the company and helped drive up

its share price.

Excited, too, by the potential opportunity, Biogen invested

heavily in recent years to enroll thousands of patients in

late-stage studies of aducanumab, some analysts said.

Biogen and Eisai, which had worked jointly on developing

aducanumab since October 2017, had been studying it in the early

stage of Alzheimer's. Researchers hypothesized that using the drug

early in the disease might be a more effective avenue for

amyloid-targeting therapy after previous such treatments at later

stages had failed.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

October 22, 2019 08:32 ET (12:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

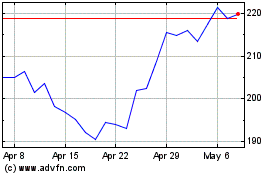

Biogen (NASDAQ:BIIB)

Historical Stock Chart

From Aug 2024 to Sep 2024

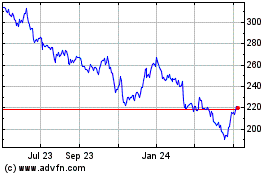

Biogen (NASDAQ:BIIB)

Historical Stock Chart

From Sep 2023 to Sep 2024