By Cara Lombardo and Laura Stevens

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 23, 2019).

Two big hedge-fund investors are circling eBay Inc. and

suggesting it part ways with its StubHub ticketing and

classified-ads businesses, moves that could again fracture the

company at the hands of activists.

In recent years, eBay shares have languished as the company has

sought to distance itself from its reputation as an online auction

house and has battled the likes of Amazon.com Inc. in the

e-commerce arena.

Elliott Management Corp. said Tuesday it has a more than 4%

stake in eBay and urged the online marketplace to consider spinning

off or selling the businesses because they could be worth more

individually.

Another hedge fund, Starboard Value LP, also has a large

position in eBay, of less than 4%, and has broached those same

changes with the San Jose, Calif.-based company, according to a

person familiar with the matter. Starboard took the stake at least

six months ago and recently has been talking to eBay about

improving its operations and exploring the split, one of the people

said.

In 2015, eBay spun off payment platform PayPal Holdings Inc., a

successful acquisition that activist investor Carl Icahn deemed

more valuable as a stand-alone business. EBay's stock has risen

just 18% since the split and is down 17% over the past year.

PayPal, meanwhile, has taken off, with its shares rising 134% since

the split.

In a letter sent to eBay's board on Tuesday, Elliott also said

the company should focus on revitalizing its core marketplace

business, boost its margins and ensure it has the right leadership

team in place. Elliott also suggested that eBay's core marketplace,

if separated from its other businesses, could be sold to a

private-equity firm or a strategic buyer eager to expand its online

footprint.

The fund said it thinks StubHub, the popular ticket-reselling

platform, could sell for between $3.5 billion and $4.5 billion and

eBay's classified businesses for between $8 billion and $12

billion. Elliott also said the remaining marketplace business,

before any improvements, could be worth about $15 billion.

EBay said in a statement Tuesday that it values its

shareholders' input and will carefully review Elliott's

proposals.

Elliott and Starboard, which aren't working in concert, are

considered two of the most aggressive activist investors and both

have shown a willingness to launch proxy fights for board seats at

companies that don't heed their suggestions. The roughly one-month

window during which shareholders can nominate directors for eBay's

board begins next week.

EBay opposed Mr. Icahn's efforts when he surfaced as a

shareholder in 2014 and urged a breakup, arguing that PayPal's

potential was shrouded by eBay's conglomerate structure. At the

time, the unit accounted for more than 40% of eBay's roughly $16

billion in annual revenue and was its fastest-growing segment.

EBay's leadership initially vowed to fight Mr. Icahn, saying its

collection of businesses were more valuable together than apart.

But following its own review, eBay spun out PayPal the next

year.

EBay jumped 6.1% to $32.90 on Tuesday, for a market

capitalization of nearly $32 billion. PayPal, which eBay bought in

2002 for $1.4 billion in stock, is now worth more than $105

billion.

StubHub, which eBay bought in 2007 for $310 million, accounted

for about 14% of company revenue in last year's third quarter. The

classified business, which operates outside the U.S. and allows

users to buy and sell goods and services, made up about 12%. EBay

is set to report its fourth-quarter results next week.

EBay got its start as a marketplace for selling goods and

services in 1995 -- the same year that Amazon's Jeff Bezos launched

operations of his online bookstore. For years, eBay dominated its

niche, allowing sellers to auction goods to the highest bidder. But

the novelty eventually wore off and Amazon, meanwhile, was inviting

other sellers onto its platform and expanding well beyond

books.

EBay has been working for years to redefine itself as shoppers

increasingly turn to their phones, showing little patience for

scrolling through thousands of listings. The company touts that 80%

of items on its site are new, with the bulk sold at a fixed price

rather than being auctioned. It has rolled out improved search

features and personalized recommendations and reviews. It also

recently launched aggressive marketing campaigns to shed its

outdated image.

The company pressed brands to sell to consumers on its site, and

it claims to have had some success. To better compete with Amazon

and others, it has highlighted free and fast shipping and the

ability for shoppers to make returns.

The steps to improve operations have led to some recent gains,

including in the important measures of users and gross merchandise

volume, or the total amount of sales on the sites. In the quarter

ended Sept. 30, growth in active buyers accelerated to 4%

year-over-year to 177 million, while gross merchandise volume was

up 5% at $22.92 billion.

The company has also diversified away from its core marketplace

with businesses like StubHub and Classifieds, as well as

international acquisitions.

Chief Executive Devin Wenig also touted its plans to quickly

build out a $1 billion advertising business -- something Amazon has

done successfully.

"Given that we have a large, stable and successful business but

must also build for the future, we're shifting our tactics to

balance the needs of a habituated base of customers who are used to

shopping on eBay in a certain way while pursuing an even larger

base of potential customers who have different expectations," Mr.

Wenig said on the company's October earnings call.

Still, the company warned growth would be relatively stable

going forward -- a disappointment to investors who were expecting

faster, double-digit gains.

Competition is stiff, as Amazon and other retailers fight for a

bigger piece of the market. Amazon last year commanded 49.1% of

U.S. online retail sales, according to eMarketer estimates,

compared with 6.6% for eBay.

EBay differs from Amazon's selling operations in that eBay is a

pure marketplace, facilitating sales while abstaining from selling

goods itself. That means lower total revenue but higher profit

margins.

Mr. Wenig has run the company since its split with PayPal, and

the company has seen some turnover in its senior management in

recent years.

"The proposal by Elliott to spin off assets is as much about the

financial benefits as it is about bringing focus and execution to

core marketplace," SunTrust Robinson Humphrey analysts wrote,

noting the eBay's recent stock underperformance. "We are not

surprised to see activists take a strong interest in eBay."

Write to Cara Lombardo at cara.lombardo@wsj.com and Laura

Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

January 23, 2019 01:48 ET (06:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

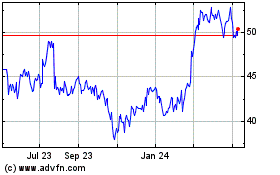

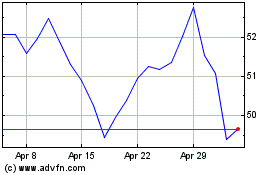

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Aug 2024 to Sep 2024

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Sep 2023 to Sep 2024