Current Report Filing (8-k)

February 05 2019 - 4:36PM

Edgar (US Regulatory)

U.S.

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 5, 2019 (January 29, 2019)

Cuentas

Inc.

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

333-148987

|

|

20-3537265

|

|

(State

or other jurisdiction of

|

|

(Commission

|

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

|

File

Number)

|

|

Identification

Number)

|

19

W. Flagler St., Suite 902

Miami,

FL

(Address

of principal executive offices)

33130

(Zip

Code)

(800)

611-3622

(Registrant’s

telephone number, including area code)

Cuentas

Inc.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under

any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

On

January 29, 2019, United States Bankruptcy Court Southern District of Florida Miami Division approved a plan whereby Cuentas Inc.

would be able to reduce a debt of $3 million by paying $600,000 to a specific creditor.

On

January 30, 2019, United States Bankruptcy Court Southern District of Florida Miami Division approved a Plan of Reorganization

for Next Communications, Inc., an independent company controlled and/or owned by individuals that either are significant owners

(10% or greater) in Cuentas and/or are officers in Cuentas, Inc.

ORDER

GRANTING DEBTOR’S ORE TENUS MOTION TO APPROVE COMPROMISE OF $3.0 MILLION RECEIVABLE DUE FROM NEXT GROUP HOLDINGS INC.

THIS

MATTER came before the Court for hearing on January 22, 2019 at 1:30 p.m. upon the Debtor’s ore tenus Motion to Approve

Compromise of the $3.0 million receivable due to the Debtor from Next Group Holdings, Inc. (“NGH), an affiliate of the Debtor

through partial common ownership. For the reasons proffered on the record by Arik Maimon, the Chief Operating Officer for the

Debtor, received without objection, the compromise will allow NGH to fund the $600,000 payment to the Debtor and to further grow

NGH operations, the compromise will not affect the distributions to Classes 2 and 3 under the Plan, and will allow the Debtor

to fund the settlement payment to 100 NWT as amended under the Plan.

Accordingly,

it is ORDERED that:

1.

The ore tenus Motion is GRANTED.

2.

The Debtor is authorized to compromise the $3.0 million receivable due to the Debtor from NGH as follows:

|

|

a.

|

On

or before 90 days from entry of the Order, NGH shall deposit $600,000.00 in cleared funds into the trust account of counsel for

the Debtor. Upon receipt, $550,000 shall be promptly disbursed by counsel for the Debtor to the trust account of Genovese Joblove

Battista, counsel for 100 NWT, and the remaining $50,000.00 shall be retained to be used as needed to fund the Plan or administrative

expenses including deferred fees of counsel for the Debtor.

|

|

|

b.

|

Upon

written confirmation from counsel for the Debtor to NGH and counsel for 100 NWT that the $600,000.00 has been deposited in cleared

funds in the trust account, the $3.0 million receivable due from NGH to the Debtor shall be satisfied and extinguished in full

without further Order of the Court. At such time, the Debtor is authorized to execute an appropriate release to NGH of all indebtedness.

|

In

re: NEXT COMMUNICATIONS, INC. (Debtor), Case No. 16-26776-RAM Chapter 11

On

January 30, 2019, United States Bankruptcy Court Southern District of Florida Miami Division approved the ORDER CONFIRMING DEBTOR’S

SECOND AMENDED PLAN OF REORGANIZATION AND SETTING POST-CONFIRMATION HEARING

A

copy of this Order is included as it completes the reorganization of Next Communications, Inc. and provides the vehicle by which

Cuentas can reduce its debt by a net $2.4 million.

|

|

Item

9.01

|

Financial

Statements and Exhibits.

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

CUENTAS

INC.

|

|

|

|

|

|

Date:

February 4, 2019

|

By:

|

/s/

Arik

Maimon

|

|

|

|

Arik

Maimon

|

|

|

|

Chief

Executive Officer

|

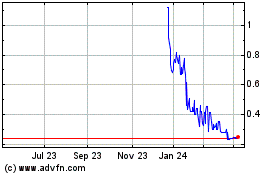

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

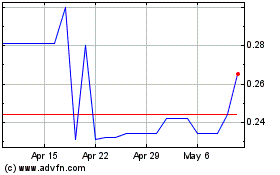

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Apr 2023 to Apr 2024