Sky Loss Muddles Disney Strategy -- WSJ

September 24 2018 - 3:02AM

Dow Jones News

By Erich Schwartzel

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 24, 2018).

LOS ANGELES -- Walt Disney Co. didn't win Sky PLC as part of its

acquisition of 21st Century Fox Inc. assets, but the end to the

unusual bidding war leaves rival Comcast Corp. paying a sum that

will benefit Disney as a minority owner of the British pay-TV

operator.

Comcast's victorious $38.8 billion bid for Sky on Saturday

complicates Disney's companywide direct-to-consumer strategy, and

leaves the company without an asset that Chief Executive Robert

Iger once called a "crown jewel" of the Fox acquisition.

The outcome may please some on Wall Street. As the contentious

bidding war between Comcast and Disney over the entirety of Fox

assets heated up over the summer, some analysts grew nervous as the

deal's price increased to $71 billion. Though Disney's balance

sheet is seen as strong, unloading Sky, they argued, would make the

acquisition easier to stomach.

Disney didn't immediately respond to a request for comment after

bidding ended on Saturday.

Despite some calls to "split the baby" and leave Sky to Comcast,

Mr. Iger fought on, taking the Sky bidding war to this weekend's

unusual finish. Though Mr. Iger's tenure at Disney has been marked

by high-profile acquisitions such as Pixar Entertainment and

Lucasfilm Ltd., he has never before had to contend with a messy

public bidding war on the scale of Comcast's pursuit of Fox and

Sky.

When the Fox deal was first announced, Mr. Iger praised Sky's

business and seemed determined to win it as part of a larger goal

of controlling distribution platforms in the direct-to-consumer

streaming age. Disney is doubling down on streaming services and

will become a majority owner of Hulu once the Fox deal closes.

Now, Disney must continue with this strategy without a TV

operator that would have given it an immediate presence in more

than 23 million homes.

The company is mounting a streaming service of Disney

programming, set to launch in late 2019, that is entering a crowded

field of competitors dominated by Netflix. The service's European

launch would have had a major advantage had Disney scored Sky.

Winning Sky would also have expanded Disney's presence in Europe

at a time when most of the company's international focus has been

on China. Mr. Iger has said getting Sky would have increased his

company's share of foreign revenue to 40%, from 24%.

Write to Erich Schwartzel at erich.schwartzel@wsj.com

(END) Dow Jones Newswires

September 24, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

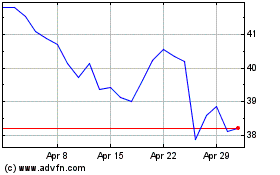

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024