Agilent Technologies Shares Fall After Slower Sales From China

May 15 2019 - 12:01PM

Dow Jones News

By Patrick Thomas

Agilent Technologies Inc. (A) shares fell about 12% to $67.11

after the California manufacturer of laboratory equipment reported

slower sales of its life-sciences instruments in China.

As a result, the firm lowered its revenue forecast for the

current fiscal year to between $5.09 billion and $5.13 billion from

between $5.15 billion and $5.19 billion.

In the latest period Agilent also posted lower-than-expected

total revenue and said sales from its life sciences and applied

markets business fell 1% from a year earlier.

Despite the weaker results, some analysts remain bullish on the

company. SVB Leerink analysts said in a research note that Agilent

is undervalued compared with its peers. The analysts maintained

their "outperform" rating on the company's stock but lowered their

price target to $80 from $86.

"We view Agilent positively and believe that the company holds

the leading position in environmental, chemical, and food testing

markets around the world while maintaining a well-diversified

position across healthcare in biopharma, life science tools and

diagnostics," the SVB analysts said in the note.

Write to Patrick Thomas at patrick.thomas@wsj.com

(END) Dow Jones Newswires

May 15, 2019 11:46 ET (15:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

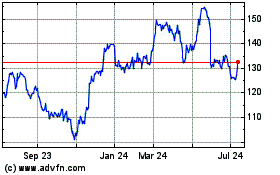

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Aug 2024 to Sep 2024

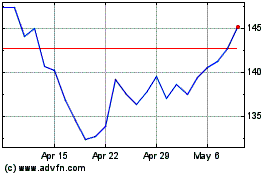

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Sep 2023 to Sep 2024