Current Report Filing (8-k)

June 20 2019 - 8:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report:

June 20, 2019

(Date of earliest event reported)

The Kroger Co.

(Exact name of registrant as specified in its charter)

|

Ohio

|

|

No. 1-303

|

|

31-0345740

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1014 Vine Street

Cincinnati, OH 45202

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

(513) 762-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Common Stock $1 par value

|

|

KR

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02

Results of Operations and Financial Condition.

On June 20, 2019, The Kroger Co. (NYSE:KR) issued a press release announcing its first quarter 2019 results. Attached hereto as Exhibit 99.1, and filed herewith, is a copy of that release.

Item 7.01

Regulation FD Disclosure.

Kroger’s Alternative Profit streams are expected to contribute an estimated incremental $100 million in operating profit in 2019, compared to 2018. This is in line with year 2 Restock Kroger expectations. Kroger expects to continue to drive Alternative Profit growth, which will now be reflected primarily in total sales, flowing through gross margin and continuing to positively contribute to operating profit. (See discussion of reclassification below.)

By leveraging unique consumer-driven capabilities to create additional value for customers and shareholders, Kroger is creating a virtuous circle built upon the rich collection of proprietary data generated by the grocery business. Data gathered from the 96 percent of transactions tethered to the loyalty card is used to improve the customer experience and create new margin rich, asset-light business opportunities.

Kroger’s ecosystem fuels the growth of adjacent alternative profit streams like Kroger Personal Finance, customer data insights, and media businesses that are essential components of Restock Kroger. These businesses comprise a significant portion of Kroger’s overall alternative profit portfolio. They are dependent on a core supermarket business to deliver sustainable, long-term growth and profitability.

Ventures at various stages of incubation are also a component of the Alternative Profit portfolio, such as the recently-announced collaboration with Lindsay Goldberg to form PearlRock Partners, a platform to identify, invest in and help grow the next generation of leading consumer product brands. Initiatives like this are expected to have a minimal impact during Restock Kroger, but to become more meaningful beyond 2020.

Kroger Personal Finance

.

Kroger Personal Finance (“KPF”) includes a broad array of consumer financial products and services including prepaid gift cards, lottery, money services and credit card services. These services are embedded within Kroger’s core supermarket operations and are primarily accounted for in total sales. Kroger is pursuing the opportunity to grow the KPF business through new product offerings and expansion of customer utilization rates which were 26.8 percent in 2018. This rate reflects the percentage of Kroger households that use at least one KPF service. Household utilization rates grew by 40 basis points in the first quarter of 2019 compared to the first quarter of 2018.

Media

.

Kroger Media enables advertisers to connect customers to value and content, both on property (ex. Kroger.com) and off property (non-Kroger digital sites), in a personalized way by utilizing our proprietary data. 84.51° offers national brands and their advertising agencies the opportunity to bridge media directly into commerce and precisely measure ad performance. Third-party entities do not have access to identifiable customer data. Media dollars are primarily accounted for in total sales, except in certain circumstances when they are netted against merchandise costs (“COGS”), similar to trade promotion. Growth

2

in media revenue has been driven by the continuous release of new ad units and increased digital traffic, with hundreds of consumer packaged goods companies investing in Kroger media assets.

Customer Data Insights

.

Customer Data Insights allow clients, advertisers and other businesses to better understand shopper behavior through retail performance measures. In turn, the insights can be used to accelerate category and brand performance. Third-party entities do not have access to identifiable customer data.

Reclassification

.

Products and services related primarily to Kroger Personal Finance and Media, which were historically accounted for as an offset to operating, general and administrative expenses, starting with the Form 10-Q for the quarter ended May 25, 2019, are now classified as a component of sales, except for certain amounts in Media, which are netted against COGS. These prior-year amounts have been reclassified to conform to current-year presentation, which is consistent with Restock Kroger and view of the products and services as part of our core business strategy. This is more consistent with industry practice.

The information furnished in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

The statements above contain certain statements that constitute “forward-looking statements” about the future performance, growth and profitability of the company, contributions, growth and other expectations about the company’s Alternative Profit Streams, the performance and success of

Restock Kroger

, including the contributions of Kroger Personal Finance, customer data insights, media businesses and other recently announced ventures to

Restock Kroger,

and the impact of the reclassification of Alternative Profit Streams on the company’s financial statements. These statements are based on management’s assumptions and beliefs in light of the information currently available to it. The remarks contain certain forward-looking statements about the future performance of the Company. These statements are based on management’s assumptions and beliefs in light of the information currently available to it. Such statements are indicated by words or phrases such as “accelerate,” “contribute,” “create,” “deliver,” “drive,” “estimate,” “expansion,” “expect,” “growth,” “meaningful,” “opportunity” and “pursuing,” and similar words used to discuss the company’s future expectations. Various uncertainties and other factors could cause actual results to differ materially from those contained in the forward-looking statements. These include the specific risk factors identified in “Risk Factors” and “Outlook” in our annual report on Form 10-K for our last fiscal year and any subsequent filings. Our ability to achieve these goals may also be affected by our ability to manage the factors identified above. Our ability to execute our financial strategy may be affected by our ability to generate cash flow.

Caution should be taken not to place undue reliance on the Company’s forward-looking statements, which represent the Company’s views only as of the date this report is filed. The Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release dated June 20, 2019

|

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

The Kroger Co.

|

|

|

|

|

|

|

|

June 20, 2019

|

By:

|

/s/ Christine S. Wheatley

|

|

|

|

Christine S. Wheatley

|

|

|

|

Group Vice President, Secretary and General Counsel

|

5

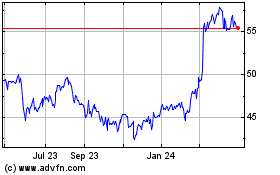

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

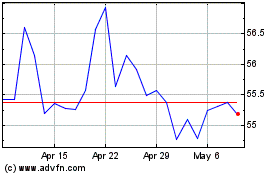

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024