Stocks: Investors Shrug Off Some Earnings Misses -- WSJ

July 16 2019 - 3:02AM

Dow Jones News

By Corrie Driebusch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 16, 2019).

Second-quarter earnings are shaping up to be a challenge, but

the stock trajectories of some companies that have already reported

show that investors are forgiving.

A handful of companies that reported disappointing earnings in

June are now in a surprising place -- their shares are near or

above their levels prior to reporting results. Shares of Conagra

Brands Inc., General Mills Inc. and Broadcom Inc. all tumbled as a

result of lowered guidance, squeezed profits or struggling sales.

They've since bounced back, suggesting to some analysts that the

market may be understanding of the global growth and trade issues

plaguing many U.S. companies.

"Some believe the 'earnings apocalypse' is upon us, with

negative [earnings per share] revisions on the rise. However, the

initial reactions...suggest this season is shaping up to be a time

of forgiveness," wrote Wells Fargo Securities senior analyst

Christopher Harvey in a note on Monday.

Shares of food makers Conagra and General Mills both fell in

late June.

Conagra's stock dropped 12% to $25.43 on June 27, one of the

worst performers in the S&P 500 that day, as its results were

hurt by expenses for steel for cans, as well as competitive

pressures.

General Mills' stock declined 4.5% to $51.31 on June 26 after

the Minneapolis-based company reported a decline in its snacks

business and flat sales of cereal and yogurt.

Broadcom in mid-June also struggled after it blamed trade

tensions between the U.S. and China for slowing sales in its

wireless business and weaker demand.

Its stock fell 5.6% to $265.93 on June 14, after reporting

disappointing earnings the prior afternoon.

Since then, Broadcom's stock is back above $288 a share, up an

additional 1% on Monday.

Meanwhile, Conagra's stock has clawed back much of its

earnings-day decline, rising more than 8% from its June 27 close.

General Mills is trading about a dollar below its closing price the

day before it reported earnings in late June.

According to Wells Fargo, this bounceback toward pre-earnings

release prices is good news, and suggests investors are prepared

"to look through bad news."

Write to Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

July 16, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

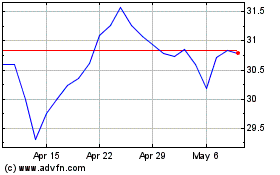

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Aug 2024 to Sep 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Sep 2023 to Sep 2024