By Jennifer Maloney and Cara Lombardo

Coca-Cola Co. is buying a stake in BodyArmor, the sports drink

startup backed by Kobe Bryant and other athletes, marking the

latest attempt by the beverage giant to break Gatorade's lock on

the sports market.

In addition to taking a minority stake, Coca-Cola's bottling

system could soon begin distributing BodyArmor's drinks, executives

said. The deal would also allow Coke to later take full ownership

of the upstart, they added. Financial terms couldn't be

learned.

BodyArmor has sought to challenge Gatorade, which is owned by

PepsiCo Inc., and Coca-Cola's Powerade. BodyArmor has marketed its

products as healthier alternatives and enlisted younger athletes,

like Los Angeles Angels outfielder Mike Trout and Houston Rockets

guard James Harden, to invest and appear in its ads.

Gatorade still dominates the market, capturing about

three-quarters of the $8 billion in U.S. sports drinks sales, but

its sales have declined in recent quarters. BodyArmor has grown

quickly in the last year but is still a distant third, behind

Powerade, with less than 6% of the market, according to a Wells

Fargo analysis of Nielsen data.

Like Gatorade and Powerade, BodyArmor is rich in electrolytes to

help with hydration. But BodyArmor, which uses coconut water, is

lower in sodium and higher in potassium and is marketed as more

natural than rivals. It doesn't use artificial colors like Gatorade

or high-fructose corn syrup as a sweetener like Powerade.

BodyArmor is expected to have about $400 million in revenue this

year and, based on recent deals in the beverage industry, could be

valued between $1 billion and $2 billion.

Under the deal, Coca-Cola would become BodyArmor's

second-largest shareholder, eclipsing a stake held by soda rival

Keurig Dr Pepper Inc., which also has a distribution deal.

BodyArmor has informed Keurig Dr Pepper that it plans to

terminate the current distribution agreement, according to a person

familiar with the matter. A Keurig spokeswoman declined to say

whether the company plans to keep its stake in BodyArmor.

The amount Coca-Cola would ultimately pay for full ownership of

BodyArmor would depend on sales and other performance measures, Jim

Dinkins, president of Coca-Cola North America, said in an

interview.

He said Coke will position BodyArmor as a premium drink above

Powerade.

BodyArmor, which is based in Queens, N.Y., was launched in 2011.

Its co-founder, chairman and principal investor, Mike Repole, also

helped create Glaceau, the maker of vitaminwater and smartwater and

a business that Coke acquired in 2007 for $4.1 billion. In 2013,

Mr. Bryant became a top BodyArmor investor and joined the

board.

Mr. Repole said the new Coke deal sets the groundwork for

distributing BodyArmor internationally, including in China, which

would ramp up his challenge to the market leader.

"To me, Gatorade is Blockbuster Video, and BodyArmor is

Netflix," he said in an interview. "If you don't evolve, you're not

going to be around much longer."

BodyArmor was valued at less than $200 million when Dr Pepper

Snapple Group amassed a 15.5% stake in 2015 and 2016, but that

stake has since fallen to about 12.5%.

The sports drink category has been under pressure, as consumers

spend more on enhanced bottled waters, teas and energy drinks.

Gatorade has responded by adding G Organic and low-calorie G2

versions, though the products haven't been big sellers. In June,

PepsiCo started selling a sugar-free version called Gatorade

Zero.

"Gatorade always attracts new players into the marketplace and

they come in with either lower prices, or they try to come in and

build distribution," PepsiCo's outgoing CEO Indra Nooyi said last

month. "If you look at it over a period of five or seven years, the

Gatorade franchise has been extremely resilient."

For decades, Coca-Cola has failed to dent Gatorade's dominance

with Powerade or organic sports drinks introduced under its Honest

brand. Under a new CEO, Coke has been looking to diversify beyond

sugary sodas.

Mr. Dinkins, the president of Coca-Cola North America, said

BodyArmor makes an alkaline water for athletes in addition to its

sports drinks, allowing Coke to broaden its reach across both

categories.

"There are trends, clearly, in the health and wellness space,"

he said.

Write to Jennifer Maloney at jennifer.maloney@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

August 14, 2018 13:23 ET (17:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

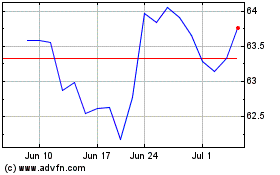

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024