Antofagasta 1st Half Ebitda Falls; Backs Outlook

August 14 2018 - 2:53AM

Dow Jones News

By Carlo Martuscelli

Antofagasta PLC (ANTO.LN) said Tuesday that its first-half

Ebitda fell 16% as production decreased and costs increased, but it

backed its full-year outlook.

The miner said earnings before interest, taxes, depreciation and

amortization for the six months ended June 30 were $904.2 million,

down from $1.08 billion the previous year. The company attributed

the decrease to higher unit-production costs.

Analysts at Jefferies expected the company to report Ebitda of

$1.06 billion for the first half.

First-half copper production fell 8.5% to 317,000 metric tons.

It attributed the decrease to lower grades of ore mined, as well as

a pipeline blockage.

Interim net profit was $194.3 million, down from $290.5 million

a year earlier, on revenue that rose 3.6% to $2.12 billion, as

higher copper prices helped offset lower sales volumes.

The company declared a dividend of 6.8 cents per share for the

period.

Antofagasta backed its full-year outlook, and said it believes a

stronger second half will offset a weaker first half. Copper

production guidance for the full year is at between 705,000 tons

and 740,000 tons at $1.35 a pound.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

August 14, 2018 02:38 ET (06:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

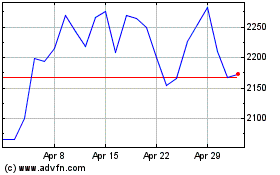

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Aug 2024 to Sep 2024

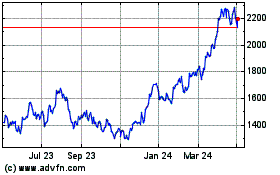

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Sep 2023 to Sep 2024