The Shipping Industry Sends a Trade Warning

November 14 2018 - 12:27PM

Dow Jones News

By Jon Sindreu

Key global trade indicators are starting to flash red. This

time, it may be for the right reasons.

A.P. Moller--Maersk Group, the world's largest containership

operator, on Wednesday reported slower than expected unit growth in

its core shipping division during the third quarter. Higher fuel

prices are also squeezing the company's margins, though its

acquisition of the Hamburg Süd container fleet helped boost overall

profits.

The Danish conglomerate moves 18% of the world's containers and

is often seen as a bellwether for world trade, which is currently

under threat by the prospect of a global economic slowdown and the

Trump administration's protectionist policies. Shipping and

logistics companies like Maersk, Hapag-Lloyd and Deutsche Post --

owner of DHL Express -- have all been forced to issue profit

warnings this year, and third-quarter results have confirmed a

darker outlook.

It's still early, but this should nonetheless concern money

managers. While the U.S. economy remains strong, weakening trade

could signal further trouble in China, which would particularly

endanger Europe and emerging markets.

For many years, analysts tried to take the pulse of the global

economy by using the Baltic Dry Index, a figure issued daily by the

London-based Baltic Exchange that tracks the cost of dry-bulk cargo

ships. But after 2014 this index became unreliable, falling even as

global growth powered ahead.

The index gave false readings mainly because of shipping

companies' woes. In 2009 those firms launched something of an arms

race, buying larger vessels in an attempt to lower unit costs and

thereby profit from economies of scale. It was a trap: According to

an analysis by research firm Drewry, megaships trimmed costs less

than expected because ports had difficulty dealing with them. They

were also harder to dispose of when no longer needed.

The excess capacity depressed freight rates for years. Now the

index is trending down again -- but this time demand, not supply,

is the driver.

Drewry's updated forecasts suggest growth in port throughput, a

measure of demand, will fall below fleet growth by year end. This

is happening even after consolidation in the shipping sector, as

well as efforts by operators to cut the size of their fleets; new

orders are now mostly made up of smaller vessels. A profitable 2017

led to high hopes for 2018, but the industry seems set to lose

money again.

This time around, investors should pay attention to the warning

flag being hoisted by the global shipping industry.

Write to Jon Sindreu at jon.sindreu@wsj.com

(END) Dow Jones Newswires

November 14, 2018 12:12 ET (17:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

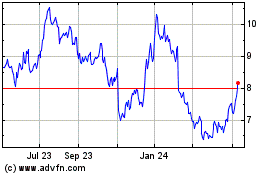

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Aug 2024 to Sep 2024

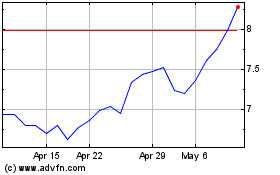

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Sep 2023 to Sep 2024