UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2019

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified

in its charter)

Nuestra Señora de los Ángeles

179

Las Condes, Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GEOPARK LIMITED

TABLE OF CONTENTS

|

ITEM

|

|

|

1.

|

Press release dated May 8, 2019 titled “First Quarter 2019 Record Operational and Financial Performance Today Expands the Growth Pathway for Tomorrow”

|

Item 1

FOR IMMEDIATE DISTRIBUTION

GEOPARK REPORTS FIRST QUARTER 2019 RESULTS

RECORD OPERATIONAL AND FINANCIAL PERFORMANCE

TODAY

EXPANDS THE GROWTH PATHWAY FOR TOMORROW

Bogota, Colombia – May 8, 2019 - GeoPark

Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent Latin American oil and gas explorer,

operator and consolidator with operations and growth platforms in Colombia, Peru, Argentina, Brazil, Chile and Ecuador reports

its consolidated financial results for the three-month period ended March 31, 2019 (“First Quarter” or “1Q2019”).

A conference call to discuss 1Q2019 financial results will be held on May 9, 2019 at 11:00 am Eastern Time.

All figures are expressed in US Dollars

and growth comparisons refer to the same period of the prior year, except when specified. Definitions and terms used herein are

provided in the Glossary at the end of this document. This release does not contain all of the Company’s financial information

and should be read in conjunction with GeoPark’s consolidated financial statements and the notes to those statements for

the period ended March 31, 2019 and 2018, available on the Company’s website.

FIRST QUARTER 2019 HIGHLIGHTS

Continuous Operational Success

|

|

·

|

Record consolidated oil and gas production

up 23% to 39,557 boepd

|

|

|

·

|

Gross operated production in Colombia,

Chile and Argentina surpassed 75,000 bopd

|

|

|

·

|

Oil production increased by 26% to 34,358

bopd

|

|

|

·

|

Gas production increased by 7% to 31.2

mmcfpd

|

|

|

·

|

Seven rigs now operational across the GeoPark

platform

|

|

|

·

|

Flowline connecting the Colombian Llanos

34 block (GeoPark operated, 45% WI) to regional pipeline completed

|

Continuous Cost Efficiency and Cash Generation

Growth

|

|

·

|

Revenue increased by 21% to $150.1 million

|

|

|

·

|

Net Profit of $19.7 million

|

|

|

·

|

Adjusted EBITDA increased by 46% to $92.3

million

|

|

|

·

|

Adjusted EBITDA per boe increased by 20%

to $27.4, in spite of 5% lower Brent oil prices

|

|

|

·

|

Lower transportation costs in Colombia

improved Adjusted EBITDA by $2.0/bbl

|

|

|

·

|

Cash Flow from Operating Activities increased

to $81.3 million

|

|

|

·

|

Free Cash Flow

1

of $44.0 million

|

Continuous Financial Track Record and

Capital Strengthening

|

|

·

|

Record Adjusted EBITDA reaching $359.5

million in the last twelve months

|

|

|

·

|

Return on Capital Employed of 38%

2

in the last twelve months

|

|

|

·

|

Net debt to Adjusted EBITDA ratio of 0.8x

|

|

|

·

|

Adjusted EBITDA to Capital Expenditures

ratio of 2.5x

|

|

|

·

|

Cash and Cash Equivalents of $146.6 million

|

|

|

·

|

40-45% of 2Q2019 oil production hedged

at floors of $55-65/bbl Brent

|

1

Free cash flow is defined as cash flow from operating activities less cash used in investing activities. Free cash flow is a non-GAAP measure. See reconciliation below.

2

Return on capital is defined as operating profit divided by total assets minus current liabilities.

Continuous Long-Term Project Inventory

Expansion

|

|

·

|

New country entry into

Ecuador and exploration acreage boost: Acquired attractive low-cost, low-risk Espejo and Perico blocks

3

(GeoPark,

50% WI), in the prolific Oriente basin in Ecuador

|

Continuous Value Return to Shareholders

|

|

·

|

Invested $16.5 million in the share buyback

program initiated in December 2018, buying 1,100,000 shares while executing self-funded growth work programs

|

James F. Park, Chief Executive Officer of

GeoPark, said: “Congratulations and thanks again to the GeoPark team. We are proud of our continuous streak of quarterly

operational and financial records - which is really the reflection of many years of work and consistent execution of our long-term

business plan. For this reason, our recent successful entry into Ecuador represents a major development for our Company. One of

the biggest most attractive underdeveloped petroleum systems in Latin America - and a long-term target of GeoPark - is the Maranon-Oriente-Putumayo

basin complex stretching from Peru through Ecuador and into Colombia with over 10 billion boe of remaining conventional hydrocarbon

resources. With our existing platforms in Peru and Colombia, our Ecuador entry into this exciting oil province substantially expands

our organic and inorganic growth fairway - laying the groundwork for a future with the potential for many more records and successes.”

CONSOLIDATED OPERATING

PERFORMANCE

Key performance indicators:

|

Key Indicators

|

1Q2019

|

4Q2018

|

1Q2018

|

|

Oil production

a

(bopd)

|

34,358

|

32,859

|

27,345

|

|

Gas production (mcfpd)

|

31,194

|

35,288

|

29,101

|

|

Average net production (boepd)

|

39,557

|

38,741

|

32,195

|

|

Brent oil price ($ per bbl)

|

63.7

|

68.0

|

67.3

|

|

Combined price ($ per boe)

|

44.6

|

44.7

|

44.7

|

|

⁻ Oil ($ per bbl)

|

48.7

|

49.0

|

48.6

|

|

⁻ Gas ($ per mcf)

|

5.0

|

5.0

|

5.4

|

|

Sale of crude oil ($ million)

|

137.6

|

136.6

|

111.0

|

|

Sale of gas ($ million)

|

12.5

|

14.6

|

12.8

|

|

Revenue ($ million)

|

150.1

|

151.2

|

123.9

|

|

Commodity risk management contracts ($ million)

|

-21.3

|

32.0

|

-3.9

|

|

Production & operating costs

b

($ million)

|

-38.9

|

-46.7

|

-34.1

|

|

G&G, G&A

c

and Selling expenses ($ million)

|

-19.6

|

-19.9

|

-15.2

|

|

Adjusted EBITDA ($ million)

|

92.3

|

85.7

|

63.3

|

|

Adjusted EBITDA ($ per boe)

|

27.4

|

25.3

|

22.9

|

|

Operating Netback ($ per boe)

|

32.3

|

31.0

|

28.5

|

|

Profit (loss) ($ million)

|

19.7

|

42.6

|

24.9

|

|

Capital expenditures ($ million)

|

37.3

|

33.8

|

21.4

|

|

Argentina acquisition ($ million)

|

-

|

-

|

52.0

|

|

Cash and cash equivalents ($ million)

|

146.6

|

127.7

|

120.4

|

|

Short-term financial debt ($ million)

|

11.4

|

18.0

|

0.8

|

|

Long-term financial debt ($ million)

|

429.2

|

429.0

|

418.7

|

|

Net debt ($ million)

|

294.0

|

319.3

|

299.1

|

a) Includes government royalties

paid in kind in Colombia for approximately 1,295, 1,181 and 930 bopd in 1Q2019, 4Q2018 and 1Q2018 respectively. No royalties were

paid in kind in Chile, Brazil or Argentina.

b) Production and operating costs

include operating costs and royalties paid in cash.

c) G&A

expenses include non-cash, share-based payments for $0.8 million, $1.3 million and $0.6 million, respectively. These expenses are

excluded from the Adjusted EBITDA calculation.

3

Subject to regulatory approval and final signature of the contracts.

Production:

Overall oil and gas production grew by 23% to 39,557 boepd in 1Q2019 from 32,195 boepd in 1Q2018, due to increased production in

Colombia and new production from acquisitions in Argentina. Oil represented 87% of total reported production compared to 85% in

1Q2018.

For further details, please refer to the

1Q2019 Operational Update published on April 11, 2019.

Reference

and Realized Oil Prices:

Brent crude oil prices averaged $63.7 per bbl during 1Q2019, 5% lower than 1Q2018 levels. However,

the consolidated realized oil sales price averaged $48.7 per bbl in 1Q2019, compared to $48.6 per bbl in 1Q2018. The smaller difference

in realized prices was due to a smaller Vasconia marker discount and significant improvements in commercial and transportation

discounts in Colombia that began in January 2019.

In Colombia, the Vasconia marker discount

averaged $3.5 per bbl in 1Q2019, compared to $4.1 in 1Q2018, and commercial and transportation discounts in Colombia averaged $12.0

in 1Q2019, compared to $15.0 per bbl in 1Q2018.

As shown in the realized oil price table

below, commercial and transportation discounts in Colombia improved by $3.0/bbl during 1Q2019, positively impacting realized oil

revenues in Colombia. These lower discounts on oil revenues in Colombia were partially offset by $1.0/bbl of higher selling expenses,

thus generating a net margin improvement of $2.0/bbl (please refer to selling expenses section below).

The flowline connecting the Llanos 34 block

to the Oleoducto de los Llanos (ODL) is being carried to completion and oil will start flowing from the Jacana oil field to the

ODL, supporting future production growth, reducing overall operational risk, and contributing to further reductions in transportation

and operating costs.

The tables below provide a breakdown of

reference and net realized oil prices in Colombia, Chile and Argentina in 1Q2019 and 1Q2018:

|

1Q2019 - Realized Oil

Prices

($ per bbl)

|

Colombia

|

Chile

|

Argentina

|

|

Brent oil price

|

63.7

|

63.7

|

63.7

|

|

Vasconia differential

|

(3.5)

|

-

|

-

|

|

Commercial and transportation discounts

|

(12.0)

|

(8.8)

|

-

|

|

Other

4

|

-

|

-

|

(9.0)

|

|

Realized oil price

|

48.2

|

54.9

|

54.7

|

|

Weight on oil sales mix

|

93%

|

2%

|

5%

|

|

|

|

|

|

|

1Q2018 - Realized Oil

Prices

($ per bbl)

|

Colombia

|

Chile

|

|

|

Brent oil price

|

67.3

|

67.3

|

|

|

Vasconia differential

|

(4.1)

|

-

|

|

|

Commercial and transportation discounts

|

(15.0)

|

(9.8)

|

|

|

Realized oil price

|

48.2

|

57.5

|

|

|

Weight on oil sales mix

|

97%

|

3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

Oil prices in Argentina have been linked to international oil prices since December 2018, subject to certain discounts. Current conditions could be temporary and oil prices in Argentina may be adjusted up or down, depending on prevailing market circumstances and other factors.

Revenue:

Consolidated revenues increased by 21% to $150.1 million in 1Q2019, compared to $123.9 million in 1Q2018. Additional

deliveries and lower discounts led to increased revenues.

Sales of crude oil

: Consolidated

oil revenues increased by 24% to $137.6 million in 1Q2019, driven by a 24% increase in deliveries. Oil revenues were 92% of total

revenues compared to 90% in 1Q2018.

|

|

·

|

Colombia: In 1Q2019, oil revenues increased

by 19% to $126.2 million following higher oil deliveries and stable realized oil prices. Oil deliveries increased by 19% to 30,498

bopd. Realized prices remained flat at $48.2 despite lower Brent oil prices, resulting from a lower Vasconia differential and improved

commercial and transportation discounts. Colombian earn-out payments increased to $6.1 million in 1Q2019, compared to $4.3 million

in 1Q2018, in line with higher oil revenues and increased production.

|

|

|

·

|

Chile: In 1Q2019, oil revenues decreased

by 22% to $3.3 million, due to lower volumes sold and lower oil prices. Oil deliveries decreased by 19% to 668 bopd due to the

natural decline of the fields whereas realized oil prices decreased by 5% to $54.9 per bbl, in line with lower Brent prices.

|

|

|

·

|

Argentina: In 1Q2019, oil revenues were

$7.9 million, with deliveries of 1,616 bopd and a realized oil price of $54.7 per bbl. This was produced from the Aguada Baguales,

El Porvenir and Puesto Touquet blocks (GeoPark operated, 100% WI).

|

Sales of gas

: Consolidated gas revenues

decreased by 2% to $12.5 million in 1Q2019 compared to $12.8 million in 1Q2018. Revenues dropped due to an 8% decrease in gas prices,

however this was offset by the 6% increase in gas deliveries.

|

|

·

|

Chile: In 1Q2019, gas revenues increased

by 14% to $5.5 million reflecting higher gas deliveries, partially offset by lower gas prices. The Jauke gas field discovery during

2018 increased gas deliveries by 21% to 12,590 mcfpd (2,098 boepd). Gas prices were 5% lower, or $4.8 per mcf ($28.9 per boe) in

1Q2019.

|

|

|

·

|

Brazil: In 1Q2019, gas revenues decreased

by 32% to $5.3 million, due to lower deliveries and prices. Planned maintenance works in the Manati field (GeoPark non-operated,

10% WI) reduced gas deliveries by 30% to 10,577 mcfpd (1,763 boepd). Gas prices decreased by 2% to $5.5 per mcf ($33.2 per boe),

due to the impact of the local currency devaluation, which was partially offset by the annual price inflation adjustment of approximately

6%, effective January 2019.

|

|

|

·

|

Argentina: In 1Q2019, gas revenues were

$1.4 million, resulting from deliveries of 3,807 mcfpd (635 boepd), and realized gas prices of $4.0 per mcf ($24.1 per boe) from

the blocks acquired in Argentina.

|

Commodity

Risk Management Contracts:

Consolidated commodity risk management contracts refers to two different components, a realized

and an unrealized portion.

The realized portion of the commodity risk

management contracts registered a cash gain of $1.8 million in 1Q2019 compared to a $10.6 million loss in 1Q2018. Realized gains

in 1Q2019 resulted from hedges in place covering 15,000 bopd with floors of $60-65 per bbl which were higher than prevailing oil

prices during a portion of the quarter.

The unrealized portion of the commodity

risk management contracts amounted to $23.1 million loss in 1Q2019 compared to a $6.7 million gain in 1Q2018. Unrealized losses

during 1Q2019 resulted from an increase in the forward Brent oil price curve compared to December 2018.

The Company uses risk management contracts

to minimize the impact of oil price fluctuations on its work program.

Production and Operating Costs

5

:

Consolidated operating costs per boe were $7.8 in 1Q2019, lower than the $8.3 per boe in 4Q2018, but higher than the

$7.2 per boe in 1Q2018 due to the addition of the new blocks in Argentina which have higher costs per boe.

Consolidated operating costs increased by

$5.4 million to $25.3 million in 1Q2019 compared to $19.9 million in 1Q2018. The majority of the increase, $4.3 million, was explained

by the acquisition in Argentina.

5

Production and operating costs = Operating costs + Royalties

The breakdown of operating costs is as follows:

|

|

·

|

Colombia: Operating costs per boe increased

slightly to $5.5 in 1Q2019 compared to $5.4 in 1Q2018. Total operating costs increased by 21% to $15.0 million, in line with higher

volumes delivered, which increased by 20%.

|

|

|

·

|

Chile: Operating costs per boe decreased

by 22% to $18.1 in 1Q2019 compared to $23.3 in 1Q2018, due to lower well intervention activities. Total operating costs decreased

by 16% to $4.5 million in 1Q2019 from $5.4 million in 1Q2018, despite an increase of 8% in oil and gas deliveries.

|

|

|

·

|

Brazil: Operating costs per boe increased

by 36% to $9.6 in 1Q2019 compared to $7.0 in 1Q2018, due to the impact of fixed costs over lower production and deliveries which

decreased by 30%. Total operating costs decreased by 38% to $1.0 million in 1Q2019 from $1.6 million in 1Q2018.

|

|

|

·

|

Argentina: Operating costs per boe decreased

by 29% to $24.3 in 1Q2019 compared to $34.4 in 4Q2018. Total operating costs decreased to $4.8 million in 1Q2019 from $7.2 million

in 4Q2018. The 1Q2019 costs decreased compared to the previous quarter due to lower well intervention activities.

|

Consolidated royalties fell by $0.8 million

to $13.3 million in 1Q2019 compared to $14.1 million in 1Q2018, reaching 9% of net revenue in 1Q2019, compared to 11% in 1Q2018.

This decrease was due to a lower “high price” royalty component in Colombia, which is a variable rate royalty depending

on prevailing oil prices. The “high price” royalty has a countercyclical effect when oil prices are lower. This effect

was partially offset by higher oil and gas deliveries.

Selling

Expenses:

Consolidated selling expenses increased by $3.1 million to $3.5 million in 1Q2019 (of which $3.0 million,

or $1.1/bbl correspond to Colombia), compared to $0.4 million in 1Q2018.

The increase of $1.0 per barrel in Colombia

is explained by accounting differences for the different kinds of sales. Transportation costs associated to sales at the wellhead

are accounted for as a deduction from revenues whereas transportation costs associated to sales at other delivery points are accounted

for as selling expenses.

As shown in the reference and realized oil

price section of this document, commercial and transportation discounts in Colombia improved by $3.0/bbl during 1Q2019, positively

impacting realized oil prices. This was partially offset by $1.0/bbl of higher selling expenses, thus generating a net margin improvement

of $2.0/bbl.

Administrative

Expenses:

Consolidated G&A costs per boe decreased by 21% to $3.4 in 1Q2019 compared to $4.3 in 1Q2018. Total consolidated

G&A decreased by 7% to $11.7 million in 1Q2019 compared to $12.6 million in 1Q2018.

Geological

& Geophysical Expenses:

Consolidated G&G costs per boe increased to $1.6 in 1Q2019 versus $1.3 in 1Q2018. Total

consolidated G&G expenses increased to $4.3 million in 1Q2019 compared to $2.2 million in 1Q2018 due to higher staff costs

associated with an increased scale of operations and continuous investment in improving capacities.

Adjusted

EBITDA:

Consolidated Adjusted EBITDA

6

surged by 46% to $92.3 million, or $27.4 per boe, in 1Q2019 compared

to $63.3 million, or $22.9 per boe, in 1Q2018.

|

|

·

|

Colombia: Adjusted EBITDA of $89.0 million

in 1Q2019

|

|

|

·

|

Chile: Adjusted EBITDA of $2.9 million

in 1Q2019

|

|

|

·

|

Brazil: Adjusted EBITDA of $2.8 million

in 1Q2019

|

|

|

·

|

Argentina: Adjusted EBITDA of $2.6 million

in 1Q2019

|

|

|

·

|

Corporate and Peru: Adjusted EBITDA of

negative $5.1 million in 1Q2019

|

6

See “Reconciliation of Adjusted EBITDA to Profit (Loss) Before Income Tax and Adjusted EBITDA per boe” included in this press release.

The table below shows production, volumes

sold and the breakdown of the most significant components of Adjusted EBITDA for 1Q2019 and 1Q2018, on a per country and per boe

basis:

|

Adjusted EBITDA/boe

|

Colombia

|

Chile

|

Brazil

|

Argentina

c

|

Total

|

|

|

1Q19

|

1Q18

|

1Q19

|

1Q18

|

1Q19

|

1Q18

|

1Q19

|

|

1Q19

|

1Q18

|

|

Production (boepd)

|

32,131

|

26,405

|

2,961

|

2,873

|

1,960

|

2,775

|

2,505

|

|

39,557

|

32,195

|

|

Stock variation /RIK

a

|

(1,501)

|

(783)

|

(195)

|

(313)

|

(165)

|

(217)

|

(254)

|

|

(2,118)

|

(1,411)

|

|

Sales volume (boepd)

|

30,630

|

25,622

|

2,766

|

2,560

|

1,793

|

2,558

|

2,251

|

|

37,439

|

30,784

|

|

% Oil

|

99.6%

|

99.6%

|

24%

|

32%

|

2%

|

2%

|

72%

|

|

88%

|

86%

|

|

($ per boe)

|

|

|

|

|

|

|

|

|

|

|

|

Realized oil price

|

48.2

|

48.2

|

54.9

|

57.5

|

70.4

|

74.6

|

54.7

|

|

48.7

|

48.6

|

|

Realized gas price

b

|

36.7

|

34.6

|

28.9

|

30.6

|

33.2

|

33.9

|

24.1

|

|

30.1

|

32.5

|

|

Earn-out

|

(2.2)

|

(2.0)

|

-

|

-

|

-

|

-

|

-

|

|

(1.8)

|

(1.6)

|

|

Combined Price

|

45.9

|

46.3

|

35.2

|

39.2

|

33.8

|

34.5

|

46.1

|

|

44.6

|

44.7

|

|

Realized commodity risk management contracts

|

0.7

|

(4.6)

|

-

|

-

|

-

|

-

|

-

|

|

0.5

|

(3.8)

|

|

Operating costs

|

(5.5)

|

(5.4)

|

(18.1)

|

(23.3)

|

(9.6)

|

(7.0)

|

(24.3)

|

|

(7.8)

|

(7.2)

|

|

Royalties in cash

|

(4.0)

|

(5.6)

|

(1.3)

|

(1.6)

|

(2.5)

|

(3.1)

|

(6.9)

|

|

(3.9)

|

(5.1)

|

|

Selling & other expenses

|

(1.1)

|

(0.1)

|

(0.4)

|

(0.6)

|

-

|

-

|

(2.1)

|

|

(1.0)

|

(0.1)

|

|

Operating Netback/boe

|

35.9

|

30.7

|

15.3

|

13.8

|

21.7

|

24.4

|

12.8

|

|

32.3

|

28.5

|

|

G&A, G&G, & other

|

|

|

|

|

|

|

|

|

(5.0)

|

(5.6)

|

|

Adjusted EBITDA/boe

|

|

|

|

|

|

|

|

|

27.4

|

22.9

|

a) RIK (Royalties in kind). Includes

royalties paid in kind in Colombia for approximately 1,295 and 930 bopd in 1Q2019 and 1Q2018 respectively. No royalties were paid

in kind in Chile, Brazil or Argentina.

b) Conversion rate of $mcf/$boe=1/6.

c) The acquisition of the Aguada

Baguales, Puesto Touquet and El Porvenir blocks in Argentina was closed on March 27, 2018, thus not representing material revenue,

operating costs, royalties or selling expenses during 1Q2018.

Depreciation:

Consolidated depreciation charges increased by 29% to $25.5 million in 1Q2019, compared to $19.7 million in 1Q2018, due to increased

volumes delivered.

Write-off

of Unsuccessful Exploration Efforts:

The consolidated write-off of unsuccessful exploration efforts was $0.3 million

in 1Q2019 compared to $1.8 million in 1Q2018.

Other Income

(Expenses):

Other operating income were $1.3 million in 1Q2019, compared to $0.8 million in 1Q2018.

CONSOLIDATED NON-OPERATING

RESULTS AND PROFIT FOR THE PERIOD

Financial

Expenses:

Net financial expenses increased slightly to $8.8 million in 1Q2019, compared to $8.5 million in 1Q2018.

Foreign

Exchange:

Net foreign exchange charges added a $1.0 million gain in 1Q2019 compared to a $1.7 million loss in 1Q2018.

Income Tax:

Income tax expenses were $18.5 million in 1Q2019 compared to $15.0 million in 1Q2018, in line with higher taxable income in 1Q2019.

Profit:

Profit of $19.7 million in 1Q2019 was $5.2 million lower than the $24.9 million recorded in 1Q2018, mainly due to the effect of

unrealized losses related to commodity risk management contracts, partially offset by higher gross profit.

BALANCE SHEET

Cash and

Cash Equivalents:

Cash and cash equivalents totaled $146.6 million as of March 31, 2019 compared to $127.7 million as

of December 31, 2018. Cash generated from operating activities equaled $81.3 million partially offset by cash used in investing

activities of $37.3 million and in financing activities of $25.3 million.

Cash generated from operating activities

of $81.3 million in 1Q2019 included income tax payments of $11.9 million. During 2Q2019 the Company expects to pay $75-85 million

in cash taxes, consisting of $45-50 million related to tax gains of fiscal year 2018 and $30-35 million of tax prepayments, which

will be deducted against tax gains of fiscal year 2019 (to be paid in 2020).

Cash used in financing activities of $25.3

million included interest payments of $13.8 million on the $425 million Notes (“2024 Notes”) and $10.2 million from

the buyback program in place since December 2018, which provides for the repurchase of up to 10% of shares outstanding.

Financial

Debt:

Total financial debt net of issuance cost was $440.6 million, including the 2024 Notes and other bank loans totaling

$20.3 million. Short-term financial debt was $11.4 million as of March 31, 2019.

For further details, please refer to Note

12 of GeoPark’s consolidated financial statements as of March 31, 2019, available on the Company’s website.

FINANCIAL RATIOS

a

|

At period-end

|

Financial Debt

|

Cash and Cash Equivalents

|

Net Debt

|

Net Debt/LTM Adj. EBITDA

b

|

LTM Interest Coverage

c

|

|

1Q2018

|

419.5

|

120.4

|

299.1

|

1.5x

|

7.2x

|

|

2Q2018

|

426.6

|

105.2

|

321.3

|

1.3x

|

8.5x

|

|

3Q2018

|

434.9

|

152.7

|

282.2

|

0.9x

|

10.5x

|

|

4Q2018

|

447.0

|

127.7

|

319.3

|

1.0x

|

11.4x

|

|

1Q2019

|

440.6

|

146.6

|

294.0

|

0.8x

|

12.2x

|

|

|

a)

|

Based on trailing

last twelve-month financial results.

|

Covenants

in 2024 Notes:

The 2024 Notes include incurrence test covenants that require the net debt to Adjusted EBITDA ratio to

be lower than 3.5 times and the Adjusted EBITDA to interest ratio higher than two times until September 2019. The Company is compliant

with all covenants.

COMMODITY RISK OIL MANAGEMENT CONTRACTS

The Company has the following commodity

risk management contracts (reference ICE Brent) in place as of the date of this release:

|

Period

|

Type

|

Volume (bopd)

|

|

Contract Terms

($ per bbl)

|

|

|

|

|

|

Purchased Put

|

Sold Put

|

Sold Call

|

|

2Q2019

|

Zero cost 3-way

Zero cost

Zero cost 3-way

|

6,000

5,000

4,000

|

65.0

65.0

55.0

|

55.0

-

45.0

|

90.0-90.5

92.3-92.5

79.0

|

|

3Q2019

|

Zero cost 3-way

Zero cost

|

8,000

5,000

|

55.0

65.0

|

45.0

-

|

79.0-81.5

92.3-92.5

|

|

4Q2019

|

Zero cost 3 way

|

8,000

|

55.0

|

45.0

|

79.0-81.5

|

|

1Q2020

|

Zero cost 3 way

|

8,000

|

55.0

|

45.0

|

79.0-81.5

|

For further details, please refer to Note

4 of GeoPark’s consolidated financial statements for the period ended March 31, 2019, available on the Company’s website.

SELECTED INFORMATION

BY BUSINESS SEGMENT

(UNAUDITED)

|

Colombia

|

1Q2019

|

1Q2018

|

|

Sale of crude oil ($ million)

|

126.2

|

106.5

|

|

Sale of gas ($ million)

|

0.4

|

0.3

|

|

Revenue ($ million)

|

126.6

|

106.8

|

|

Production and operating costs

a

($ million)

|

-26.3

|

-25.4

|

|

Adjusted EBITDA ($ million)

|

89.0

|

61.9

|

|

Capital expenditures

b

($ million)

|

21.3

|

17.9

|

|

Chile

|

1Q2019

|

1Q2018

|

|

Sale of crude oil ($ million)

|

3.3

|

4.2

|

|

Sale of gas ($ million)

|

5.5

|

4.8

|

|

Revenue ($ million)

|

8.8

|

9.0

|

|

Production and operating costs

a

($ million)

|

-4.9

|

-5.8

|

|

Adjusted EBITDA ($ million)

|

2.9

|

1.7

|

|

Capital expenditures

b

($ million)

|

3.8

|

0.0

|

|

Brazil

|

1Q2019

|

1Q2018

|

|

Sale of crude oil ($ million)

|

0.2

|

0.3

|

|

Sale of gas ($ million)

|

5.3

|

7.7

|

|

Revenue ($ million)

|

5.5

|

8.0

|

|

Production and operating costs

a

($ million)

|

-1.5

|

-2.3

|

|

Adjusted EBITDA ($ million)

|

2.8

|

5.0

|

|

Capital expenditures

b

($ million)

|

1.2

|

1.3

|

|

Argentina

c

|

1Q2019

|

|

|

Sale of crude oil ($ million)

|

7.9

|

|

|

Sale of gas ($ million)

|

1.4

|

|

|

Revenue ($ million)

|

9.3

|

|

|

Production and operating costs

a

($ million)

|

-6.3

|

|

|

Adjusted EBITDA ($ million)

|

2.6

|

|

|

Capital expenditures

b

($ million)

|

3.8

|

|

|

|

a)

|

Production and operating costs = Operating costs +

Royalties.

|

|

|

b)

|

The difference with the reported figure in Key performance

indicators table corresponds mainly to capital expenditures in Peru.

|

|

|

c)

|

The acquisition of the Aguada Baguales, Puesto Touquet

and El Porvenir blocks in Argentina was closed in March 27, 2018, thus not representing material information during 1Q2018 other

than capital expenditures related to the acquisition.

|

CONSOLIDATED STATEMENT

OF INCOME

(UNAUDITED)

|

|

|

|

|

|

|

|

|

(In millions of $)

|

1Q2019

|

1Q2018

|

|

REVENUE

|

|

|

|

Sale of crude oil

|

137.6

|

111.0

|

|

Sale of gas

|

12.5

|

12.8

|

|

TOTAL REVENUE

|

150.1

|

123.9

|

|

Commodity risk management contracts

|

-21.3

|

-3.9

|

|

Production and operating costs

|

-38.9

|

-34.1

|

|

Geological and geophysical expenses (G&G)

|

-4.3

|

-2.2

|

|

Administrative expenses (G&A)

|

-11.7

|

-12.6

|

|

Selling expenses

|

-3.5

|

-0.4

|

|

Depreciation

|

-25.5

|

-19.7

|

|

Write-off of unsuccessful exploration efforts

|

-0.3

|

-1.8

|

|

Impairment for non-financial assets

|

-

|

-

|

|

Other operating

|

1.3

|

0.8

|

|

OPERATING PROFIT

|

46.0

|

50.0

|

|

|

|

|

|

Financial costs, net

|

-8.8

|

-8.5

|

|

Foreign exchange gain (loss)

|

1.0

|

-1.7

|

|

PROFIT BEFORE INCOME TAX

|

38.1

|

39.8

|

|

|

|

|

|

Income tax

|

-18.5

|

-15.0

|

|

PROFIT FOR THE PERIOD

|

19.7

|

24.9

|

|

Non-controlling minority interest

|

-

|

6.4

|

|

ATTRIBUTABLE TO OWNERS OF GEOPARK

|

19.7

|

18.4

|

SUMMARIZED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

(QUARTERLY INFORMATION UNAUDITED)

|

(In millions of $)

|

Mar '19

|

Dec '18

|

|

|

|

|

|

Non-Current Assets

|

|

|

|

Property, plant and equipment

|

574.1

|

557.2

|

|

Other non-current assets

|

59.4

|

45.8

|

|

Total Non-Current Assets

|

633.5

|

603.0

|

|

|

|

|

|

Current Assets

|

|

|

|

Inventories

|

10.1

|

9.3

|

|

Trade receivables

|

36.8

|

16.2

|

|

Other current assets

|

63.4

|

106.5

|

|

Cash at bank and in hand

|

146.6

|

127.7

|

|

Total Current Assets

|

256.9

|

259.7

|

|

|

|

|

|

Total Assets

|

890.4

|

862.7

|

|

|

|

|

|

Equity

|

|

|

|

Equity attributable to owners of GeoPark

|

153.7

|

143.1

|

|

Total Equity

|

153.7

|

143.1

|

|

|

|

|

|

Non-Current Liabilities

|

|

|

|

Borrowings

|

429.2

|

429.0

|

|

Other non-current liabilities

|

78.4

|

72.2

|

|

Total Non-Current Liabilities

|

507.6

|

501.2

|

|

|

|

|

|

Current Liabilities

|

|

|

|

Borrowings

|

11.4

|

18.0

|

|

Other current liabilities

|

217.7

|

200.4

|

|

Total Current Liabilities

|

229.1

|

218.4

|

|

Total Liabilities

|

736.7

|

719.6

|

|

Total Liabilities and Equity

|

890.4

|

862.7

|

SUMMARIZED CONSOLIDATED STATEMENT OF CASH

FLOW

(UNAUDITED)

|

(In millions of $)

|

1Q2019

|

1Q2018

|

|

|

|

|

|

Cash flow from operating activities

|

81.3

|

76.3

|

|

Cash flow used in investing activities

|

-37.3

|

-73.4

|

|

Cash flow used in financing activities

|

-25.3

|

-17.2

|

RECONCILIATION OF ADJUSTED EBITDA TO PROFIT

BEFORE INCOME TAX

(UNAUDITED)

|

1Q2019 (In millions of $)

|

Colombia

|

Chile

|

Brazil

|

Argentina

|

Other

(a)

|

Total

|

|

Adjusted EBITDA

|

89.0

|

2.9

|

2.8

|

2.6

|

-5.1

|

92.3

|

|

Depreciation

|

-11.4

|

-8.3

|

-1.7

|

-3.8

|

-0.2

|

-25.5

|

|

Unrealized commodity risk management contracts

|

-23.1

|

-

|

-

|

-

|

-

|

-23.1

|

|

Write-off of unsuccessful exploration efforts & impairment

|

-0.2

|

-

|

-

|

-0.1

|

-

|

-0.3

|

|

Share based payment

|

-0.3

|

-0.1

|

-0.03

|

-0.3

|

-0.5

|

-1.3

|

|

Others

|

0.7

|

0.2

|

1.5

|

0.8

|

0.6

|

3.8

|

|

OPERATING PROFIT (LOSS)

|

54.7

|

-5.3

|

2.5

|

-0.7

|

-5.1

|

46.0

|

|

Financial costs, net

|

|

|

|

|

|

-8.8

|

|

Foreign exchange charges, net

|

|

|

|

|

|

1.0

|

|

PROFIT BEFORE INCOME TAX

|

|

|

|

|

|

38.1

|

|

|

|

|

|

|

|

|

|

1Q2018 (In millions of $)

|

Colombia

|

Chile

|

Brazil

|

Argentina

|

Other

(a)

|

Total

|

|

Adjusted EBITDA

|

61.9

|

1.7

|

5.0

|

-1.2

|

-4.0

|

63.3

|

|

Depreciation

|

-11.0

|

-5.8

|

-2.8

|

-0.1

|

-0.1

|

-19.7

|

|

Unrealized commodity risk management contracts

|

6.7

|

-

|

-

|

-

|

-

|

6.7

|

|

Write-off of unsuccessful exploration efforts & impairment

|

-

|

-

|

-1.8

|

-

|

-

|

-1.8

|

|

Share based payment and other

|

1.0

|

-

|

-0.1

|

1.0

|

-0.4

|

1.5

|

|

OPERATING PROFIT (LOSS)

|

58.6

|

-4.1

|

0.3

|

-0.3

|

-4.4

|

50.0

|

|

Financial costs, net

|

|

|

|

|

|

-8.5

|

|

Foreign exchange charges, net

|

|

|

|

|

|

-1.7

|

|

PROFIT BEFORE INCOME TAX

|

|

|

|

|

|

39.8

|

(a)

Includes Peru and Corporate.

FREE CASH FLOW RECONCILIATION

(UNAUDITED)

|

(In millions of $)

|

1Q2019

|

|

|

|

|

Cash flow from operating activities

|

81.3

|

|

Cash flow used in investing activities

|

-37.3

|

|

Free Cash Flow

|

44.0

|

RETURN ON CAPITAL EMPLOYED CALCULATION

(UNAUDITED)

|

(In millions of $)

|

1Q2019

|

|

|

|

|

Last-twelve months Operating Profit

|

252

|

|

Total Assets less Current Liabilities - March 31, 2019

|

661

|

|

Return on Capital Employed

|

38%

|

CONFERENCE

CALL INFORMATION

GeoPark management will host a conference

call on May 9, 2019 at 11:00 am (Eastern Time) to discuss these 1Q2019 financial results. To listen to the call, participants can

access the webcast located in the Investor Support section of the Company’s website at www.geo-park.com.

Interested

parties may participate in the conference call by dialing the numbers provided below:

United States Participants: 866-547-1509

International Participants: +1 920-663-6208

Passcode: 7551936

Please

allow extra time prior to the call to visit the website and download any streaming media software that might be required to listen

to the webcast.

An

archive of the webcast replay will be made available in the Investor Support section of the Company’s website at www.geo-park.com

after the conclusion of the live call.

|

For further information,

please contact:

INVESTORS:

|

|

|

Stacy Steimel – Shareholder Value Director

Santiago, Chile

|

ssteimel@geo-park.com

|

|

T: +562 2242 9600

|

|

|

|

|

|

Miguel Bello – Market Access Director

Santiago, Chile

T: +562 2242 9600

|

mbello@geo-park.com

|

|

|

|

|

Jared Levy – Sard Verbinnen

& Co

|

j

levy@sardverb.com

|

|

New York, USA

|

|

|

T: +1 (212) 687-8080

Kelsey Markovich – Sard Verbinnen & Co

New York, USA

T: +1 (212) 687-8080

|

kmarkovich@sardverb.com

|

GeoPark can be visited online at

www.geo-park.com.

GLOSSARY

|

Adjusted EBITDA

|

Adjusted EBITDA is defined as

profit for the period before net finance costs, income tax, depreciation, amortization, the effect of IFRS 16, certain non-cash

items such as impairments and write-offs of unsuccessful efforts, accrual of share-based payments, unrealized results on commodity

risk management contracts and other non-recurring events

|

|

Adjusted EBITDA per boe

|

Adjusted EBITDA divided by total

boe deliveries

|

|

Operating Netback per boe

|

Revenue, less production and

operating costs (net of depreciation charges and accrual of stock options and stock awards), selling expenses, and realized results

on commodity risk management contracts, divided by total boe deliveries. Operating Netback is equivalent to Adjusted EBITDA net

of cash expenses included in Administrative, Geological and Geophysical and Other operating costs

|

|

Bbl

|

Barrel

|

|

|

|

|

Boe

|

Barrels of oil equivalent

|

|

Boepd

|

Barrels of oil equivalent per

day

|

|

Bopd

|

Barrels of oil per day

|

|

|

|

|

D&M

|

DeGolyer and MacNaughton

|

|

Free Cash Flow

F&D costs

|

Operating cash flow less cash

flow used in investment activities

Finding and Development costs,

calculated as capital expenditures divided by the applicable net reserve additions before changes in Future Development Capital

|

|

Mboe

|

Thousand barrels of oil equivalent

|

|

Mmbo

|

Million barrels of oil

|

|

Mmboe

|

Million barrels of oil equivalent

|

|

Mcfpd

|

Thousand cubic feet per day

|

|

Mmcfpd

|

Million cubic feet per day

|

|

Mm

3

/day

|

Thousand cubic meters per day

|

|

PRMS

|

Petroleum Resources Management

System

|

|

WI

|

Working interest

|

|

NPV10

|

Present value of estimated future

oil and gas revenues, net of estimated direct expenses, discounted at an annual rate of 10%

|

|

Sqkm

|

Square kilometers

|

NOTICE

Additional information about GeoPark can

be found in the “Investor Support” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain

amounts and percentages included in this press release have been rounded for ease of presentation. Percentage figures included

in this press release have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts

prior to rounding. For this reason, certain percentage amounts in this press release may vary from those obtained by performing

the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this press

release may not sum due to rounding.

This press release contains certain oil

and gas metrics, including information per share, Operating Netback, reserve life index, and others, which do not have standardized

meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other

companies. Such metrics have been included herein to provide readers with additional measures to evaluate the Company's performance;

however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare

to the performance in previous periods.

CAUTIONARY

STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that

constitute forward-looking statements. Many of the forward- looking statements contained in this press release can be identified

by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’

‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’

‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in

a number of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations,

regarding various matters, including expected 2019 production growth and operating and financial performance, Operating Netback

per boe and capital expenditures plan. Forward-looking statements are based on management’s beliefs and assumptions, and

on information currently available to the management. Such statements are subject to risks and uncertainties, and actual results

may differ materially from those expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as

of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future

developments or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to

reflect the occurrence of unanticipated events. For a discussion of the risks facing the Company which could affect whether these

forward-looking statements are realized, see filings with the U.S. Securities and Exchange Commission.

Oil and gas production figures included

in this release are stated before the effect of royalties paid in kind, consumption and losses. Annual production per day is obtained

by dividing total production for 365 days.

Information about oil and gas reserves

:

The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proven, probable and possible reserves

that meet the SEC's definitions for such terms. GeoPark uses certain terms in this press release, such as "PRMS

Reserves" that the SEC's guidelines do not permit GeoPark from including in filings with the SEC. As a result, the

information in the Company’s SEC filings with respect to reserves will differ significantly from the information in this

press release.

NPV10 for PRMS 1P, 2P and 3P reserves is

not a substitute for the standardized measure of discounted future net cash flow for SEC proved reserves.

The reserve estimates provided in this release

are estimates only, and there is no guarantee that the estimated reserves will be recovered. Actual reserves may eventually prove

to be greater than, or less than, the estimates provided herein. Statements relating to reserves are by their nature forward-looking

statements.

Non-GAAP Measures:

The Company believes

Adjusted EBITDA, free cash flow and operating netback per boe, which are each non-GAAP measures, are useful because it allows us

to more effectively evaluate our operating performance and compare the results of our operations from period to period without

regard to our financing methods or capital structure. The Company’s computation of Adjusted EBITDA, free cash flow, return

on capital employed and operating netback

per boe may not be comparable to other similarly titled measures of other companies.

Adjusted EBITDA:

The Company defines

Adjusted EBITDA as profit for the period before net finance costs, income tax, depreciation, amortization and certain non-cash

items such as impairments and write-offs of unsuccessful exploration and evaluation assets, accrual of stock options stock awards,

unrealized results on commodity risk management contracts and other non-recurring events. Adjusted EBITDA is not a measure of profit

or cash flow as determined by IFRS. The Company excludes the items listed above from profit for the period in arriving at Adjusted

EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods

and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered

as an alternative to, or more meaningful than, profit for the period or cash flow from operating activities as determined in accordance

with IFRS or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant

components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and

tax structure and significant and/or recurring write-offs, as well as the historic costs of depreciable assets, none of which are

components of Adjusted EBITDA. For a reconciliation of Adjusted EBITDA to the IFRS financial measure of profit for the year or

corresponding period, see the accompanying financial tables.

Free cash flow:

Free cash flow is

a non-GAAP measure and does not have a standardized meaning under GAAP. Free cash flow is defined as cash provided by operating

activities less cash used in investing activities excluding Argentina acquisition and cash advances from disposal of long-term

assets.

Operating Netback per boe

: Operating

netback per boe should not be considered as an alternative to, or more meaningful than, profit for the period or cash flow from

operating activities as determined in accordance with IFRS or as an indicator of our operating performance or liquidity. Certain

items excluded from Operating Netback per boe are significant components in understanding and assessing a company’s financial

performance, such as a company’s cost of capital and tax structure and significant and/or recurring write-offs, as well as

the historic costs of depreciable assets, none of which are components of Operating Netback per boe. The Company’s computation

of Operating Netback per boe may not be comparable to other similarly titled measures of other companies. For a reconciliation

of Operating Netback per boe to the IFRS financial measure of profit for the year or corresponding period, see the accompanying

financial tables.

Net Debt

: Net debt is defined as

current and non-current Borrowings less Cash and Cash equivalents.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

GeoPark Limited

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Andrés Ocampo

|

|

|

|

|

|

Name:

|

Andrés Ocampo

|

|

|

|

|

|

Title:

|

Chief Financial Officer

|

Date: May 9, 2019

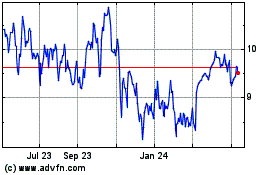

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Aug 2024 to Sep 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Sep 2023 to Sep 2024