Fannie, Freddie to Consider Alternatives to FICO Scores--Update

August 13 2019 - 2:58PM

Dow Jones News

By Andrew Ackerman

WASHINGTON -- One firm's dominance over the credit scores used

to vet many U.S. mortgages is getting a shake-up.

Fannie Mae and Freddie Mac, two mortgage-finance firms that back

nearly half of U.S. mortgages, will have to consider credit-score

alternatives to Fair Isaac Corp.'s FICO score when determining a

mortgage applicant's creditworthiness, under a new rule completed

on Tuesday by the mortgage-finance giants' federal overseer.

The move by the Federal Housing Finance Agency is seen as a win

for VantageScore, a credit-score system by VantageScore Solutions

LLC, which is owned by the three large credit-reporting firms:

Equifax Inc., TransUnion and Experian PLC.

"One of my priorities is to ensure that the American people have

a safe and sound path to sustainable homeownership, which requires

tools to accurately measure risk," FHFA Director Mark Calabria said

in a written statement. "The final rule we are publishing today is

an important step toward achieving that goal."

The measure is required by regulatory rollback legislation

signed into law last year.

(More)

AnnaMaria Andriotis contributed to this article.

(END) Dow Jones Newswires

August 13, 2019 14:43 ET (18:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

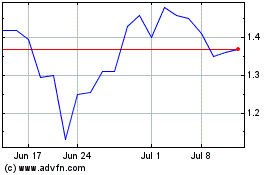

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

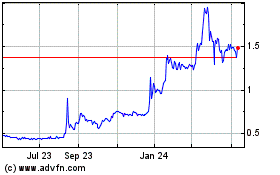

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024