By Asa Fitch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 24, 2019).

This week's court ruling against Qualcomm Inc. was more than a

business setback: It came with a stinging rebuke of the chip

giant's leaders from the federal judge who delivered the

decision.

Federal District Judge Lucy Koh repeatedly criticized Qualcomm

executives for their sworn testimony during the Federal Trade

Commission's antitrust case against the chip maker, pointing to

discrepancies between their words and the evidence.

Judge Koh called out Qualcomm witnesses including Chief

Executive Steve Mollenkopf, President Cristiano Amon, and retired

co-founder Irwin Jacobs for what she said were dubious statements

and, in some cases, for their demeanor on the stand.

"In addition to giving testimony under oath at trial that

contradicted their contemporaneous emails, handwritten notes, and

recorded statements to the IRS, some Qualcomm witnesses also lacked

credibility in other ways," Judge Koh wrote. She said that the

court "largely discounts Qualcomm's trial testimony prepared

specifically for this litigation," relying instead on that

contemporaneous evidence.

Judge Koh, in a ruling made public late Tuesday, found that

Qualcomm unlawfully suppressed competition in the market for

mobile-phone chips and used its dominant position to exact

excessive licensing fees.

Qualcomm sharply criticized the ruling, in which Judge Koh

raised scant concerns about witnesses the FTC called. She didn't

refer, positively or negatively, to the FTC's main expert witness,

Carl Shapiro, an economics professor at the University of

California, Berkeley, whose arguments Qualcomm had sought to

discredit. Qualcomm said it would pursue a stay on the judge's

order and an appeal.

"Qualcomm believes many aspects of Judge Koh's decision are

flawed, and [the decision] disregards many key facts that

contradict her conclusions, " Mr. Mollenkopf said. The decision

"also, without basis, casts aspersions on our company and its

witnesses, all of whom have demonstrated their complete integrity

and expertise successfully many times in multiple legal disputes

around the world."

Messrs. Amon and Jacobs didn't respond to requests for

comment.

Qualcomm's top brass had been in a celebratory mood since

mid-April, when the company signed a deal with Apple Inc. that

ended a lengthy and bitter legal dispute that threatened to

undermine the chip maker's business model.

The deal lifted a cloud that had hung over Qualcomm for years,

and sent its stock soaring by more than 50%. In recognition, five

top executives were awarded bonus shares. Mr. Mollenkopf's were

valued at around $3.2 million as of Tuesday's close; Mr. Amon's, at

around $1.9 million.

Judge Koh's ruling again throws doubt on Qualcomm's outlook.

Qualcomm shares have fallen sharply from the highs they reached in

the weeks after the Apple deal, and were down 1.5% Thursday. They

have now dropped more than 20% since last Wednesday's close.

The judge said the executives' testimony during the antitrust

trial, which took place in January, didn't align with their notes

and internal documents, and was evasive in other ways.

Mr. Mollenkopf testified he wasn't aware of Qualcomm ever

exercising its right to cut off chip shipments to a customer if

there was a dispute over royalties, Judge Koh wrote. But she

pointed to a case where Qualcomm had done it to Sony, and

enumerated at least seven others in which she said a cutoff had

been threatened, affecting customers including LG Electronics Inc.,

Samsung Electronics Co., Huawei Technologies Co., Motorola

Solutions Inc., Lenovo Group and Nokia Corp.

Mr. Amon testified that he hadn't been informed of such threats

being used as a negotiating tactic, the judge wrote, though he

"himself approved joint QTL and QCT plans to cut off chip supply

during patent licensing disputes." QTL and QCT are Qualcomm's two

main business units.

Another executive "pretended not to recall" a meeting with the

Internal Revenue Service until he was played an audio clip from it

and made reference to a disagreement that came up later in the

recording, she wrote.

Patrick Moorhead, the president of Moor Insights & Strategy,

called it odd that the ruling was so one-sided when there were

significant questions about the reliability of the FTC's chief

expert, Mr. Shapiro. Mr. Shapiro put forth a theory of how Qualcomm

could cause anticompetitive harm, but offered no on-ground evidence

that actual harm had been done.

Mr. Shapiro declined to comment.

As Qualcomm seeks relief from higher courts, Mr. Mollenkopf

said, "We will continue focusing on running our business and

delivering every day for our customers and shareholders."

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

May 24, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

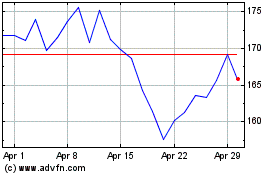

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Aug 2024 to Sep 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Sep 2023 to Sep 2024