Higher Costs Depress Sysco Profit -- WSJ

November 06 2018 - 3:02AM

Dow Jones News

By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 6, 2018).

Sysco Co.'s shares tumbled Monday after the world's largest

food-service distributor said it is struggling against labor,

transportation and other costs that are pressuring many U.S.

companies.

The Houston-based distributor to restaurants and other

food-service outlets reported weaker-than-expected profit and sales

for the company's first quarter as costs eroded margins. Adjusted

earnings per share were 91 cents on sales of $15.2 billion. Both

figures fell below expectations.

"We continue to see significant cost challenges," Chief

Executive Tom Bené said on a call with investors.

Shares in the company were off 9.5% on Monday afternoon, the

largest one-day percentage slump since 2010, according to

FactSet.

Sysco's report sent a chill across food-distributor stocks

Monday. US Foods Holding Corp. was down 3.5%, Performance Food

Group Co. was off 2.7% and SpartanNash Co. was down 1.9%. Sysco is

the first of several food distributors to report financial results

this week.

Food distributors are being hit hard by a number of challenges

facing the broader U.S. economy.

The tight labor market has made recruiting warehouse and

transportation workers a struggle. The labor shortage is now

damaging the food distributors' earnings as well. Sysco's overtime

expenses rose in the company's quarter ended in September. The cost

of hiring and drivers and retaining warehouse workers hurt profit,

executives said.

"We are having to struggle to get as many people where we need

them, when we need them there," Chief Financial Officer Joel Grade

told investors.

Transportation costs are also growing as a result of higher fuel

prices and and new reporting requirements on the hours that truck

drivers log. Those expenses are expected to grow as the U.S.

holiday season arrives, fueling consumer spending that is driving a

surge in demand for shipping capacity from e-commerce

companies.

Sysco, which distributes around the world and has a large U.K.

business, also said it was hurt by tariff costs and an expected

damping of the British economy caused by the U.K.'s planned exit

from the European Union.

The food distributor is raising prices in response to the cost

increase, as are many companies facing rising input costs. But the

distributor said costs rose higher than its price increases in some

areas during the quarter. Executives said further price changes

could take place as contracts with customers renew.

Restaurants could resist additional price increases because the

competition between distributors is fierce and some customers could

switch to cooking at home if restaurant prices climb too high, RBC

Capital Markets said in a note to investors.

Sysco said its profit rose 17% in the latest quarter to $431

million, or 81 cents a share, compared with the same period last

year. Sales in the company's domestic food-service operations rose

5.6%, while its international sales increased 0.6%.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

November 06, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

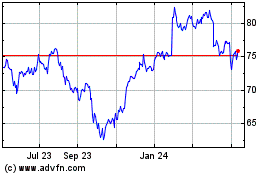

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

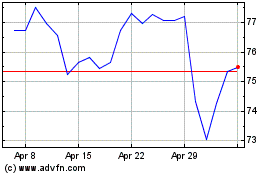

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024