Goldman Lures Top JPMorgan Banker -- WSJ

August 11 2018 - 3:02AM

Dow Jones News

By Liz Hoffman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 11, 2018).

Goldman Sachs Group Inc. has poached a top JPMorgan Chase &

Co. deal maker, continuing a hiring spree that has brought more

than a dozen outsiders into the Wall Street powerhouse's upper

ranks in the past few months.

Kurt Simon -- a veteran banker in mergers as well as media and

technology, whose clients include Walt Disney Co. and Dell

Technologies Inc. -- will join Goldman as a partner later this

year, according to people familiar with the matter.

At Goldman, Mr. Simon will be a vice chairman of investment

banking and co-chairman of its technology, media and

telecommunications, or TMT, group, the people said.

Bankers regularly hop from one firm to another, but a move at

Mr. Simon's level is less typical. And he isn't going to a boutique

bank, but rather to another large firm, and a fierce rival at

that.

Goldman has hired 16 people firmwide at the elite rank of

partner in the past year, about half of them in its

investment-banking division, where top-tier relationships can

command huge fees.

The hiring push amounts to a bet -- a potentially expensive one

-- that the merger and capital-raising boom will continue. It is a

departure for Goldman, which has historically favored homegrown

talent.

The firm aims to add $5 billion in annual revenue by 2020. Its

revenues have stalled in recent years, as growth in areas such as

investment banking and asset management have barely compensated for

steady trading declines.

Investment bankers are expected to contribute about $500 million

of that figure. Mr. Simon would be the eighth partner that division

-- run jointly by John Waldron and Gregg Lemkau in New York, and

Marc Nachmann in London -- has hired.

Mr. Simon joined JPMorgan in 2002 from Merrill Lynch and ran the

firm's TMT group from 2009 to 2015. Since then, he has been its

global chairman of mergers and acquisitions, a job that typically

entails fewer management responsibilities and more client

face-time.

He has been one of JPMorgan's most visible bankers, brokering

big deals and frequently appearing on television to discuss the

M&A boom. He advised on SoftBank Group Corp.'s roughly $21

billion acquisition of Sprint Corp., Dell's $25 billion leveraged

buyout, AT&T Inc.'s $85 billion takeover of Time Warner Inc.

and Broadcom's $37 billion sale to Avago.

JPMorgan banking head Carlos Hernandez wrote in a memo to his

team that he didn't plan to replace Mr. Simon in his role, "given

the depth of talent" at the firm. Brian Marchiony, a JPMorgan

spokesman, said that "no one person owns relationships" with big

clients and added that many transactions are spearheaded by the

bank's CEO, James Dimon.

Mr. Simon has spent much of the past year across the table from

his new employer. He has been advising Disney on its planned

purchase of a big chunk of assets from 21st Century Fox, which

Goldman is advising. The Wall Street Journal's parent shares common

ownership with Fox.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

August 11, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

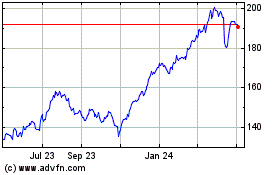

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

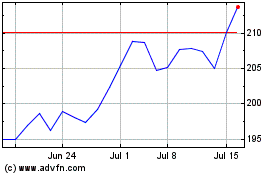

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024