Microsoft Results to Hinge on Cloud-Computing Growth

April 24 2019 - 5:59AM

Dow Jones News

By Asa Fitch

Microsoft Corp. is set to report fiscal third-quarter earnings

after the market closes Wednesday. Here's what to expect:

EARNINGS FORECAST: Analysts surveyed by FactSet as of Tuesday

afternoon expect Microsoft to report adjusted earnings of $1.00 a

share, up from 95 cents a share a year ago. The company reported

$7.42 billion in net income in the same quarter last year.

REVENUE FORECAST: Analysts surveyed by FactSet expect revenue of

$29.88 billion, up from last year's $26.82 billion.

WHAT TO WATCH:

AZURE SLOWING: Revenue growth at Microsoft's cloud-computing

division, called Azure, has slowed in recent quarters, even though

it is still the fastest-growing service the company offers. Part of

that is a result of Azure's success: as its size increases, so does

the difficulty of posting eye-popping percentage gains. But

investors still want to see healthy demand for Azure, which has

helped Microsoft stay relevant in recent years as sales of the

company's Windows operating system took a back seat. Analysts at

UBS estimate Azure revenue grew 66% in the fiscal third quarter

compared with the same period last year, down from a 76% annual

growth rate in the previous quarter.

A BIGGER CLOUD: Azure is just one piece of Microsoft's broader

cloud strategy, which combines software and other services into a

division that is accounting for an ever-larger share of the

company's overall revenues. The cloud business overall had $9

billion of sales in the fiscal second quarter, and investors are

counting on it to propel Microsoft as it competes with Amazon.com

Inc., the global leader in cloud computing, as well as competitors

that sell software via the internet, such as Adobe Systems Inc. and

Salesforce.com Inc. "There are few technology firms globally that

are benefiting from business at this scale yet [are] still growing

this fast," KeyBanc Capital Markets analysts said in a recent note,

estimating that Microsoft's broader cloud division could account

for a third of its revenues in its third quarter.

SILICON SHORTAGE: A scarcity of computer chips caused by

capacity shortages at Intel Corp., the largest U.S. chip maker, has

constrained sales of PCs with Windows software on them,

contributing to a 5% fall in Microsoft's revenue in its fiscal

second quarter. Intel expects its capacity to improve by the middle

of this year, but until then, the shortage may continue to be a

drag on Microsoft's results. The importance of Windows for

Microsoft is decreasing as its other businesses mature, but it

still accounts for about 17% of revenue, according to analysts at

Bernstein Research.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

April 24, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

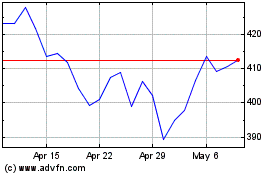

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024