By Peg Brickley and Katherine Blunt

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 24, 2019).

A bondholder group's bid to take control of PG&E Corp. by

paying off massive wildfire damage claims threatens to derail the

company's plan for the mega-billion-dollar bankruptcy case as the

battle over California utility intensifies.

PG&E has a chapter 11 exit plan and backing from major

shareholders. Meanwhile, bondholders led by Paul Singer's Elliott

Management Corp. have an exit plan of their own, which is backed by

victims of the fires that put the company into bankruptcy.

The bondholder plan would damage the company's shareholders. But

the alliance with fire victims in a case that was filed to tackle

$30 billion or more in wildfire damages is a political and

strategic coup for the bondholders. Bondholders, a group comprising

hedge funds, buyout firms and institutional investors, have been in

talks for months attempting to rally wide-ranging public

support.

It isn't game over yet for PG&E's existing leaders, which

have, at least for a few weeks, the sole right to shape the chapter

11 plan that goes out to creditors for vote.

In early October, Judge Dennis Montali will decide whether to

leave PG&E in charge of the proceeding, or open up the field to

competition.

Tom Dalzell, business manager of International Brotherhood of

Electrical Workers Local 1245, said the union supports terminating

exclusivity and generally favors the bondholders' plan for the

protections it offers union members and the structure of the

company. The union had negotiated with the bondholders to ensure

retirement benefits are paid in full under the reorganization plan

and prevent the company from selling parts of its business to

cities launching public takeover bids.

"They've made a much greater effort to communicate with us than

the equity group," Mr. Dalzell said. "They've explained their

position, answered our questions and generally given us the things

that we've asked for."

As shifting alliances shake up the power dynamic of the chapter

11 proceeding that PG&E launched in January, California's

largest utility is struggling to keep its footing.

In a divide-and-conquer move, PG&E on Sept. 13 settled with

Baupost Group LLC and insurance companies seeking repayment for

what they spent on the blazes. The group that had been standing

shoulder-to-shoulder with fire victims, demanding full payment from

PG&E, is now pledged to support the company's plan.

Fire victims turned to Elliott, a hedge fund with a reputation

for sharp tactics in bankruptcy court, and a week after the

insurance settlement was announced, the bondholders and fire

victims announced they had joined forces to challenge PG&E for

control of the bankruptcy.

The combination of the fire victims and the bondholders was a

marriage of convenience, several representatives for the victims

told The Wall Street Journal. But the victims were willing to look

past their reservations if it results in PG&E improving its

offer of about $8.4 billion to people who lost homes and loved ones

in the fires, they said.

TURN, a nonprofit that advocates for PG&E ratepayers, on

Friday added its voice to the call for competition over a chapter

11 plan for the utility.

Monday, both sides flexed their financial muscle, with PG&E

and the bondholders each claiming to have lined up the funding

needed for their chapter 11 plans. Along with Elliott and Pacific

Investment Management Co., the bondholder group has signed up

support from financial giants Apollo Capital Management, and

Oaktree Capital Management, along with other big investment firms,

many of them based in California.

PG&E says it has equity commitments of $14 billion from a

broad group that includes existing shareholders, bondholders and

some new investors. The company's plan, however, could leave

PG&E with at least $5 billion more debt than the bondholder

plan, perhaps more, according to people who reviewed the terms.

"Their strategy is twofold. It's to use creative accounting and

the bankruptcy laws to get this done," said David Frank of Corso

Capital Management in New York, which trades PG&E stock.

"Creative accounting is using multiple levels of leverage. The

bankruptcy law is that, as long as the numbers add up, we can

maintain exclusivity and no one else can come in."

Bondholders want to buy most of PG&E in a deal partially

financed with debt, and give the rest to the fire victims in

partial payoff for their claims. The bondholders are also providing

cash -- $12 billion earmarked for fire victims, including insurance

claims holders and individual victims -- under the plan. There is

cash for bondholders, as well, fees of more than $600 million for

financing PG&E's bankruptcy exit, and hundreds of millions of

dollars more interest than PG&E intends to give them if its

plan prevails.

Shareholders -- including Boston hedge fund Baupost Group --

that have bet hundreds of millions of dollars that PG&E can

exit bankruptcy without sacrificing equity would take a hit under

the bondholders' proposal. Shareholders would get the opportunity

to invest in about 5% of the revamped PG&E, under the

bondholder plan.

In response to the Elliott-led group's plan, PG&E said

Monday that its chapter 11 plan "will continue to be updated as

developments require, including to reflect any additional

settlements or the outcome of the ongoing wildfire claims

proceedings."

The wildfire claims proceedings involve three separate court

proceedings to determine how much PG&E should have to pay for

the blazes. A state court jury trial will test whether victims can

hold PG&E to account for one of the most disastrous fires, the

Tubbs Fire of 2017, while a federal judge conducts hearings on

damages and Judge Montali, in bankruptcy court, handles some of the

legal questions.

The bondholder plan halts those proceedings in favor of a

settlement. Advocates say the end of hostilities with fire victims

ensures that PG&E will get out of bankruptcy in time to meet a

June 30, 2020, deadline to participate in a state fund meant to

cushion utilities against the financial damage of wildfires.

Patrick Thomas contributed to this article.

Write to Peg Brickley at peg.brickley@wsj.com and Katherine

Blunt at Katherine.Blunt@wsj.com

(END) Dow Jones Newswires

September 24, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

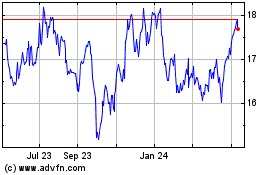

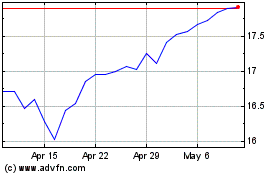

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024