Barrick Gold Renews Its Interest in Newmont -- WSJ

February 23 2019 - 3:02AM

Dow Jones News

By Jacquie McNish

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 23, 2019).

TORONTO -- Barrick Gold Corp. said it is sizing up Newmont

Mining Corp. for a possible deal that would unite the world's two

biggest gold producers and cap a flurry of big acquisitions in

their industry.

Barrick, with a market value of almost $23 billion, said on

Friday it is considering an all-stock, no-premium transaction to

merge with Newmont, which is valued at about $19 billion. The

Toronto-based company hasn't yet initiated discussions with

Newmont, two people familiar with the matter said.

The development comes on the heels of deal-making by Newmont --

and threatens to complicate it. The Denver-based company agreed

earlier this year to buy miner Goldcorp Inc. in a stock deal worth

$10 billion. The pending deal would make Newmont the biggest gold

miner by production, passing long-time rival Barrick, whose output

has been declining.

A Newmont spokesman said the company remains confident that its

planned merger with Goldcorp is an "unparalleled opportunity." He

said the company won't speculate on Barrick's motivation for

announcing it is considering making a hostile bid. Goldcorp

shareholders are set to vote on Newmont's offer April 4.

Barrick has long considered merging with Newmont to pair up

their large gold-mining operations in Nevada and create an industry

giant that would dwarf its nearest competitor. The last serious

attempt at a deal faltered in 2014.

The Canadian mining company was the undisputed king of gold

production until its output slumped, falling 25% over five years to

5.3 million troy ounces at the end of 2017 -- about the same as

Newmont at the time. Barrick has since acquired Randgold and its

annual production of about 1.3 million troy ounces as of the end of

2017. In that year, Newmont and Goldcorp produced a combined 7.9

million troy ounces.

Barrick's renewed interest in its rival reflects heightened

pressure to rein in costs for ore extraction and production at a

time when gold prices are languishing and ore reserves are

shrinking.

Mark Bristow, Barrick's chief executive, said in a recent

interview that to lower costs, "it makes sense to work it out" with

Newmont. He also said that by the end of 2020 he wants to eliminate

$200 million in expenses at the company. Mr. Bristow was named CEO

in January after Barrick and Randgold Resources merged, a $6

billion all-stock deal struck late last year.

Barrick's shares fell 2.1% on Friday, while Newmont gained

3%.

Barrick is seeking to shed a number of noncore mining properties

and any combination with Newmont would likely trigger a fresh wave

of gold property sales. If Newmont resists Barrick's entreaties,

Barrick could also recruit partners for any unsolicited bid. One

possible ally: Australia's Newcrest Mining Ltd. It walked away from

discussions to merge with Vancouver-based Goldcorp last year,

paving the way for the Newmont bid, a person familiar with the

matter said.

--Alistair MacDonald contributed to this article.

Corrections & Amplifications Goldcorp is based in Vancouver.

An earlier version of this article incorrectly said the head office

was in Toronto. ( Feb. 22, 2019)

Write to Jacquie McNish at Jacquie.McNish@wsj.com

(END) Dow Jones Newswires

February 23, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

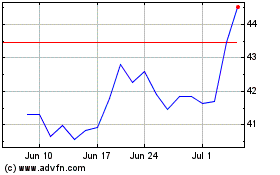

Newmont (NYSE:NEM)

Historical Stock Chart

From Aug 2024 to Sep 2024

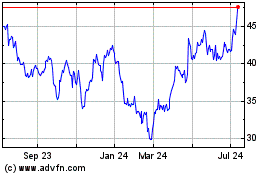

Newmont (NYSE:NEM)

Historical Stock Chart

From Sep 2023 to Sep 2024