Morphic Holding Sets IPO at 5 Million Shares; Sees Pricing at $14-$16 Apiece

June 14 2019 - 8:04AM

Dow Jones News

By Colin Kellaher

Morphic Holding Inc., a biopharmaceutical company backed by

several large drug makers, on Friday said it will sell five million

shares in its initial public offering, with an expected price range

of $14 to $16 each.

At the $15 midpoint of that range, the Waltham, Mass., company

said it expects net proceeds of about $67 million, or roughly $77.4

million if the underwriters exercise their option to buy an

additional 750,000 shares.

Morphic said it will have about 29.3 million shares outstanding

after the IPO and overallotment option, for a valuation of about

$440.2 million at the $15 midpoint.

Morphic, which is working to develop oral small-molecule

integrin therapeutics aimed at a range of diseases, said it has

raised $248 million through equity financings and collaborations

since its inception.

Biotech entrepreneur Timothy Springer, a co-founder of Morphic,

will hold an 18.1% stake after the IPO, while GlaxoSmithKline PLC

(GSK) will own 8%, Pfizer Inc. (PFE) will hold 7.7% and Novo

Nordisk A/S (NVO) will own 6.9%, according to a filing with the

Securities and Exchange Commission.

Morphic said it has applied to list its shares on the Nasdaq

Global Market under the symbol MORF.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

June 14, 2019 07:49 ET (11:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

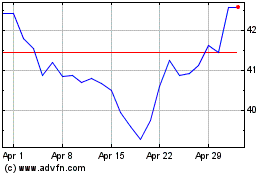

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024